Harris Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Texas Tax Affidavit Designation Other Property As Homestead Property?

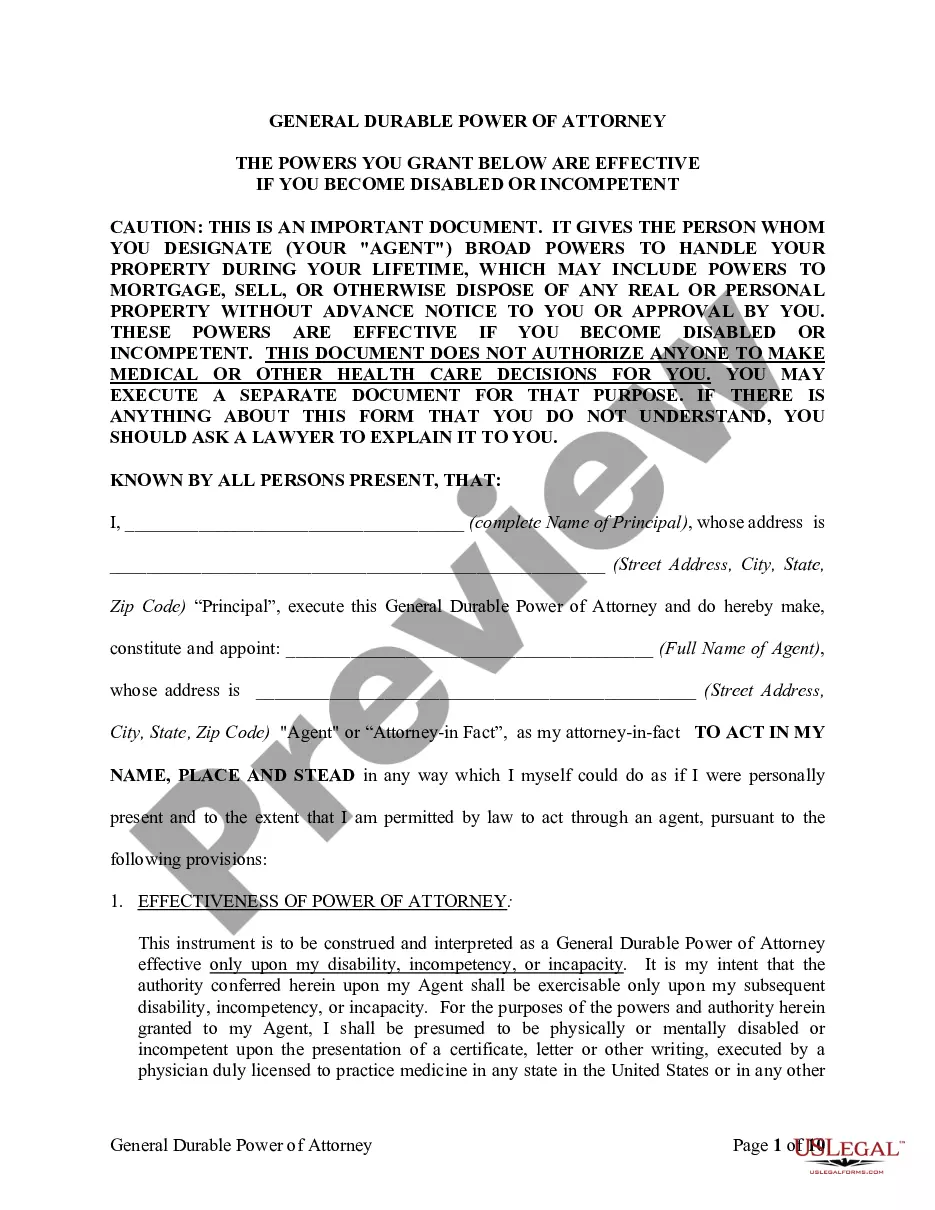

Irrespective of societal or occupational rank, completing law-related paperwork is a regrettable requirement in today's workplace.

Frequently, it’s nearly unfeasible for individuals without any legal expertise to generate this kind of documentation from scratch, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms comes to the aid.

Ensure that the document you found is tailored for your area, as regulations in one state may not apply to another state.

Review the document and read a concise description (if provided) of the circumstances the paper can be utilized for.

- Our platform provides an extensive library with over 85,000 state-specific documents that are applicable for nearly any legal matter.

- US Legal Forms also serves as an excellent resource for associates or legal advisors aiming to enhance their efficiency by utilizing our DIY forms.

- Whether you require the Harris Texas Tax Affidavit Designation Other Property as Homestead Property or any other documentation that will be suitable in your region, with US Legal Forms, everything is readily accessible.

- Here’s how to quickly obtain the Harris Texas Tax Affidavit Designation Other Property as Homestead Property using our reliable platform.

- If you are an existing customer, you may proceed to Log In to your account to access the required form.

- However, if you are new to our library, make sure to follow these steps before acquiring the Harris Texas Tax Affidavit Designation Other Property as Homestead Property.

