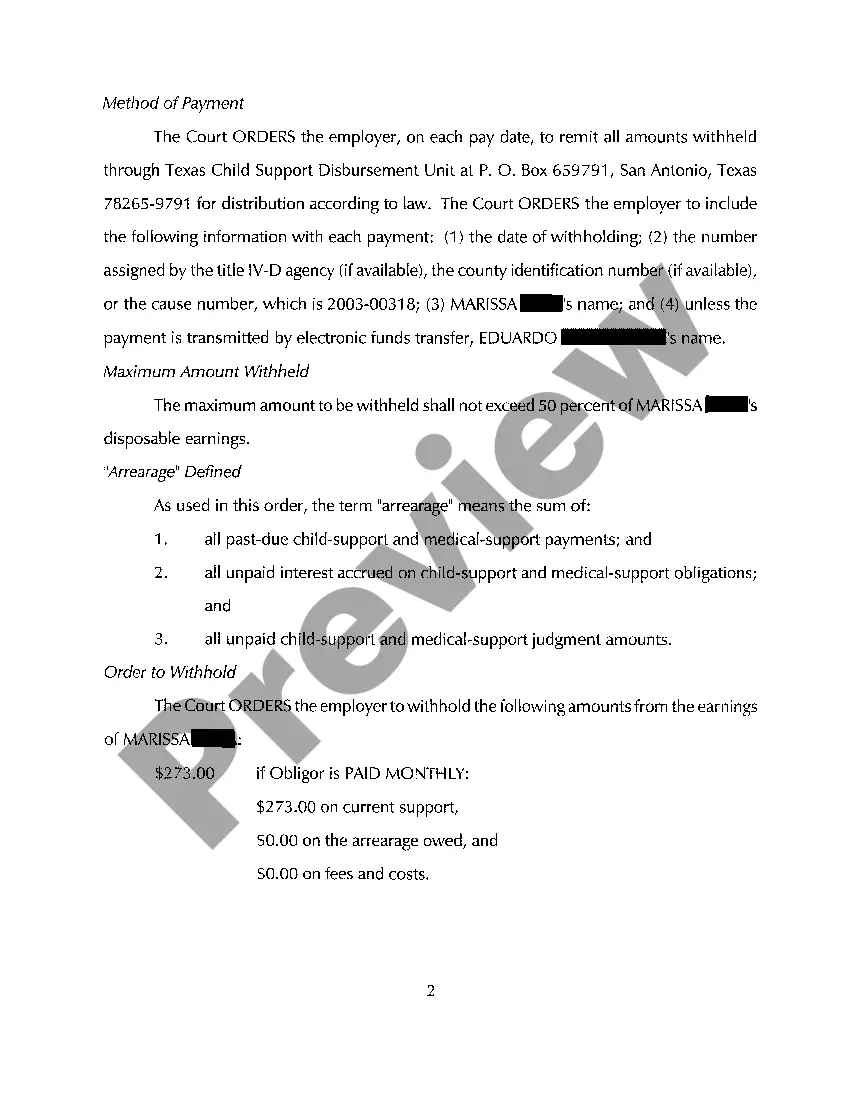

San Antonio Texas Order to Withhold From Earnings Child Support

Description

How to fill out Texas Order To Withhold From Earnings Child Support?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous platform with a vast array of files simplifies finding and acquiring nearly any document sample you need.

You can download, fill out, and authenticate the San Antonio Texas Order to Withhold From Earnings Child Support in just minutes rather than spending hours searching online for an appropriate template.

Using our directory is an excellent method to enhance the security of your form submissions. Our knowledgeable attorneys routinely review all documents to ensure they are appropriate for specific jurisdictions and comply with current laws and regulations.

Locate the form you need. Ensure it is the document you were looking for: verify its title and description, and use the Preview feature if available. Alternatively, use the Search bar to find the required one.

Initiate the saving process. Click Buy Now and choose the pricing option that best fits your needs. Then, set up an account and pay for your order using a credit card or PayPal.

