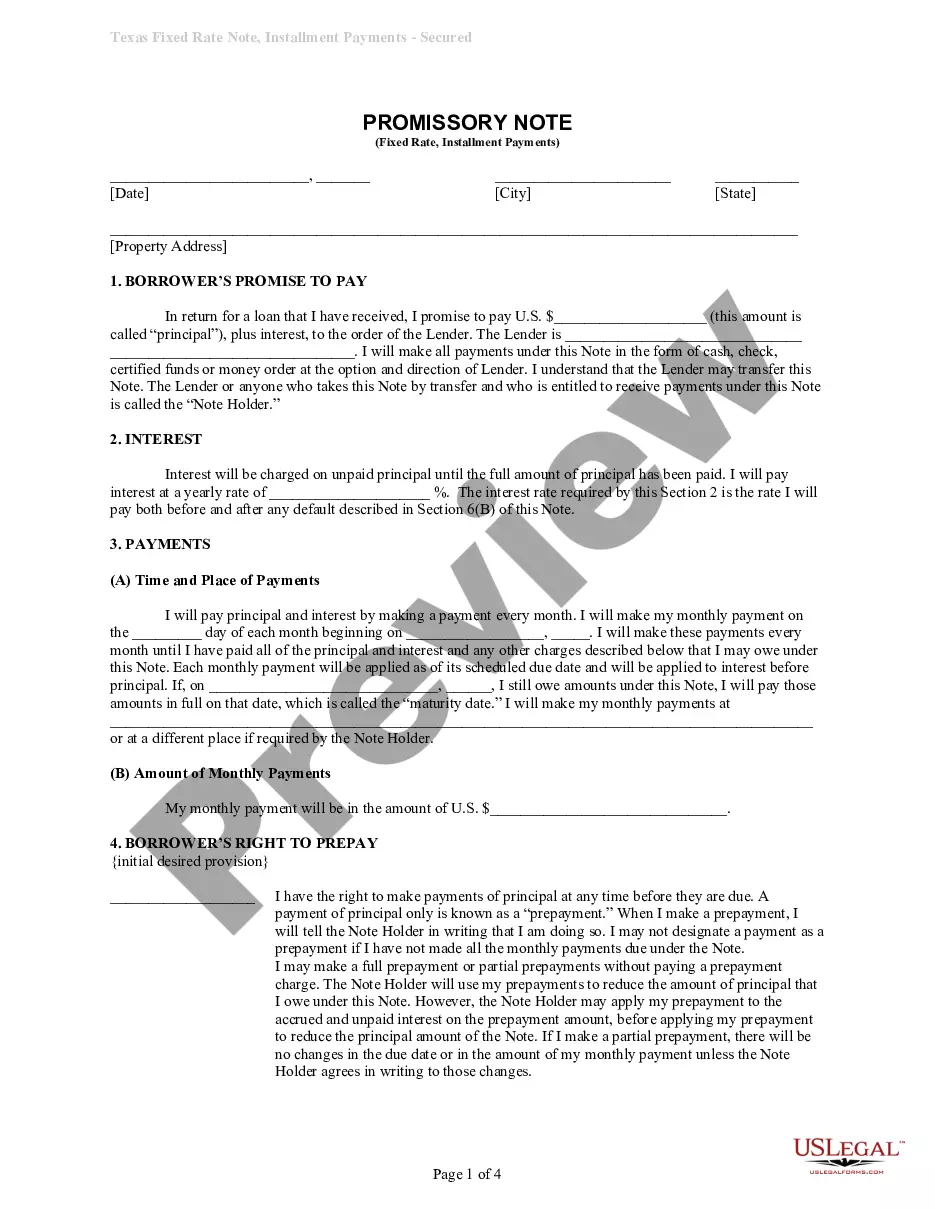

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Fort Worth Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Irrespective of one’s social or occupational standing, completing legal documents is a regrettable requirement in today's society.

Frequently, it’s nearly impossible for an individual without a legal background to generate this type of documentation from the ground up, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms proves to be useful.

Make sure the form you have located is tailored to your area, as the laws of one state or region do not apply to another.

You can either print the document or fill it out online. If you encounter any difficulties obtaining your purchased forms, you can easily locate them in the My documents tab.

- Our platform offers an extensive array of over 85,000 ready-to-use, state-specific forms applicable to nearly every legal scenario.

