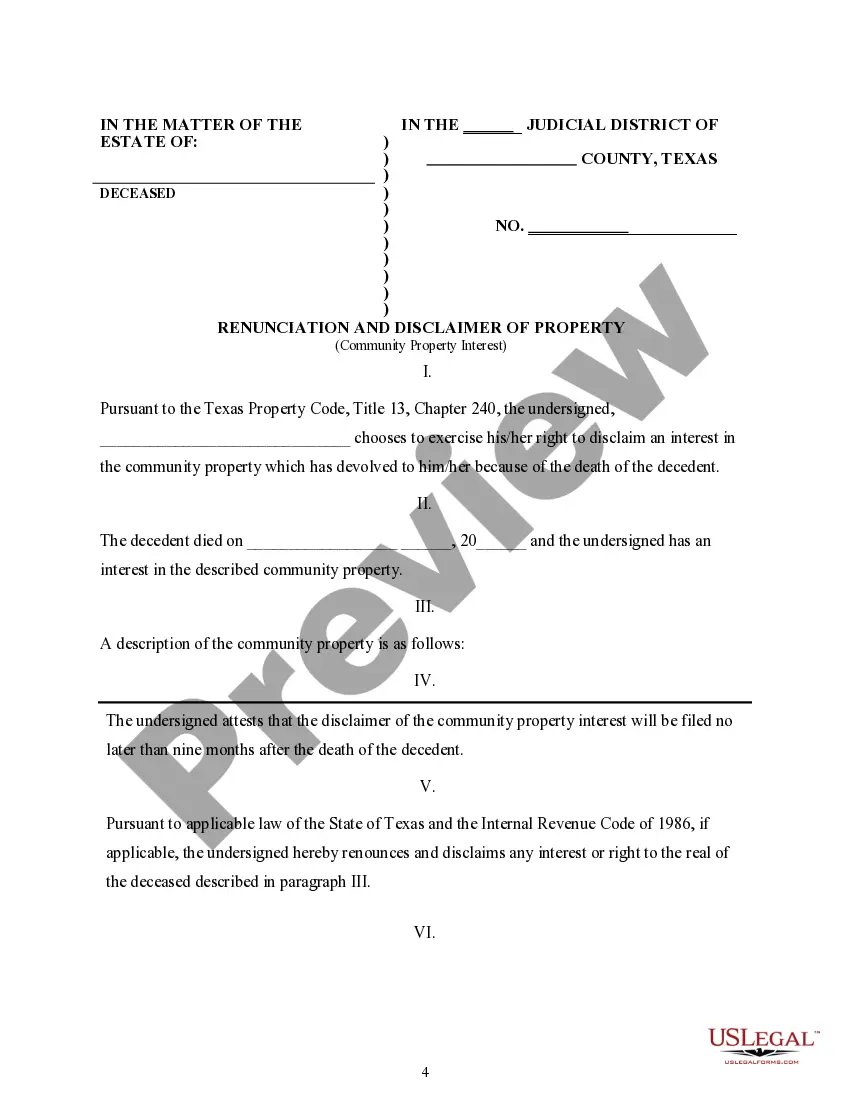

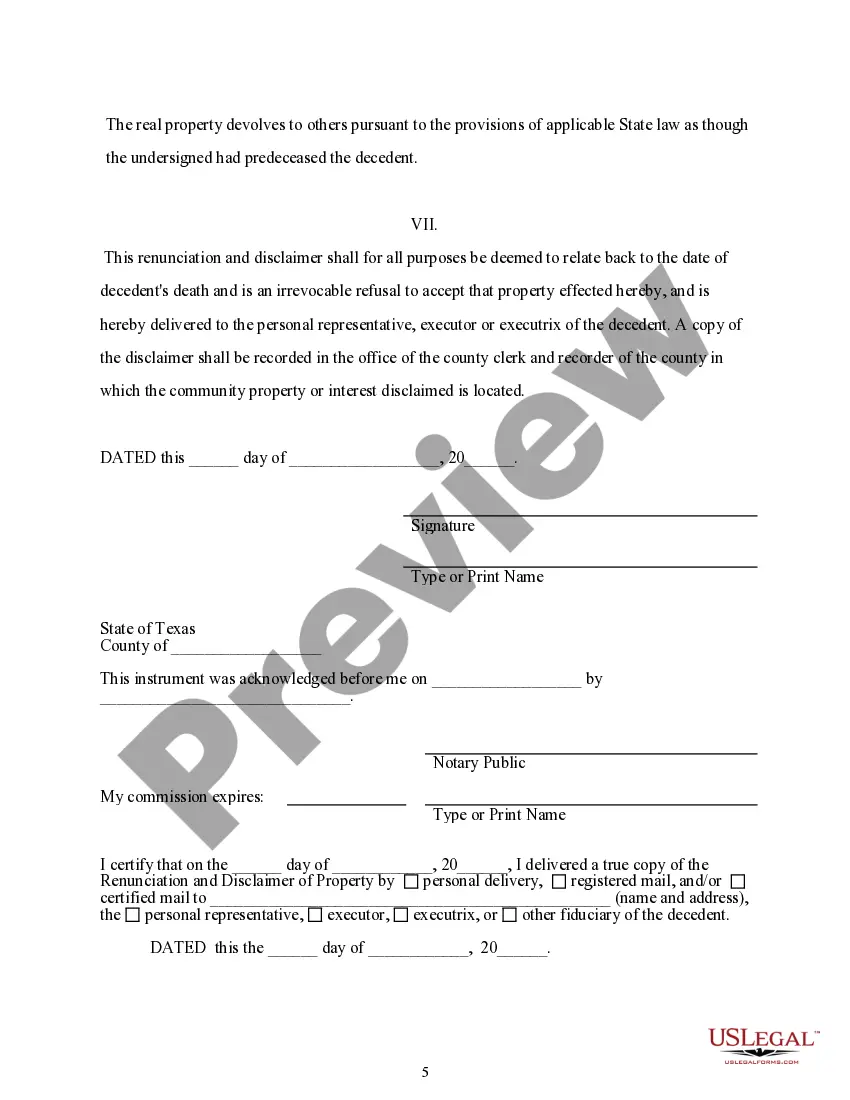

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest

Description

How to fill out Texas Renunciation And Disclaimer Of Property - Community Property Interest?

Regardless of one's social or professional rank, completing legal documents is a regrettable requirement in today’s occupational landscape.

Frequently, it’s nearly unattainable for an individual lacking legal training to compose such documents from scratch, predominantly due to the complicated terminology and legal nuances they involve.

This is where US Legal Forms can provide assistance.

Ensure the template you have selected is tailored to your region as the laws of one state or area may not apply to another.

Review the paper and read any brief description (if available) regarding the situations the document can be utilized for.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to enhance their efficiency through our DIY templates.

- Whether you need the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest or any other form relevant to your region, US Legal Forms has you covered.

- Here’s how you can swiftly obtain the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest using our dependable service.

- If you are already a registered user, feel free to Log In to your account to access the required document.

- However, if you are new to our collection, be sure to follow these steps before acquiring the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest.

Form popularity

FAQ

In real estate, a 'disclaimer' refers to a legal assertion where an individual formally denies ownership or responsibility for a property. This typically aims to protect the individual from liabilities that may arise from the property. Understanding the concept of the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest can further clarify your rights and obligations in real estate matters.

Writing a disclaimer of interest involves drafting a document that clearly states your intention to renounce any rights to inherited property. The disclaimer should include your name, the description of the property, and a statement of refusal. The Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest provides templates and guidelines that can simplify this process.

A disclaimer of interest in property of an estate is a legal statement that allows a person to refuse their rights to an inheritance, thereby avoiding responsibilities associated with that property. This document must be filed timely to ensure its validity. Using the resources available in the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest will support you in this essential step.

