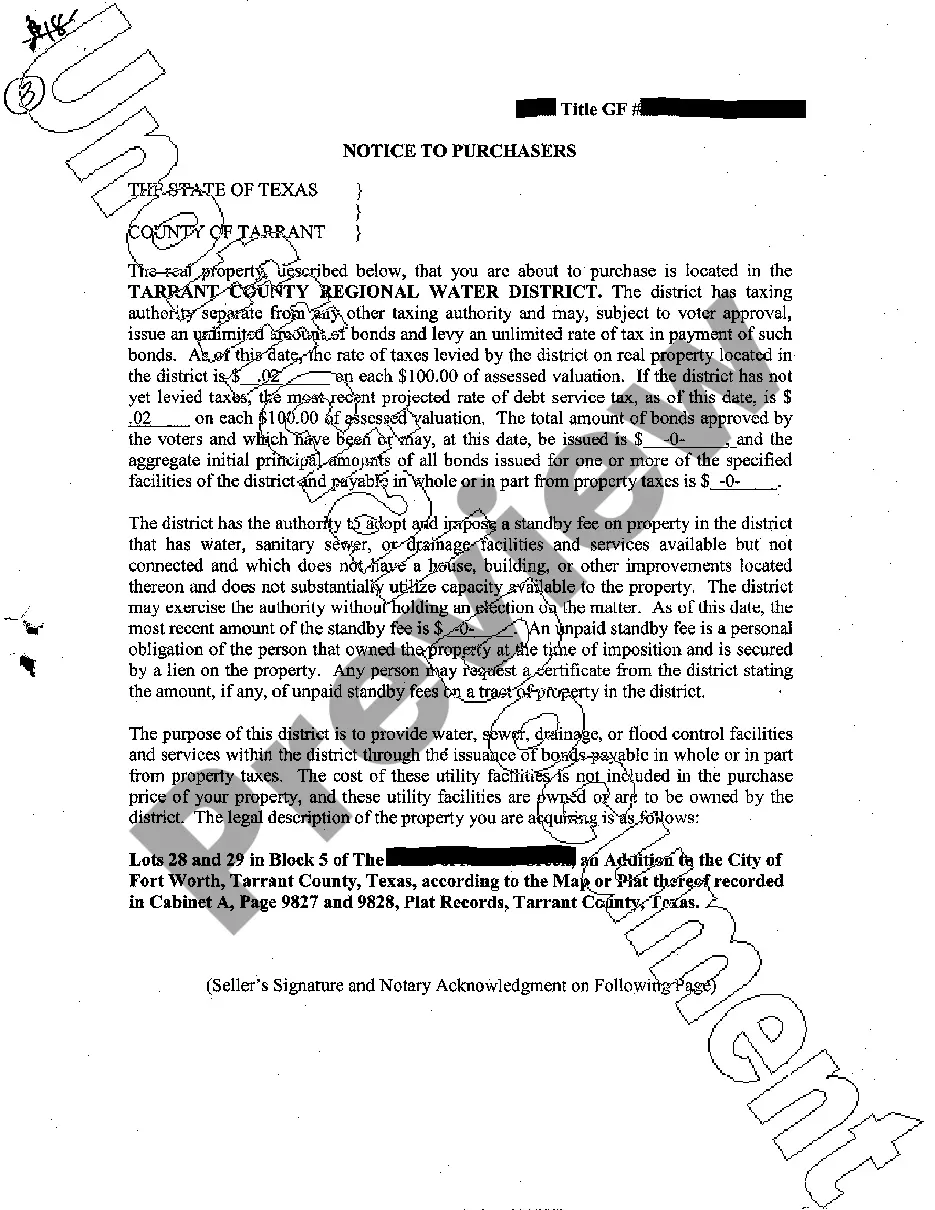

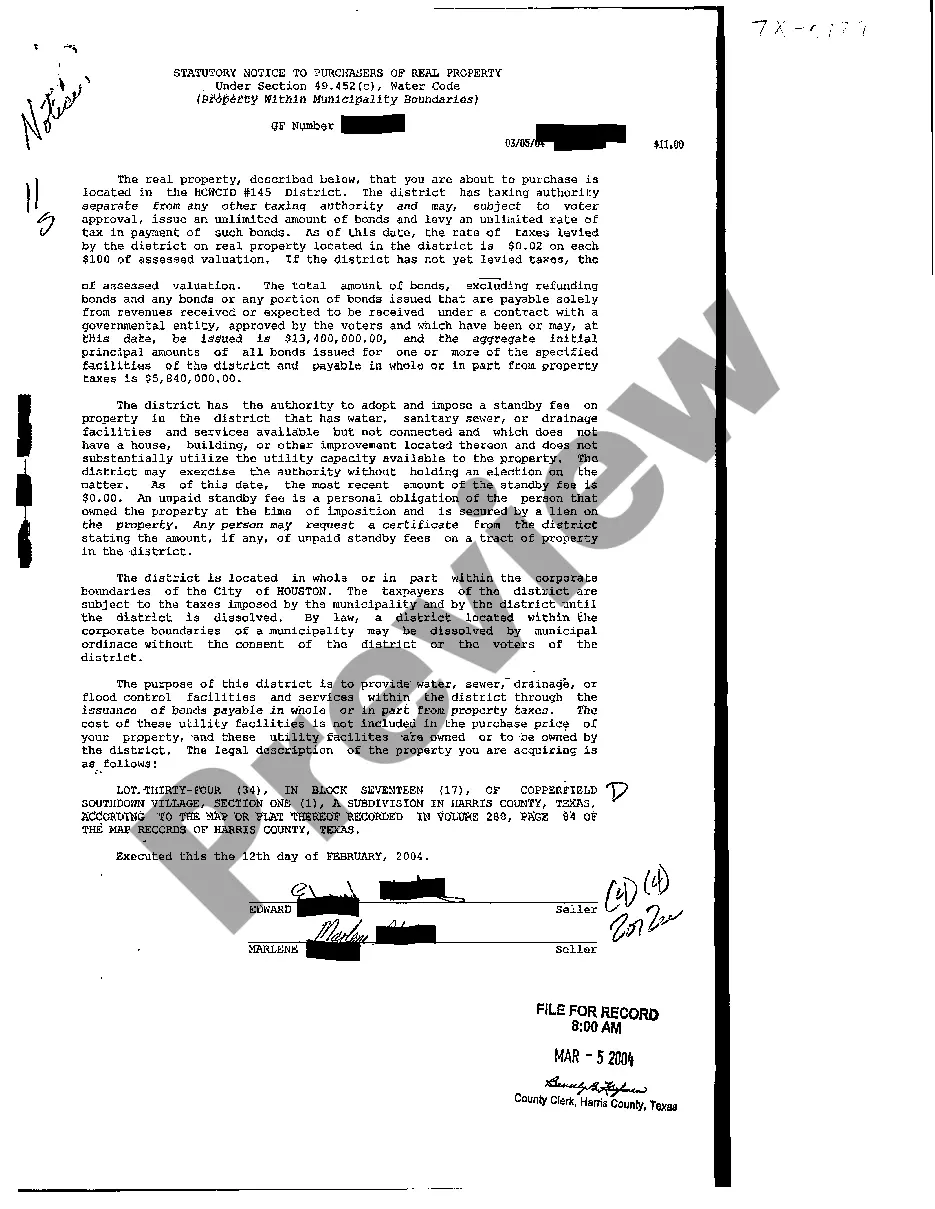

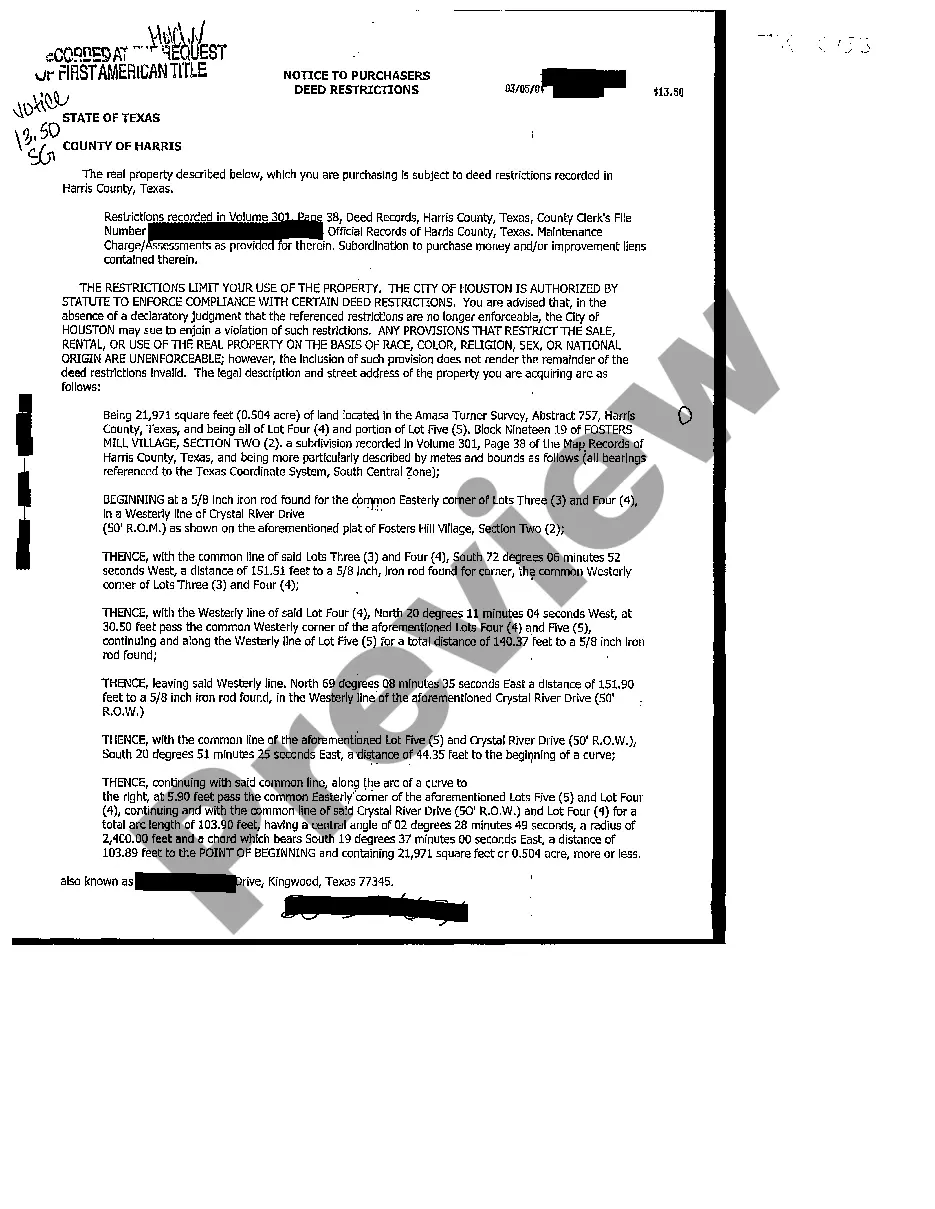

Round Rock Texas Notice to Purchasers

Description

How to fill out Texas Notice To Purchasers?

If you are in search of a legitimate document, it’s challenging to select a more suitable platform than the US Legal Forms site – one of the most extensive online collections.

With this collection, you can locate a multitude of templates for business and personal purposes categorized by type and region, or key terms.

Using our enhanced search feature, finding the latest Round Rock Texas Notice to Purchasers is as simple as 1-2-3.

Finalize the payment process. Use your credit card or PayPal account to complete the registration steps.

Receive the document. Select the format and save it on your device.

- Moreover, the validity of each document is verified by a group of experienced attorneys who routinely review the templates on our platform and update them according to the most current state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Round Rock Texas Notice to Purchasers is to Log In to your user profile and select the Download option.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have selected the document you require. Review its description and utilize the Preview feature to inspect its contents. If it does not align with your needs, employ the Search bar at the top of the page to find the suitable document.

