Irving Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Texas Non- Homestead Affidavit And Designation Of Homestead?

Finding authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms collection.

It’s an internet resource comprising over 85,000 legal forms for both personal and business purposes and various real-world situations.

All documents are appropriately categorized by usage area and jurisdictional regions, making it as simple as pie to find the Irving Texas Non-Homestead Affidavit and Designation of Homestead.

Maintaining paperwork organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily available for any requirements!

- Review the Preview mode and form overview.

- Ensure you’ve selected the correct one that fulfills your needs and aligns with your local jurisdiction requirements.

- Search for another template, if necessary.

- If you spot any discrepancies, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

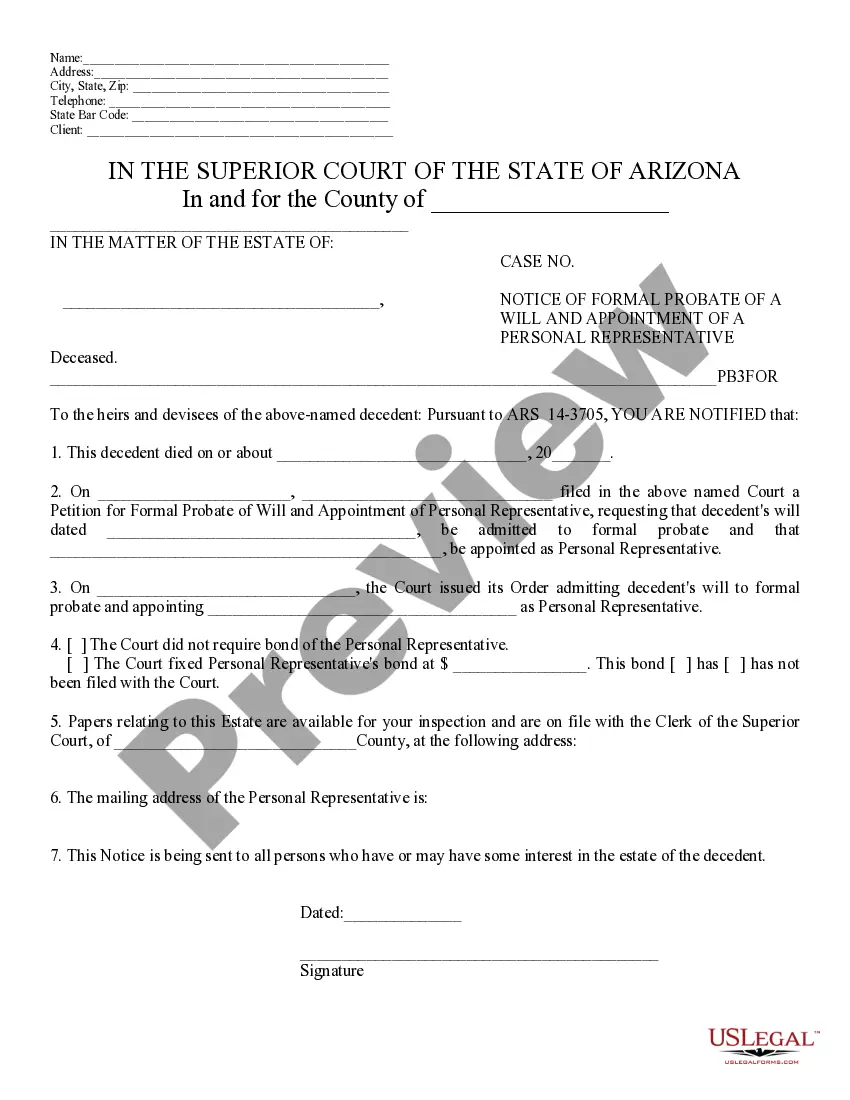

When applying for a Texas homestead exemption, you typically need to provide a copy of your driver's license or identification card displaying your home address. You will also need the Irving Texas Non-Homestead Affidavit and Designation of Homestead, along with any other supporting documents that verify your ownership. Collecting all these documents ahead of time will help you complete your application successfully.

To qualify for a homestead exemption in Texas, you must own your home and use it as your primary residence. You will need to submit the Irving Texas Non-Homestead Affidavit and Designation of Homestead, along with other required documents. Additionally, the application must be filed by a specific deadline, usually between January 1 and April 30, to receive benefits for that tax year. Meeting these criteria ensures you maximize your exemption benefits.

