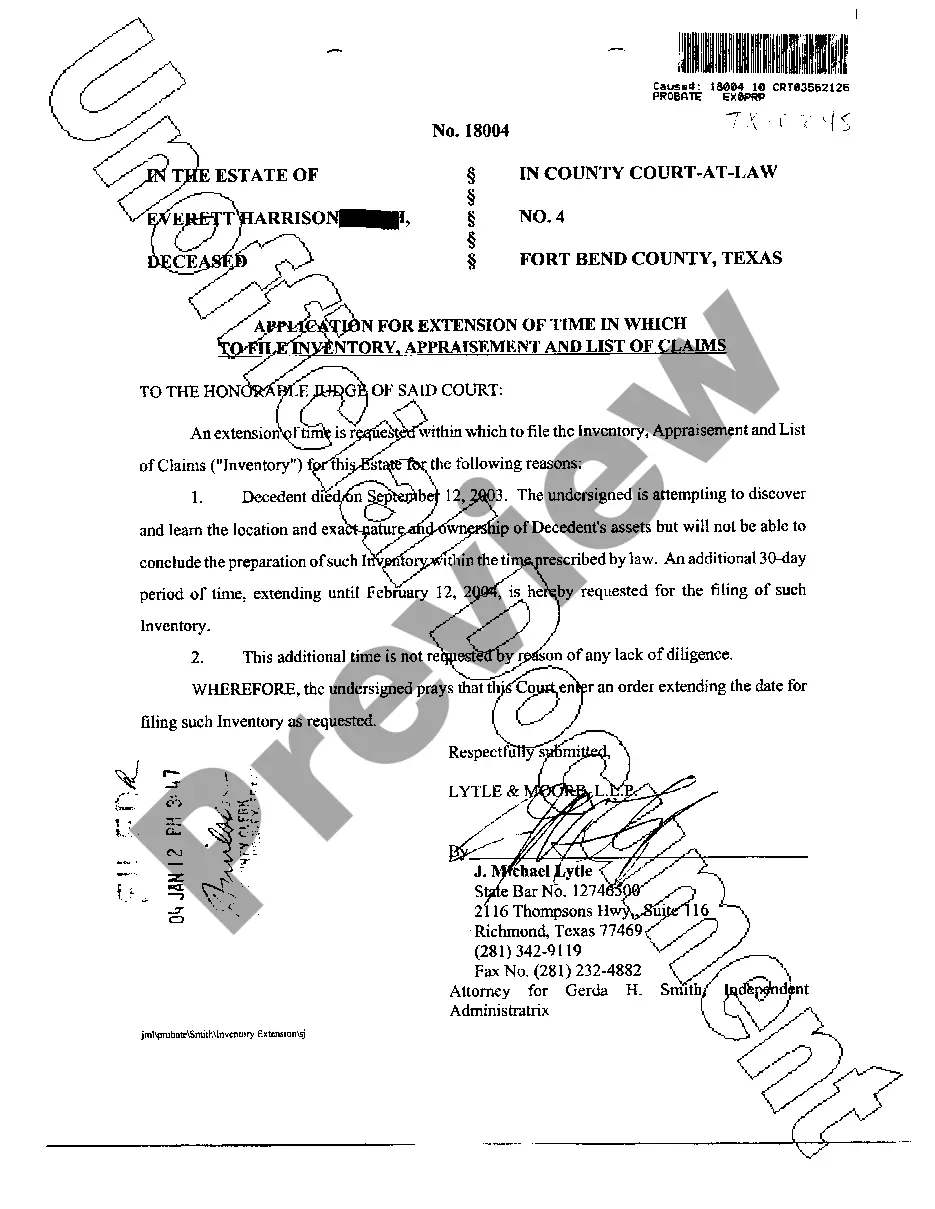

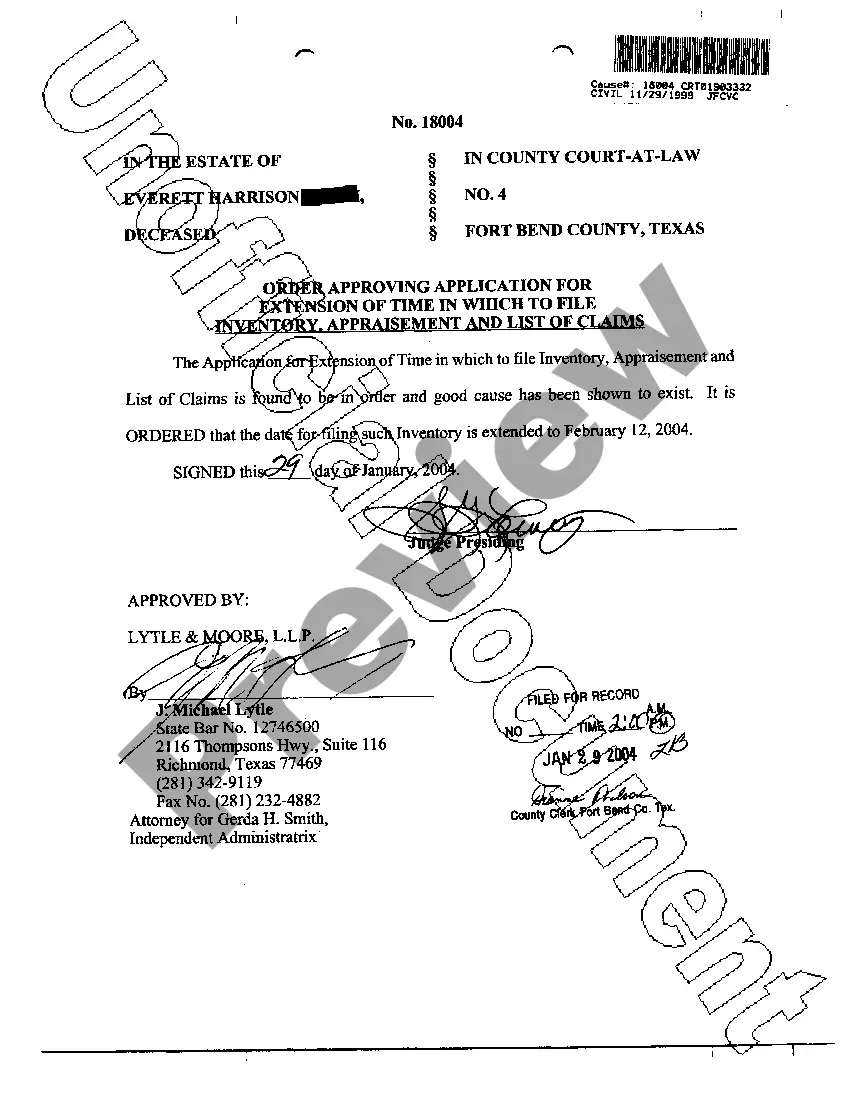

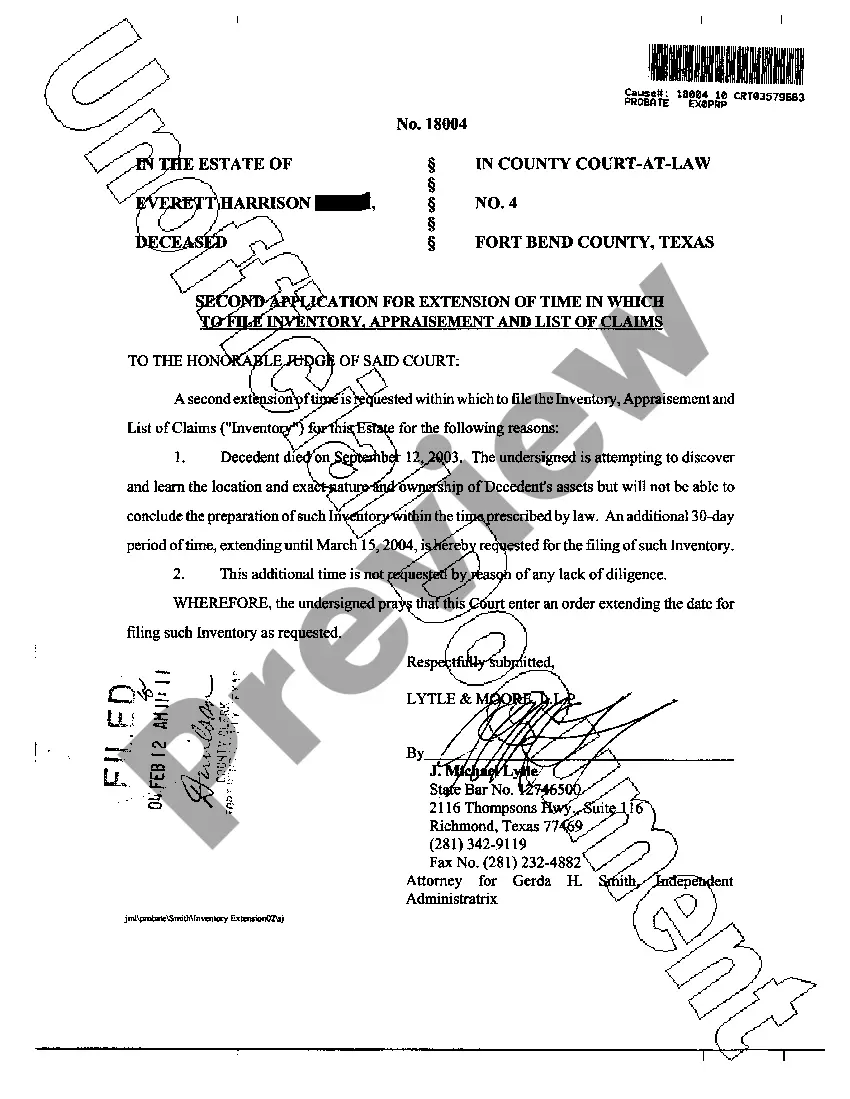

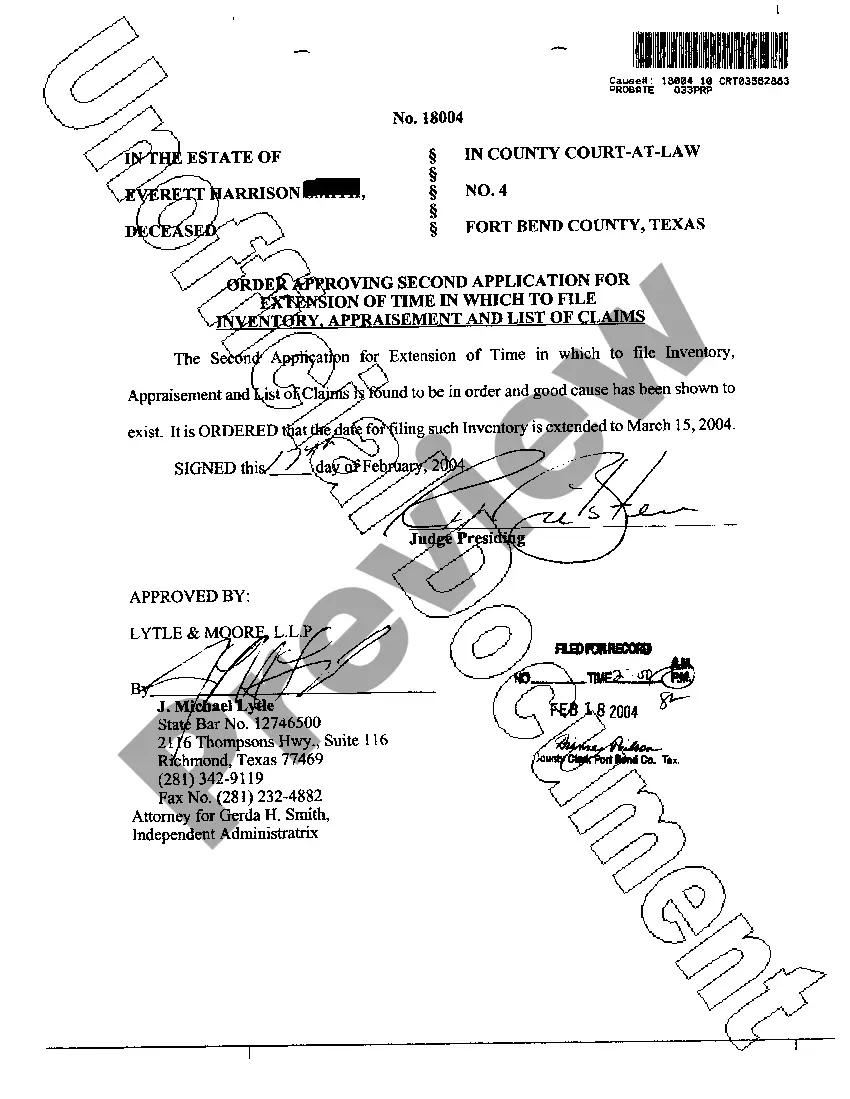

McAllen Texas Application for Extension of Time

Description

How to fill out Texas Application For Extension Of Time?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our user-friendly platform with a vast array of documents makes it easy to locate and obtain nearly any document sample you need.

You can download, complete, and sign the McAllen Texas Application for Extension of Time in just a few minutes instead of spending hours searching the internet for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you haven't registered an account yet, follow the instructions below.

Access the page with the form you need. Verify that it is the template you were looking for: check its title and description, and take advantage of the Preview option when available. Otherwise, use the Search field to find the correct one.

- Our knowledgeable attorneys frequently review all documents to ensure that the forms are applicable to a specific state and adhere to new laws and regulations.

