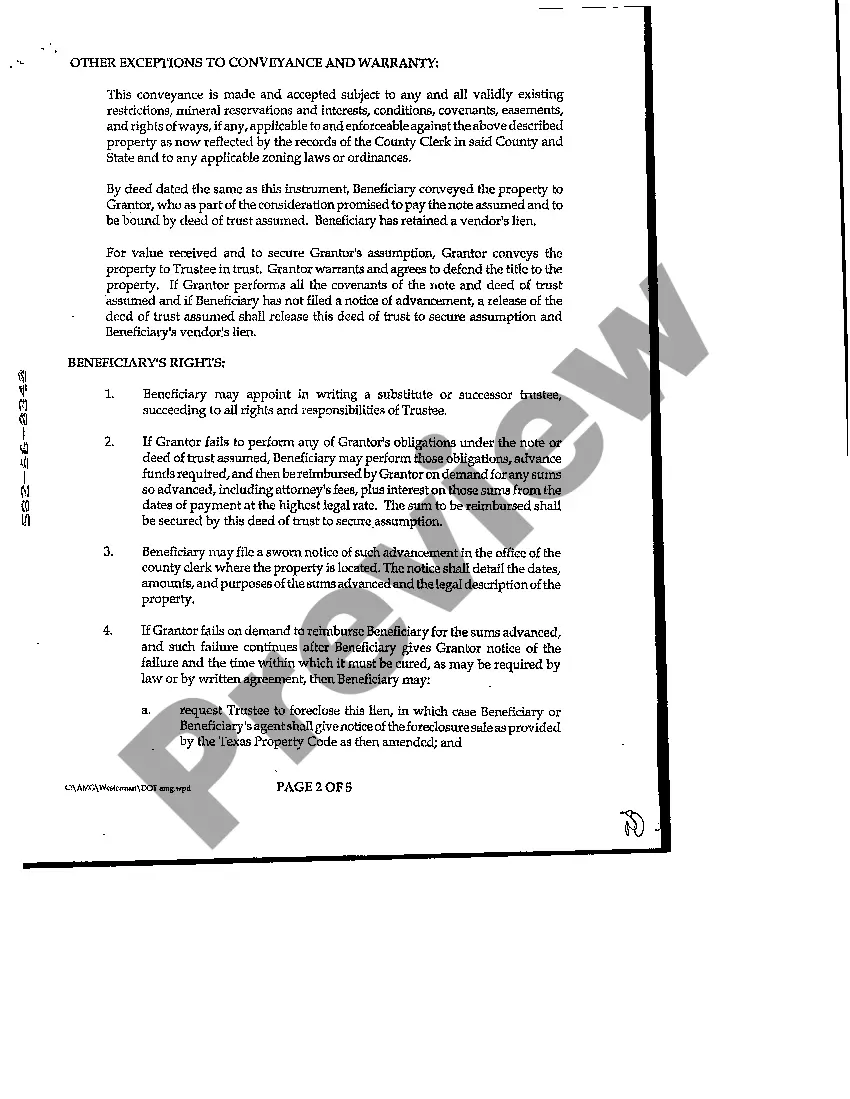

Grand Prairie Texas Deed of Trust to Secure Assumption

Description

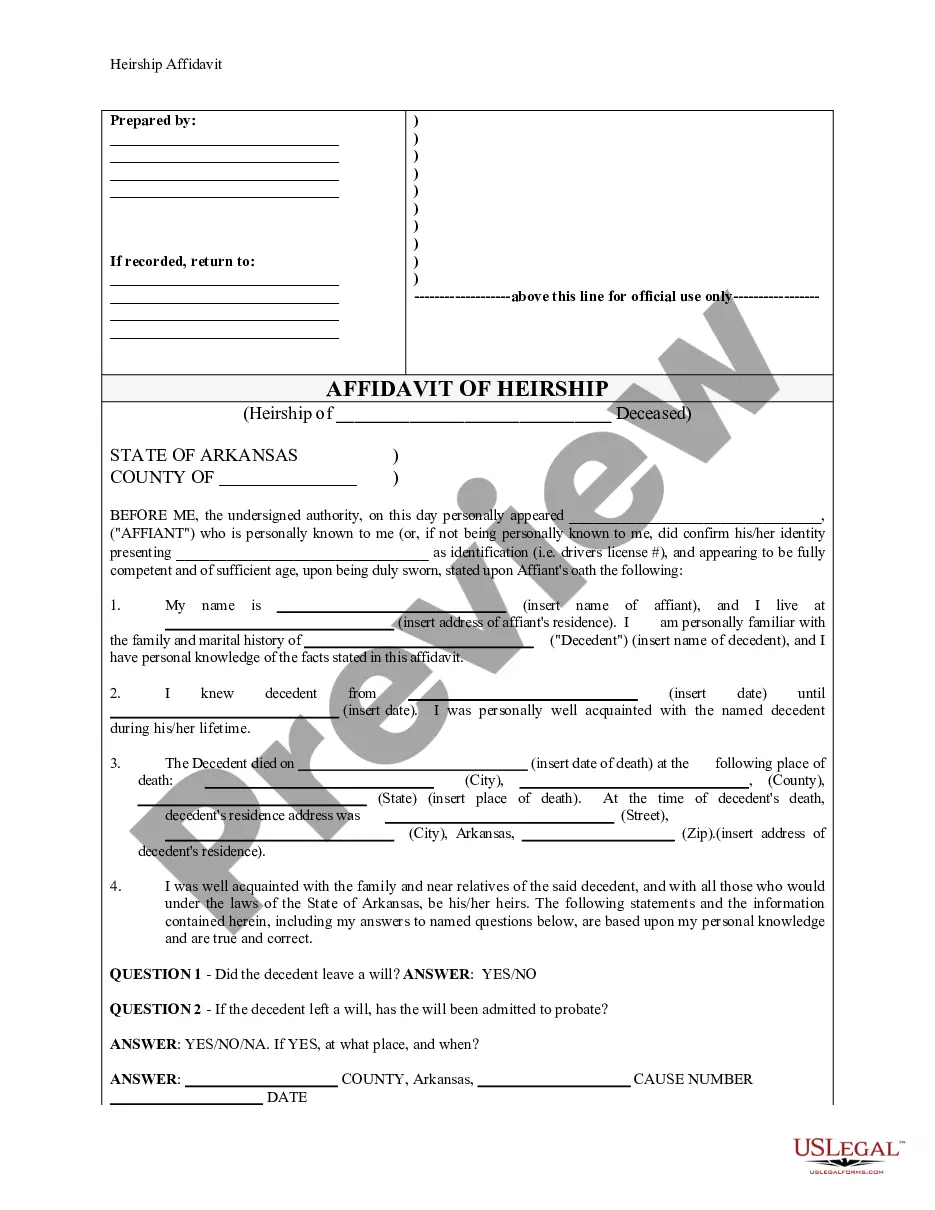

How to fill out Texas Deed Of Trust To Secure Assumption?

Finding authenticated templates that comply with your local laws can be difficult unless you utilize the US Legal Forms database.

This is an internet repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life scenarios.

All paperwork is appropriately organized by category and jurisdiction, making it simple and efficient to find the Grand Prairie Texas Deed of Trust to Secure Assumption.

Maintaining organized paperwork that adheres to legal requirements is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any situation!

- Review the Preview mode and document description.

- Ensure you select the correct one that satisfies your needs and aligns fully with your local jurisdiction standards.

- Look for another template if necessary.

- If you spot any discrepancies, utilize the Search tab above to locate the correct version.

- If it meets your criteria, proceed to the following step.

Form popularity

FAQ

To assume a mortgage in Texas, you must first verify if the existing mortgage is assumable. If so, you'll need to complete the required documentation, which often includes an application and an assumption deed. For the Grand Prairie Texas Deed of Trust to Secure Assumption, both you and the seller must communicate with the lender to ensure all conditions are met and documented.

