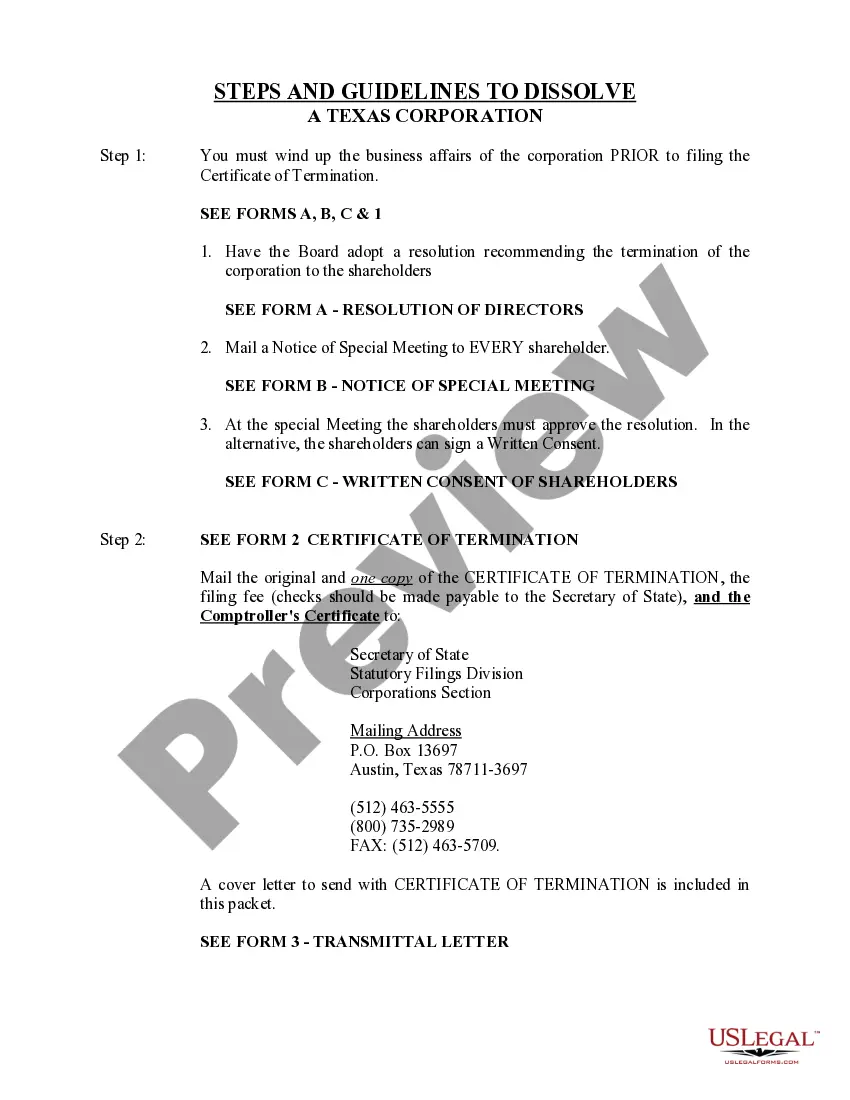

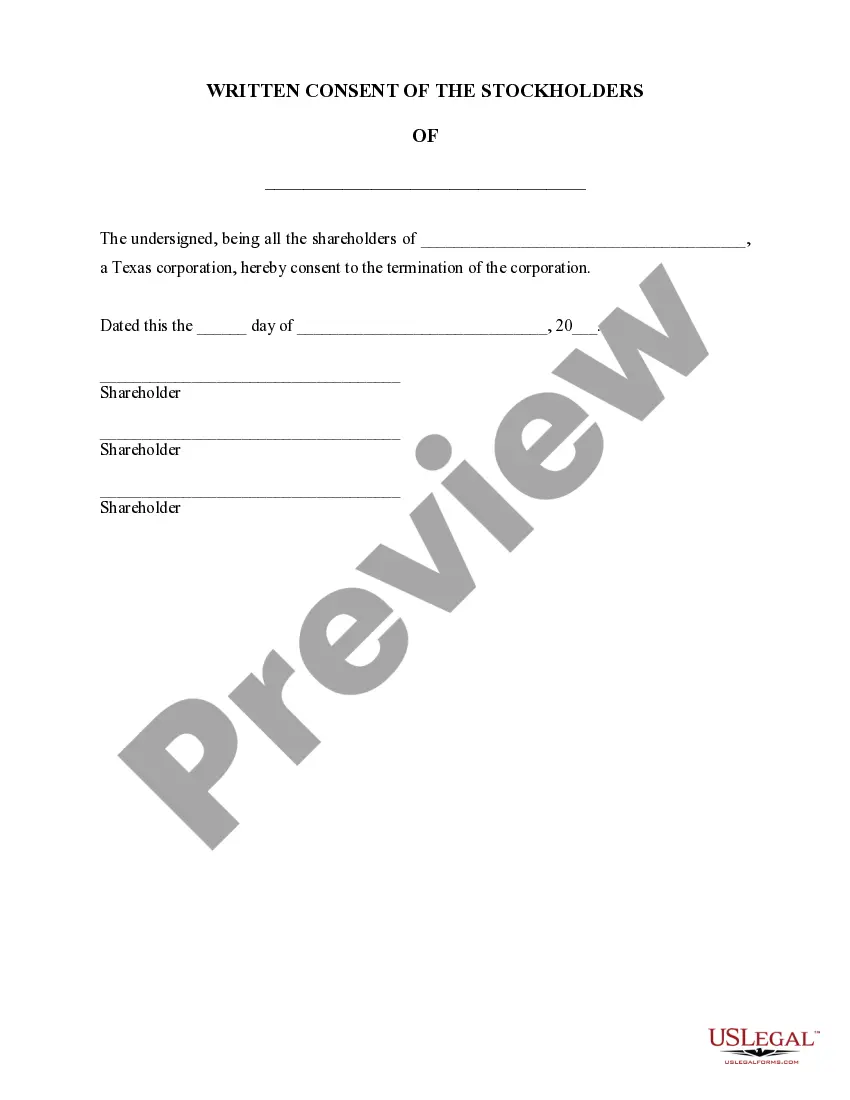

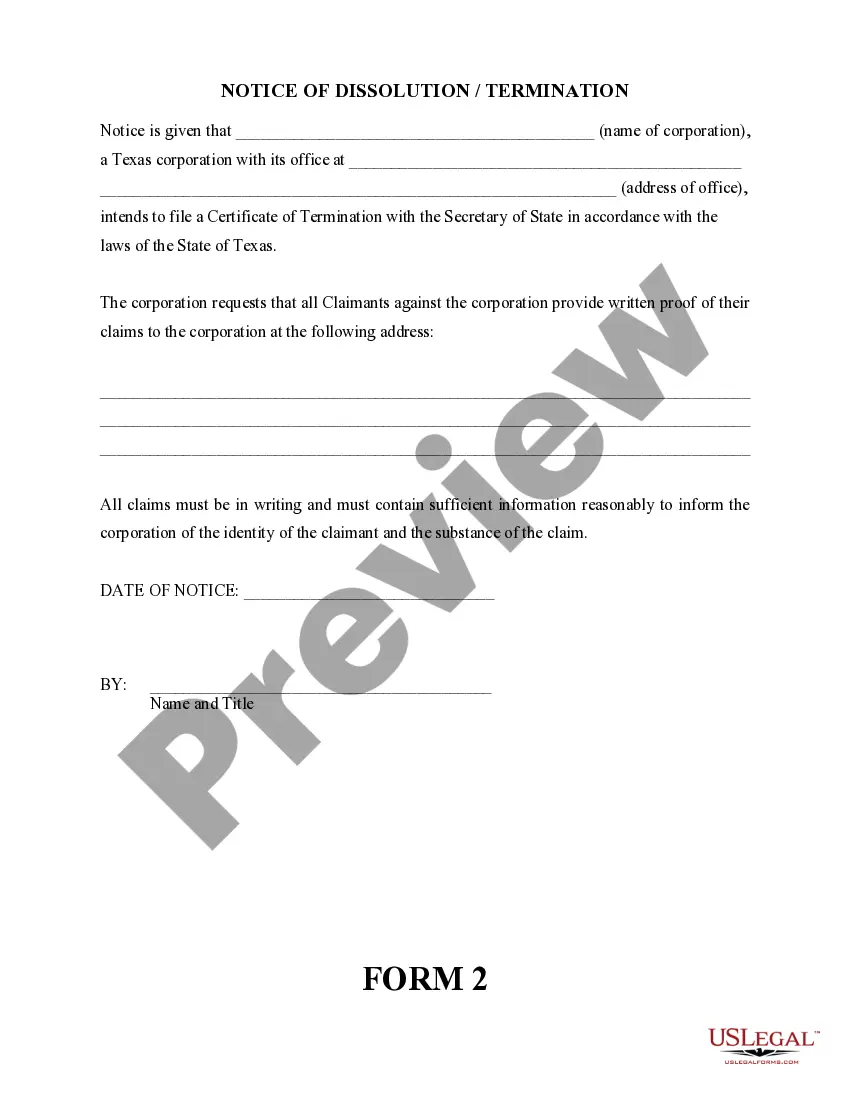

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Harris Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you are looking for a pertinent document, it’s challenging to find a more suitable service than the US Legal Forms website – one of the most extensive collections online.