- How can you obtain the McAllen Texas Application for Extension of Time.

- If you have a subscription, simply Log In to your account.

- The Download button will be activated on all samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Yes, you can file an extension for Texas franchise tax by submitting Form 05-164 to the Texas Comptroller's office. This form acts as your McAllen Texas Application for Extension of Time, allowing you additional time to prepare your franchise tax report. Be sure to submit it on or before the original due date to avoid penalties.

Filing a request for extension involves completing Form 4868 for individuals or the respective business extension form. Use the McAllen Texas Application for Extension of Time for your specific needs, and file it online for convenience. Ensure it is sent to the IRS before the tax deadline to secure your extension.

To file a file extension, complete Form 4868 for personal returns or the relevant form for business taxes. You can easily access the McAllen Texas Application for Extension of Time online. Make sure to provide your information accurately to facilitate the processing of your extension.

You can submit an extension request by filling out Form 4868 or the McAllen Texas Application for Extension of Time, which you can do online via the IRS website. Alternatively, you may also print the form and mail it to the appropriate IRS address. Make sure to submit the request by the due date of your tax return.

To file an extension for taxes in Texas, you need to complete the appropriate forms, such as Form 7004, and submit them to the IRS. You can file the McAllen Texas Application for Extension of Time online or by mail. Be sure to include your personal information and the estimated tax payments, if applicable.

To get an extension, you must complete and submit Form 4868. This action grants you extra time to file your tax return, but does not extend the time for payment. It's important you stay informed about all deadlines. Utilizing the McAllen Texas Application for Extension of Time can assist you in ensuring everything is done correctly.

Qualifying for an extension involves submitting Form 4868 to the IRS or your state tax authority. This form does not require you to prove a specific reason for the extension. You simply need to file it before the original deadline. The McAllen Texas Application for Extension of Time is designed to help you manage this process efficiently.

To qualify for a tax extension, you must demonstrate a valid reason, such as illness or unforeseen circumstances. The IRS allows anyone to file Form 4868, granting an automatic extension regardless of the situation. Remember that this extension only applies to time for filing, not for payment. Planning ahead with the McAllen Texas Application for Extension of Time can help you avoid issues.

You can file Form 4868 electronically through the IRS website or via approved third-party tax software. When completing the McAllen Texas Application for Extension of Time, ensure all information is accurate to avoid delays. An electronic submission is often faster and more secure. Follow the instructions provided by your chosen platform for a successful filing.

Obtaining an IRS extension is generally straightforward. Following the correct procedures, like submitting Form 4868, typically leads to approval. However, ensuring you meet all filing requirements and deadlines is crucial. With the McAllen Texas Application for Extension of Time, you can navigate this easily.