- US Legal Forms is also a fantastic resource for associates or legal advisers who wish to enhance their efficiency by utilizing our DIY paperwork.

- Regardless of whether you need the Fort Worth Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other documentation that is valid in your jurisdiction, US Legal Forms has everything available.

- Here’s how you can quickly obtain the Fort Worth Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate using our reliable service.

- If you are an existing client, you can proceed to Log In to your account to access the necessary form.

- However, if you are unfamiliar with our database, make sure to follow these steps before downloading the Fort Worth Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Form popularity

FAQ

A Promissory Note is a contract between a borrower and a lender. In the note, the borrower promises to repay the loan according to the terms of agreement specified within the note. If the borrower fails to repay the loan according to the agreed terms, the borrower may be liable for breach of note.

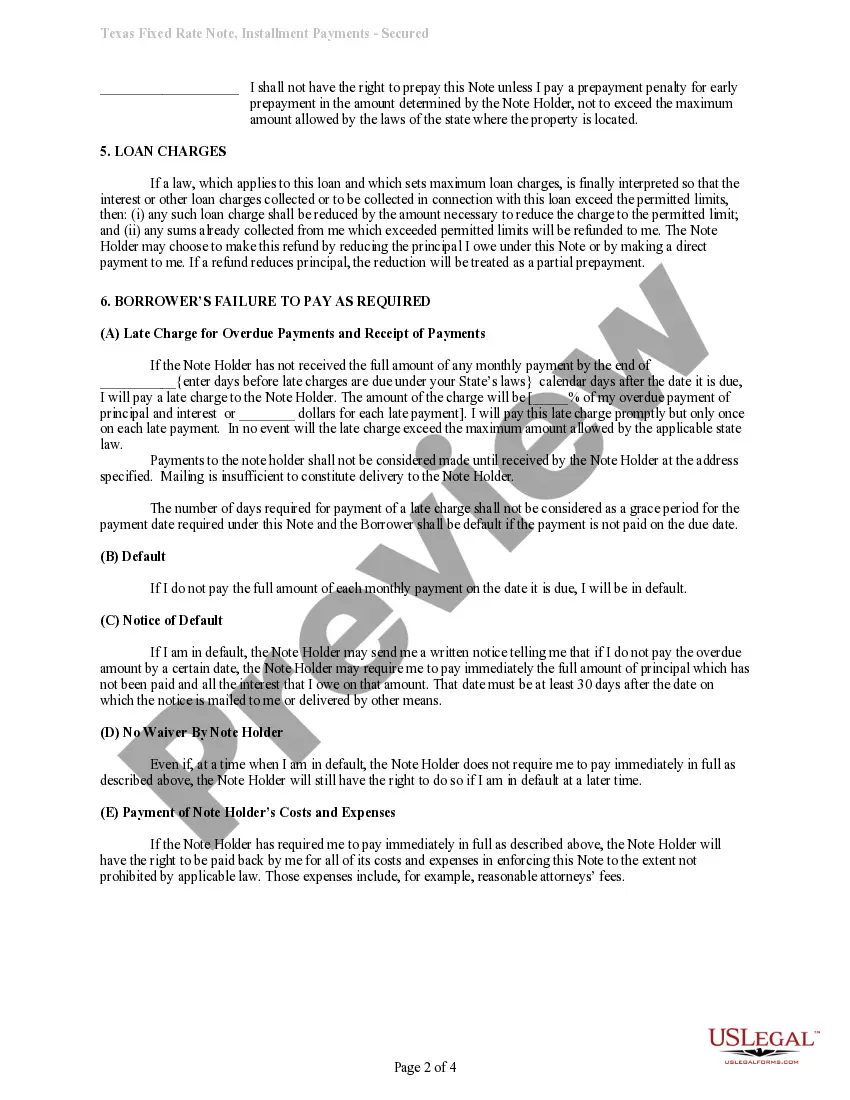

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Governing Law. Texas promissory notes do not have to be notarized. However, to make them a legal document, they must be signed and dated by the borrower. If there is a co-signer, they should also sign and date the agreement.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Secured Promissory Notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

In the instance of a promissory note (a promissory note is an agreement to pay back money that gets borrowed or loaned), the statute of limitations in Texas is typically four years. Promissory notes are often accompanied by some sort of security interest, in either real estate or a car.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.