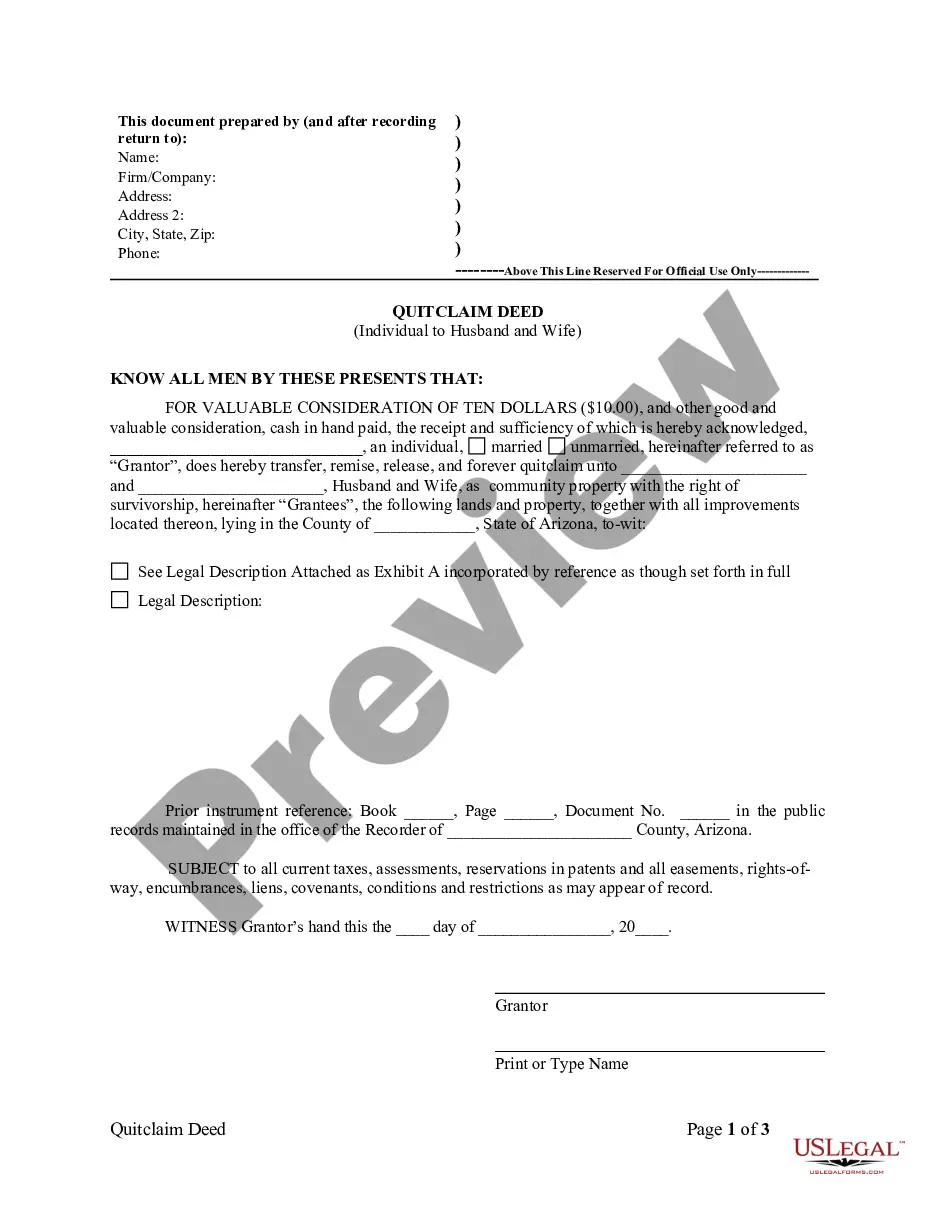

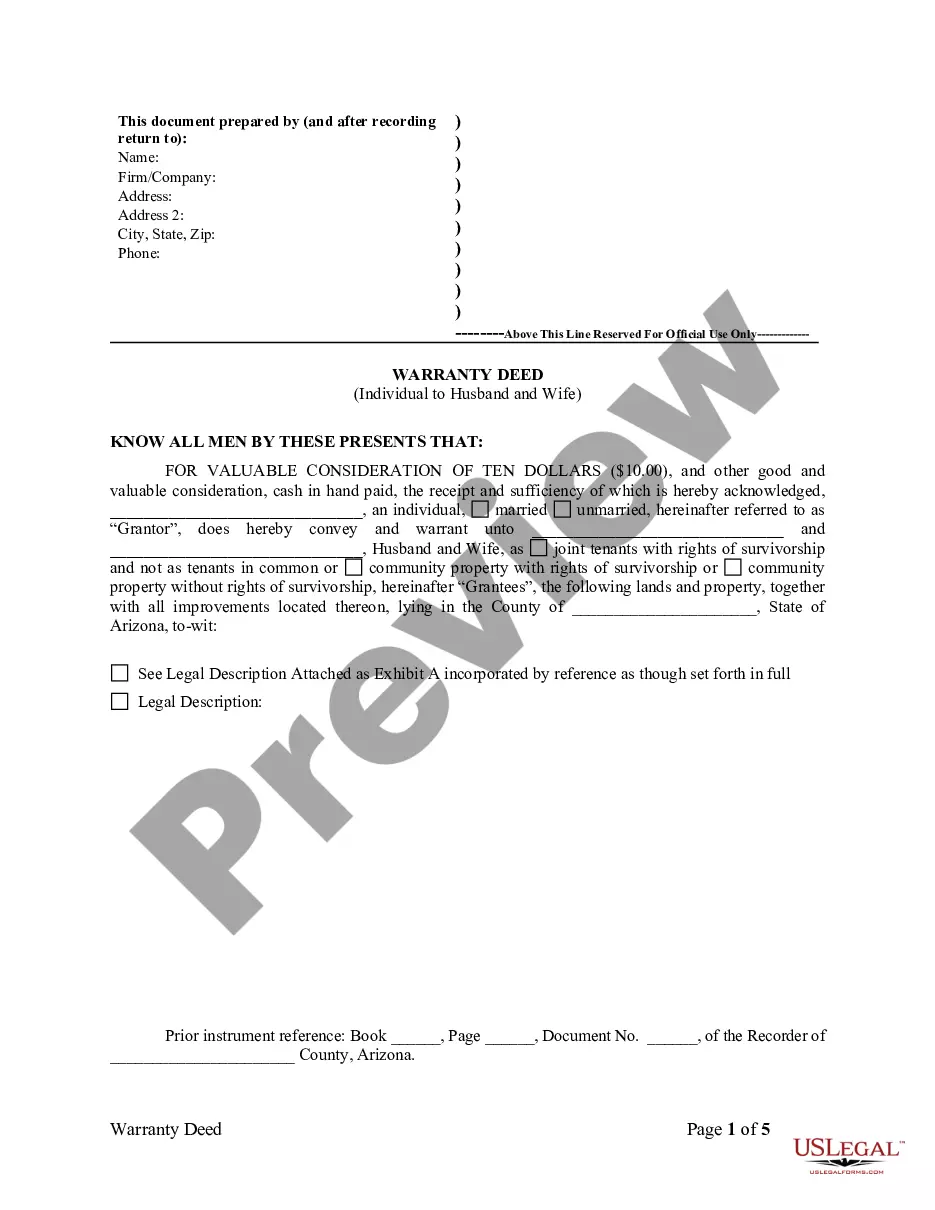

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. It is also known as a "Lady Bird" Deed. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, to an Individual

Description

How to fill out Texas Enhanced Life Estate Or Lady Bird Quitclaim Deed From Two Individuals, Or Husband And Wife, To An Individual?

If you've previously utilized our service, sign in to your account and obtain the Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, to an Individual on your device by clicking the Download button. Ensure your subscription is current. If it isn't, renew it per your payment plan.

If this is your initial experience with our service, follow these simple steps to acquire your document.

You have ongoing access to every document you have acquired: you can locate it in your profile under the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or business needs!

- Confirm you've located the correct document. Review the description and utilize the Preview option, if available, to check if it satisfies your requirements. If it doesn't suit your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, to an Individual. Select the file format for your document and store it on your device.

- Finalize your sample. Print it out or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

You can include multiple names on a ladybird deed, whether they are beneficiaries or co-owners. This flexibility allows for a tailored estate plan that reflects your intentions. It's important to accurately list all the parties involved to ensure a smooth transfer of property. For further assistance, consider reaching out to uslegalforms, a reliable resource for legal documentation.

Indeed, a ladybird deed can have multiple beneficiaries. This allows you to divide your property among several individuals according to your wishes. If you are contemplating a Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, to an Individual, ensuring each beneficiary is clearly identified can streamline the transfer process. Consulting legal advice can ensure proper execution.

While a ladybird deed has many advantages, there are some disadvantages to consider. For example, it may complicate Medicaid eligibility if not structured properly. Additionally, creditors of the beneficiaries may have access to the property after your passing. Evaluating these factors is essential before finalizing your Harris Texas Enhanced Life Estate documentation.

Yes, it is possible to designate multiple beneficiaries on a lady bird deed. This flexibility allows you to divide the property among different heirs. When creating a Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, to an Individual, clearly specifying multiple beneficiaries can help ensure your wishes are honored. Just make sure to consult with legal professionals for proper drafting.

Yes, a lady bird deed is indeed a specific type of enhanced life estate deed. Both terms refer to a legal arrangement that allows you to retain control over property during your lifetime while designating beneficiaries for when you pass away. This deed is particularly popular due to its simplicity and beneficial tax implications. Understanding this distinction is crucial for anyone exploring estate planning options.

