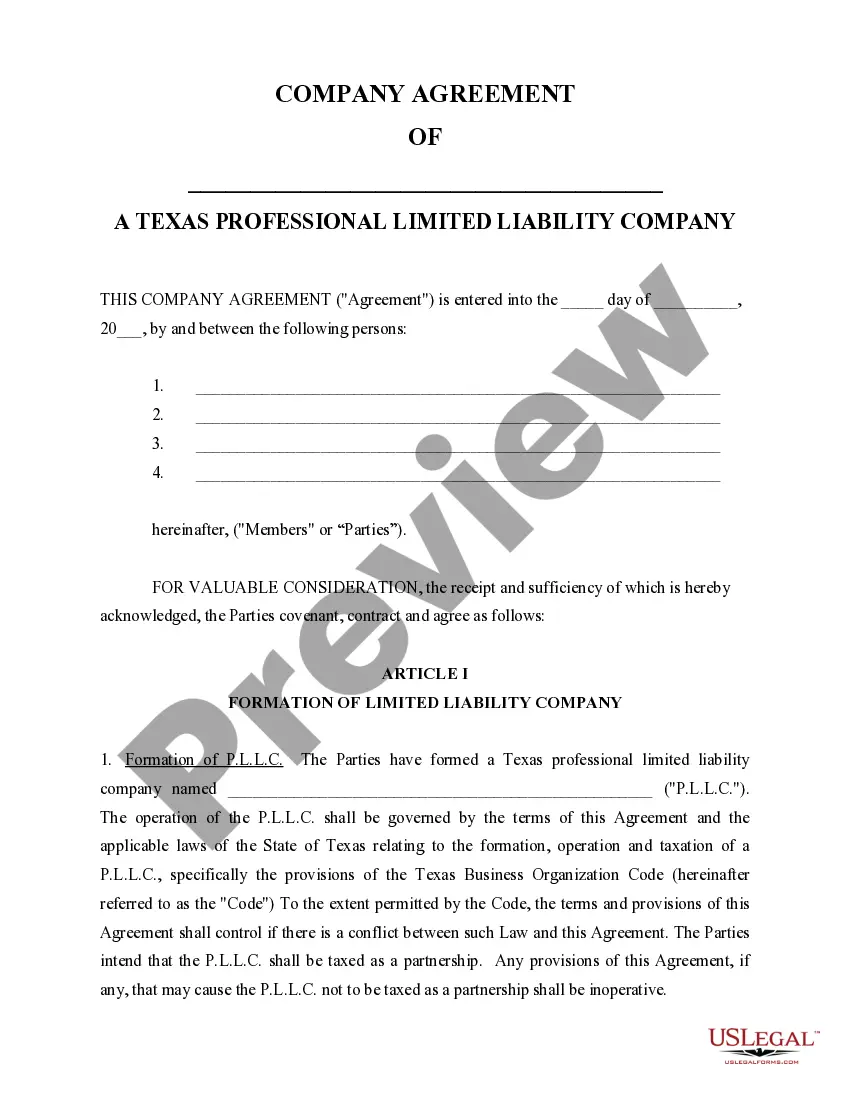

This sample Operating Agreement describes the rules by which the Members agree to govern the company. Modify to suit your needs.

Arlington Texas Sample Operating Agreement for Professional Limited Liability Company PLLC

Description

How to fill out Texas Sample Operating Agreement For Professional Limited Liability Company PLLC?

If you are searching for a pertinent form, it’s challenging to discover a more accessible site than the US Legal Forms website – one of the most extensive collections on the internet.

Here you can obtain thousands of document samples for business and personal use categorized by types and states, or keywords.

With our sophisticated search feature, locating the latest Arlington Texas Sample Operating Agreement for Professional Limited Liability Company PLLC is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the file format and download it to your device. Edit the document. Fill in, modify, print, and sign the downloaded Arlington Texas Sample Operating Agreement for Professional Limited Liability Company PLLC.

