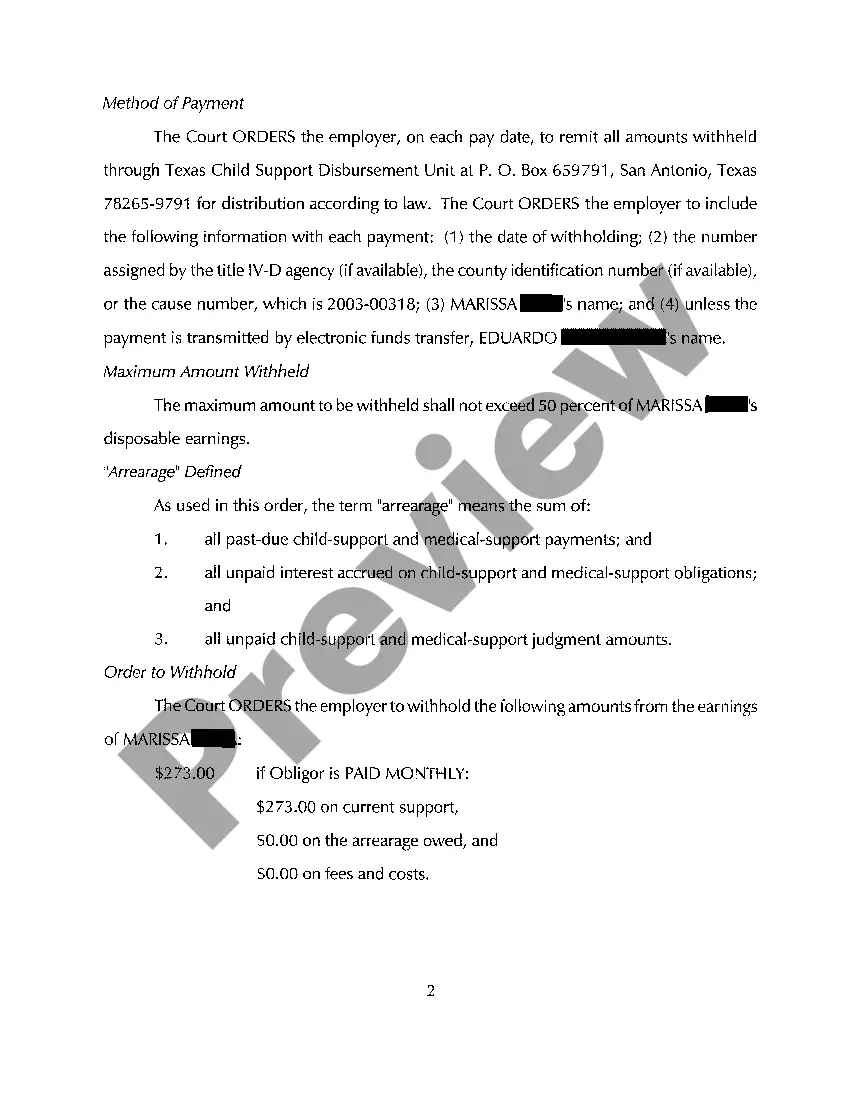

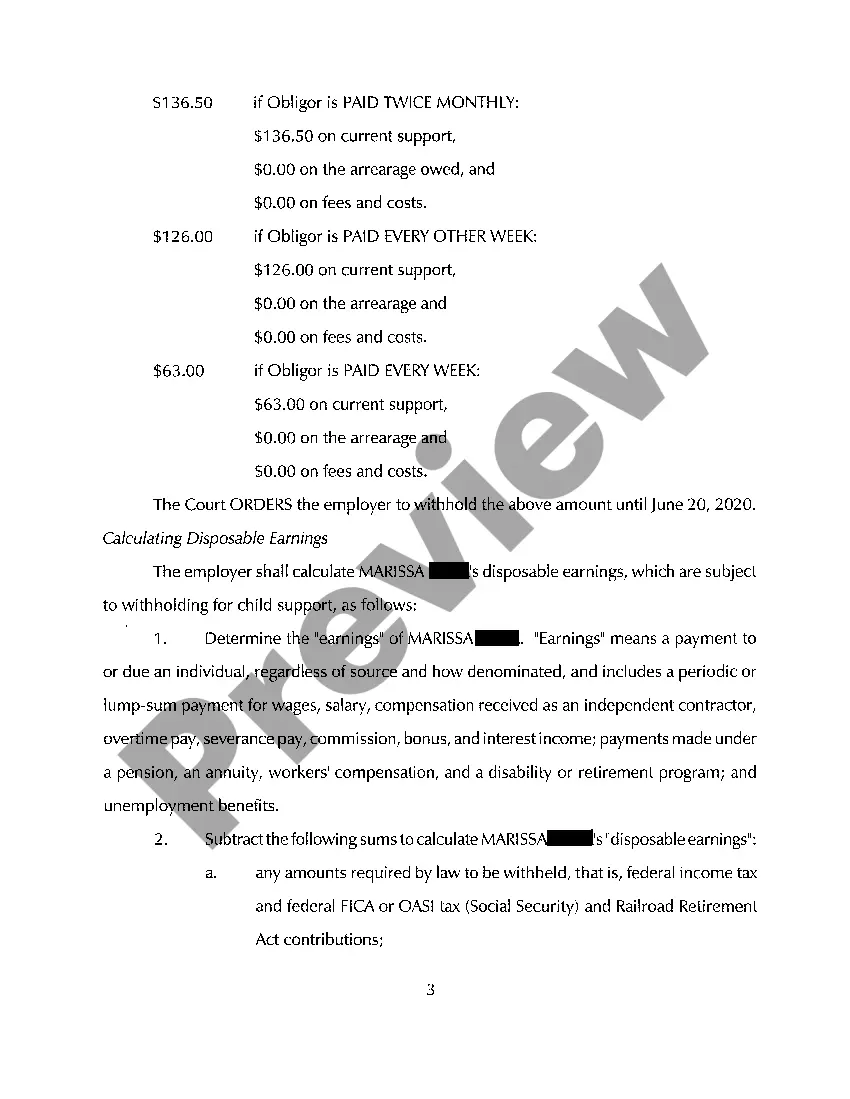

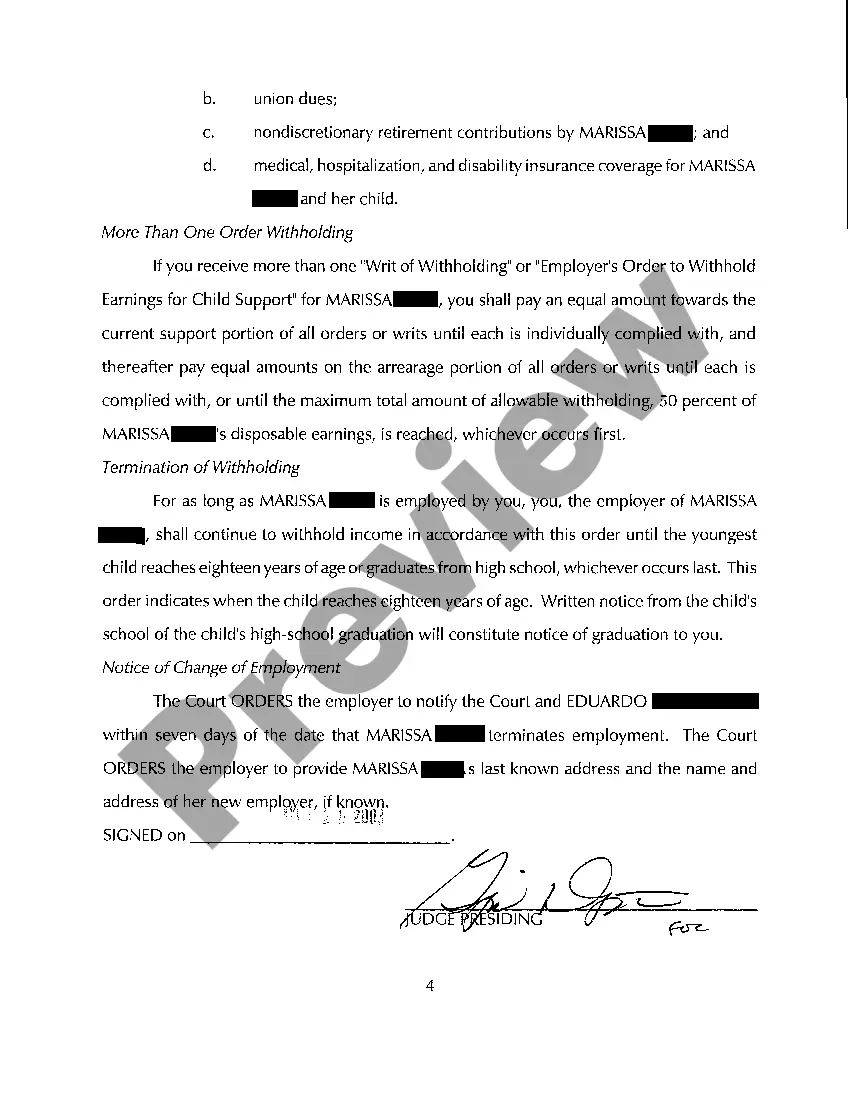

McKinney Texas Order to Withhold From Earnings Child Support

Description

How to fill out Texas Order To Withhold From Earnings Child Support?

If you have previously made use of our service, Log In to your account and save the McKinney Texas Order to Withhold From Earnings Child Support on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Utilize the US Legal Forms service to efficiently locate and save any template for your personal or professional requirements!

- Ensure you have found an appropriate document. Review the description and utilize the Preview feature, if present, to verify it meets your needs. If it doesn't fit, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and complete a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your McKinney Texas Order to Withhold From Earnings Child Support. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To file a motion to terminate withholding for child support in Texas, you will need to prepare the appropriate legal documents and submit them to the court. This documentation should clearly state your reasons for requesting the termination and include any supporting evidence. Consulting a legal expert familiar with the McKinney Texas Order to Withhold From Earnings Child Support can simplify this process.

Child support can be dismissed in Texas but typically only under specific conditions, such as the child aging out of support eligibility or changes in custody arrangements. The court must review and approve any request to dismiss the order to ensure compliance with the law. It is crucial to understand the implications of the McKinney Texas Order to Withhold From Earnings Child Support when pursuing dismissal.

