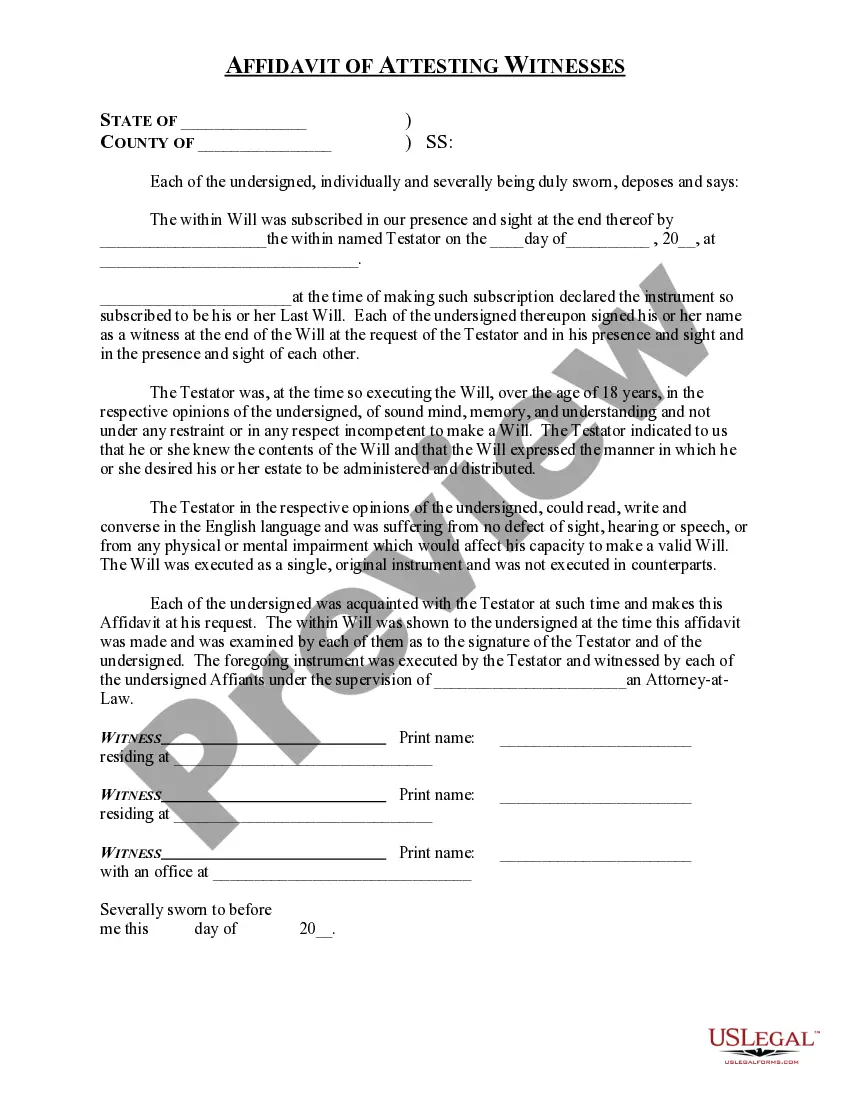

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Irving Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our helpful website with an extensive array of files streamlines the process of locating and obtaining virtually any document template you desire.

You can download, complete, and validate the Irving Texas Renunciation And Disclaimer of Property acquired through Intestate Succession in just a few minutes rather than spending hours browsing the internet for an apt template.

Utilizing our collection is an excellent method to enhance the security of your document submission.

If you haven’t set up an account yet, follow the instructions outlined below.

Locate the template you need. Confirm that it is the template you were looking for: check its title and description, and use the Preview feature if available. If not, use the Search bar to find the desired one.

- Our experienced attorneys routinely examine all the records to guarantee that the forms are applicable for a specific state and comply with current laws and regulations.

- How can you acquire the Irving Texas Renunciation And Disclaimer of Property received via Intestate Succession.

- If you already possess a subscription, simply sign in to your account.

- The Download button will be visible on all the samples you examine.

- Moreover, you can locate all the previously saved documents in the My documents section.

Form popularity

FAQ

In Texas, when someone passes away without a will, intestate succession rules determine how their property is distributed. Generally, the estate goes to the decedent's closest relatives, starting with the spouse and children. If no immediate family members exist, more distant relatives may inherit. Understanding the Irving Texas Renunciation And Disclaimer of Property received by Intestate Succession can help clarify your options and rights during this process.

Recent changes to inheritance laws in Texas focus on protecting the rights of heirs and simplifying the process of inheritance. These modifications may impact procedures around Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. Staying updated on these legal developments is crucial to fully understanding your rights as an heir. If you're unclear about how these changes affect you, explore legal resources for clarity and support.

In Texas, an executor has a reasonable amount of time to settle an estate, typically around one to two years. However, this timeframe can vary based on the complexity of the estate and may be influenced by the Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. It's essential for executors to keep beneficiaries informed throughout the process. If you are involved in an estate, consider using legal resources to guide you through the settlement.

The intestate succession process in Texas entails distributing a deceased person's assets when they have not left a will. State laws dictate how property is divided among relatives, which aligns with the principles of Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. Typically, close relatives, such as children and spouses, are first in line to inherit. You might find it beneficial to understand this process better to navigate your rights as an heir.

The statute of limitations on inheritance in Texas is four years. This means you have a limited window to assert your rights as an heir under the laws of Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. If you do not take action within this period, you risk losing your claim to the inheritance. It is wise to stay informed and proactive to protect your interests.

As an heir in Texas, you typically have four years to claim your inheritance after the decedent's death. This period is essential for protecting your interests in the context of Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. If you miss this deadline, you may forfeit your right to inherit. Seek guidance to navigate estate claims effectively and to ensure you adhere to all necessary timelines.

In Texas, you generally have four years from the date of death to claim heirship. This timeframe is crucial to ensure your rights are protected under the laws governing Irving Texas Renunciation and Disclaimer of Property received by Intestate Succession. It is advisable to act promptly, as delays can complicate the process of claiming your rightful inheritance. If you have questions about your specific situation, consider consulting with a legal expert.

Transferring property after a parent's death without a will in Texas involves following intestacy laws, which dictate the distribution of the estate. You may need to file for a small estate affidavit or go through formal probate proceedings, depending on the value of the estate. Engaging in Irving Texas Renunciation And Disclaimer of Property received by Intestate Succession can clarify your rights and streamline the process, ensuring the property transitions smoothly.

To disclaim an inheritance in Texas, you must provide a written disclaimer that meets state requirements. This should be submitted to the executor of the estate or the appropriate probate court. It is important to act within the allotted time frame to ensure your refusal of the inheritance is honored. Utilizing resources from uslegalforms can simplify this process for understanding Irving Texas Renunciation And Disclaimer of Property received by Intestate Succession.

To disclaim part of an inheritance, you must file a formal disclaimer with the probate court in Texas. This document should clearly state your intention to renounce the specific asset you want to refuse. By doing so, you ensure that the asset transfers to the next in line designated by the laws of intestate succession, making the Irving Texas Renunciation And Disclaimer of Property received by Intestate Succession an effective method for asset management.