The simple assumption process involves several steps: first, the buyer and seller must agree on the terms; then, they prepare an assumption deed; finally, the document is submitted to the lender for approval. This streamlined process helps facilitate the Grand Prairie Texas Deed of Trust to Secure Assumption more efficiently. Buyers should ensure they meet lender requirements to avoid complications.

An assumption deed in Texas is a document that allows a buyer to assume the seller's existing mortgage obligations. It effectively transfers responsibility for the mortgage from the seller to the buyer. This process is vital for managing a Grand Prairie Texas Deed of Trust to Secure Assumption, as it establishes the new terms between the parties involved.

While you are not required to hire a lawyer to transfer a deed in Texas, having legal guidance can simplify the process. A lawyer can ensure that the Grand Prairie Texas Deed of Trust to Secure Assumption adheres to all legal requirements and helps prevent potential disputes. If you feel uncertain about the transfer process, consulting a legal professional is wise.

An assumable mortgage allows a buyer to take over the seller's existing mortgage under its current terms. This arrangement can be beneficial, particularly if the original mortgage has a lower interest rate. When managing a Grand Prairie Texas Deed of Trust to Secure Assumption, both parties must meet the lender's requirements to ensure a smooth transition.

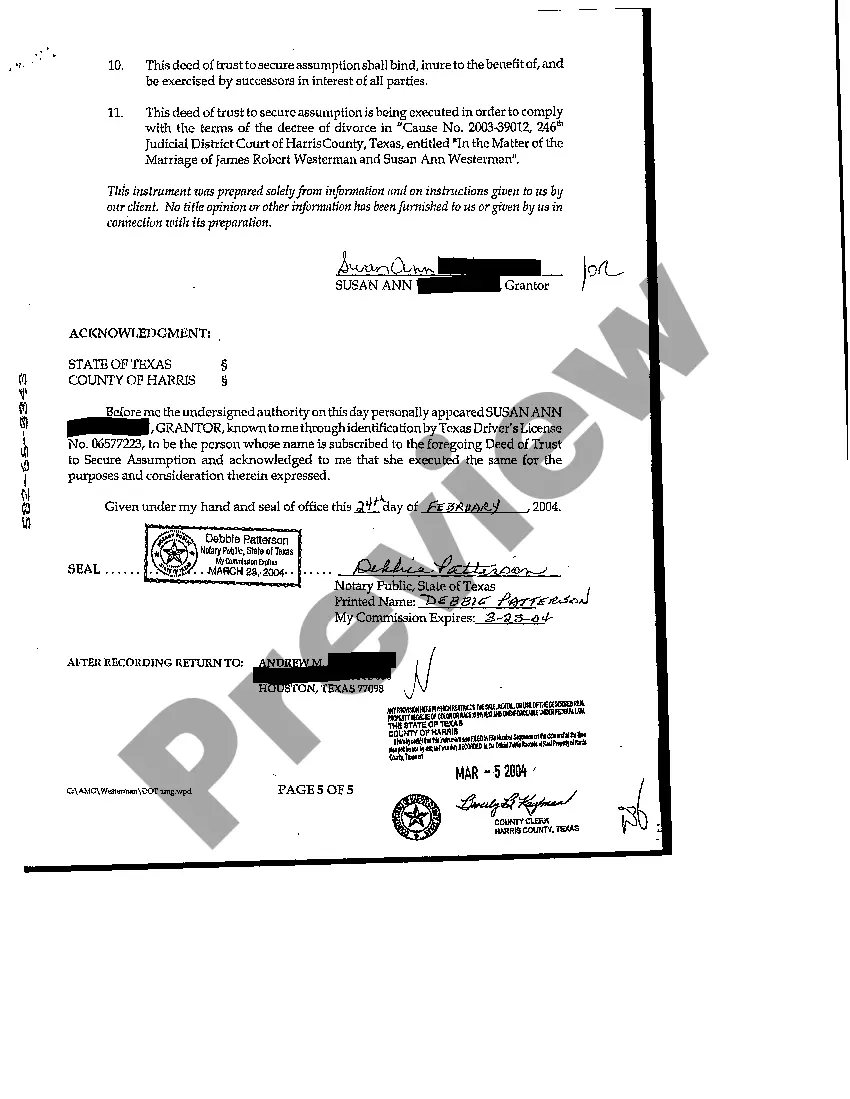

To file a deed of trust in Texas, you need to prepare the document with the necessary details, such as the names of the parties involved and the property description. Once you have the document prepared, you can file it with the county clerk's office where the property is located. It's essential to ensure that the Grand Prairie Texas Deed of Trust to Secure Assumption complies with local regulations.