The approval time for a homestead exemption in Texas can vary by county, but it generally takes between four to six weeks. During this time, the local appraisal district will review your application, including the Irving Texas Non-Homestead Affidavit and Designation of Homestead. Patience is key, as this review ensures that all qualifications are met. Once approved, you will receive a notice confirming your exemption.

In Texas, seniors can qualify for property tax exemptions starting at age 65. This exemption can significantly lower your property tax burden, making it easier to manage expenses. Additionally, when applying, seniors should complete the Irving Texas Non-Homestead Affidavit and Designation of Homestead. This ensures that they receive the full benefits available to them.

Yes, you can submit your homestead exemption online in Texas. Many counties provide an online platform for filing, which simplifies the process. You will likely need to complete the Irving Texas Non-Homestead Affidavit and Designation of Homestead as part of your application. Always ensure that you have all necessary information at hand to streamline your submission.

Yes, you can waive homestead rights in Texas, but the process requires precision to ensure legal compliance. Typically, this waiver may be initiated during financial transactions or agreements, such as loans. However, waiving these rights can expose you to certain risks, so it’s important to consult a legal professional. For clearer guidance on the implications of waiving homestead rights, consider utilizing the services provided by the USLegalForms platform.

The homestead rule in Texas protects a homeowner's primary residence from forced sale to satisfy debts, except for specific exceptions such as mortgages or property taxes. This law ensures that individuals have a place to live even amidst financial challenges. Additionally, it provides tax benefits, making homeownership more accessible and secure. Understanding these aspects can be easier with the supportive resources available on the USLegalForms platform.

An example of a homestead exemption in Texas is the general homestead exemption that reduces the property taxes on your principal residence. This exemption can lower the appraised value of your home, leading to significant savings on your annual tax bill. Additionally, some exemptions apply to specific groups, such as the elderly or disabled. To navigate these options, consider using the USLegalForms platform for guidance on claiming your Irving Texas Non-Homestead Affidavit and Designation of Homestead.

