Pima Arizona Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

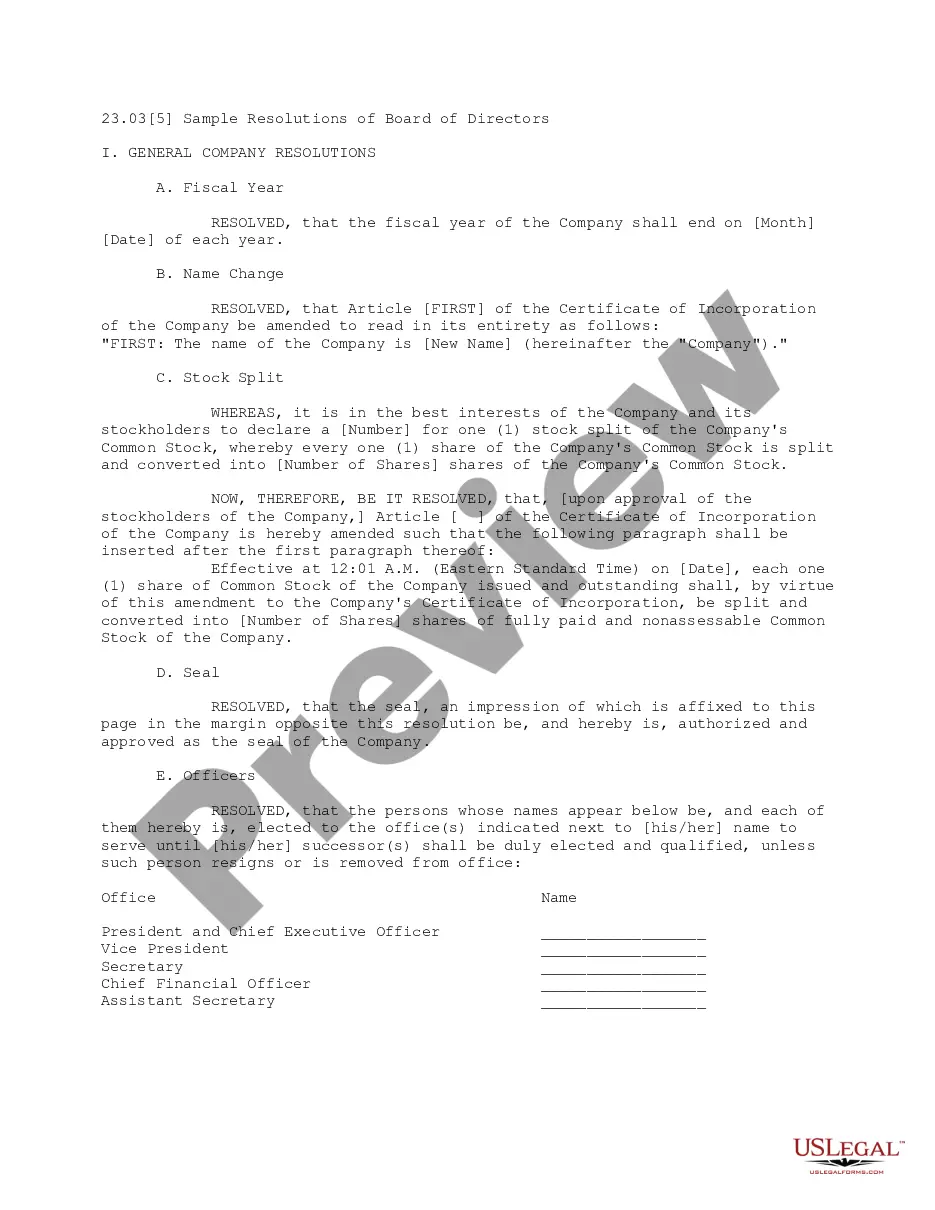

Are you seeking to swiftly compose a legally-binding Pima Affidavit of Lost Promissory Note or perhaps any other document to manage your personal or business matters.

