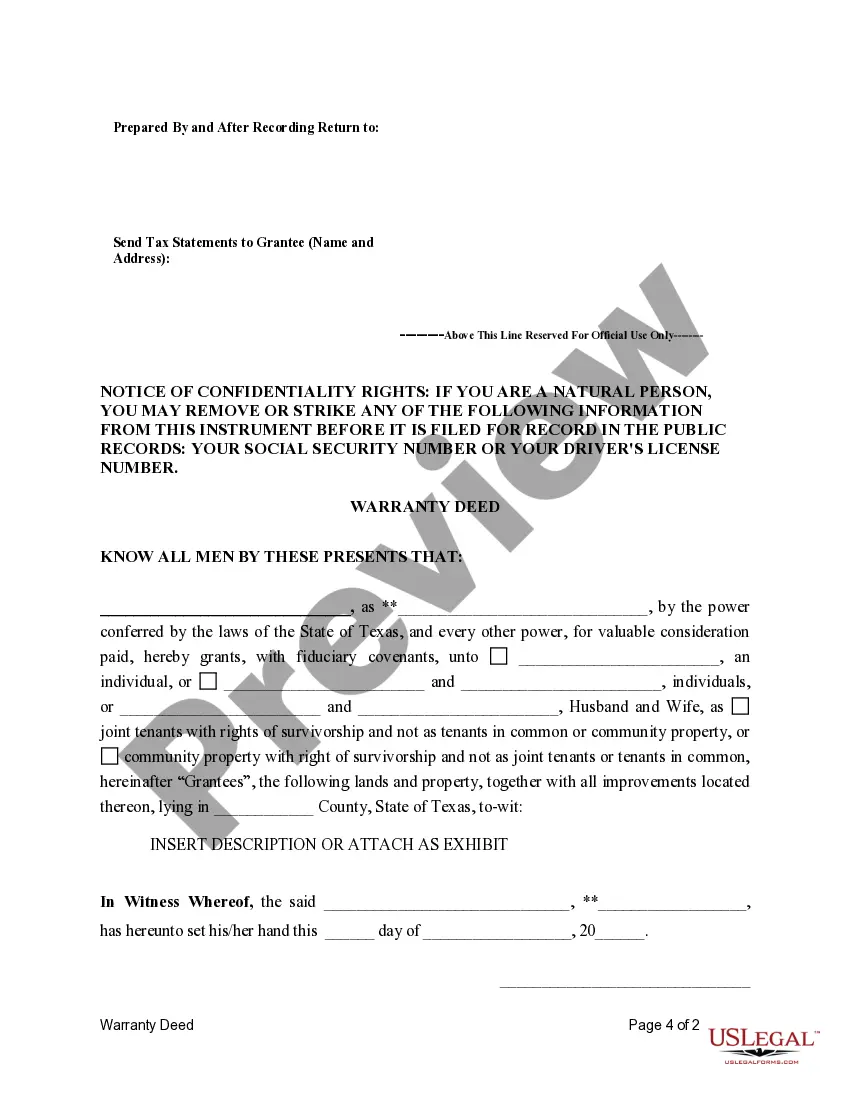

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Texas Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Locating authenticated templates tailored to your regional regulations may prove challenging unless you utilize the US Legal Forms repository.

It's an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life circumstances.

All the files are accurately organized by usage categories and jurisdictional areas, making it straightforward and simple to find the Waco Texas Fiduciary Deed for utilization by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Maintaining paperwork organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates at your fingertips for any needs!

- For individuals already familiar with our service and have utilized it previously, acquiring the Waco Texas Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- The procedure will involve a few more steps for new users.

- Adhere to the instructions below to commence with the most comprehensive online form catalog.

- Review the Preview mode and form description. Ensure you’ve picked the right one that aligns with your requirements and fully meets your local jurisdiction stipulations.