- Furthermore, the relevance of each document is validated by a team of proficient attorneys who regularly examine the templates on our site and revise them based on the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Arlington Texas Sample Operating Agreement for Professional Limited Liability Company PLLC is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have accessed the sample you need. Review its description and use the Preview feature to assess its content. If it doesn’t satisfy your requirements, use the Search box at the top of the page to locate the necessary document.

- Verify your selection. Choose the Buy now option. Subsequently, select the desired pricing plan and provide your details to register for an account.

Form popularity

FAQ

Your Texas LLC Operating Agreement doesn't need to be notarized. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legally binding document for all of you.

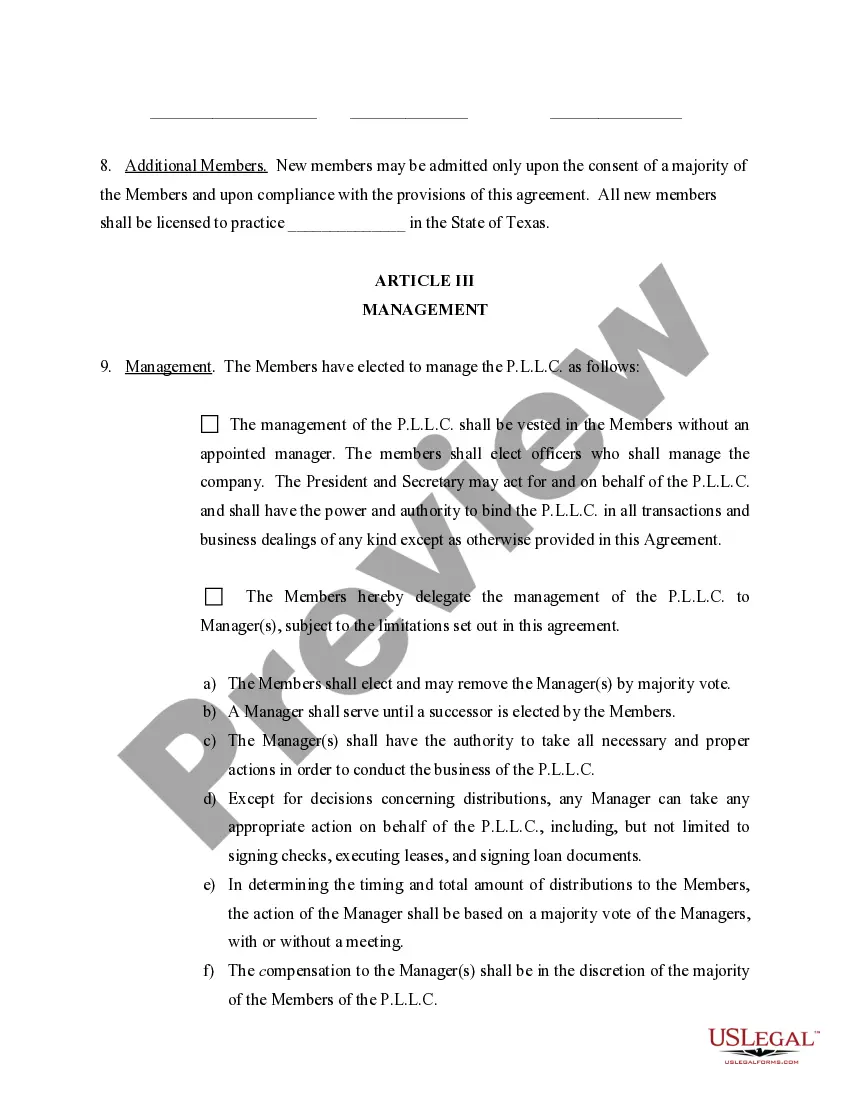

With an LLC, anyone can be a member, or owner, of the business. State PLLC laws often provide that only licensed professionals can be members, or that a certain number of members must be licensed professionals. A PLLC cannot be used to shield the members from claims for malpractice.

Advantages. Members of a PLLC aren't personally liable for the malpractice of any other member. This is a big advantage over a general partnership or sole proprietorship. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent.