You have two choices: reach out to an expert to draft a legitimate document for you or create it entirely by yourself.

First, carefully confirm if the Pima Affidavit of Lost Promissory Note aligns with the laws of your state or county.

If the form has a description, ensure you understand what it is meant for.

- Fortunately, there's another option - US Legal Forms.

- It will assist you in obtaining well-written legal documents without exorbitant fees for legal services.

- US Legal Forms provides a comprehensive catalog of over 85,000 state-compliant document templates, including the Pima Affidavit of Lost Promissory Note and form packages.

- We offer documents for a variety of life situations: from divorce papers to real estate contracts.

- Having been in business for over 25 years, we have built an impeccable reputation among our clientele.

- Here’s how you can join them and acquire the necessary template without any hassle.

Form popularity

FAQ

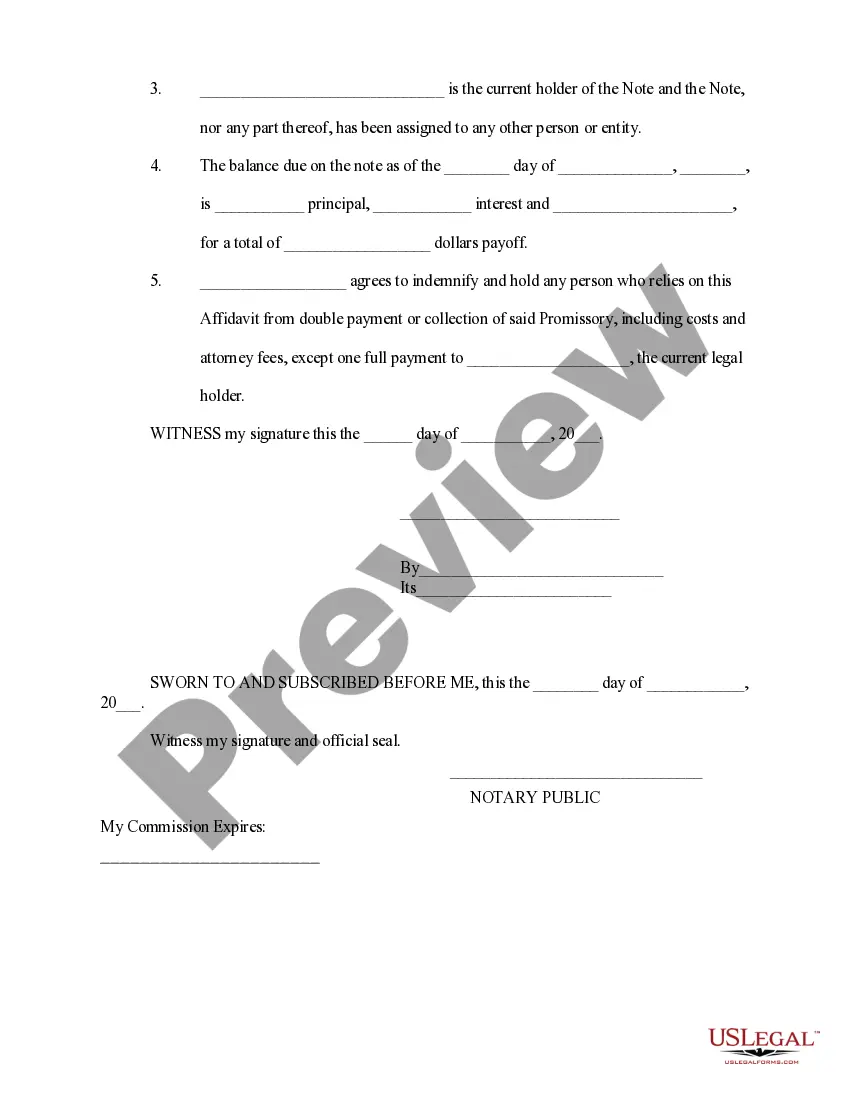

If a promissory note is lost, the holder should attempt to locate it through their personal records or the issuing bank. If the note cannot be found, you can file a Pima Arizona Affidavit of Lost Promissory Note, enabling you to claim the debt legally and protect your interests.

