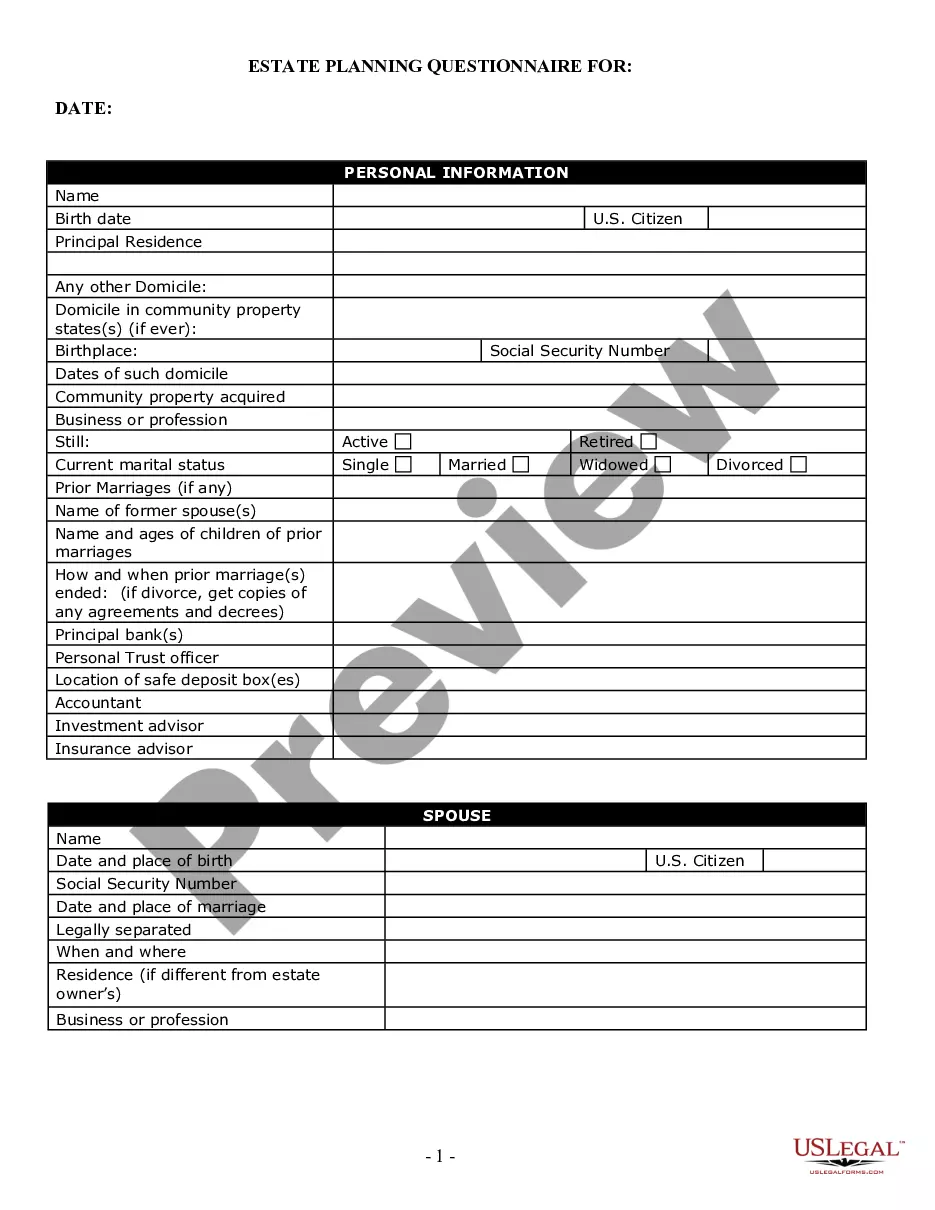

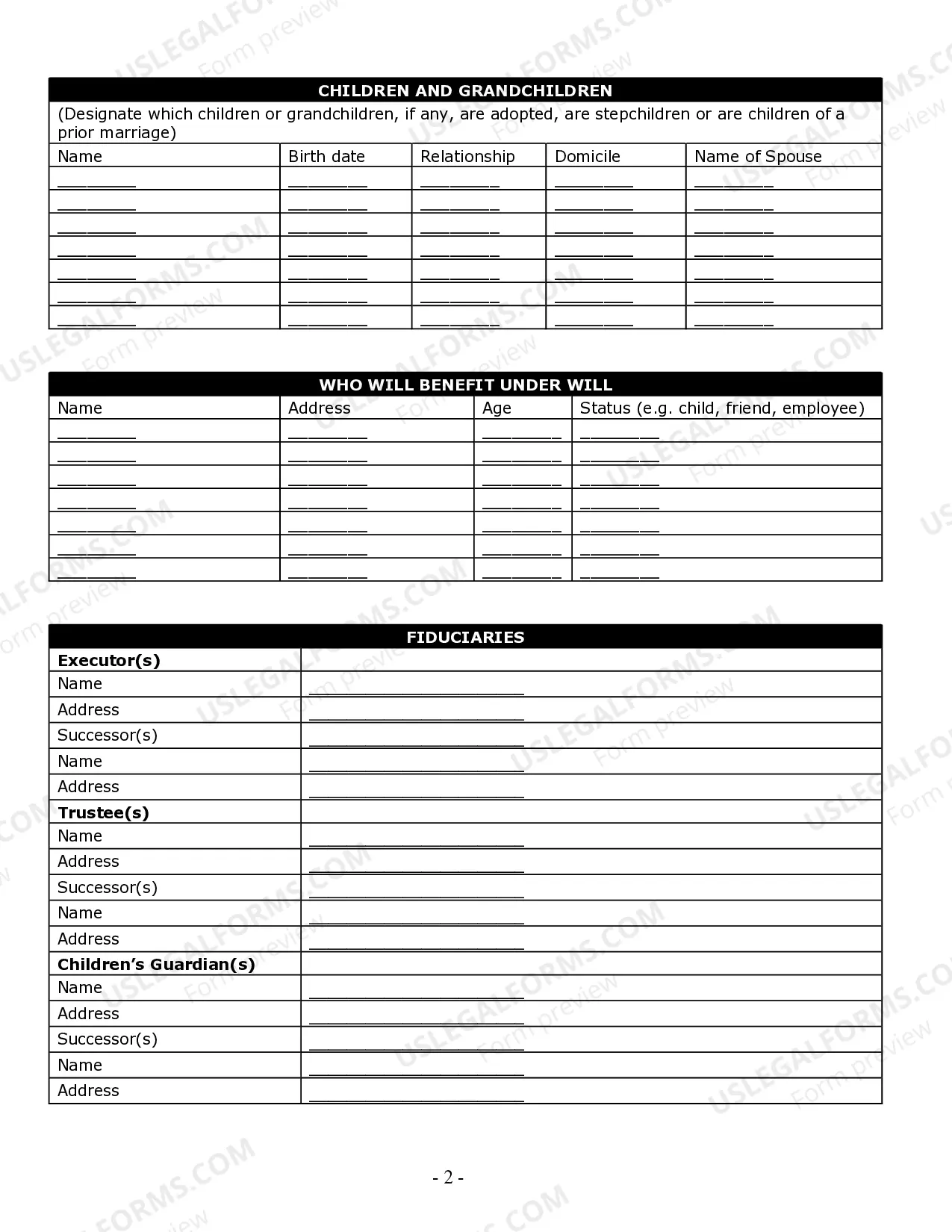

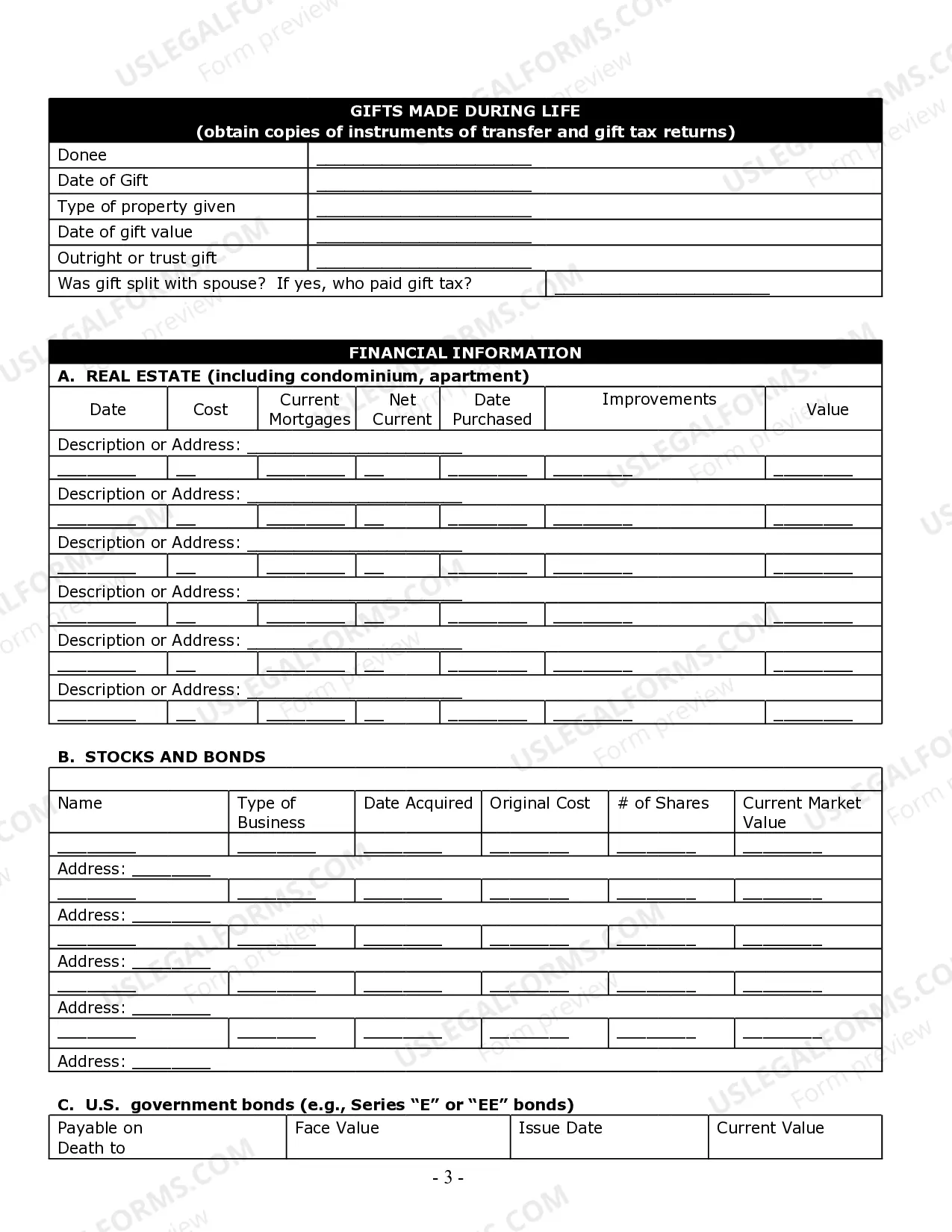

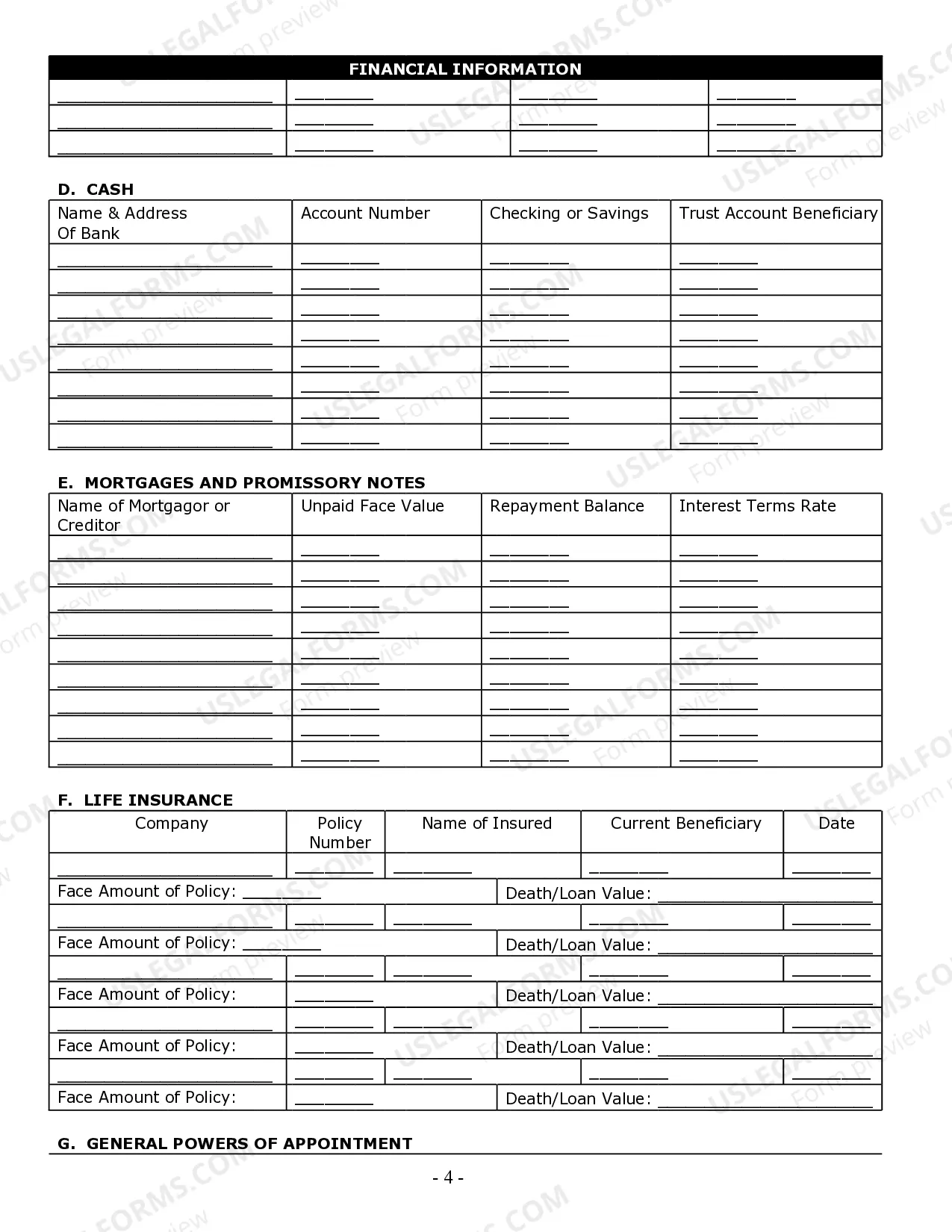

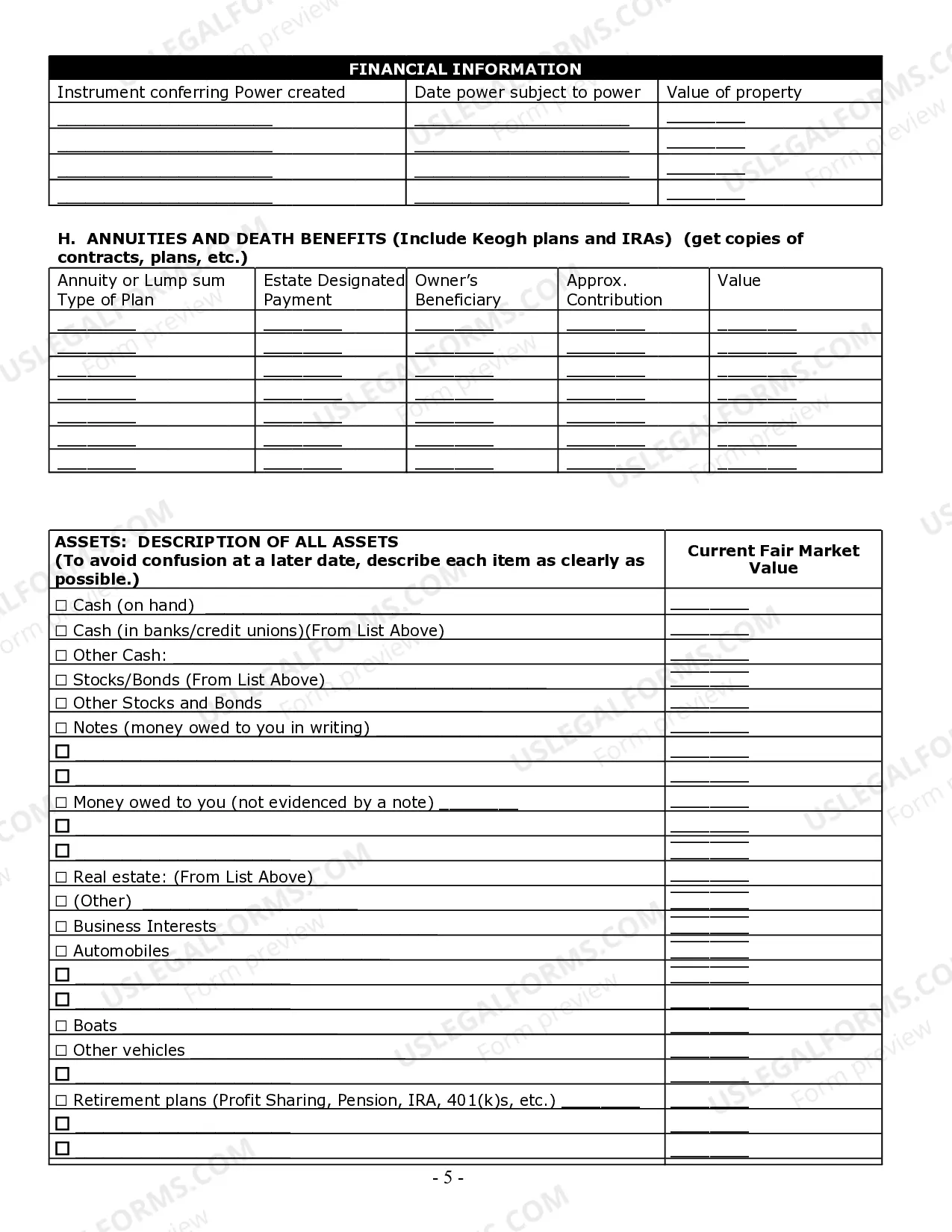

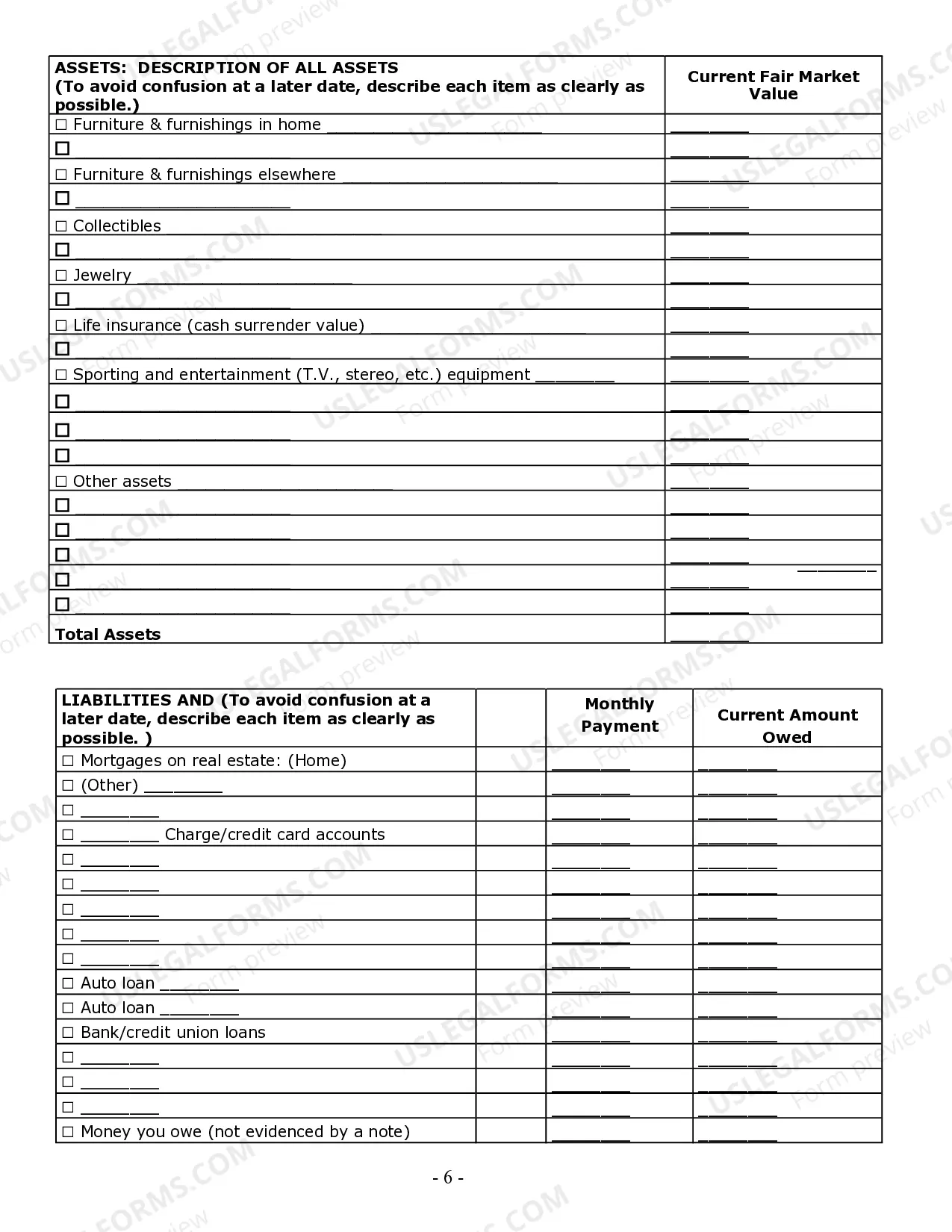

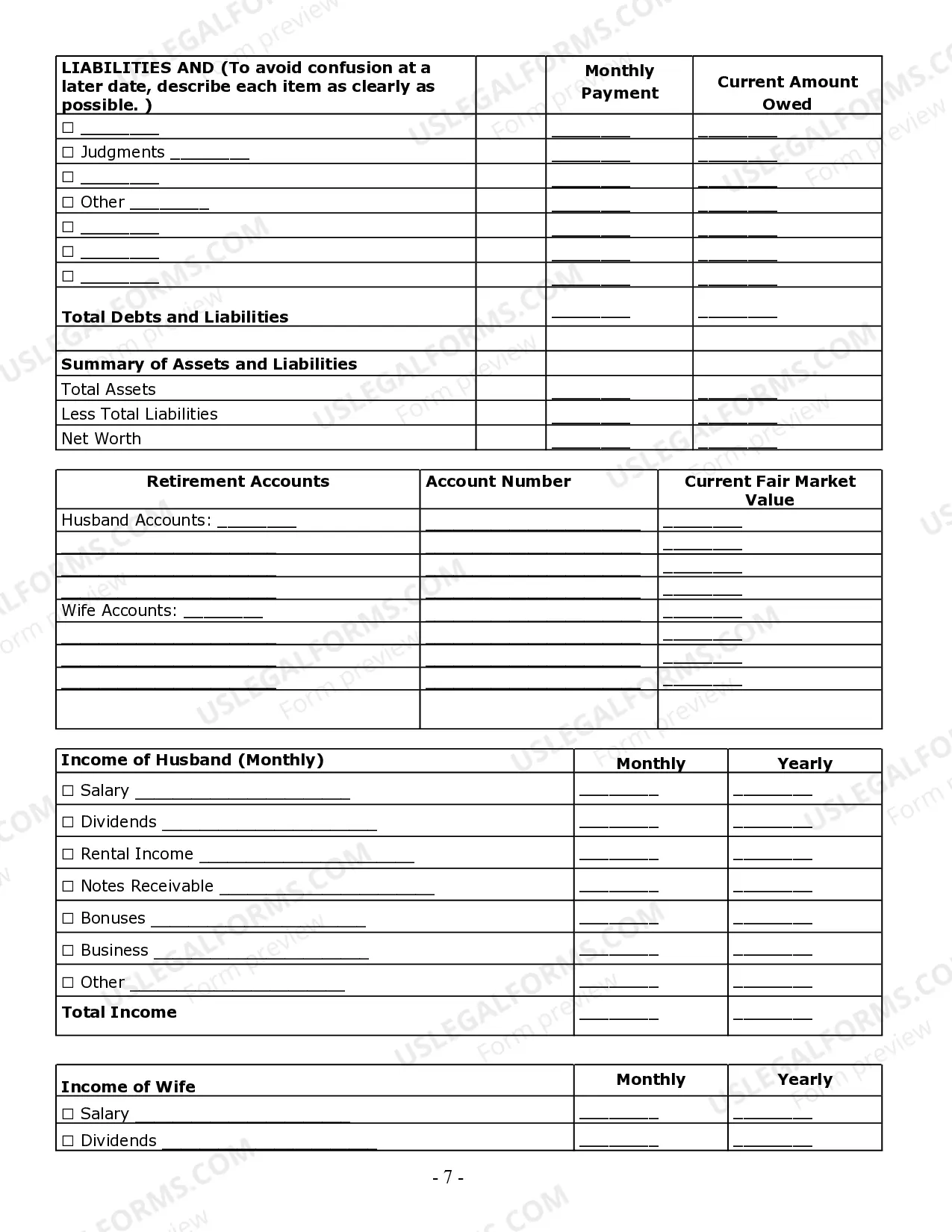

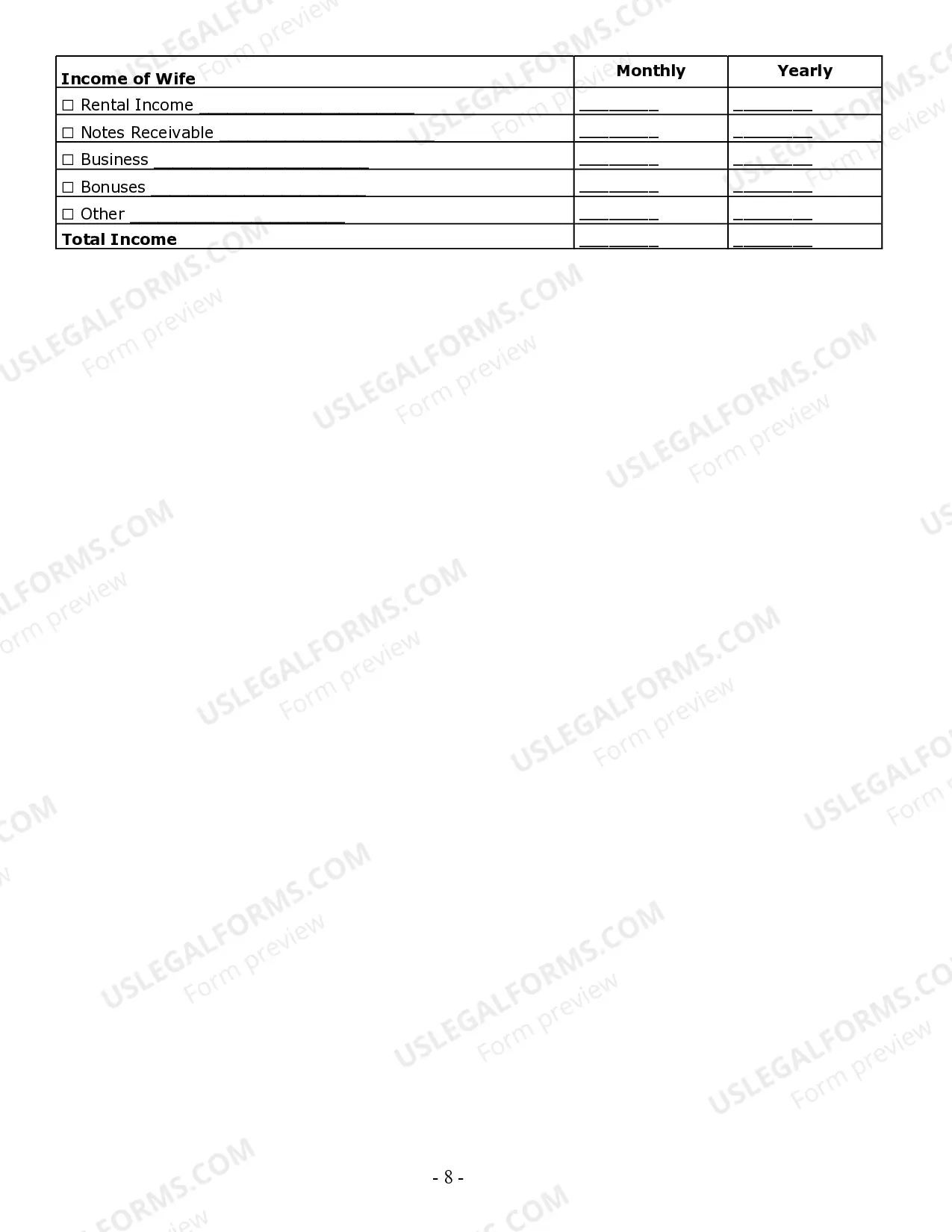

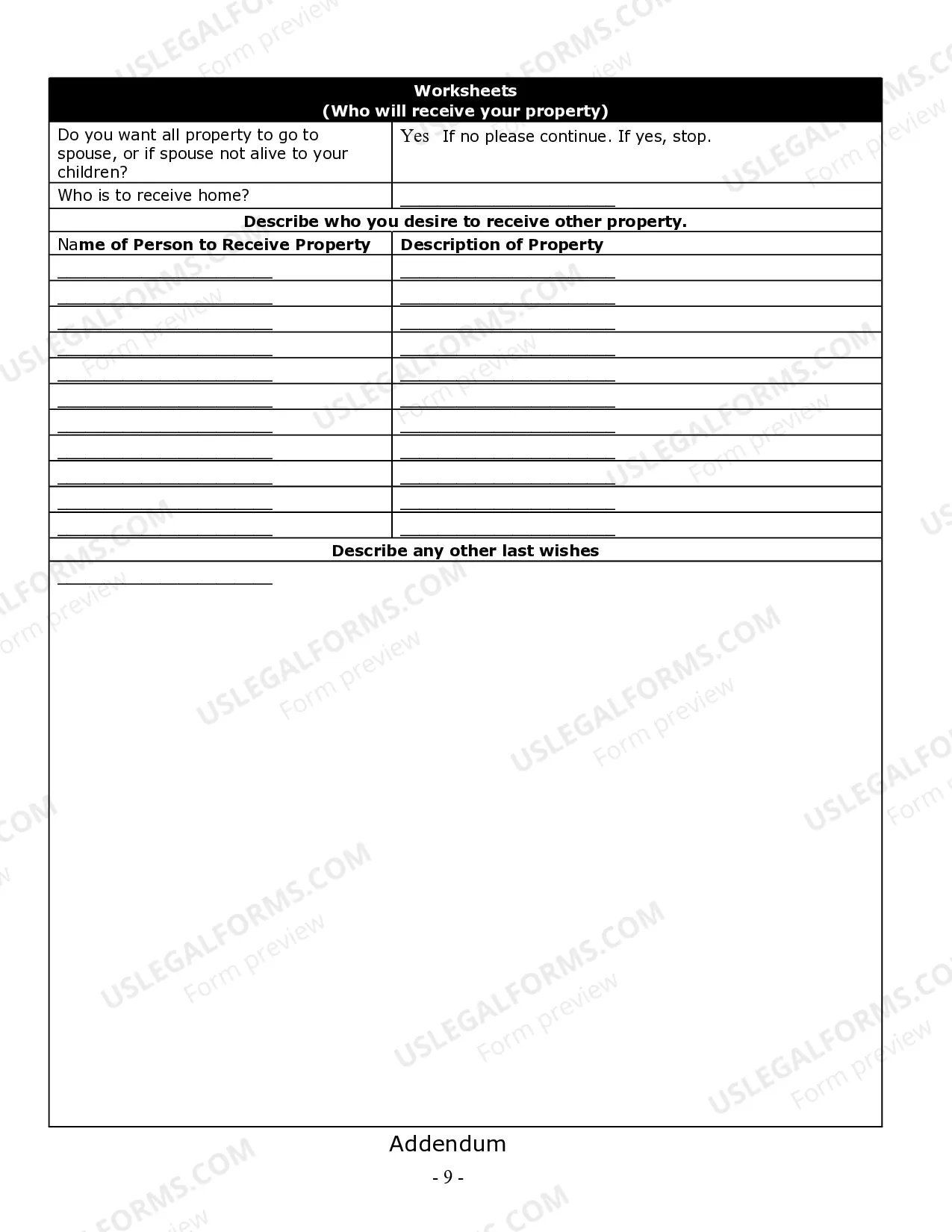

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Laredo Texas Estate Planning Questionnaire and Worksheets

Description

How to fill out Texas Estate Planning Questionnaire And Worksheets?