Typically, PLLCs benefit from what is referred to as ?pass-through? taxation. This means that the business entity itself does not pay taxes to the federal government. Rather, income for the business is taxed at the individual level and paid on the tax returns of the PLLC members.

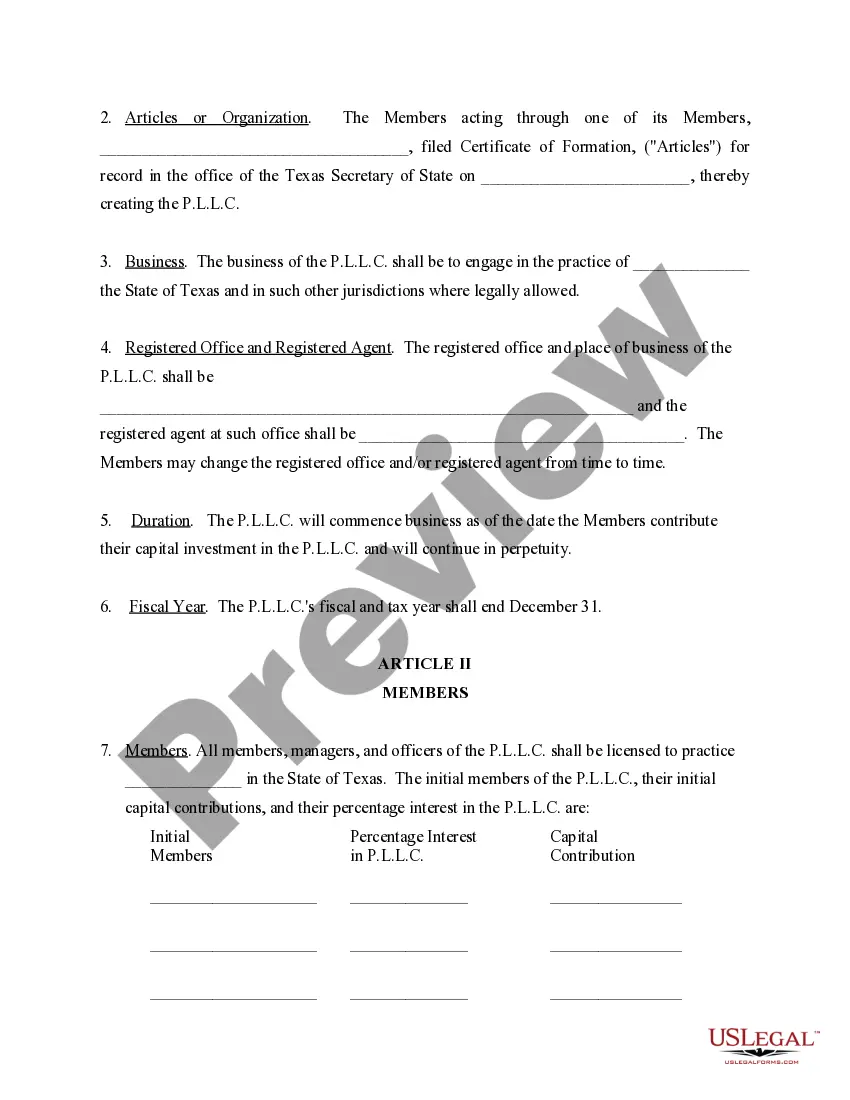

A Texas PLLC is a limited liability company (LLC) formed specifically by people who will provide Texas licensed professional services. LLCs in general are businesses registered with the state that consist of one or more people?called LLC members?who own the business.

Although this document is not required for companies doing business in Texas, without an operating agreement in place, the members could be held financially liable in the event of a lawsuit. Filing an operating agreement ensures the LLC owners' personal assets will be protected from business liability.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

The professional limited liability company (hereinafter PLLC) is a limited liability company that is formed for the purpose of providing a professional service.

Texas does not require LLCs to have operating agreements, but it is highly recommended. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.