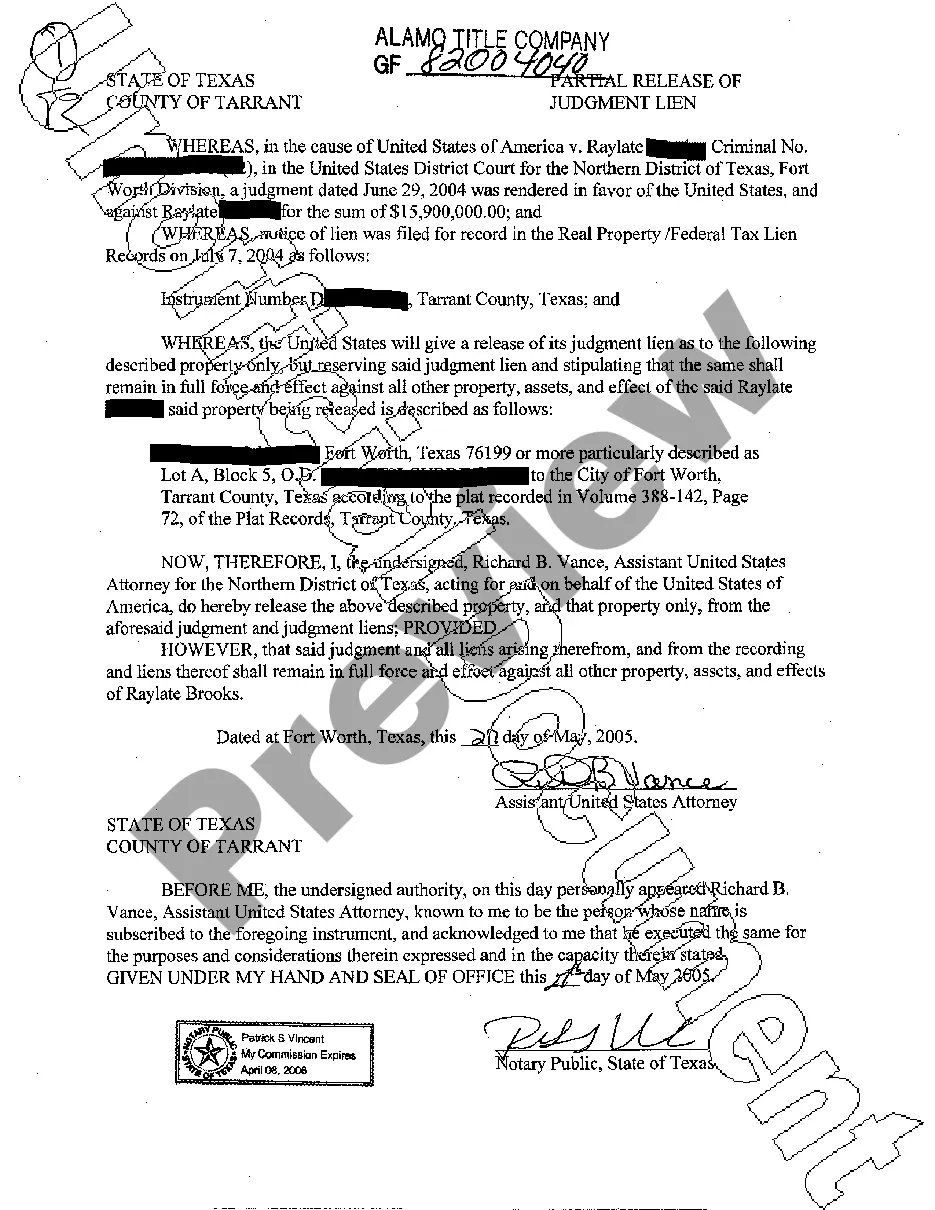

Austin Texas Partial Release of Judgment Lien

Description

How to fill out Texas Partial Release Of Judgment Lien?

If you have already used our service previously, Log In to your account and download the Austin Texas Partial Release of Judgment Lien onto your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your billing plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile within the My documents section whenever you wish to use them again. Utilize the US Legal Forms service to easily locate and save any template for your personal or professional requirements!

- Ensure you've located the correct document. Review the description and use the Preview feature, if available, to confirm it suits your requirements. If it doesn't fit, utilize the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Receive your Austin Texas Partial Release of Judgment Lien. Choose the file format for your document and store it on your device.