To renounce and to disclaim both signify a refusal of property, yet they can have different legal implications. Renouncing typically refers to formally rejecting rights to an estate, while disclaiming often refers to rejecting specific interests or property. Engaging with the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest will help clarify the appropriate terminology and usage.

Renunciation and disclaimer of interests in an estate involve the rejection of rights to inherited property or assets. This legal strategy allows an individual to forfeit their entitlement, which may have tax or liability implications. Understanding the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest can be beneficial for individuals weighing these decisions.

A renunciation of an estate refers to the act of formally rejecting an inheritance. This legal process allows heirs to refuse their share of the estate, often for financial or personal reasons. The Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest serves as an excellent resource for those considering this option.

An estate disclaimer is a legal document where an individual renounces their right to inherit property. For example, if a person inherits a house that comes with significant debt, they may choose to disclaim it to avoid financial responsibility. Utilizing the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest can provide clarity on how to navigate such decisions.

To disclaim inherited property in Texas, you must file a written declaration with the probate court. This declaration should state your intent to renounce the property and must be filed within nine months of the decedent’s death. Consulting the Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest can simplify this process and ensure compliance with all necessary legal requirements.

Texas law outlines specific rules for filing a disclaimer, requiring individuals to submit a written document that clearly states their intention to renounce their property interest. Notably, the disclaimer must be filed within a certain time frame after becoming aware of the interest. For those in Round Rock Texas dealing with Renunciation And Disclaimer of Property - Community Property Interest, understanding these rules is essential for ensuring valid disallowance of property claims. Resources like US Legal Forms can guide you through the process and provide the necessary documentation.

In Texas, a will does not generally override community property laws. Community property is considered jointly owned by both spouses, and unless explicitly stated, a will cannot alter that designation. This principle is crucial for residents navigating the complexities of Round Rock Texas Renunciation And Disclaimer of Property - Community Property Interest. If a spouse wishes to manage property differently, they may need to consider disclaimers or other legal mechanisms to restructure ownership.