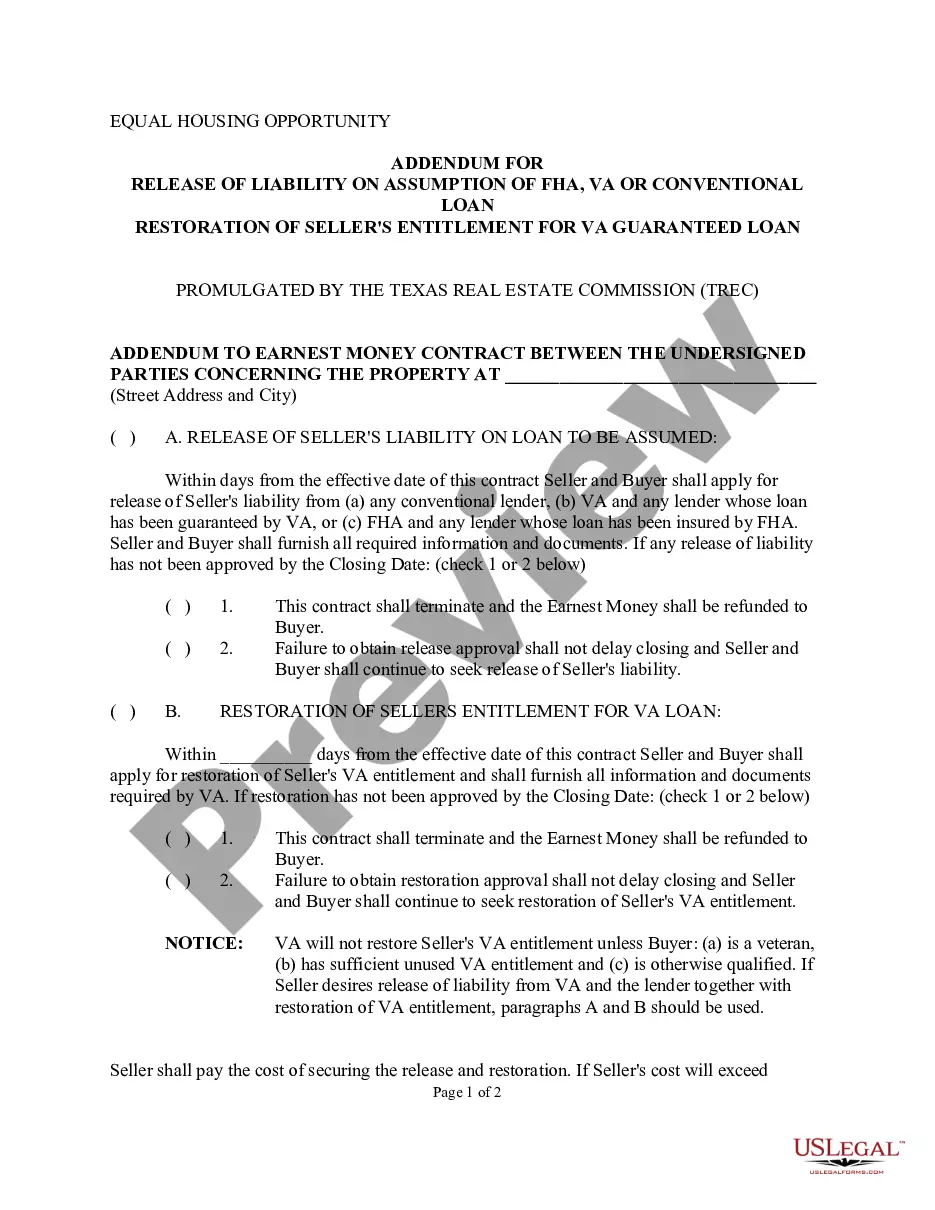

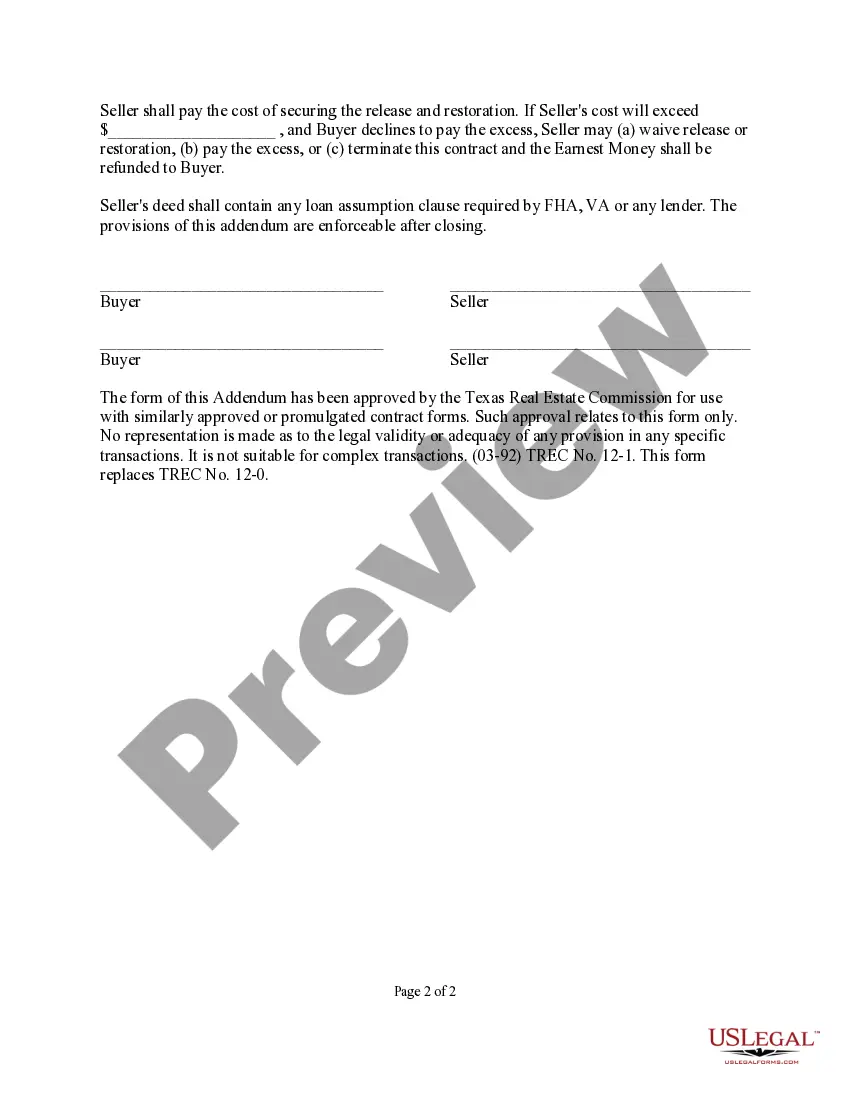

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Corpus Christi Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

If you are in search of an authentic form template, it’s incredibly challenging to discover a more suitable location than the US Legal Forms site – arguably the most extensive libraries available online.

With this repository, you can locate thousands of document examples for corporate and personal uses organized by categories and states, or by keywords.

Utilizing our premium search feature, finding the newest Corpus Christi Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is as simple as 1-2-3.

Obtain the template. Select the format and save it onto your device.

Make alterations. Fill out, edit, print, and sign the acquired Corpus Christi Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

- If you are already acquainted with our system and possess a registered account, all you need to obtain the Corpus Christi Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have selected the form you need. Review its details and utilize the Preview feature to view its contents. If it does not align with your needs, use the Search box at the top of the page to find the right document.

- Verify your selection. Click the Buy now button. Next, select your desired pricing plan and enter your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the account registration process.

Form popularity

FAQ