By Practical Law Finance. Maintained 2022 USA (National/Federal) A standard form of affidavit used when a promissory note has been delivered to a lender in a financing transaction and subsequently lost by that lender.

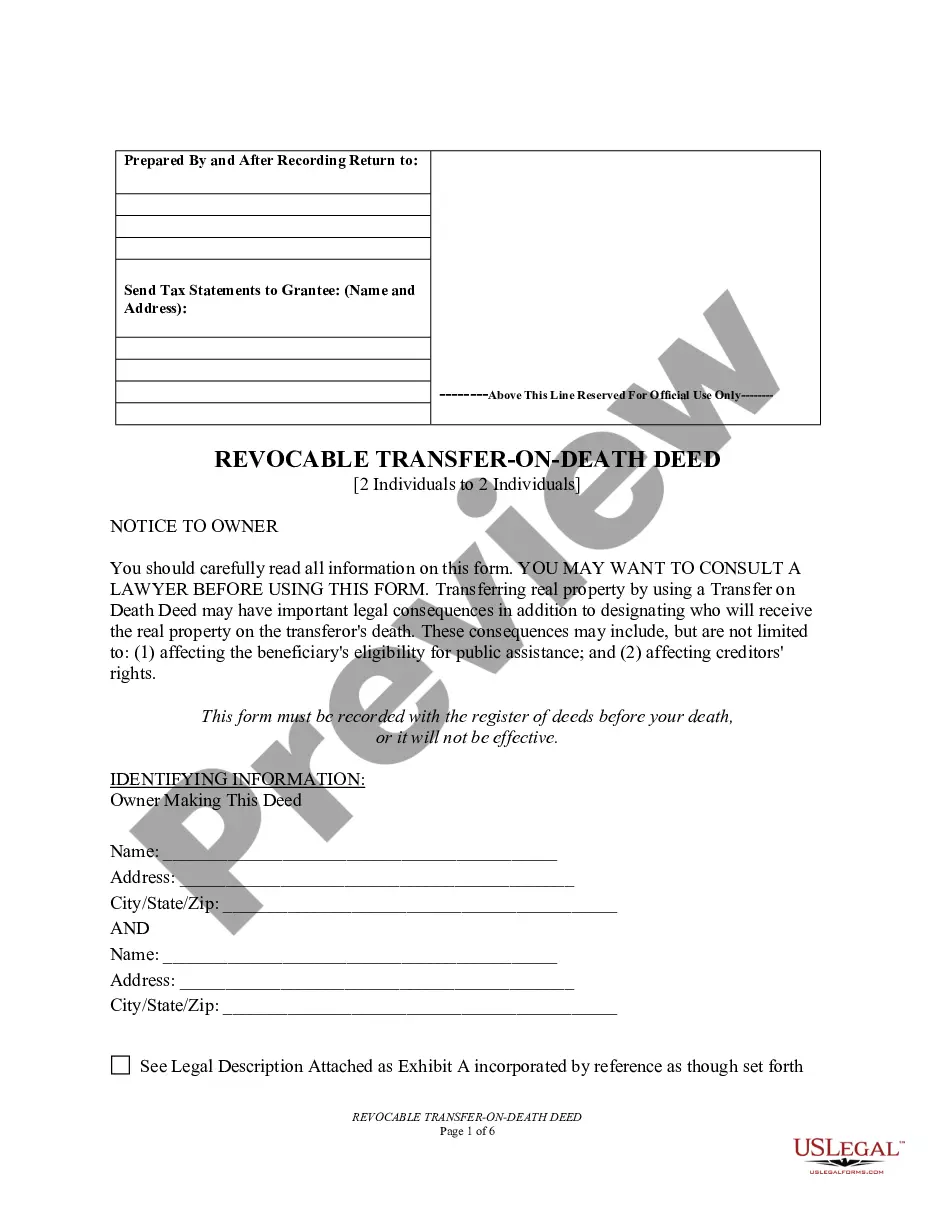

In a mortgage by legal charge or technically "a charge by deed expressed to be by way of legal mortgage", the debtor remains the legal owner of the property, but the creditor gains sufficient rights over it to enable them to enforce their security, such as a right to take possession of the property or sell it.