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our supportive platform with a vast collection of templates enables you to locate and acquire nearly any document template you desire.

You can save, complete, and verify the Laredo Texas Estate Planning Questionnaire and Worksheets in just a few minutes rather than spending countless hours online searching for an appropriate template.

Using our database is a superb approach to enhance the security of your document submissions. Our qualified attorneys frequently examine all documents to ensure that the forms are suitable for a specific region and adhere to current laws and regulations.

Initiate the saving process. Click Buy Now and select the pricing option you prefer. Then, register for an account and purchase your order with a credit card or PayPal.

Download the file. Choose the format to obtain the Laredo Texas Estate Planning Questionnaire and Worksheets and review and fill it out, or sign it according to your preferences.

- How can you access the Laredo Texas Estate Planning Questionnaire and Worksheets.

- If you already have an account, simply Log In to your profile. The Download button will be activated for all the samples you view.

- Additionally, you can retrieve all previously saved documents in the My documents section.

- If you do not have an account yet, follow the steps below.

- Locate the template you require. Confirm that it is the form you need: check its title and description, and utilize the Preview option when available. Otherwise, utilize the Search feature to find the desired one.

Form popularity

FAQ

The 5 by 5 rule provides a strategy for beneficiaries to withdraw funds from a trust without triggering taxes, as it allows a beneficiary to take out the greater of 5% of the trust value or the amount of $5,000 each year. This rule is particularly advantageous for maintaining financial stability while adhering to trust guidelines. By using the Laredo Texas Estate Planning