- How do you acquire the San Antonio Texas Order to Withhold From Earnings Child Support? If you have an account, simply Log In to access it.

- The Download feature will be activated for all documents you examine. Moreover, you can view all previously saved documents in the My documents section.

- If you have not created an account yet, follow these instructions.

Form popularity

FAQ

Under Texas law, the statute of limitations for seeking back child support when a court order is already in place is ten years from the child's 18th birthday. If a claim isn't filed by the deadline, then any recovery for back child support in Texas may be denied.

A Texas court can order a parent jailed for up to six months for contempt of court due to unpaid child support. The court can also issue fines of up to $500 for each nonpayment and force the delinquent party to pay the other parent's attorney fees and court costs.

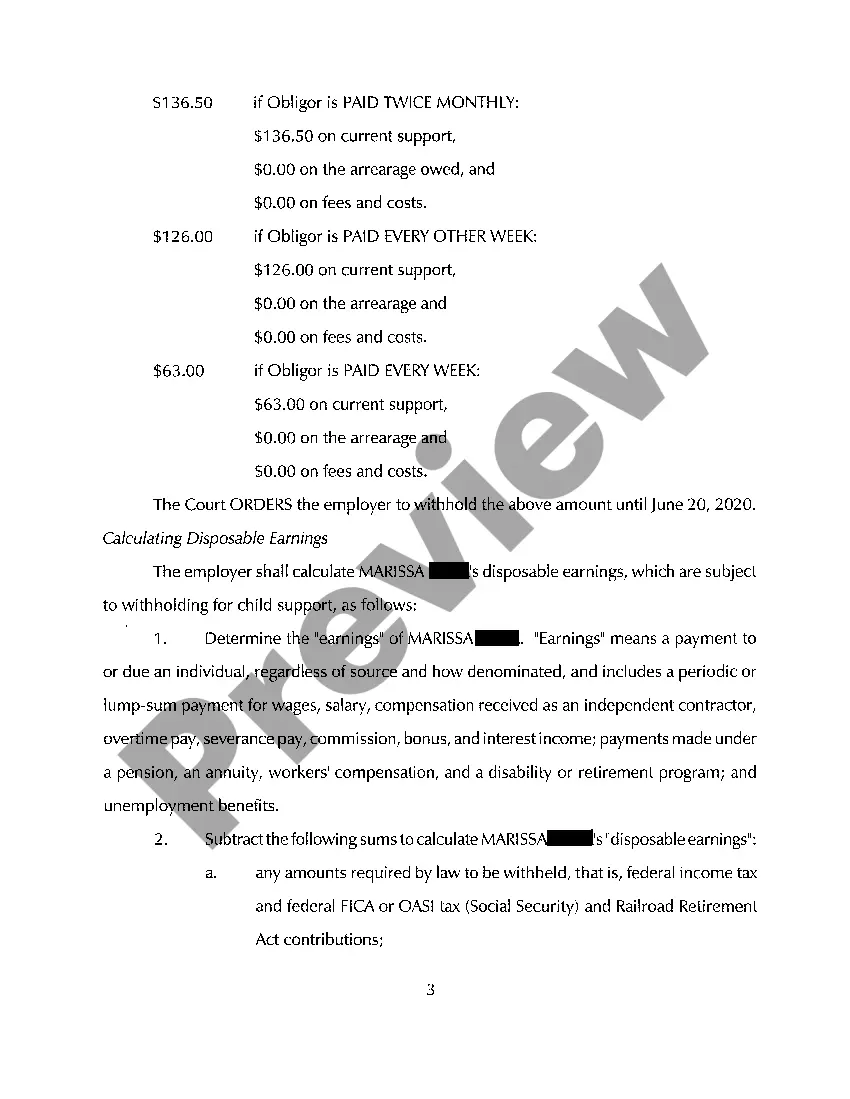

Yes. What is the maximum amount that may be withheld from a lump sum payment? The maximum amount that may be withheld is 50 percent of the lump sum after taxes or the total amount of arrears, whichever is less.

