This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Bexar Texas Revocation of Living Trust

Description

How to fill out Texas Revocation Of Living Trust?

If you are looking for a legitimate form template, it’s difficult to discover a superior location than the US Legal Forms website – one of the most comprehensive libraries online.

With this collection, you can find countless document examples for both organizational and personal uses by categories and regions, or keywords.

With the enhanced search capability, locating the most current Bexar Texas Revocation of Living Trust is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration right.

Obtain the template. Choose the file format and save it to your device. Edit. Fill in, alter, print, and sign the acquired Bexar Texas Revocation of Living Trust.

- Furthermore, the significance of each document is validated by a team of professional attorneys who routinely examine the templates on our platform and update them according to the latest state and county regulations.

- If you are familiar with our platform and possess an account, all you require to obtain the Bexar Texas Revocation of Living Trust is to Log In to your profile and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the directions below.

- Ensure you have accessed the form you need. Review its details and utilize the Preview feature to examine its content.

- Verify your choice. Click the Buy now button. After that, select your preferred payment plan and provide details to create an account.

Form popularity

FAQ

Yes, an irrevocable trust is subject to the 5-year rule for Medicaid eligibility. Once assets are placed in an irrevocable trust, they are generally considered out of your control, but any transfers made may affect your eligibility if done within five years of your application. This aspect is crucial for anyone planning a Bexar Texas Revocation of Living Trust, as it influences asset management strategies. Getting expert advice can help you navigate these rules effectively.

To avoid inheritance tax with a trust, one can establish a living trust and transfer assets to it before passing away. This strategy can help your beneficiaries avoid probate and potentially reduce tax liabilities. Utilizing a Bexar Texas Revocation of Living Trust allows you to amend or dissolve the trust during your lifetime, which provides flexibility in estate planning. Consulting with professionals can ensure your trust is structured effectively to minimize tax exposure.

The 5-year rule for trusts refers to a provision that affects how assets are treated for Medicaid eligibility. When applying for Medicaid, assets transferred into a trust may be subject to a 5-year look-back period. This means any transfers made within the last five years could impact your eligibility for assistance. Understanding this rule can guide your decisions on the Bexar Texas Revocation of Living Trust, ensuring your assets are protected.

Changing a revocable trust is generally a straightforward process, particularly in Bexar Texas. You can make modifications to your living trust by preparing an amendment or creating a new trust altogether. It is wise to consult with an attorney or use platforms like US Legal Forms to ensure you follow proper legal procedures. Understanding the Bexar Texas Revocation of Living Trust ensures your changes reflect your current wishes.

While it is not legally required to have a lawyer dissolve a trust, it is highly recommended, especially in complex situations. A legal professional can guide you through the specifics of Bexar Texas Revocation of Living Trust, ensuring that all legal protocols are correctly followed. Utilizing resources like uslegalforms can also provide you with the necessary documents and templates to navigate the process effectively.

A trust can be terminated in three primary ways: through the revocation by the trust maker, reaching its predetermined ending date, or by the trust assets being fully distributed. When considering Bexar Texas Revocation of Living Trust, understanding these methods helps you choose the best route for your unique situation. Consulting with a legal expert can clarify the most suitable option for your needs.

One major mistake parents often make is failing to clearly outline their intentions and distributions in the trust document. This oversight can lead to confusion or disputes among heirs. To avoid this, it is advisable to seek guidance, especially regarding Bexar Texas Revocation of Living Trust, ensuring the trust reflects your wishes accurately.

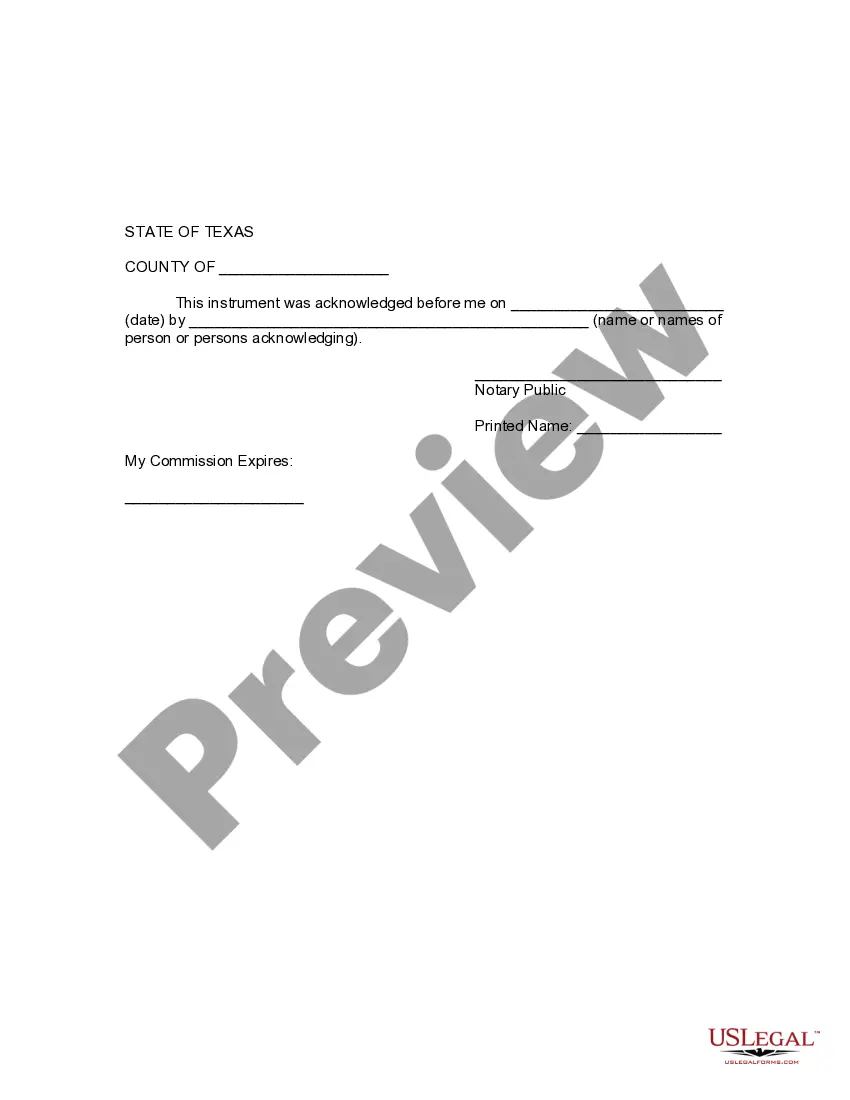

In Texas, revoking a living trust involves completing a Revocation of Trust document and signing it in front of a notary. After this step, it is crucial to inform all relevant parties, such as beneficiaries and trustees, about the revocation. Following these procedures guarantees compliance with the Bexar Texas Revocation of Living Trust requirements, making the process smoother.

To revoke a trust, you typically need a formal document known as a Revocation of Trust. This legal paper allows you to officially cancel the trust and redirect how your assets are distributed. Having a clear and properly drafted Revocation of Trust is essential in Bexar Texas Revocation of Living Trust situations, as it ensures clarity and legal standing.