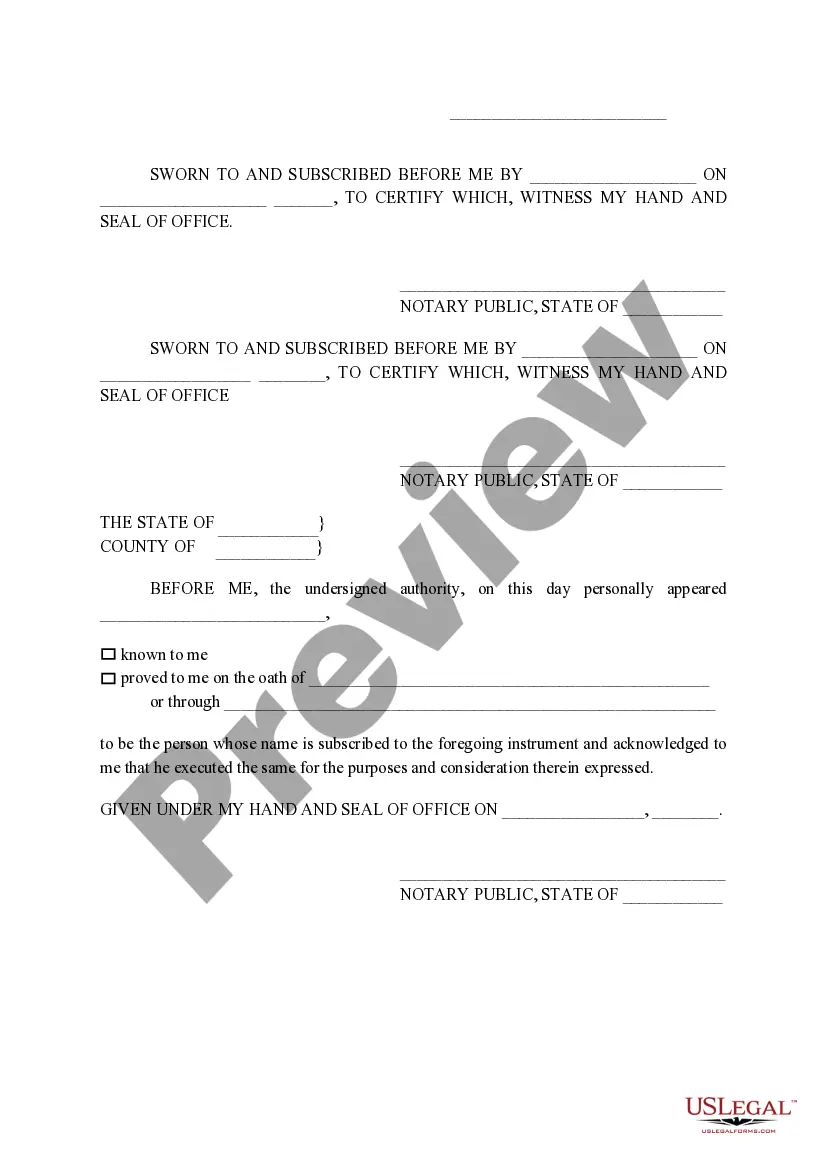

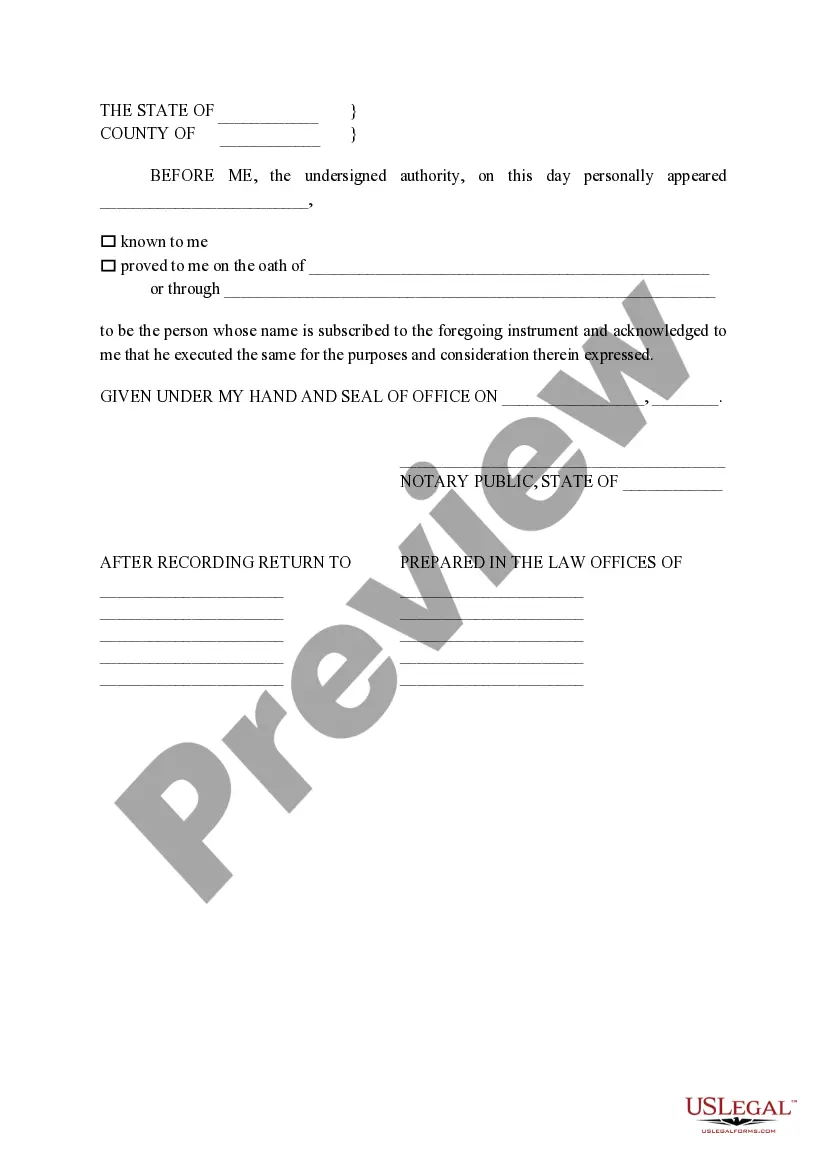

The designation of homestead affidavit in Texas is a declaration that specifies a property as a homestead, affording it certain legal protections and tax exemptions. This document confirms that the property serves as your principal residence, which is crucial for claiming homestead exemptions. Filing a designation of homestead can protect your property from creditors and ensure you benefit from tax breaks. You can explore this process further through resources available on the USLegalForms platform.

homestead affidavit in Texas is a legal document that declares a property does not qualify for homestead exemptions. This affidavit is necessary when property owners wish to clarify the status of their property for tax purposes. By filing a nonhomestead affidavit, you formally state the property is not your primary residence, which can have implications for taxation. You can learn more about how an Irving Texas NonHomestead Affidavit and Designation of Homestead works on the USLegalForms platform.