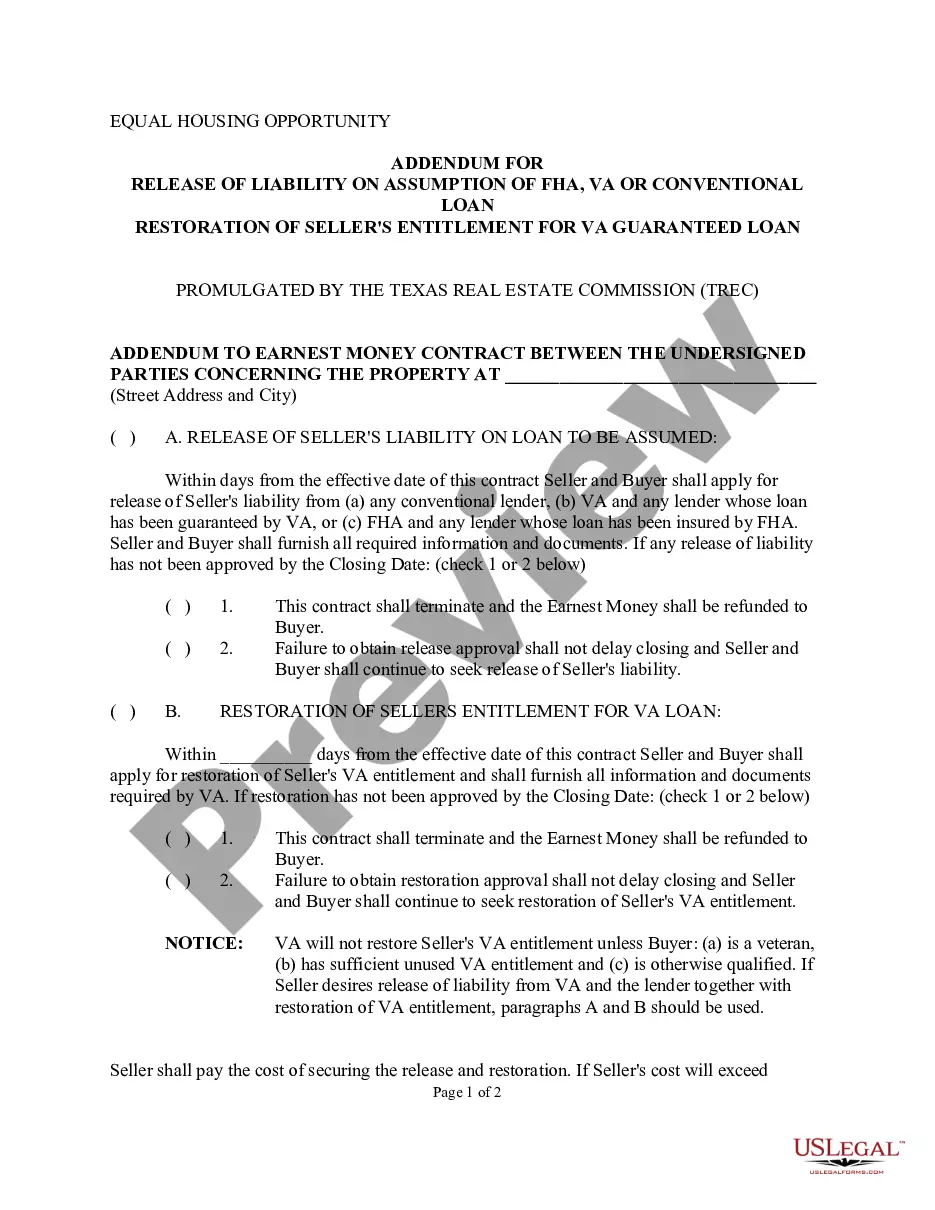

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Harris Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

If you’ve previously utilized our service, Log In to your account and download the Harris Texas Addendum for Release of Liability on Acceptance of FHA, VA or Standard Loan, Restoration of Seller's Entitlement for VA Backed Loan onto your device by selecting the Download button. Ensure your subscription is active. Otherwise, renew it as per your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to effortlessly discover and save any template for your individual or business requirements!

- Ensure you’ve located the correct document. Review the description and utilize the Preview feature, if present, to verify it satisfies your requirements. If it doesn’t align with you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Receive your Harris Texas Addendum for Release of Liability on Acceptance of FHA, VA or Standard Loan, Restoration of Seller's Entitlement for VA Backed Loan. Choose the file format for your document and store it on your device.

- Fill out your document. Print it or make use of professional online editors to complete and sign it electronically.

Form popularity

FAQ

An addendum is an addition to a finished document, such as a contract. The most common addendum is an attachment or exhibit at the end of such a document. For example, a contract to manufacture widgets may have an addendum listing the specifications for said widgets.

Is easy! Phone: 1-800-827-0611.Go to WebLGY, Eligibility, Automated Certificate of Eligibility, Fill out electronic application, upload the 1880 and DD214 or Points Summary State- ment.Reminder: The COE will only be good for Cash Out Refinance purposes only.?Is there anything I can do to obtain another VA Loan??

An addendum is used to clarify and add things that were not initially part of the original contract or agreement. Think of addendums as additions to the original agreement (for example, adding a deadline where none existed in the original version).

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

Borrowers who decide to apply for a new VA mortgage after the waiting period must apply to have their VA loan eligibility restored by filing a copy of VA Form 26-1880 to the Winston-Salem Eligibility Center. The VA will process the paperwork and let the lender and applicant know when restoration is official.

However, you are still required to pay off the initial loan in full to be eligible for the restoration. That usually means either paying the entire mortgage, which can take up to 30 years, or refinancing the VA loan into another type of non-VA mortgage.

But there is a one-time exception that allows VA buyers to purchase a home, hold onto the property, and later regain access to their full VA loan entitlement. It's known as the one-time restoration of entitlement.

What part of the Third Party Financing Addendum for Credit Approval specifically pertains to people getting FHA or VA loans? Paragraph D of the Third Party Financing Addendum for Credit Approval concerns FHA and VA loans.

What Is an Addendum? An addendum is an attachment to a contract that modifies the terms and conditions of the original contract. Addendums are used to efficiently update the terms or conditions of many types of contracts.

A VA restoration of entitlement allows borrowers who have previously utilized their VA loan entitlement to purchase another home with the VA's guaranty again.