- Verify your choice. Click on the Buy now option. Subsequently, choose your desired pricing plan and provide the information to create an account.

Form popularity

FAQ

A notice of purchaser's interest indicates a buyer's claim on the property, affirming their right to ownership after the transaction. This document is vital for establishing legal rights, especially if disputes arise later. Understanding the importance of such notices, including the Round Rock Texas Notice to Purchasers, can safeguard your investment.

A notice to purchaser in Texas informs buyers about specific legal obligations and property details before completing a sale. This document ensures transparency and protects the interests of both parties involved in the transaction. It is essential when dealing with real estate to understand your rights and obligations, which is where the Round Rock Texas Notice to Purchasers becomes crucial.

In Round Rock, Texas, the total sales tax rate currently stands at 8.25%. This rate combines the state's base sales tax and local taxes. If you want to make informed purchases in Round Rock, knowing the sales tax details can help you budget effectively; using the Round Rock Texas Notice to Purchasers can assist in this regard.

Round Rock, Texas, has relatively low property taxes compared to many other cities in the state. While taxes can vary based on personal circumstances, residents often find that Round Rock offers a favorable tax environment. If you're exploring real estate options, consider understanding the implications of the Round Rock Texas Notice to Purchasers for a better financial decision.

Here's an example of an email signature that correctly links to the IABS form. Texas law requires all license holders to provide the Information About Brokerage Services form to prospective clients. 1234 Main St.

Related Definitions IABS means Integrated Access Billing System or any successor billing system.

The Consumer Protection Notice must be hyperlinked in a readily noticeable location on the homepage of your business website. For real estate brokers, sales agents, and inspectors, the text for the link must be either: Texas Real Estate Commission Consumer Protection Notice in at least 10-point font.

Sales Tax Information The sales tax rate for the City of Round Rock: 8.25% Total. 6.25% to State. 1.00% to City.

Texas law does not permit dual agency.

An intermediary is a broker who negotiates a real estate transaction between two parties. An intermediary relationship can occur when a broker, or a sales agent sponsored by the Broker, has obtained written consent from the parties to represent both the buyer and the seller.