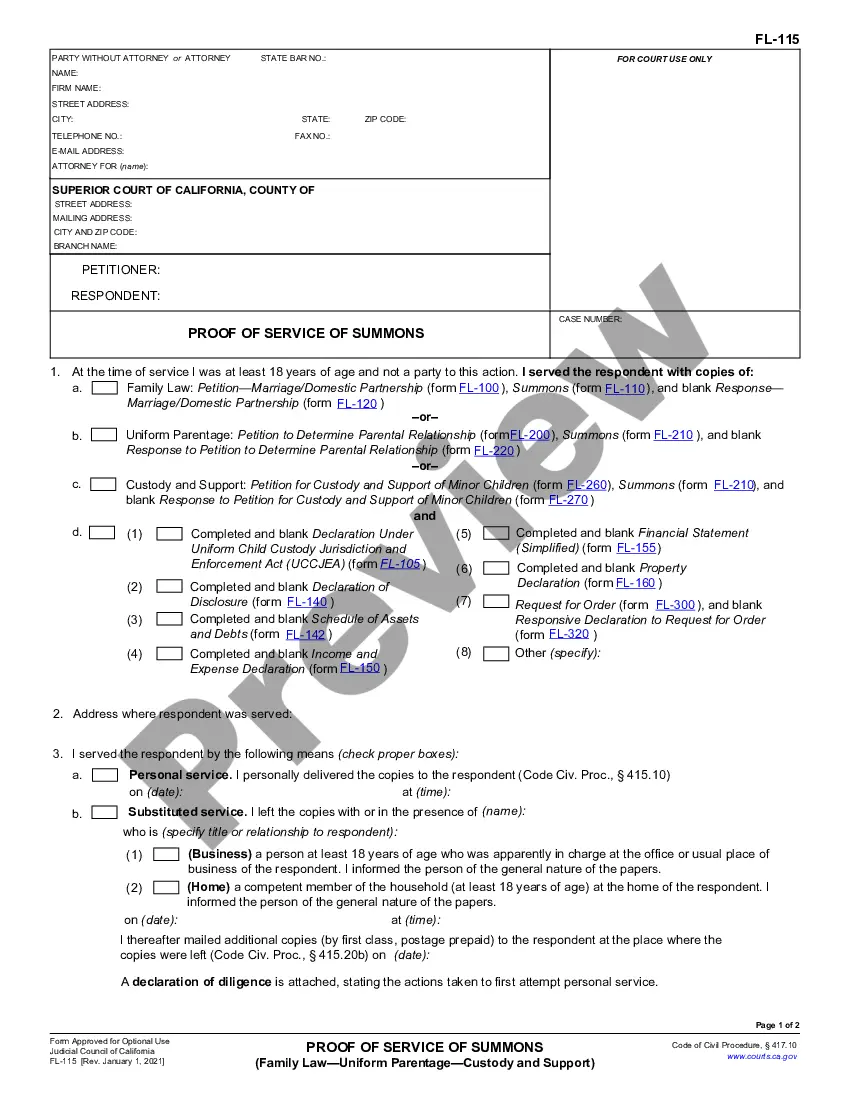

This is one of the official workers' compensation forms for the state of Texas.

League City Texas Application For Attorneys Fees

Description

How to fill out Texas Application For Attorneys Fees?

If you have previously availed yourself of our service, sign in to your account and store the League City Texas Application For Attorney Fees for Workers' Compensation on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to quickly discover and save any template for your personal or professional requirements!

- Confirm that you’ve found the correct file. Browse the description and utilize the Preview feature, if available, to verify if it suits your requirements. If it doesn’t match, use the Search tab above to discover the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and make a purchase. Enter your credit card information or use the PayPal option to finish the transaction.

- Obtain your League City Texas Application For Attorney Fees for Workers' Compensation. Choose the format for your document and save it to your device.

- Finalize your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

The amount that the average person spends on legal fees in Texas can range significantly based on various factors, including the type of legal issue and the attorney’s fees structure. Generally, legal fees can be anywhere from a few hundred to several thousand dollars. Using the League City Texas Application For Attorneys Fees can assist you in managing and understanding these potential costs upfront. Being informed can help you budget for legal expenses more effectively.

Reasonable attorney's fees in Texas vary based on the complexity of the case and the attorney's level of experience. Generally, these fees should reflect the amount of work put into a case, ensuring they are fair and justifiable. When using the League City Texas Application For Attorneys Fees, your attorney can help clarify what constitutes reasonable fees for your specific situation. Understanding this can empower you to challenge excessive charges when necessary.

Yes, in Texas, you can recover attorney's fees for negligence if you successfully prove your case. The League City Texas Application For Attorneys Fees allows you to seek these costs when pursuing compensation for damages caused by someone else's negligence. To qualify, it's essential to present a strong case that demonstrates the negligence and the resulting legal expenses. Engaging with an experienced attorney can help navigate this process effectively.

In general, attorney fees can be tax deductible if they are necessary for tax preparation, business operations, or certain legal proceedings. However, personal legal fees are usually not deductible. To clarify any uncertainties regarding the League City Texas Application For Attorneys Fees, it's wise to consult a tax expert or reliable resources to ensure compliance.

If you receive a 1099, you will typically report attorney fees in the section designated for nonemployee compensation. The fees should align with the services rendered and must be documented clearly. For thorough guidance on this process, especially in relation to the League City Texas Application For Attorneys Fees, consider utilizing uslegalforms for comprehensive support.

Attorney fees can often be deducted on Schedule C if they are business-related. If you incurred these fees while managing a personal matter, they may not be deductible. For specifics regarding the League City Texas Application For Attorneys Fees, it is beneficial to work with a tax professional who can guide you through the nuances.

To report legal fees, start by gathering all related documentation and receipts. You can typically report them as business expenses on your tax return if they are associated with your business operations. If you need assistance, consider using platforms like uslegalforms to simplify the process related to the League City Texas Application For Attorneys Fees.

In League City, Texas, fees directly related to your job or business can often be tax deductible. This includes attorney fees for legal services that help you generate income, as well as certain professional fees that contribute to your business operations. To fully understand what qualifies, consult a tax professional or explore resources regarding the League City Texas Application For Attorneys Fees.

Yes, there is an apostrophe in 'attorneys fees' when referring to fees charged by multiple attorneys. The correct form should be 'attorneys' fees,' indicating that the fees belong to the attorneys. When filling out a League City Texas Application For Attorneys Fees, ensure you are using the correct terminology to avoid any misunderstandings in legal documents.

In many cases, you can deduct lawyer fees from your taxes if they relate to certain legal matters, like business expenses. However, it's essential to review the specifics of your situation, ensuring compliance with IRS guidelines. If you are preparing a League City Texas Application For Attorneys Fees, consulting with a tax professional can provide the best advice for your financial situation.