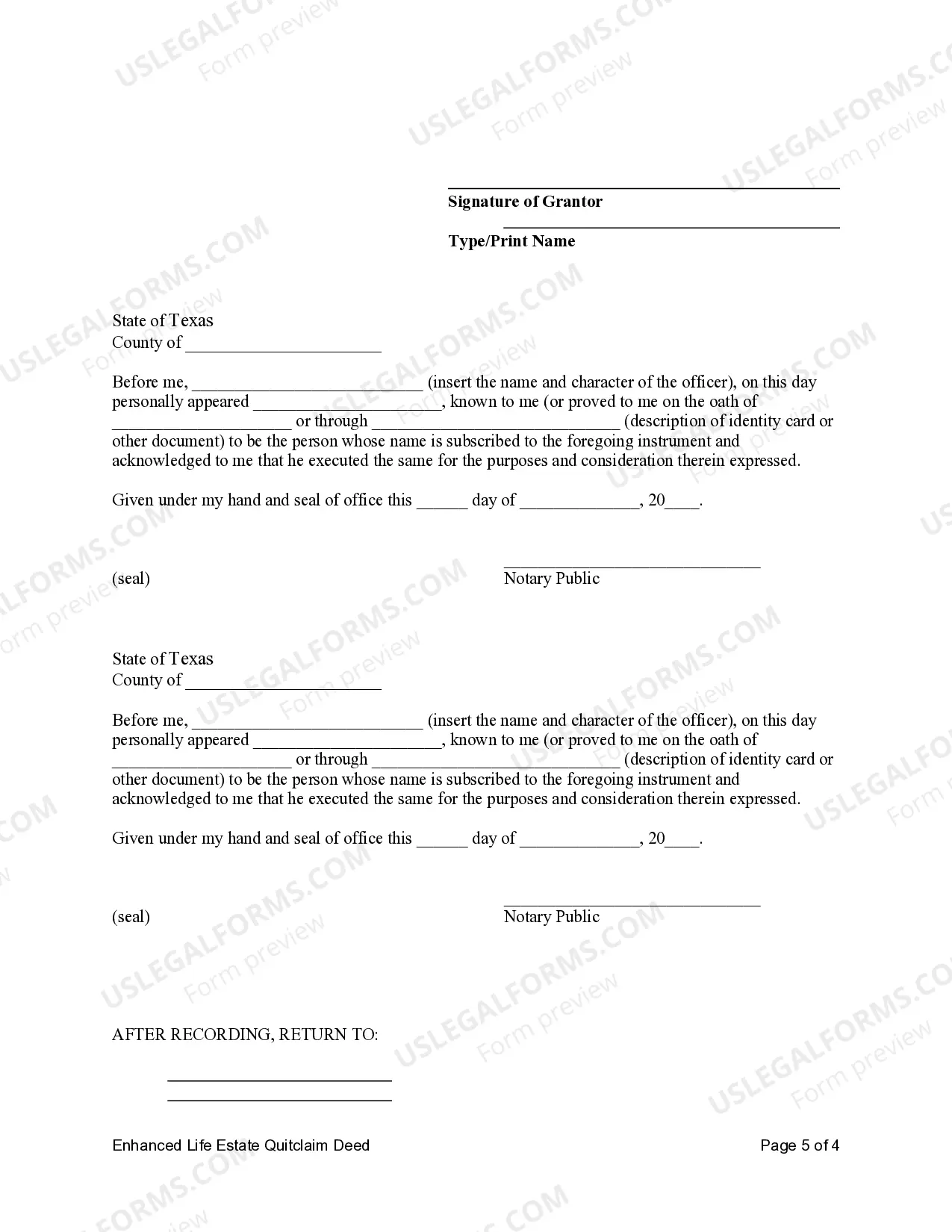

To record a lady bird deed in Texas, you must first complete the deed form accurately. After that, you will need to sign it in front of a notary public. Once notarized, take the deed to the county clerk's office where the property is located and submit it for recording. This process secures the legal recognition of your Harris Texas Enhanced Life Estate, making it effective for your estate planning.

A ladybird deed, also known as a Harris Texas Enhanced Life Estate, can indeed provide tax benefits. When set up properly, it allows the property to pass to heirs without triggering capital gains tax at the time of transfer. This feature is especially beneficial for individuals looking to maintain tax efficiency in estate planning. However, it's important to consult with a tax advisor to understand specific implications.

To add your wife to your deed in Texas, you can execute a Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals. This deed facilitates the transfer of ownership rights while providing you with the ability to retain control over the property during your lifetime. Complete the necessary form, sign it in front of a notary, and file it with your county clerk. This straightforward process ensures both parties have equal rights to the property.

It is generally advisable for both spouses to be on the house title in Texas, especially when using a Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals. This helps ensure that both parties have legal rights to the property, providing added security and clarity. Furthermore, having both names can simplify the transfer of property in the event of one spouse's passing, making the process smoother for the surviving partner.

Yes, a Lady Bird deed must be filed in Texas for it to be legally recognized. This means you need to submit the Harris Texas Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals to your county clerk. Filing the deed helps establish clear ownership and outlines your wishes for the property upon your passing. It is important to keep documentation evidence for your estate planning.