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

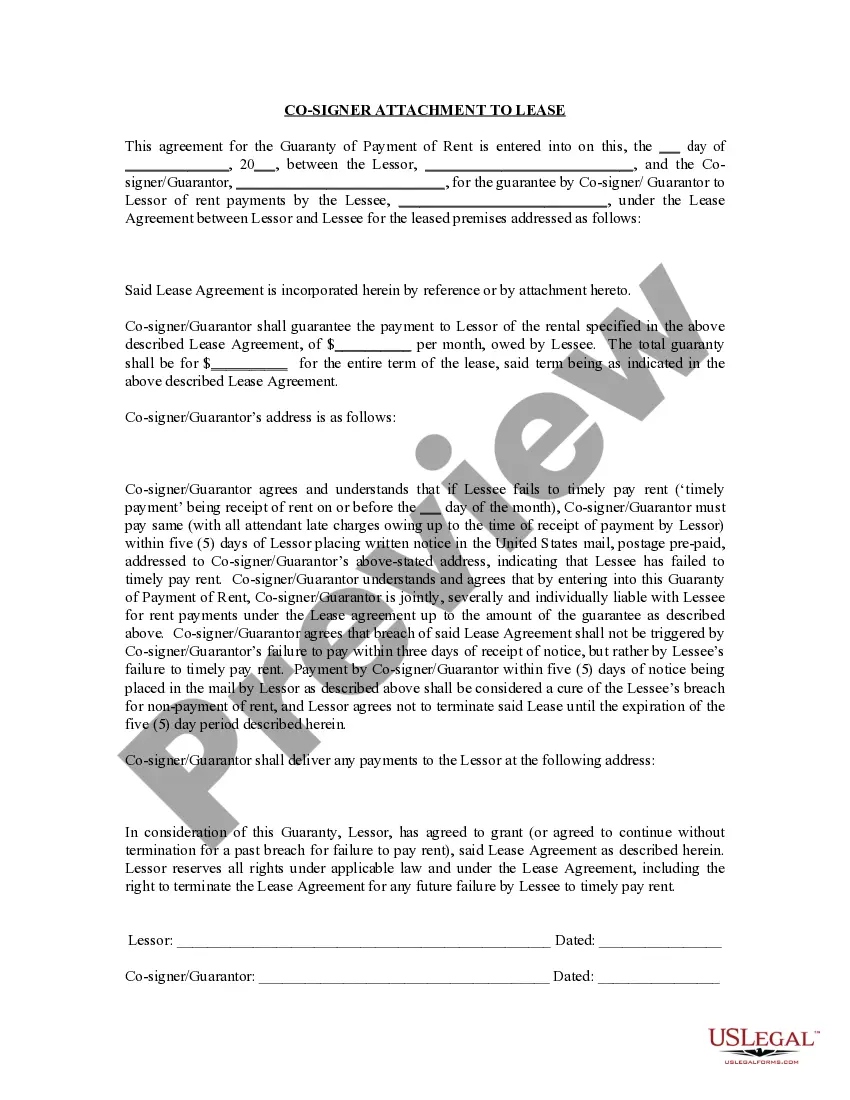

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

A mortgage specifies the procedure that will be followed if the borrower doesn't repay the loan. If you live in a deed of trust state, you will not get a mortgage note. Therefore, it's essential to ensure that your mortgage note and all other legal documents involved in your home buying process are completely accurate.

Often there is no legal requirement that a promise to pay be evidenced in a promissory note, nor any prohibition from including it in a loan or credit agreement. Although promissory notes are sometimes thought to be negotiable instruments, this typically is not the case.