Questionnaire and Worksheets, you can explore your options and create a well-structured estate plan that leverages the benefits of the 5 by 5 rule.

The 5 or 5 rule in estate planning allows a person to withdraw up to 5% of the trust's value each year or to withdraw up to 5% of the principal without incurring gift tax. This rule emphasizes flexibility in managing trust assets while ensuring compliance with tax regulations. Utilizing the Laredo Texas Estate Planning Questionnaire and Worksheets can help you understand how to implement this rule effectively, ensuring your estate plan meets your financial needs and complies with legal standards.

An estate planning questionnaire is a tool designed to help you organize your thoughts and information about your estate. It typically includes questions about your assets, family situation, and specific wishes for your estate's distribution. By completing the Laredo Texas Estate Planning Questionnaire and Worksheets, you take an important step toward creating a comprehensive estate plan that reflects your unique situation.

To fill out an estate planning questionnaire, start by gathering personal information such as your name, address, and details about your assets and liabilities. Take your time to answer each question thoroughly, as this information will guide you in creating your estate plan. Using the Laredo Texas Estate Planning Questionnaire and Worksheets can simplify this process by providing clear prompts and organization to your responses.

The 5 and 5 rule allows individuals to gift up to $15,000 per year to different individuals without incurring a gift tax. This rule essentially enables you to spread your gifts over a five-year period, thus maximizing your tax advantages. Utilizing the Laredo Texas Estate Planning Questionnaire and Worksheets can help you understand how to incorporate this rule into your financial strategy.

