This is a Texas deed of trust to sure an assumption.

Dallas Texas Deed of Trust to Secure Assumption

Description

How to fill out Texas Deed Of Trust To Secure Assumption?

Regardless of social or professional position, completing law-related paperwork is an unfortunate requirement in today’s business landscape.

Frequently, it’s nearly impossible for an individual lacking legal expertise to create these kinds of documents from scratch, primarily due to the complex language and legal nuances involved.

This is where US Legal Forms steps in to assist.

Make sure the template you have selected is specific to your region, as regulations for one state or county do not apply to another.

Examine the document and read a brief description (if available) of the situations in which the form can be utilized.

- Our platform offers an extensive library with over 85,000 state-specific documents that cater to almost any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who aim to optimize their time by using our Do-It-Yourself forms.

- Regardless of whether you require the Dallas Texas Deed of Trust to Secure Assumption or any other valid document for your state or county, US Legal Forms has everything readily available.

- Here’s how to obtain the Dallas Texas Deed of Trust to Secure Assumption in minutes using our trustworthy platform.

- If you are already a registered user, you can go ahead and Log In to access the relevant form.

- However, if you are new to our platform, make sure to follow these steps before acquiring the Dallas Texas Deed of Trust to Secure Assumption.

Form popularity

FAQ

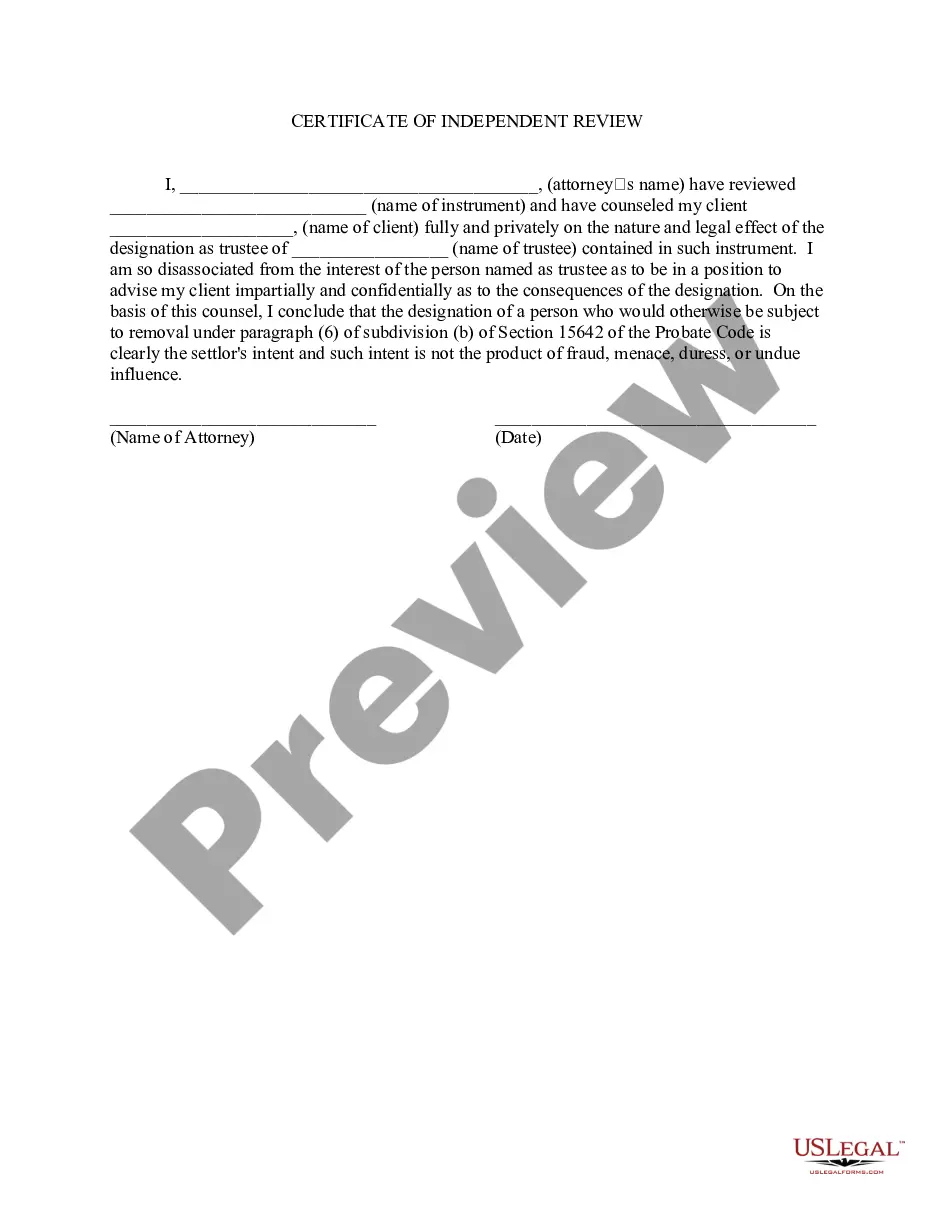

