Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

Form popularity

FAQ

Another term for a 1031 exchange is a like-kind exchange. This terminology reflects the primary condition that properties involved in the exchange must be similar in nature or use. Familiarity with this terminology can enhance your understanding of the process. For comprehensive resources on these exchanges, including the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031, explore our platform.

The primary difference between a 1031 exchange and a reverse 1031 exchange lies in the timing of the transactions. In a traditional 1031 exchange, you sell your current property before acquiring the new one. In a reverse 1031 exchange, you buy the new property first and then sell your existing property later. Understanding these options can be crucial, and the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 provides essential guidance.

To create a 1031 exchange, follow a clear process. First, identify a qualified intermediary who will facilitate the transaction. Next, choose the property you wish to sell and the replacement property you want to acquire. Ensure that you meet the strict timelines set by the IRS for the exchanges, specifically the 45-day identification period and the 180-day closing requirement, which can be detailed in the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031.

The rules for a 1031 exchange in Arizona include the necessity of reinvesting the proceeds into a similar property and identifying a replacement within 45 days after selling your original property. Additionally, you must complete the exchange within 180 days. The Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 provides clarity on these regulations, ensuring you stay compliant throughout the process. Utilizing professional legal assistance can also help navigate these rules smoothly.

To complete a 1031 exchange in Arizona, you must first identify the property you wish to sell and find a suitable replacement property. Next, it’s essential to adhere to the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031, which outlines specific requirements and timelines. Working with a qualified intermediary can simplify the process, ensuring all documentation and deadlines are met. This ensures you can defer your capital gains tax effectively.

You can defer capital gains without a 1031 exchange by utilizing other strategies, such as investing in Qualified Opportunity Funds or leveraging your primary residence exclusion. However, these alternatives may not offer the same benefits as a 1031 exchange. If you're considering your options, the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 might still be a worthwhile document to understand the tax landscape.