- Complete your form. Print it or use professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

The lien release should be signed and notarized by the same person (contractor) who filed the mechanic's lien. Preparing and filing the document itself can be done by the interested party (i.e. the project owner) or any other individual.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

As far as lien waivers, the vast majority of states don't require notarization. However, Texas is one of those states that require notarized lien waivers.

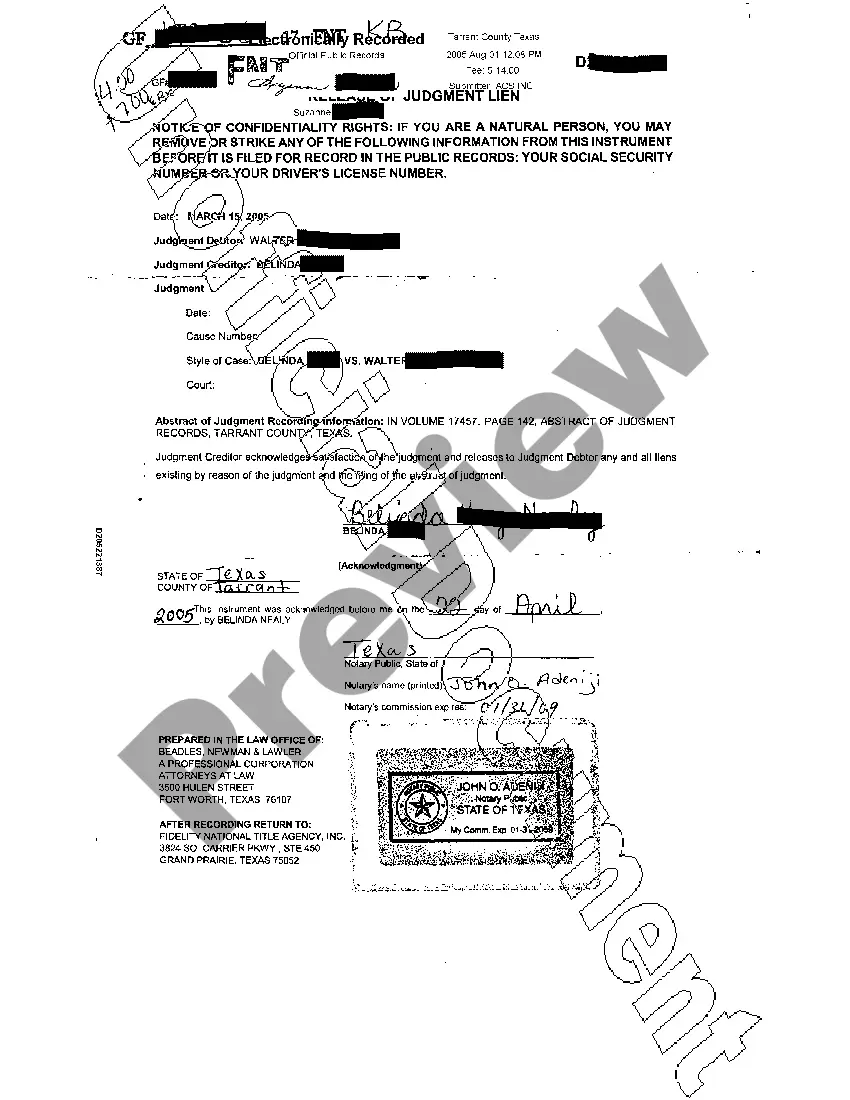

A release of a portion of real property from the lien of a deed of trust securing a loan on commercial real property in Texas. Lenders in Texas customarily use a partial release of lien to discharge a deed of trust lien against some but not all of the borrower's real property.

When a Texas mechanics lien has been paid and satisfied, the claimant must file a release of lien within 10 days after receiving a request for the release of the claim. However, there is no penalty provided by the statute. That doesn't mean that there are no consequences for failing to release it on time.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

After the lien on a vehicle is paid off, the lienholder has 10 business days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

There is no removal procedure for such liens other than entering into a payment arrangement with the taxing authority. The existence of a judgment lien or other type of lien is usually discovered when a title company checks the property records and produces a title commitment in anticipation of a sale or refinance.