Form popularity

FAQ

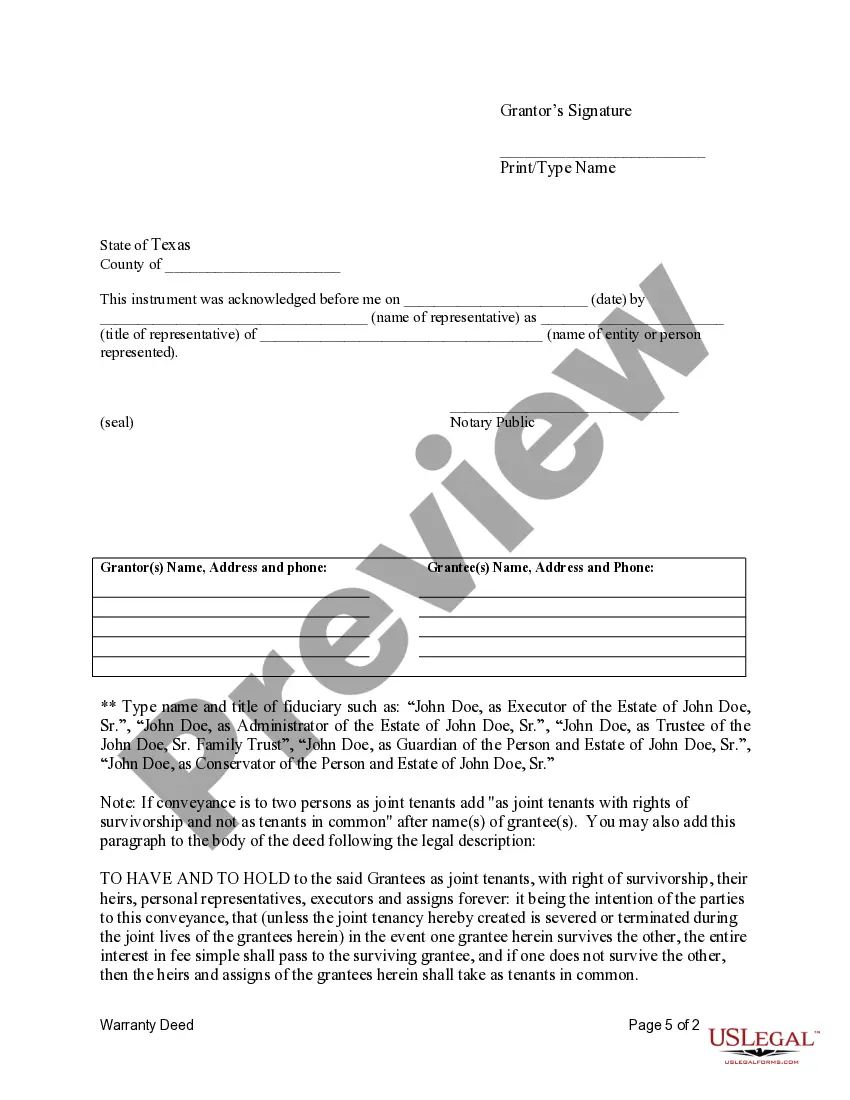

In Texas, anyone can prepare a deed as long as they are knowledgeable about the required elements and adhere to state laws. However, for more complex transactions, especially those involving a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, enlisting the help of a legal expert is advisable. They can ensure that all aspects of the deed are correctly addressed and executed.

The document that releases a deed of trust is often referred to as a release or reconveyance deed. This document must be properly executed to ensure that the borrower is relieved of the obligations tied to the deed of trust. If you’re working with a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, securing this release is crucial to clear the property title.

A fiduciary deed in real estate is a legal document that allows an executor, trustee, or other fiduciary to transfer property on behalf of another party. This type of deed ensures that fiduciaries fulfill their responsibilities while adhering to the laws governing property transactions. The Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries plays a vital role in facilitating these transactions efficiently.

The deed of trust is typically created by the borrower or their representative, such as a title company or attorney. In situations involving a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it is crucial that the document is prepared accurately to reflect the agreement between all parties. This guarantees proper legal standing and avoids issues down the line.

One of the main disadvantages of a trust deed is that it can limit the ability to sell the property without the lender's approval. Additionally, failure to meet the terms of a trust deed can lead to foreclosure. When using a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it’s important to understand these implications to guide your fiduciary duties.

In Texas, a deed of trust can be prepared by various individuals, including lawyers and licensed title agents. If you are dealing with a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it’s wise to seek professional help to ensure that it meets all legal requirements. This can prevent future disputes and streamline the property transfer process.

In Texas, it is not legally required to have a lawyer transfer a deed, including a Waco Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries. However, engaging a legal professional can simplify the process and ensure compliance with local laws. A lawyer can help navigate potential complications and ensure that everything is clearly documented.

One disadvantage of a trust deed is that it may complicate the transfer process, especially if the property is not clearly defined. Furthermore, the legal obligations tied to managing a trust can impose additional responsibilities on fiduciaries in Waco, Texas. It is vital for executors and trustees to be well-informed about these obligations to avoid potential misunderstandings. Utilizing services like US Legal Forms can provide the necessary resources to navigate these complexities smoothly.

In real estate, the three main types of deeds include warranty deeds, quitclaim deeds, and trustee's deeds. Warranty deeds provide a guarantee of clear title, while quitclaim deeds transfer any ownership interest without warranties. A trustee's deed, as used in Waco, Texas, specifically relates to properties held in trust. Understanding these options gives executors, trustees, and other fiduciaries the knowledge to make informed decisions.

A trustee's deed in Texas is a legal document that allows a trustee to transfer property to a new owner. This deed is executed when a trustee acts according to the terms laid out in a trust agreement, ensuring transparency in the asset distribution process. It plays a crucial role in estate management for executors, trustees, trustors, and administrators. Using a Waco Texas fiduciary deed simplifies this process, providing clarity and legal assurance.