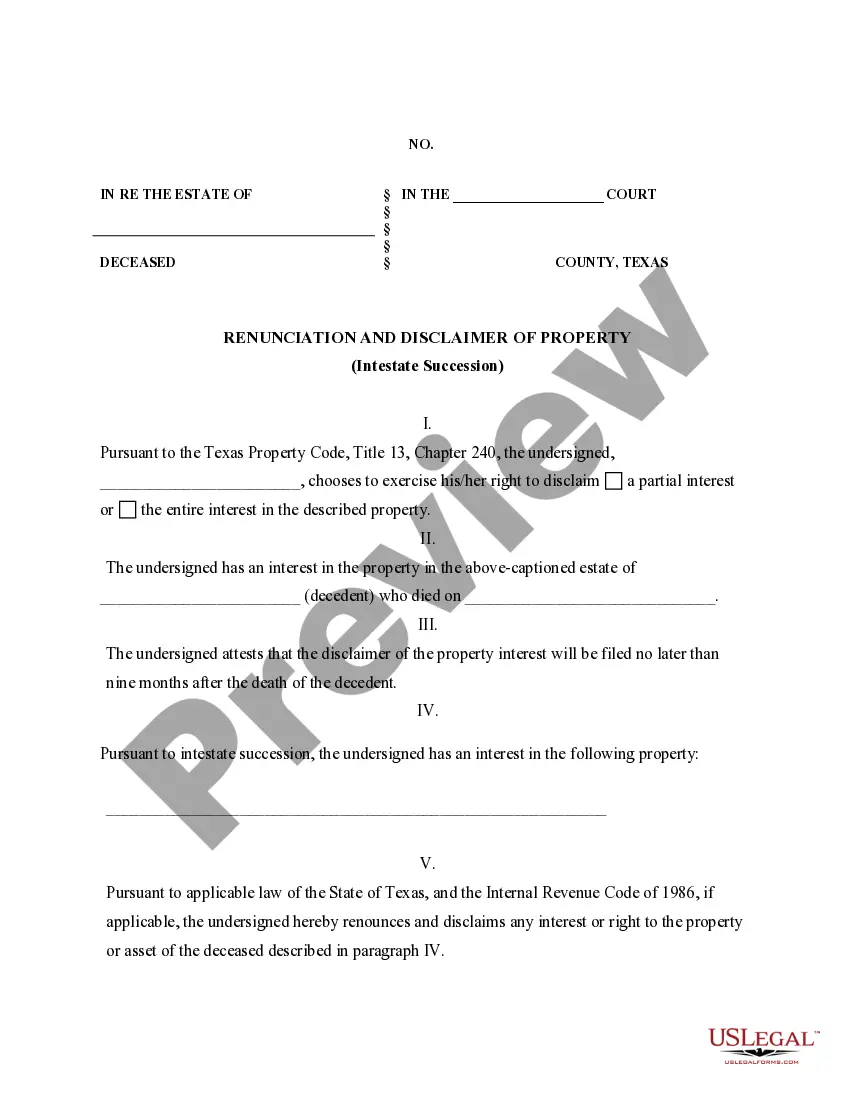

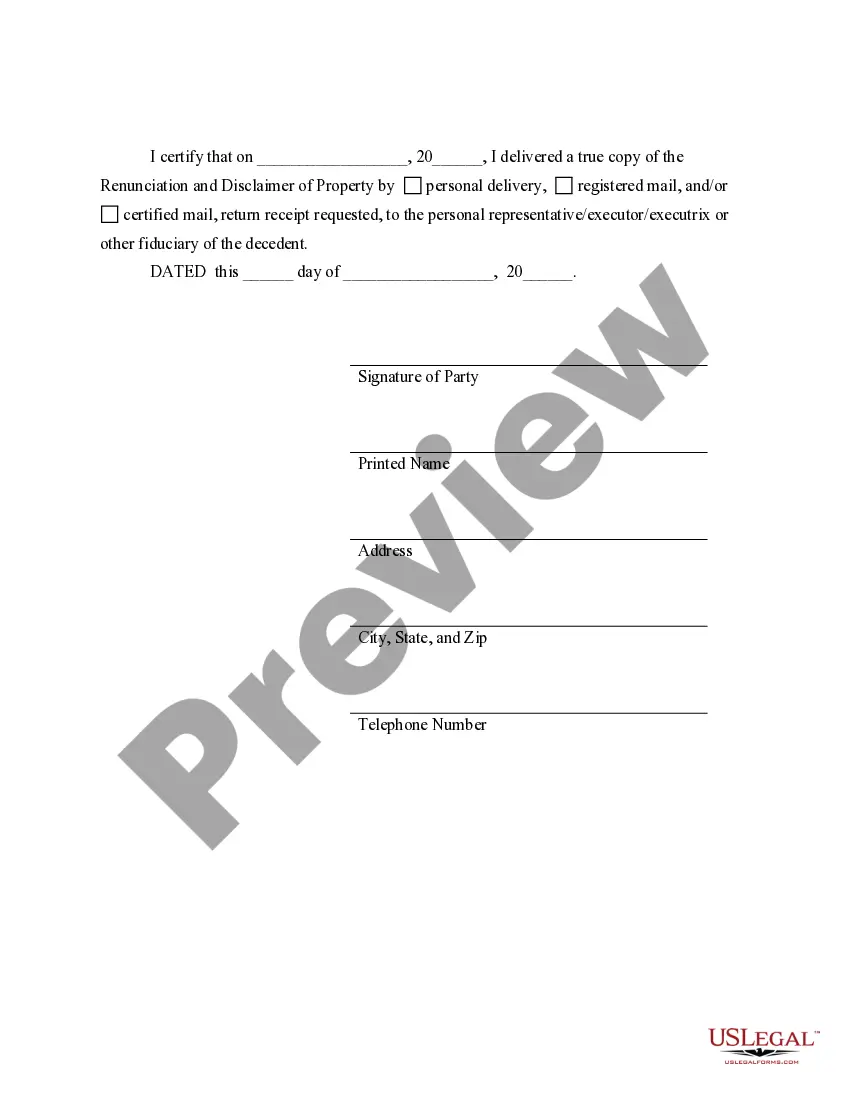

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Acquiring verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s a digital compilation of over 85,000 legal documents for both individual and business purposes and various real-life scenarios.

All the files are appropriately organized by area of application and jurisdiction regions, making the retrieval of the Sugar Land Texas Renunciation And Disclaimer of Property acquired via Intestate Succession as straightforward and simple as ABC.

Purchase the document. Click on the Buy Now button and choose the subscription plan that suits you best. You'll need to create an account to access the library’s resources. Complete your purchase. Enter your credit card information or use your PayPal account to pay for the subscription. Download the Sugar Land Texas Renunciation And Disclaimer of Property acquired via Intestate Succession. Save the template on your device to fill it out and have access in the My documents section of your profile whenever you need it. Maintaining organized documentation that meets legal standards is of utmost importance. Utilize the US Legal Forms library to have crucial document templates for any requirements readily available at your fingertips!

- Familiar users of our service will find that accessing the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession requires just a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- New users will need to follow a few additional steps to finalize the process.

