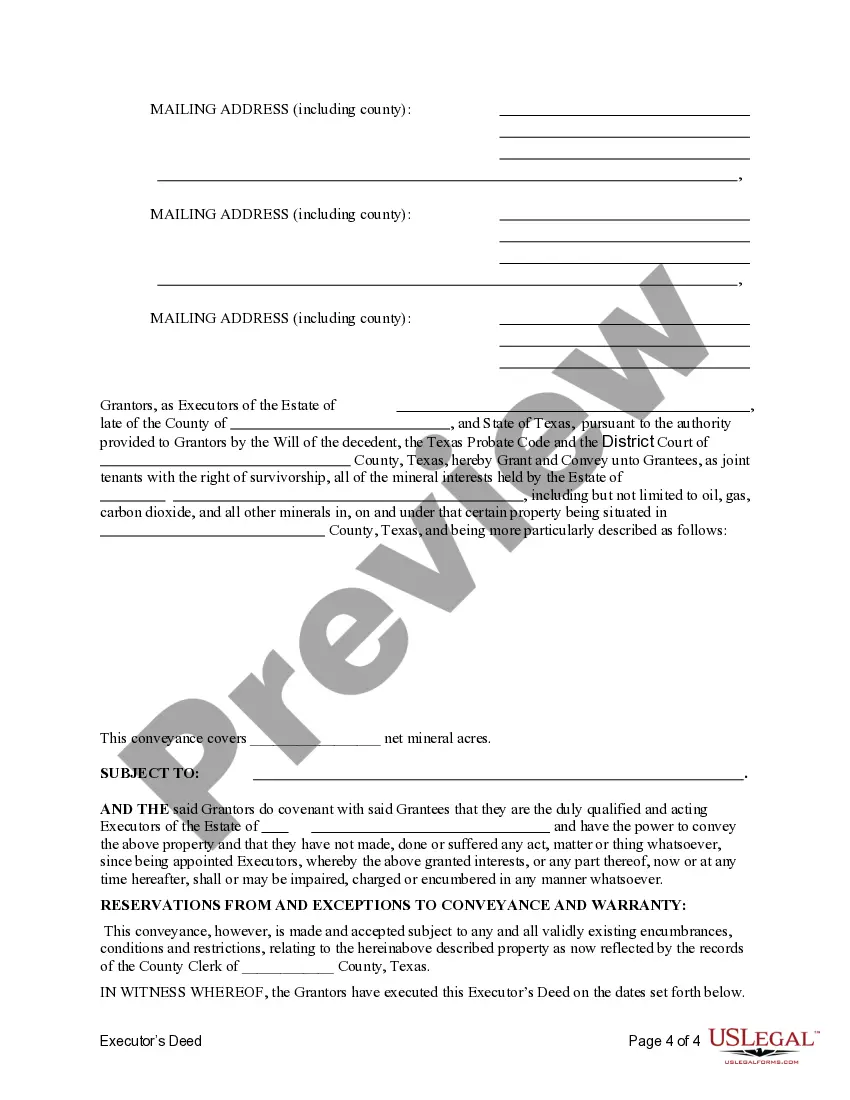

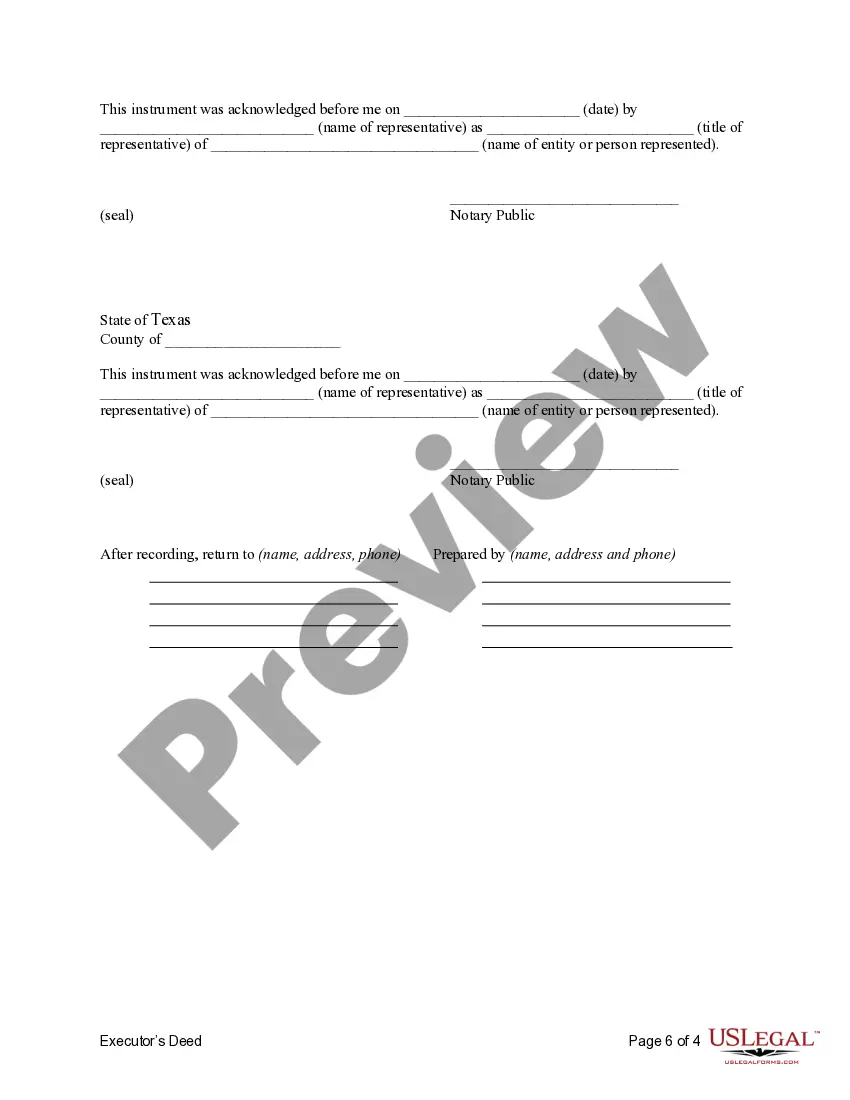

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

Travis Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will

Description

How to fill out Texas Executor's Deed - Three Executors To Five Beneficiaries Pursuant To Terms Of Will?

If you have previously employed our service, Log In to your account and retain the Travis Texas Executor's Deed - Three Executors to Five Beneficiaries According to Will Terms on your device by selecting the Download button. Ensure that your subscription is active. If not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly find and store any template for your personal or professional use!

- Confirm that you have found a suitable document. Review the details and use the Preview feature, if available, to verify that it fulfills your requirements. If it does not suit your needs, use the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Travis Texas Executor's Deed - Three Executors to Five Beneficiaries According to Will Terms. Select the file format for your document and store it on your device.

- Fill out your sample. Print it or use professional online editing tools to complete and sign it electronically.

Form popularity

FAQ

How many executors can you have? You can name as many executors as you like in your will, and you can also choose substitute executors in case your initial choices are unable to act. However, the maximum number of people that can act as executor at any one time is four.

The executor will notify all creditors about the person's death and validate any claims before paying them to ensure that they are legitimate debts. Other duties include: Filing tax returns for the decedent and the estate and paying any taxes due. Notifying the Social Security Administration regarding benefits payments.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

Up to four executors can act at a time, but they all have to act jointly. So it might not be practical to appoint that many people. It's a good idea, though, to choose two executors in case one of them dies before you do or 'renounce probate' if they do not want the job.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

When there is a will, the executor is responsible for selling the house, with the approval of the heirs. The executor may recruit a real estate agent or broker experienced in probate law to help with the sale. A formal appraisal may also be necessary. The selling process isn't quite like a traditional house sale.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died. If one of the executors wishes to act alone, they must first get the consent of the other executors.

A General Rule of Thumb The takeaway here is that the answer to the question of whether a beneficiary can stop the sale of property is generally no. Property sale is indicated in a will, and the provisions of that will are carried out by an executor. As such, the beneficiary can't go against these instructions.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.