This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Austin Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously utilized our service, sign in to your account and store the Austin Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment schedule.

If this is your inaugural experience with our service, follow these straightforward steps to obtain your file.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

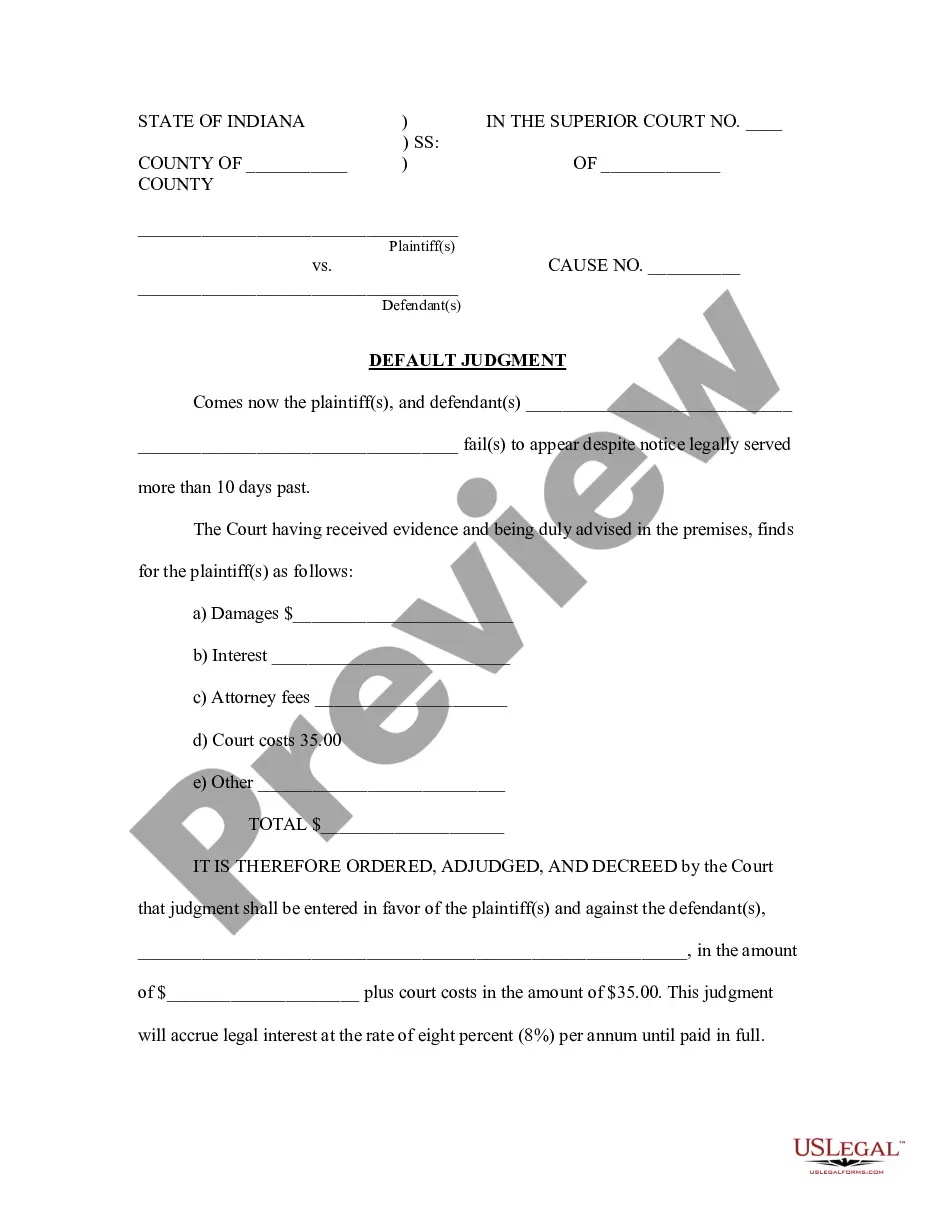

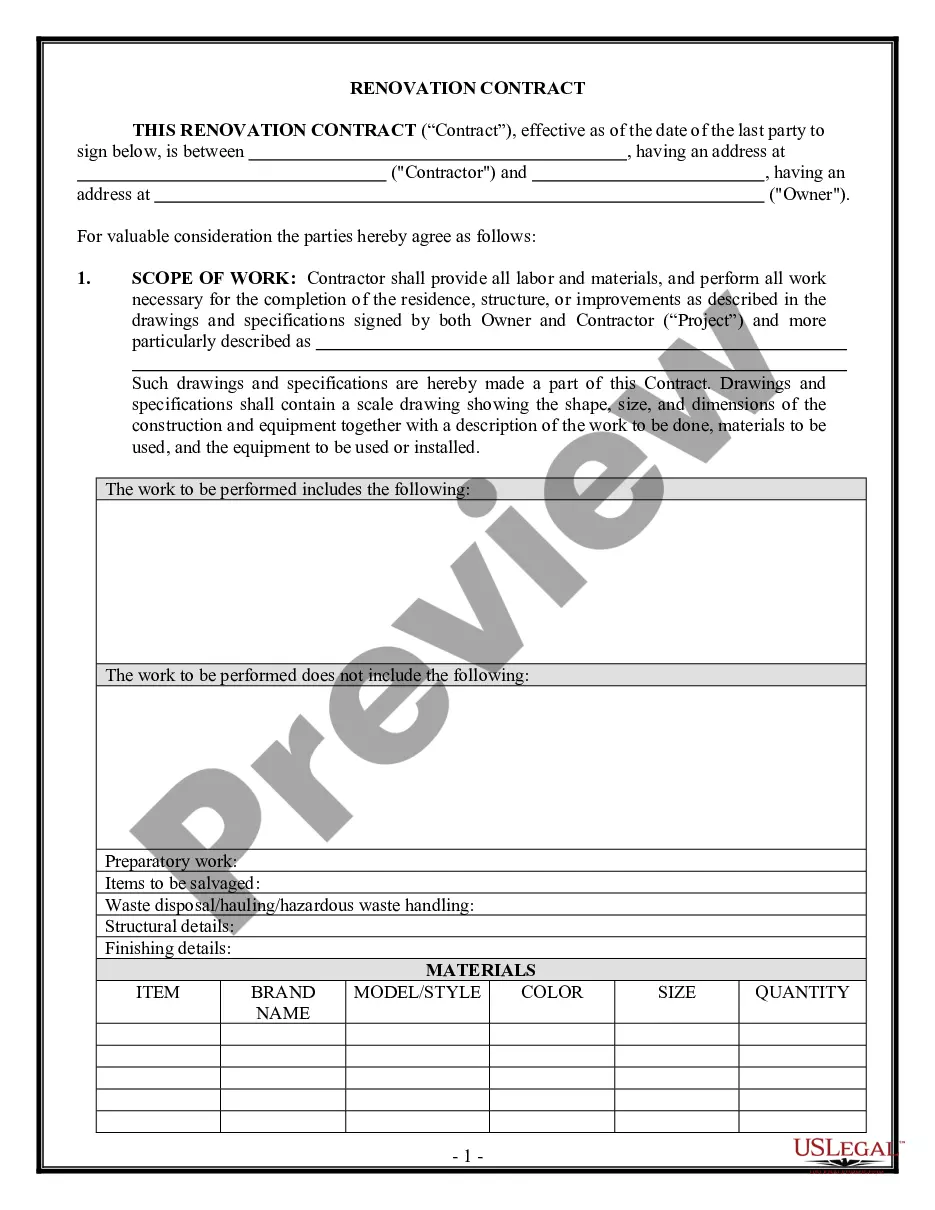

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify if it fulfills your needs. If it does not suit you, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Austin Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

Governing Law. Texas promissory notes do not have to be notarized. However, to make them a legal document, they must be signed and dated by the borrower. If there is a co-signer, they should also sign and date the agreement.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

With a deed of trust, the lender gives the borrower the funds to make the purchase. The borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise to pay. At this point, the borrower transfers the real property interest to the trustee.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note secured by deed of trust is a type of loan document that details how and when a borrower will repay money to a lender. A promissory note is a kind of IOU that's secured by property, often property that the borrower owns.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.