One child: 20% of the non-custodial parent's net resources. Two children: 25% of the non-custodial parent's net resources. Three children: 30% of the non-custodial parent's net resources. Four children: 35% of the non-custodial parent's net resources.

§ 1673). In Texas, up to 50% of your disposable earnings may be garnished to pay domestic support obligations such as child support or alimony. (Tex. Fam.

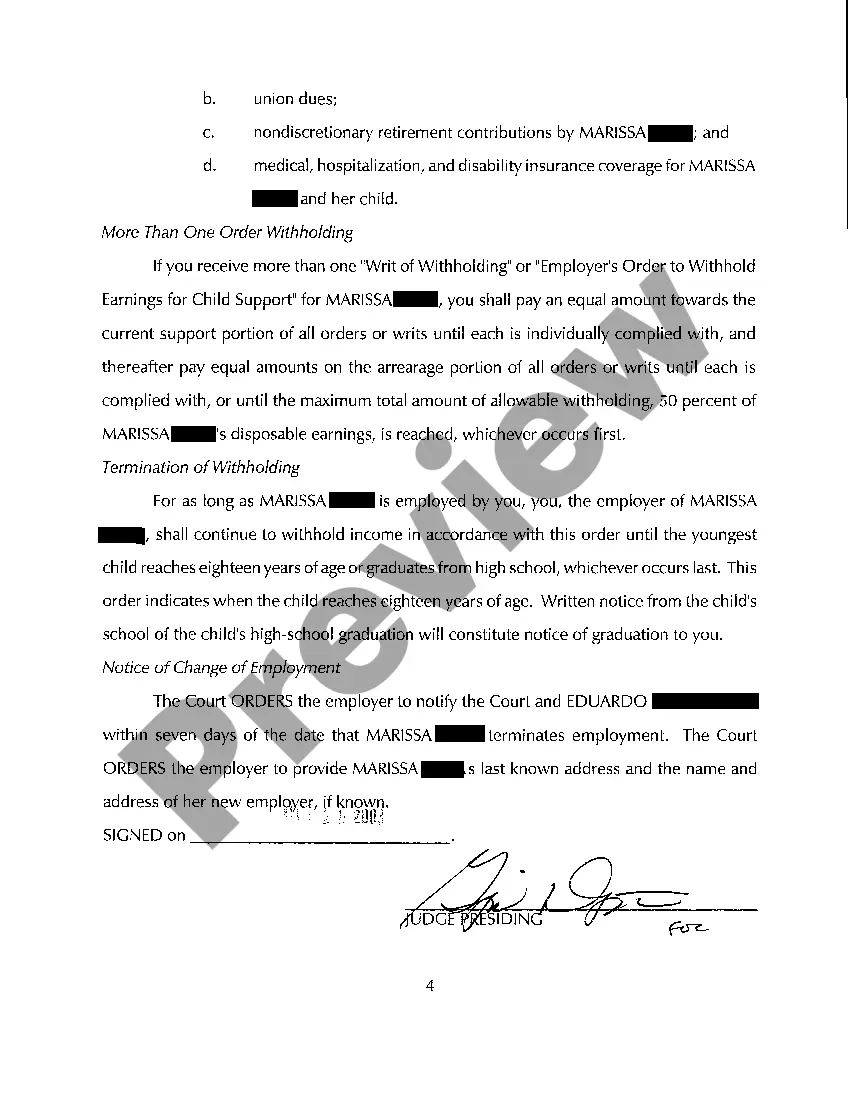

Turn in your completed Petition to Terminate Withholding for Child Support form at the district clerk's office in the county where your current order was made. Get a copy for both you and the other party. The clerk will ?file-stamp? your forms with the date and time and return the copies to you.

This means that child support payments are based on both parents' income and how much more the higher-earning parent makes, but there is no law that caps child support at any specific dollar amount.

The OAG operates a Child Support Evader Program in which officials publish the names and photos of parents who owe more than $5,000 in child support and have a warrant out for their arrest.