Franklin Ohio Bill of Sale - Quitclaim

Description

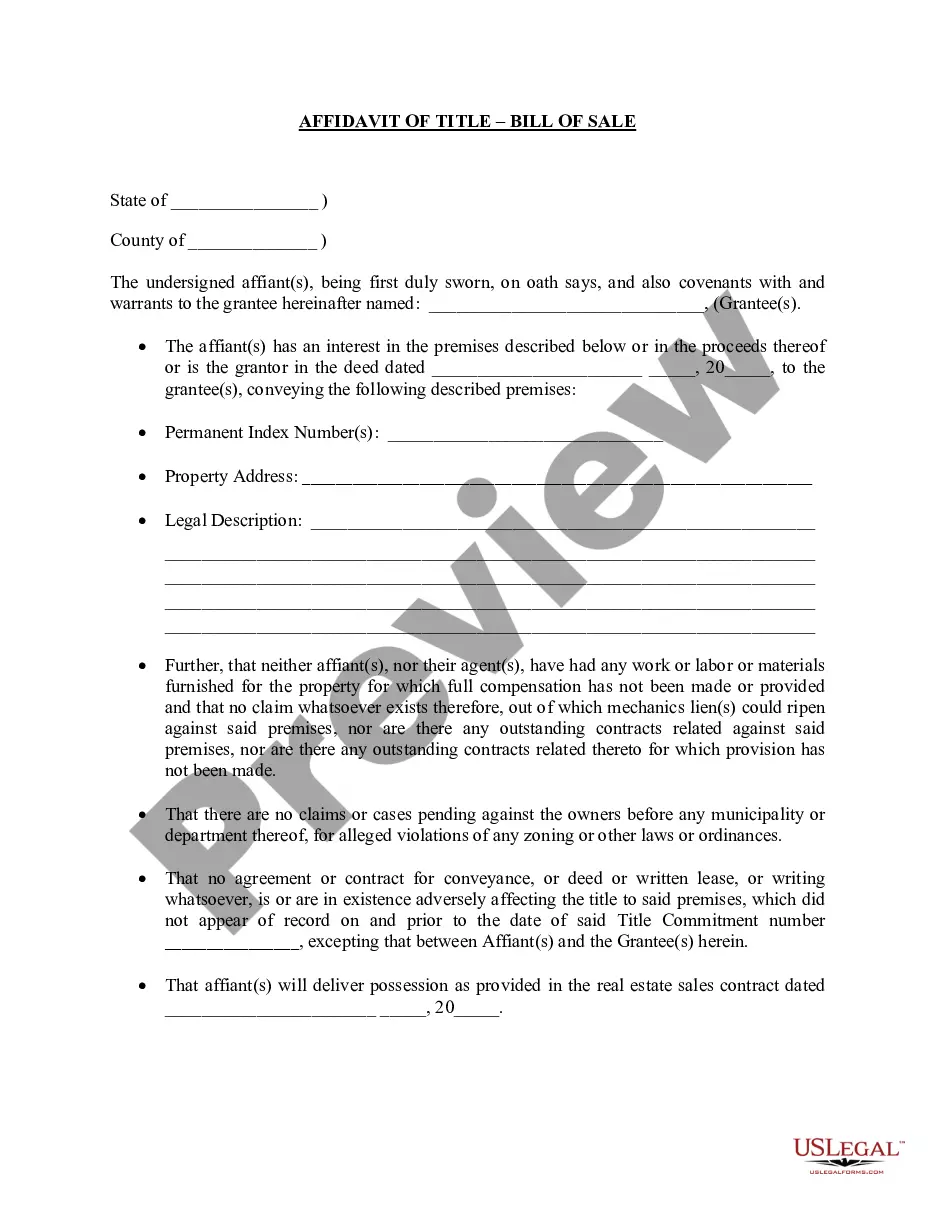

How to fill out Bill Of Sale - Quitclaim?

Producing documentation, such as the Franklin Bill of Sale - Quitclaim, to oversee your legal affairs is a challenging and labor-intensive endeavor.

Numerous circumstances necessitate an attorney’s participation, which also renders this task rather expensive.

However, you can take charge of your legal dilemmas and manage them independently.

The onboarding process for new users is equally straightforward! Here’s what you need to do prior to downloading the Franklin Bill of Sale - Quitclaim: Ensure that your form is tailored to your state/county since the regulations for drafting legal documents can differ significantly from one state to another.

- US Legal Forms is here to help.

- Our site offers over 85,000 legal documents tailored for a multitude of situations and life scenarios.

- We ensure each form complies with the regulations of each state, alleviating concerns about possible legal complications linked to adherence.

- If you are already familiar with our platform and have a subscription with US, you understand how simple it is to obtain the Franklin Bill of Sale - Quitclaim template.

- Just Log In to your account, download the form, and customize it to your needs.

- Have you misplaced your document? No problem. You can retrieve it from the My documents section in your account - accessible on both desktop and mobile.

Form popularity

FAQ

The Illinois quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

An Ohio quitclaim deed is a statutorily authorized deed form that transfers real estate without warranty of title. Warranty of title is a guaranty from the current owner (the grantor) to the new owner (the grantee) that the deed conveys clear title to the real estate. A quitclaim deed comes with no such guaranty.

Rates vary by state and law office but typically fall in the range of $200 to $400 per hour. Title companies routinely prepare quitclaim deeds in many states. Fees for title companies vary, but a market scan shows an average of $100 to $200 for a simple quitclaim deed.

A quitclaim bill of sale transfers personal property from one person or company to another. A quitclaim deed is a document used to change the title to a piece of real estate.

Disadvantage. The great disadvantage for the grantee who takes property using a quitclaim deed is the fact that if events prove that the grantor had no title, or limited title, to the property, the quitclaim deed does not allow the grantee to sue the grantor.

Record the deed at the recorder's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment. A Conveyance Fee Statement (Form DTE 100, or DTE 100EX if claiming an exemption) must be signed by the grantee and filed with the deed.

In Ohio, you need to have the quitclaim deed signed by both parties and notarized by a notary public. Step 6: File the deed at the Recorder's Office. The deed must be filed at the Recorder's Office in the county where the property is located to finalize the transfer.

How do I fill out a Quitclaim Deed?Name the parties. To complete a Quitclaim Deed, you must name the grantor and grantee.Establish consideration. Depending on your state, you may have to specify a price at which the recipient is paying for the piece of real property.Describe the property. Next, describe the property.

Take both the quitclaim deed form and the PCOR to the County Recorder or Clerk's office and ask to file. You must pay a recording fee. The recording fee will vary by county, but you can expect as a range to pay between $6 and $21 for the first page and $3 for any additional page.