In Texas, both the borrower assuming the mortgage and the original borrower typically sign the deed of trust to secure assumption. This signature solidifies the transfer of responsibilities and rights associated with the mortgage. A clear understanding of this process is integral in the context of the Dallas Texas Deed of Trust to Secure Assumption, ensuring everyone involved is legally protected.

Assuming a mortgage can be a smart decision in particular situations, allowing buyers to take advantage of lower interest rates from the original mortgage. However, it’s crucial to assess your financial situation and the benefits of the existing mortgage before proceeding. The Dallas Texas Deed of Trust to Secure Assumption provides clarity on obligations, helping you make a well-informed choice.

Many banks do offer assumable mortgages, but it largely depends on the specific lender and the type of mortgage. Current regulations indicate that certain loans, like FHA and VA loans, are often assumable. Before proceeding, it's beneficial to review the terms laid out in the Dallas Texas Deed of Trust to Secure Assumption to understand your options.

To assume a mortgage in Texas, the buyer usually must meet specific credit and financial criteria set by the lender. It's essential to check the original mortgage agreement, as it may outline conditions for assumption. The Dallas Texas Deed of Trust to Secure Assumption plays a crucial role in ensuring all relevant regulations and requirements are adhered to during the assumption process.

An assumption warranty deed in Texas is a legal document that allows a buyer to take over the mortgage obligations of the seller. This deed enables the new owner to assume the responsibilities tied to the current mortgage, making the transition smoother. In the context of the Dallas Texas Deed of Trust to Secure Assumption, it ensures that all parties are aware of the obligations involved in the ownership transfer.

