Bexar Texas Acknowledgment of Protest

Description

How to fill out Texas Acknowledgment Of Protest?

Locating authenticated templates that align with your regional laws can be challenging unless you utilize the US Legal Forms repository.

This is an online assortment of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are appropriately categorized by usage area and jurisdictional domains, making it as straightforward as ABC to find the Bexar Texas Acknowledgment of Protest.

Submitting your credit card information or utilizing your PayPal account to pay for the service will finalize the transaction.

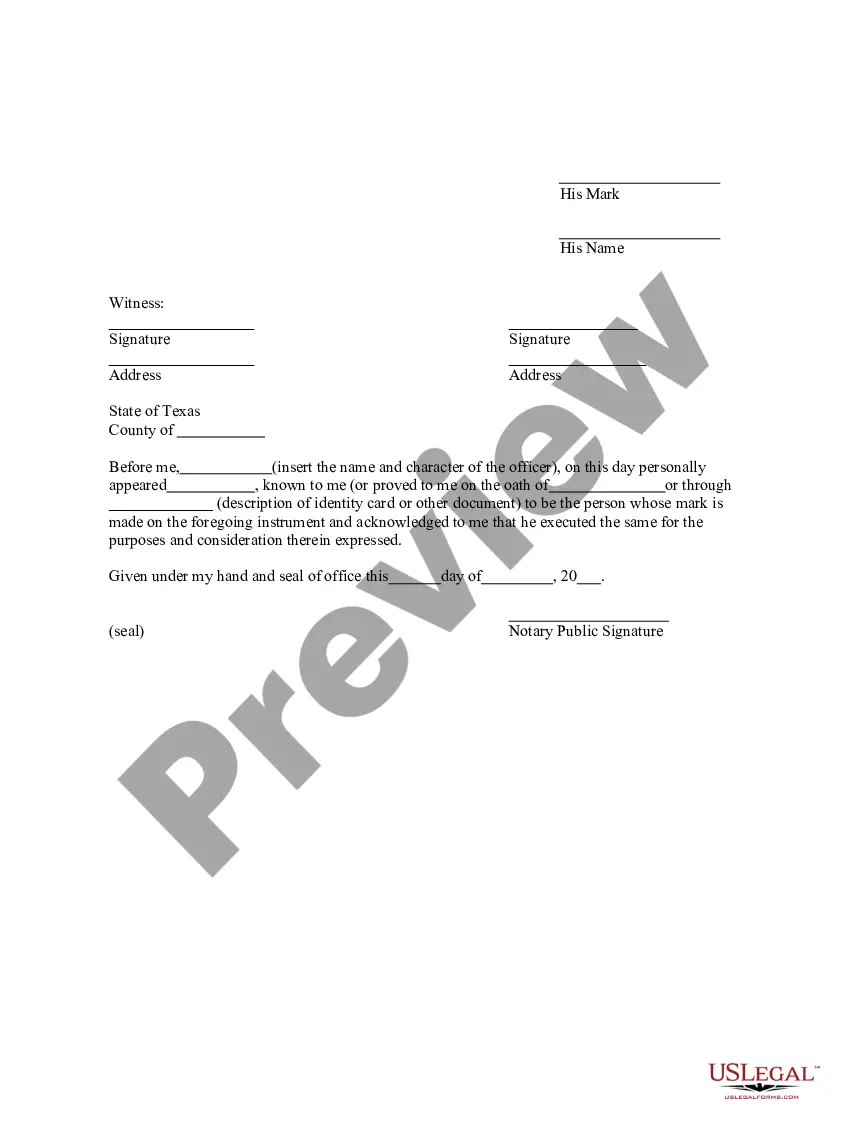

- Examine the Preview mode and form details.

- Ensure you’ve chosen the correct one that meets your needs and fully conforms to your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your criteria, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

The best evidence to protest property taxes includes comparable sales data, professional appraisals, and photographs of your property. When preparing your Bexar Texas Acknowledgment of Protest, ensure you gather clear supporting documents that substantiate your claims about overvaluation. This evidence is vital in convincing the appraisal review board to consider your position. A well-documented protest increases your likelihood of achieving a favorable result.

Filling out the property owners notice of protest form is straightforward but requires attention to detail. You will need to complete the form with accurate information about your property and the reason for your protest. Make sure to properly indicate your intent to file a Bexar Texas Acknowledgment of Protest. If you need guidance, USLegalForms can provide templates and support to ensure your submission is correct.

In Texas, the last day to protest property taxes is typically May 15, unless otherwise noted by the appraisal district. By submitting the Bexar Texas Acknowledgment of Protest before this date, you engage in the essential steps to challenge any perceived inaccuracies in your property’s valuation. Being aware of this cutoff date helps ensure you take action on time. Engaging promptly can significantly impact your tax obligations.

In Texas, you typically have until May 15 to file a dispute regarding your property taxes. If you initiate the Bexar Texas Acknowledgment of Protest, you begin the formal process of challenging your property's valuation. Timely action is crucial, so be sure to prepare all necessary documentation as soon as you receive your appraisal notice. The sooner you respond, the better your chances of a favorable outcome.

The new law for Texas property taxes introduces updates designed to provide homeowners with more clarity and options. It emphasizes the importance of filing a Bexar Texas Acknowledgment of Protest if you believe your property has been overvalued. This law also aims to streamline the process for disputing property taxes, ensuring that property owners have fair opportunities for adjustment. Staying informed about these changes can greatly benefit your financial planning.

Winning a property tax protest in Texas largely depends on presenting strong evidence to support your case. Gather data like comparable property sales, recent appraisals, and any relevant market studies. It’s also helpful to know the timeline for filing your Bexar Texas Acknowledgment of Protest and to prepare for the hearing by practicing your presentation. Ultimately, a well-prepared case based on factual evidence increases your chances of a favorable outcome.

There are several valid reasons to protest property taxes in Texas, including a perceived overvaluation of your property or significant changes in the local real estate market. Homeowners may also protest if they believe there are errors in property characteristics, such as square footage or property type. Other reasons include evidence of declining property values or recent sales data that contradict the assessed value. Filing a Bexar Texas Acknowledgment of Protest can help ensure these concerns are formally addressed.

When you protest property taxes in Bexar, Texas, it’s essential to clearly state your reasons in your protest letter. Start by including your property details and reference the tax assessment you would like to contest. Highlight any discrepancies in property value, and provide supporting evidence, such as recent sales of similar properties, to strengthen your argument. Utilizing a well-structured Bexar Texas Acknowledgment of Protest can make your case more compelling.

Successfully protesting your property taxes in Texas requires timely action and well-prepared documentation. Follow the deadlines for filing your Bexar Texas Acknowledgment of Protest and ensure you gather necessary evidence. Consistent communication with the appraisal district can also enhance your chances of a favorable outcome.

To protest property taxes in Texas, you'll need specific evidence to substantiate your claim. Commonly accepted evidence includes recent sales data for similar properties, photographs, and professional appraisals. By filing a Bexar Texas Acknowledgment of Protest, you can organize this evidence, making it easier to present your case effectively.