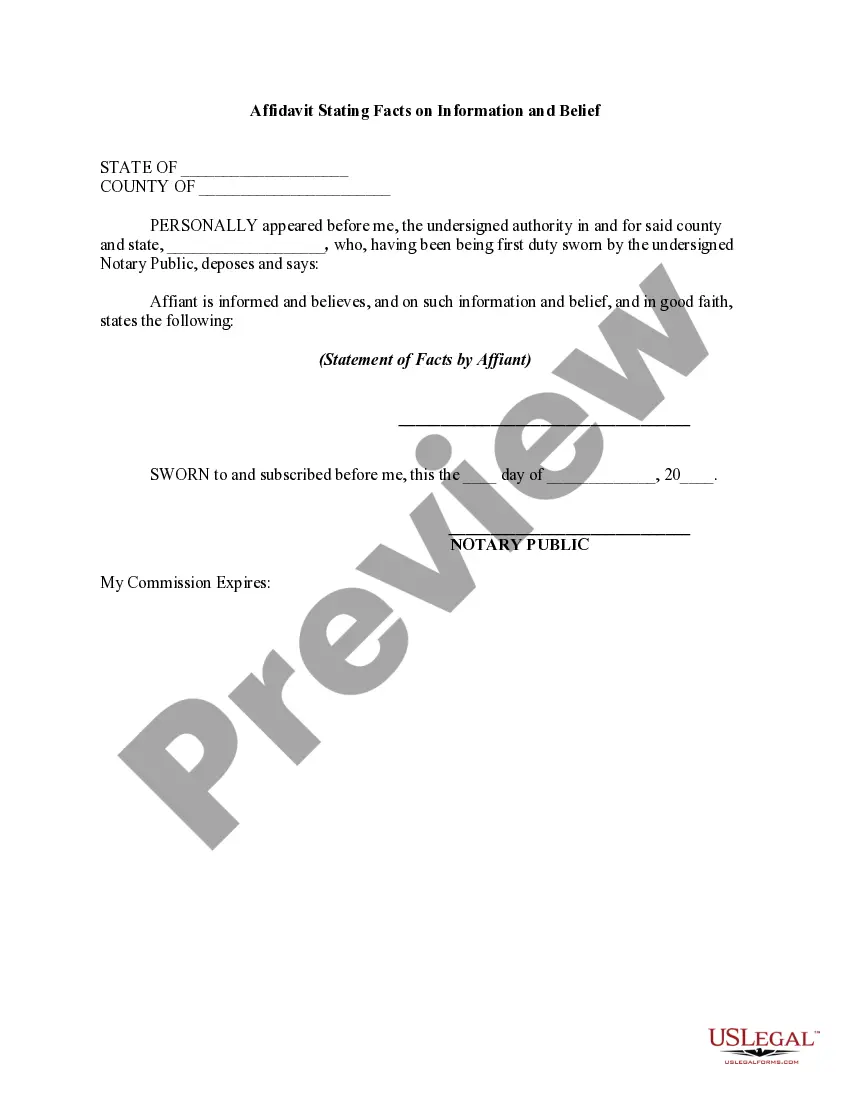

- Begin by Reviewing the Preview mode and document description. Ensure you’ve selected the correct one that fulfills your needs and aligns with your local legislative criteria.

- Search for another template, if required. If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your expectations, proceed to the next step.

Form popularity

FAQ

An inheritance letter for a beneficiary typically includes a statement of the beneficiary’s rights and entitlements. You would begin by addressing the relevant parties, and then outline the details of the estate and your acceptance or disclaimer of the inheritance. In situations invoking the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession, this letter can clarify your intentions regarding the inheritance.

An estate Disclaimer is a document in which a beneficiary formally declines any claims to an estate, detailing assets and debts. For example, it might specify your refusal to accept a share of the property left by a relative. This process is essential for beneficiaries aware of the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession, ensuring clear communication and legal standing.

To write a real estate Disclaimer, start by clearly identifying the property involved and your relationship to the decedent. In your letter, express your intention to disclaim any rights to the property, ensuring you mention the specifics of the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession. It's advisable to consult a legal professional or use uslegalforms for templates to ensure compliance with state laws.

An example of an inheritance Disclaimer can be a document where a beneficiary states their refusal to accept property or assets from an estate. This document should specify the property, the deceased's name, and your decision to reject the inheritance. This process is vital for those considering the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession.

To write a beneficiary Disclaimer letter, first clearly state your intention to renounce the property you received through intestate succession. Include your full name, address, and the specific details of the property you wish to disclaim. It’s crucial to mention that you understand the implications of the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession, and you are choosing to proceed with this decision.

To disclaim an inherited property, you should complete a written disclaimer that clearly states your refusal of the asset. This statement should comply with the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession. Ensure it is signed and dated, and submit it to the appropriate parties, such as the executor of the estate. By doing this, the property can then pass on to the next heir, avoiding any undue tax burdens for you.

Writing a disclaimer for an inheritance requires clear language and specific information about the property. The document must express your refusal of the inheritance and follow the format outlined in the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession. Include your name, the description of the property, and your signature. It’s advisable to consult a legal professional to ensure the disclaimer meets all legal criteria.

Disclaiming an inheritance in Texas involves submitting a written disclaimer within a specific time frame after you receive notice of your inheritance. The Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession must be in writing and state your intent to refuse the inheritance. Make sure to follow the guidelines set forth by Texas law, as a proper disclaimer ensures that the property passes to the next eligible heir without tax implications.

To avoid capital gains tax on inherited property in Texas, you should consider utilizing the Sugar Land Texas Renunciation And Disclaimer of Property received by Intestate Succession. By disclaiming the property, you can transfer it to another beneficiary, potentially bypassing tax implications. It is crucial to act within nine months of the inheritance and ensure that the disclaimer adheres to Texas legal requirements. Consult a legal expert to ensure you follow the proper steps.

Generally, you have nine months from the date of death in Sugar Land Texas to issue a disclaimer of your inheritance. This allows you to assess the potential tax implications or personal circumstances affecting your decision. Utilizing the USLegalForms platform can simplify this process by providing guided resources to help you submit your disclaimer with confidence.