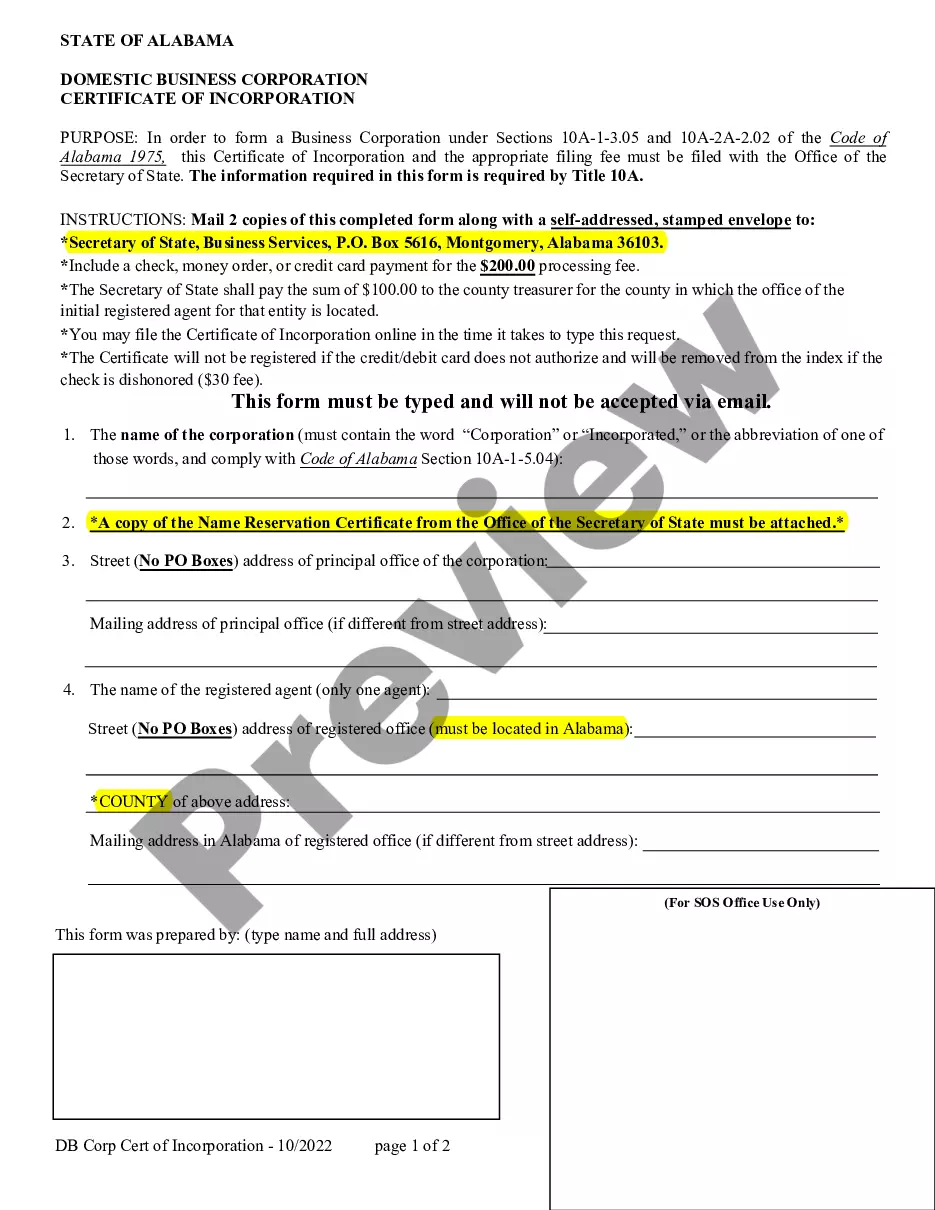

To file a deed of trust in Texas, you first need to complete the document according to state requirements. Then, you submit it to the county clerk's office in the county where the property is located. It’s important to ensure that all signatures are notarized to prevent any issues. Using the USLegalForms platform can simplify this process by providing templates and guidance tailored for a Dallas Texas Deed of Trust to Secure Assumption.

A deed of trust can be released by the lender once the borrower has fulfilled all payment obligations. This process typically involves a formal declaration that the debt has been satisfied. It’s essential to record this release with the county clerk’s office to clear the title. For guidance on the release process and necessary paperwork, you can refer to the user-friendly tools on uslegalforms.

In Texas, a deed can generally be prepared by a real estate attorney, a title company, or the sellers and buyers themselves if they are knowledgeable. It’s advisable to use a professional to ensure the deed complies with state laws and accurately conveys property ownership. By employing services like uslegalforms, you can access reliable templates that guide you through the deed preparation process.

To create a deed of trust in Texas, you'll need the legal descriptions of the property, names of the borrower and lender, and details about the repayment terms. Additionally, the document must meet the state's legal formatting requirements to be enforceable. It's crucial to include all necessary clauses that outline the responsibilities of both parties. Using uslegalforms can simplify the creation of a compliant deed of trust.

In Texas, a deed of trust can be prepared by a licensed attorney, or in some cases, by the parties involved if they understand the legal requirements. While you may attempt to draft it yourself, consulting with a professional ensures that the document meets all statutory requirements. Using specialized services like those offered on uslegalforms can help streamline this process and ensure accuracy.