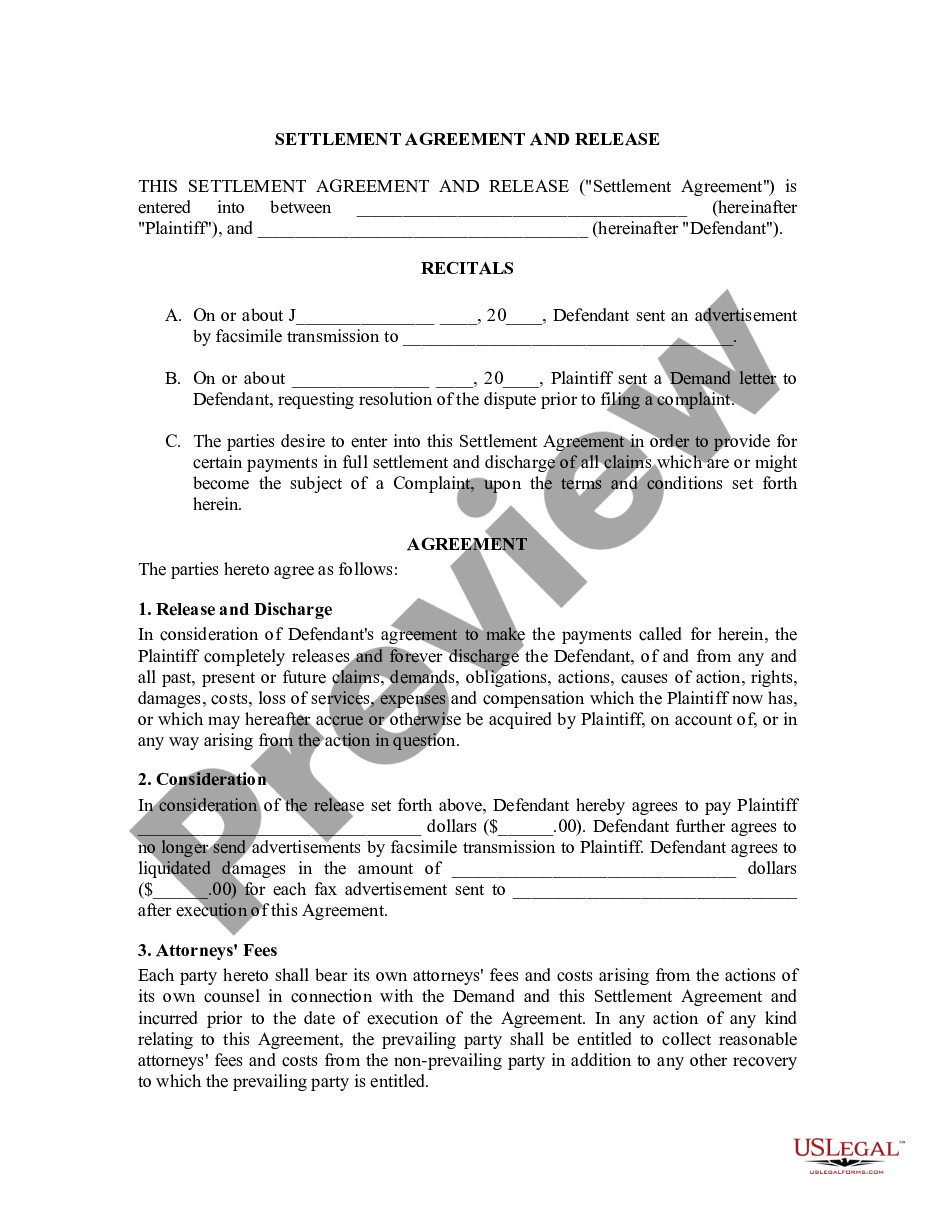

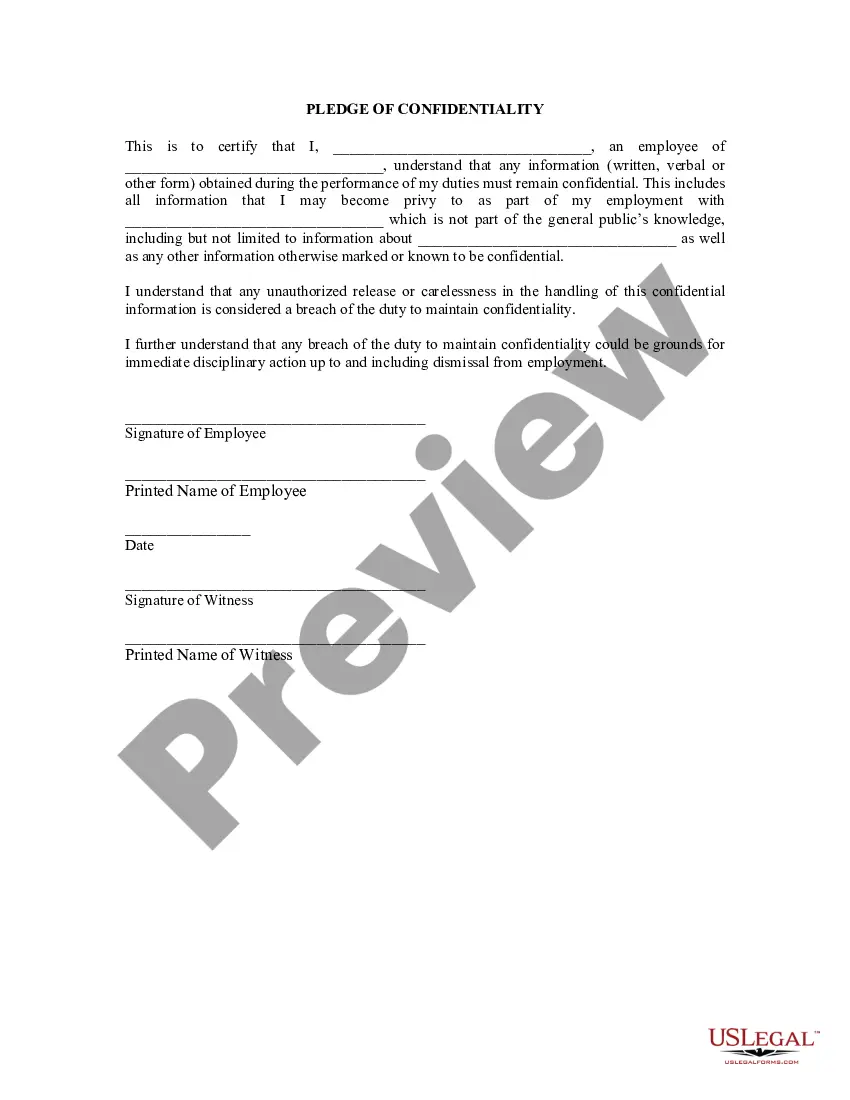

The verbiage for a 1031 exchange typically includes terms like 'replacement property,' 'qualified intermediary,' and 'like-kind exchange.' It's crucial to be precise when detailing these terms in your documents. The Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 can guide you in using the correct terminology to ensure clarity and compliance.

An example of an addendum is one that includes specific clauses addressing contingencies in a real estate sale. For instance, it can specify conditions under which the buyer may withdraw or alter the agreement. The Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 would also include specific tax-related terms essential for a smooth exchange.

A 1031 addendum is a supplementary document that accompanies a real estate contract. It details the arrangements for a 1031 exchange, ensuring all requirements are met for tax deferral. You can obtain the Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 from US Legal Forms to streamline this process.

The purpose of the addendum is to provide additional terms that may not be included in the main contract. It specifically addresses the transaction's requirements for 1031 exchanges, ensuring compliance with tax regulations. The Gilbert Arizona Exchange Addendum to Contract - Tax Free Exchange Section 1031 can help you clearly define these terms and prevent misunderstandings.