Does a seller have to sign the VA escape clause? No, a seller doesn't have to sign the VA escape clause. But by refusing to sign, the seller cannot accept the offer of the veteran buyer. It is worth pointing out that many buyers with all kinds of loans will insist on an appraisal contingency.

To receive VA home loan benefits and services, the Veteran's character of discharge or service must be under other than dishonorable conditions (e.g., honorable, under honorable conditions, general). Generally, there is no character of discharge bar to benefits to Veterans' Group Life Insurance.

If you sell the property which secures your VA loan, you will still be legally liable to the government unless one of the following conditions is met: -Your loan is paid in full. -The VA releases you in writing from liability on the loan.

The easiest way to remove someone from a VA mortgage is to refinance the loan in the remaining borrower's name alone. A VA Interest Rate Reduction Refinance Loan (VA IRRRL) is a simple way to achieve this.

How do I request a waiver? A Financial Status Report (VA Form 5655) A personal statement that explains why you feel you shouldn't have to repay the debt. In your statement, share more information to support your waiver request.

What is VA Restoration of Entitlement? A VA restoration of entitlement allows borrowers who have previously utilized their VA loan entitlement to purchase another home with the VA's guaranty again.

An addendum is used to clarify and add things that were not initially part of the original contract or agreement. Think of addendums as additions to the original agreement (for example, adding a deadline where none existed in the original version).

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.