To legally stop child support in Texas, one must file a motion to modify or terminate the existing support order. This process involves demonstrating to the court that circumstances have changed significantly since the order was put in place. Gathering evidence and possibly seeking professional legal help can streamline this process, especially regarding the McKinney Texas Order to Withhold From Earnings Child Support.

If an employer fails to withhold child support in Texas, they may face penalties imposed by the court, which can include fines and legal consequences. Additionally, the parent receiving support could experience delays in payment, causing financial issues. It is vital for employers to understand their obligations under the McKinney Texas Order to Withhold From Earnings Child Support to avoid these complications.

Yes, a father can be removed from child support responsibilities in Texas if a court finds valid reasons to terminate the order. This process often requires sufficient proof showing that paying support is no longer necessary, such as changes in custody or the child reaching adulthood. It is advisable to seek legal assistance, especially when dealing with the McKinney Texas Order to Withhold From Earnings Child Support.

The deadbeat dad law in Texas refers to legal measures taken against parents who fail to meet their child support obligations. This law aims to ensure that parents contribute to the financial support of their children. Non-compliance can result in wage garnishment or even criminal charges. Thus, understanding the McKinney Texas Order to Withhold From Earnings Child Support is crucial for all parents.

A father can stop paying child support in Texas by filing a petition to modify the existing order due to changed circumstances. This might include loss of income, job changes, or changes in the child's needs. It's essential to follow the legal procedures to avoid arrears. Consulting a legal expert can help navigate the McKinney Texas Order to Withhold From Earnings Child Support process.

To stop child support withholding in Texas, you must follow a formal legal process. You typically need to petition the court to modify or terminate the existing McKinney Texas Order to Withhold From Earnings Child Support. This may involve demonstrating changes in your financial circumstances or compliance with the terms of your support. Consulting with legal professionals or services like US Legal Forms can provide the necessary guidance to navigate this process effectively.

If an employer fails to withhold child support as required by a McKinney Texas Order to Withhold From Earnings Child Support, they may face legal consequences. This can include fines and compliance orders from the court. Moreover, the employee may still be held responsible for the unpaid amounts, which can lead to further penalties. It’s vital for both employees and employers to understand their roles in this process.

Texas does not automatically garnish wages for child support; however, when a McKinney Texas Order to Withhold From Earnings Child Support is issued, the process is initiated. Once this order is in place, the court mandates the withholding of child support directly from your paycheck. This system helps ensure that child support payments are collected efficiently. Staying informed about your order can help you navigate responsibilities smoothly.