Yes, a deed of trust must be recorded in Texas to be enforceable against third parties. By recording this document, you establish public notice of the lender's interest in the property. This process not only protects the lender but also provides security for the buyer. Using the Grand Prairie Texas Deed of Trust to Secure Assumption effectively ensures that your rights are documented properly.

In Texas, a deed of trust can be prepared by a licensed attorney, a title company, or a qualified real estate professional. It is important to seek help from experienced individuals familiar with Texas property laws. US Legal Forms offers resources that can guide you in creating a valid Grand Prairie Texas Deed of Trust to Secure Assumption.

An assumption warranty deed in Texas is a document that states the buyer assumes the seller's mortgage obligation as part of the transaction. This deed ensures that the buyer is legally responsible for the mortgage payments. Utilizing the Grand Prairie Texas Deed of Trust to Secure Assumption can help streamline this process and protect all parties involved.

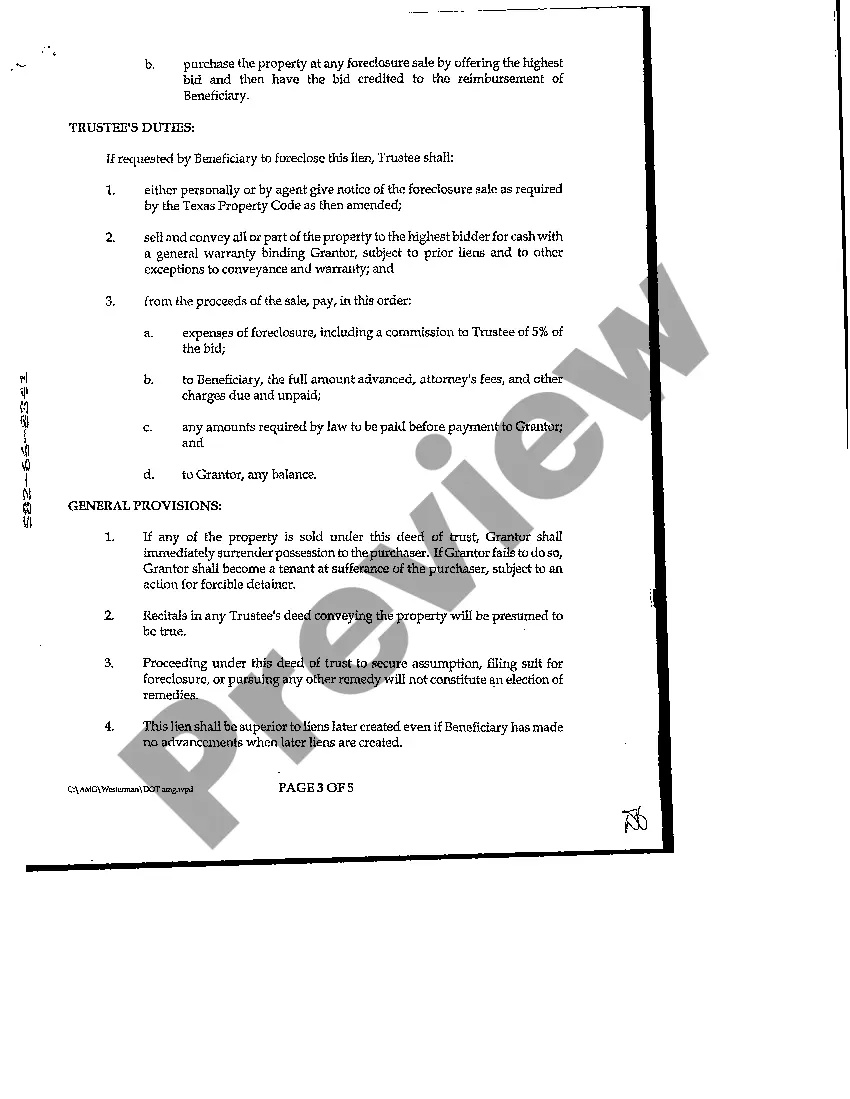

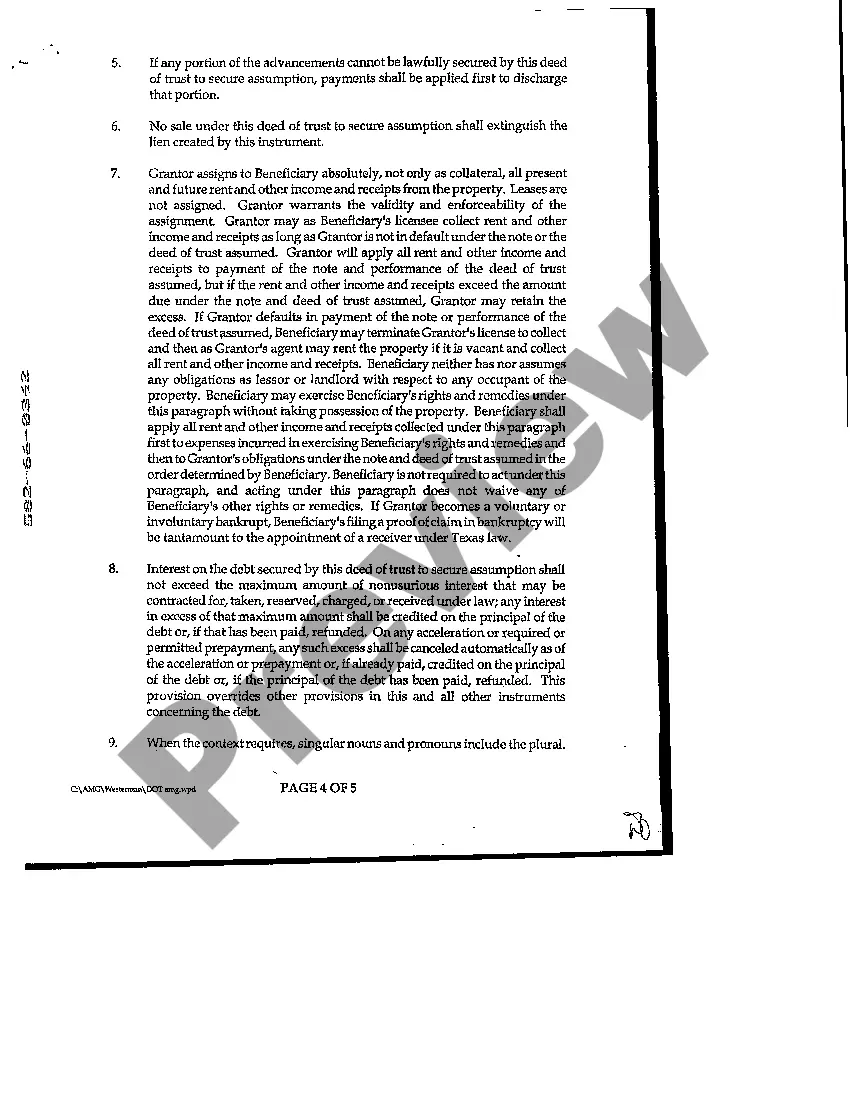

A deed of trust to secure assumption in Texas is a legal document that protects the lender's interest when a new borrower assumes an existing mortgage. This type of deed outlines the responsibilities of the new borrower regarding the mortgage repayment. Using a Grand Prairie Texas Deed of Trust to Secure Assumption helps ensure that all parties understand their obligations.