Form popularity

FAQ

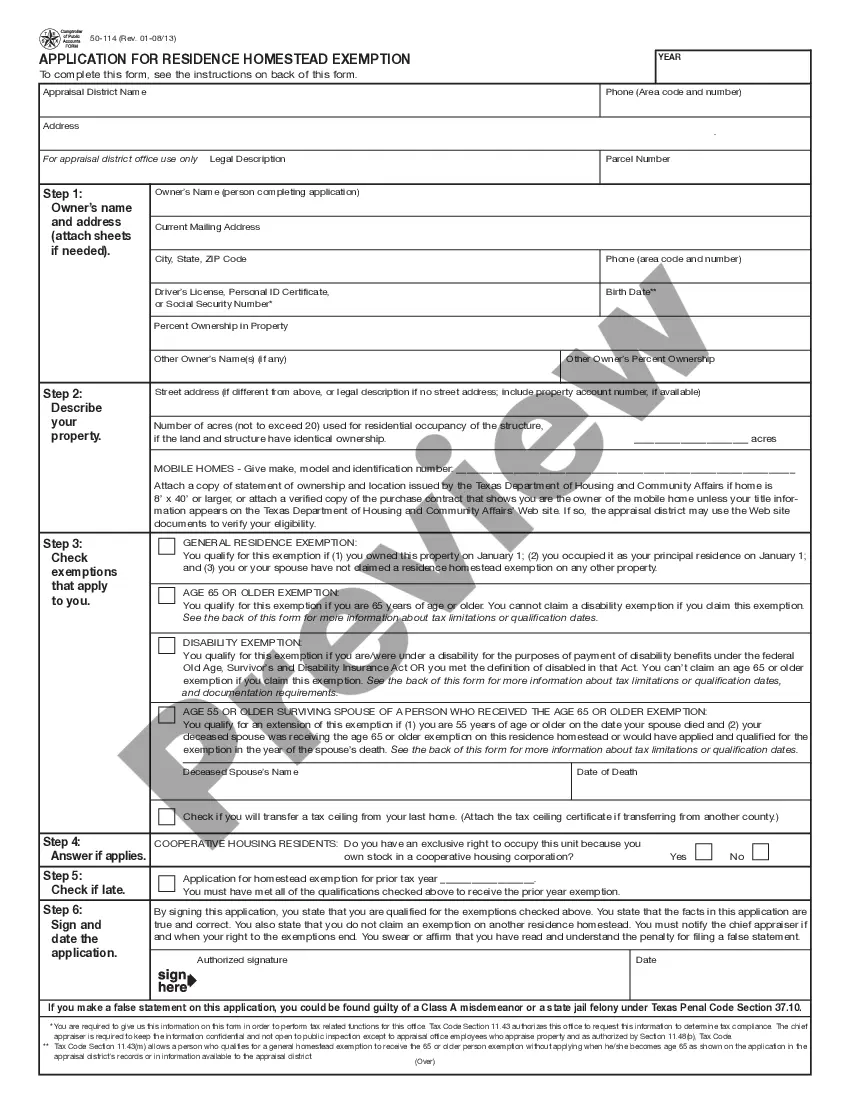

You can verify if you have a homestead exemption in Texas by checking with your local appraisal district. They maintain records on property exemptions, including the Harris Texas Tax Affidavit Designation Other Property as Homestead Property. You can usually find this information online or by calling their office directly, ensuring you receive any tax savings you qualify for.

No, you do not automatically receive a homestead exemption in Texas. To qualify, you must apply by submitting the Harris Texas Tax Affidavit Designation Other Property as Homestead Property to your local appraisal district. This process ensures that you benefit from reduced property taxes and protects your home from creditors.

In Texas, you typically do not have to renew your homestead exemption every year. Once you file the Harris Texas Tax Affidavit Designation Other Property as Homestead Property and receive approval, your exemption will automatically apply each year as long as you maintain ownership and occupy the home. However, it's essential to inform your local appraisal office if there are any changes that could affect your status.

To file a homestead exemption in Texas, you need to provide a completed application form, proof of ownership, and identification such as a driver's license. You may also need to present a copy of the Harris Texas Tax Affidavit Designation Other Property as Homestead Property if applicable. Gathering these documents ensures a smooth filing process, helping you take advantage of the exemptions available to you. If you need assistance, consider using the UsLegalForms platform for an easy and efficient experience.

The property ID on a homestead exemption is a unique identifier assigned to your property by the local appraisal district. This ID helps the county recognize your property and link it to your homestead exemption application. When filing the Harris Texas Tax Affidavit Designation Other Property as Homestead Property, you will need this ID to ensure your property is aptly categorized. Make sure to check your local appraisal district for accurate information regarding your property ID.

The homestead exemption in Texas can significantly reduce your property taxes, depending on your home's appraised value. Typically, this exemption can lower your tax bill by an average of $25,000 to $50,000 off the appraised value. By designating your property with the Harris Texas Tax Affidavit Designation Other Property as Homestead Property, you can access these savings effectively. This financial relief can lead to substantial savings over time.

The primary difference between a homestead and a non-homestead in Texas lies in property usage and tax treatment. A homestead is your primary residence, eligible for tax exemptions that lower your property tax bill. In contrast, a non-homestead property is not your primary residence and does not qualify for these exemptions. Understanding this distinction can assist you in making an informed decision about applying for the Harris Texas Tax Affidavit Designation Other Property as Homestead Property.

The property ID on a homestead exemption in Texas refers to the unique number assigned to your property that links it to your exemption application. This ID is vital for tracking the status of exemptions and ensuring they are correctly applied to your property. By utilizing the Harris Texas Tax Affidavit Designation Other Property as Homestead Property, you can maximize your property tax savings with this information.

In Texas, a property ID is a numerical code that identifies a specific parcel of land within the appraisal district. This ID plays a crucial role in maintaining comprehensive records for tax purposes, ownership information, and exemptions. If you are pursuing the Harris Texas Tax Affidavit Designation Other Property as Homestead Property, knowing your property ID is essential for accurate filing.

To file for a homestead exemption in Harris County, you must complete the designated application form, which you can find on the Harris County Appraisal District website. Be sure to gather required documents, such as proof of identification and evidence of residency. By filing for the Harris Texas Tax Affidavit Designation Other Property as Homestead Property, you can enjoy various tax benefits that enhance your financial stability.