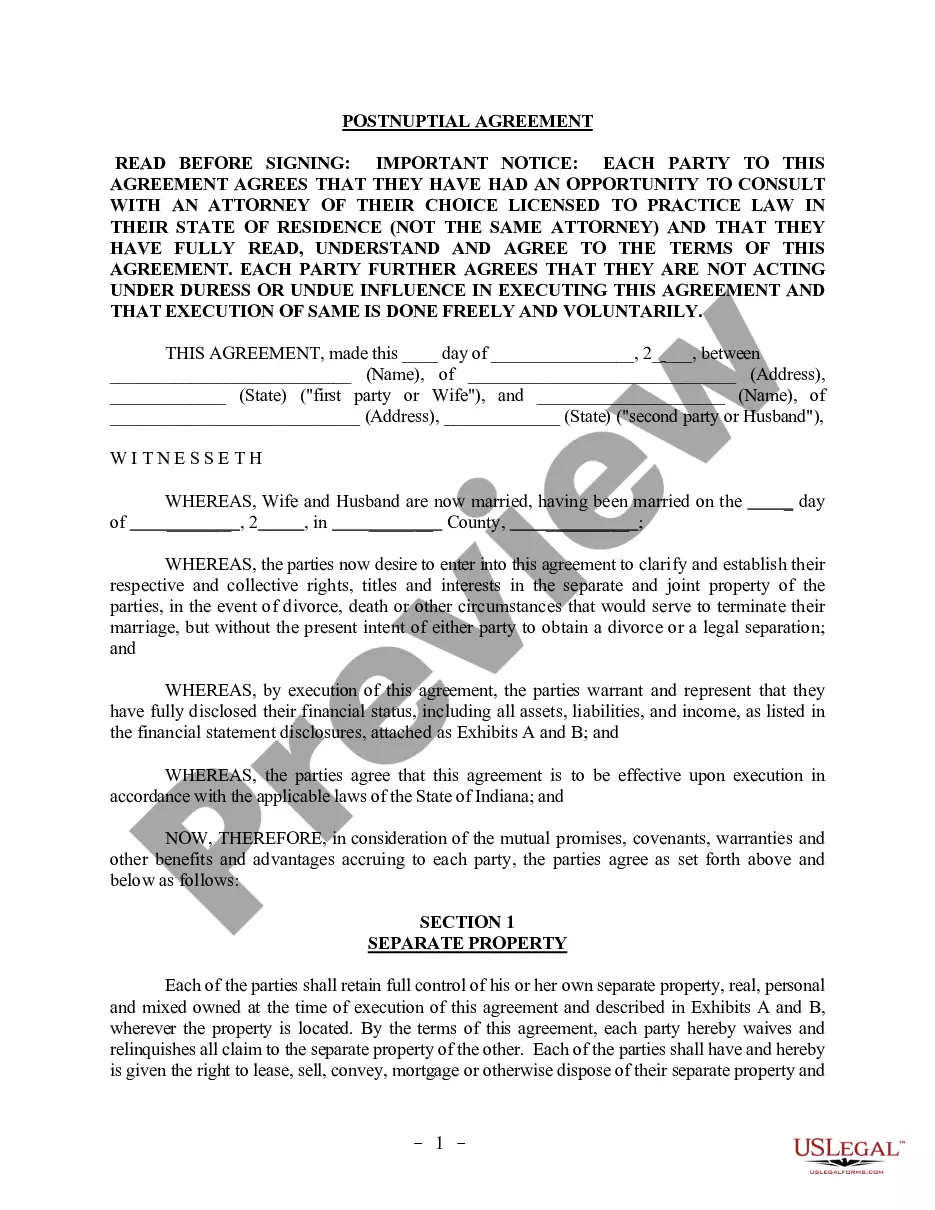

The five components of estate planning include a will, power of attorney, healthcare directive, trust, and beneficiary designations. These elements work together to ensure your assets are distributed according to your wishes, and your healthcare decisions are respected. When using the Laredo Texas Estate Planning Questionnaire and Worksheets, you can easily gather the necessary information to create these important documents.

The estate planning process generally involves the following seven steps: assessing your assets, determining your goals, selecting beneficiaries, choosing an executor, creating a will, establishing trusts if necessary, and reviewing your plan regularly. Each step is crucial in ensuring your wishes are honored after your passing. To simplify this process, consider using the Laredo Texas Estate Planning Questionnaire and Worksheets, which guide you through each stage effectively. Regularly updating your plan helps to accommodate any changes in your circumstances or family dynamics.

Filing for probate yourself in Texas is feasible, and many individuals choose to do so to save costs. You'll want to familiarize yourself with the required forms and the filing process. Resources like the Laredo Texas Estate Planning Questionnaire and Worksheets can provide a structured approach to managing your responsibilities. By being thorough and following the guidelines, you can navigate the probate process with confidence.

In Texas, you typically have four years from the date of death to file probate. However, it's beneficial to begin the process sooner to avoid complications, especially if the will might be contested. Using the Laredo Texas Estate Planning Questionnaire and Worksheets can help you stay organized and on track with deadlines. Remember, timely filing helps ensure a smoother transition in managing the estate.

In Texas, you can submit your own will for probate without an attorney. You will need to file the will in the county where the deceased resided at the time of death. Utilizing the Laredo Texas Estate Planning Questionnaire and Worksheets can enhance your understanding of the filing process and requirements. Make sure to include any accompanying documents, such as a death certificate, to ensure a smooth submission.