Here you can discover countless form examples for organizational and personal needs categorized by types and states, or keywords.

With our premium search capability, obtaining the most recent Harris Texas Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Every single document you incorporate into your account has no expiration date and is yours indefinitely.

You always have the opportunity to access them via the My documents menu, so if you need to retrieve another copy for editing or printing, you can return and download it again whenever you like.

- Ensure you have accessed the form you require.

- Review its details and utilize the Preview feature to assess its contents. If it doesn’t satisfy your requirements, use the Search box at the top of the page to find the suitable document.

- Verify your selection. Click the Buy now option. After that, select your desired subscription plan and provide details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Retrieve the form. Specify the format and save it to your device.

- Make modifications. Complete, revise, print, and sign the acquired Harris Texas Dissolution Package to Dissolve Corporation.

Form popularity

FAQ

Dissolving a partnership in Texas involves several key steps, including notifying partners and creditors, settling debts, and filing a Statement of Dissolution with the Texas Secretary of State. It is essential to have an agreement that outlines the dissolution process, allowing for a clearer path forward. Using the Harris Texas Dissolution Package to Dissolve Corporation can simplify this process by providing the necessary documents and guidance tailored for partnerships.

To dissolve an LLC in Texas, you will need to file the Certificate of Termination with the Texas Secretary of State. This document officially ends your business's existence in the state. Additionally, you should consider preparing a final tax return and notifying any creditors. For your convenience, the Harris Texas Dissolution Package to Dissolve Corporation offers comprehensive forms and support to ensure a smooth dissolution process.

Dissolving an S-Corp can be straightforward if you follow the correct procedures and utilize the right resources. While there are several steps involved, including filing paperwork and handling taxes, using a Harris Texas Dissolution Package to Dissolve Corporation simplifies the process. This package reduces the complexity and helps you avoid mistakes that could lead to issues later on. With the right support, dissolving your S-Corp can be a manageable task.

Dissolving your S-Corp in Harris Texas involves several key steps, starting with a formal vote by the shareholders. You will need to file the appropriate documents with the state, including the Articles of Dissolution. Utilizing a Harris Texas Dissolution Package to Dissolve Corporation can guide you through this process and ensure you complete all necessary paperwork correctly. Once this is done, you will also need to address any outstanding liabilities and distribute the remaining assets.

When you close your business, it is crucial to consider the status of your EIN, or Employer Identification Number. You do not need to cancel your EIN if you are using it to file your final tax returns. However, if you choose to dissolve your corporation in Harris Texas using a Harris Texas Dissolution Package to Dissolve Corporation, you might want to formally close your EIN to avoid potential issues in the future. Taking this step ensures that you are not held liable for any additional taxes or obligations related to your dissolved business.

Closing an LLC in Texas requires several steps to comply with state regulations. Start by obtaining member approval to dissolve the LLC, then file the Certificate of Termination with the Secretary of State. It’s crucial to settle your LLC’s debts and notify any creditors. Consider the Harris Texas Dissolution Package to Dissolve Corporation to simplify these steps and provide you with a clear roadmap through the process.

Notifying the IRS of a corporation's dissolution requires you to file your final tax return on IRS Form 1120, indicating that it is your final return. Be sure to check the box stating that this is a final return, as it ensures proper processing by the IRS. Including the Harris Texas Dissolution Package to Dissolve Corporation can guide you on accurately completing this step and any other related requirements.

Dissolving a corporation does not inherently trigger an audit, but your past financial records may still be reviewed. It is advisable to maintain accurate and organized records throughout your dissolution process. This approach minimizes surprises and ensures compliance. If you are looking for a streamlined method, consider the Harris Texas Dissolution Package to Dissolve Corporation, which can help keep your records up to date.

The easiest way to close a business involves following a clear and concise plan. Begin with gathering necessary documents, ensuring all debts are settled, then file a dissolution notice with the state. The Harris Texas Dissolution Package to Dissolve Corporation simplifies this process, providing you with all the essential tools and instructions needed to close your business effectively.

Dissolution of a company involves formally ending the business's legal existence. Initially, you'll need to gather consent from owners or shareholders and file necessary paperwork with state authorities. Don’t forget to settle all debts and distribute any remaining assets among the members. Consider using the Harris Texas Dissolution Package to Dissolve Corporation for a seamless experience.