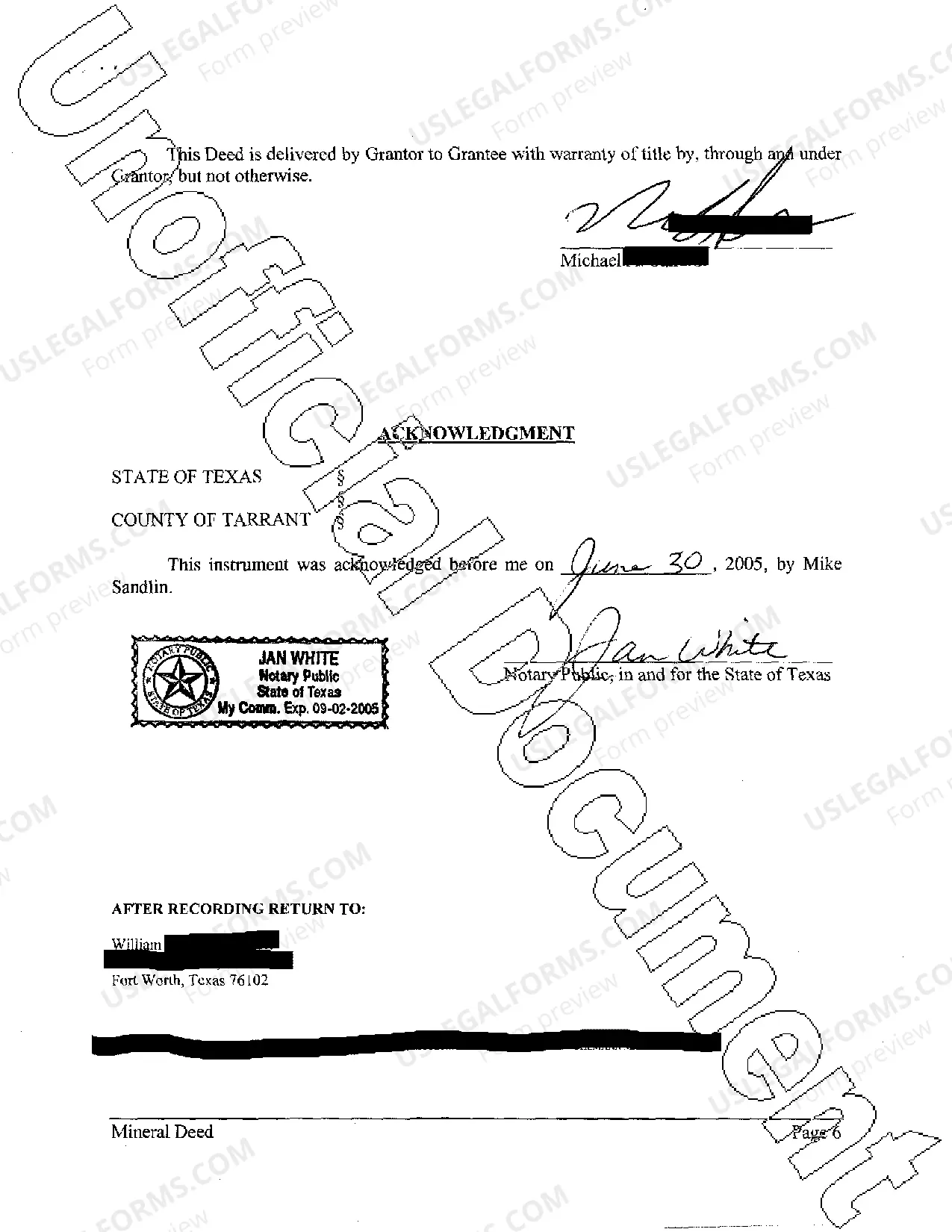

This deed grants, bargains, sells, conveys, and transfers to Grantee an undivided ten percent interest in and to all of Grantor's right, title, and interest in the oil, gas, and other minerals in, on, and under that may be produced from the agreed upon land.

Austin Texas Mineral Deed

Description

How to fill out Texas Mineral Deed?

We consistently aim to minimize or avert legal complications when handling intricate legal or financial matters.

To achieve this, we seek legal aid that, as a general rule, tends to be quite costly.

Nonetheless, not all legal situations are equally intricate; the majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents that encompass everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your affairs independently without consulting a lawyer.

- We offer access to legal form templates that aren’t universally accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Take advantage of US Legal Forms whenever you need to quickly and securely obtain and download the Austin Texas Mineral Deed or any other form.

Form popularity

FAQ

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

A Texas mineral deed with general warranty, used to convey all of the grantor's oil, gas, and other minerals under real property. This Standard Document has integrated notes with explanations and drafting tips.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Landowners commonly sever and sell their mineral rights, often to big oil and gas exploration companies. The most common way of claiming mineral rights today is by buying them at auction or through private sales .

Like surface interests, mineral interests are passed down by inheritance. If there is a valid will, it controls who gets the property. If not, Texas laws of heirship controls.

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals ? $25,000+ per acre is not unusual.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property.

To locate your mineral rights records, begin at the county recorder's office. The legal description of the property should be in county deed books. You can specifically search the book and page where the property is located if you have a take-off.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.