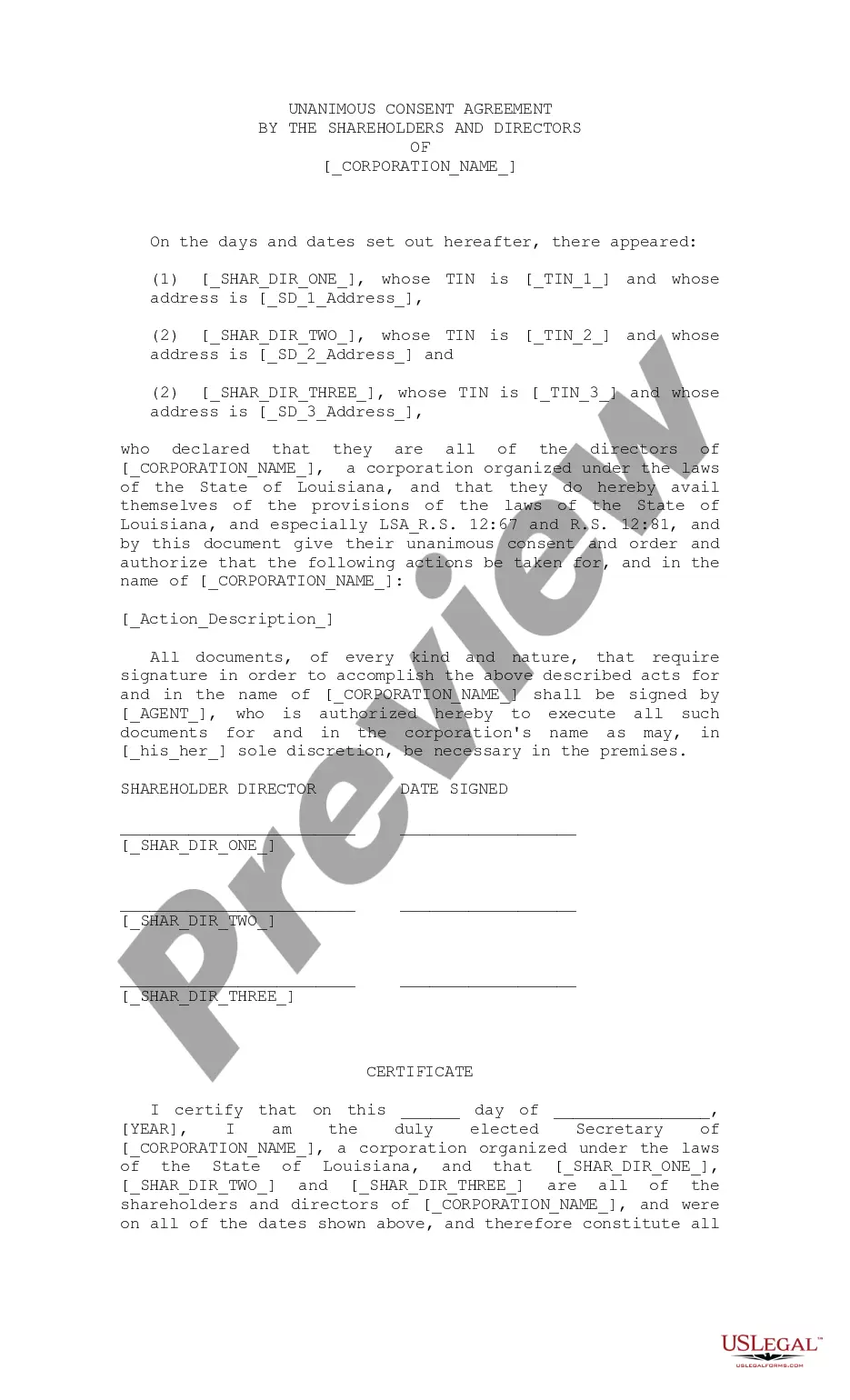

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

We consistently aim to minimize or avert legal complications when handling intricate legal or financial matters.

To achieve this, we seek attorney services that, in general, are quite expensive.

However, not all legal issues are equally complicated. Many can be addressed independently.

US Legal Forms is a digital repository of current do-it-yourself legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you've lost the form, you can always retrieve it from the My documents tab. The procedure remains effortlessly simple for those unfamiliar with the website! You can create your account in just a few minutes. Ensure the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession complies with your local laws and regulations. Moreover, it is essential to review the form's details (if available), and if you find any inconsistencies with your needs, look for an alternative form. Once you confirm that the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession is suitable for you, you can select the subscription plan and complete your payment. You can then download the form in any format you prefer. For over 24 years, we have assisted millions by providing customizable and current legal documents. Make full use of US Legal Forms today to conserve time and resources!

- Our platform empowers you to manage your affairs independently without seeking a lawyer's assistance.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

- Benefit from US Legal Forms whenever you need to obtain and download the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession or similar documents easily and securely.

Form popularity

FAQ

When formatting a disclaimer for College Station, Texas, clarity is key. Start with your full name, relation to the decedent, a clear statement of the property you are disclaiming, and your intent to renounce the property. Following a structured format ensures that your disclaimer meets legal standards and conveys your intentions properly.

In College Station, Texas, a disclaimer does not need to be notarized to be valid, but having it notarized can add an additional layer of credibility. Notarization can help prove the authenticity of your signature and the date of the disclaimer. While it is not required, it is advisable to consult legal resources as you proceed.

To file a qualified disclaimer in College Station, Texas, you must provide a written declaration that meets state laws. This declaration should clearly state your intention to refuse the inheritance and must be submitted within a specific time frame. Utilizing platforms like US Legal Forms can simplify this process, ensuring that you have the correct documentation ready.

If a disclaimer does not meet the qualifications in College Station, Texas, it may not achieve the intended legal effects. A non-qualified disclaimer could lead to the property being treated as part of your estate, subject to potential taxation or claims by creditors. It is crucial to ensure that your disclaimer adheres to the specific legal requirements.

When you make a disclaimer in College Station, Texas, regarding the renunciation and disclaimer of property received by intestate succession, it is not considered a taxable gift. This is because a disclaimer allows you to refuse an inheritance rather than give it away. Therefore, any property you disclaim is not included in your taxable income.

A beneficiary has nine months from the date of the decedent's death to formally disclaim an inheritance in Texas. This deadline is critical for maintaining the legal standing of the disclaimer. Failure to act within this period may result in automatic acceptance of the inheritance, which can lead to tax obligations or other issues. To better understand the implications of the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession, consider seeking legal advice.

While there’s a time limit for disclaiming inheritance, claiming your inheritance typically does not have a strict deadline in Texas. However, it's essential to act promptly to avoid complications such as tax implications or disputes among heirs. Engaging with the process early can significantly benefit you. Learning about the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession is a good starting point.

When a beneficiary disclaims inheritance, that person forfeits their right to receive the property or asset. This renunciation can affect the distribution of the estate, as the assets may pass to other beneficiaries according to Texas law. In many cases, disclaimed property goes to the next eligible heir, ensuring that the estate is distributed fairly. For a complete understanding of the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession, legal resources are available to assist.

Yes, in Texas, there is a specific time limit for disclaiming an inheritance. A beneficiary must submit a disclaimer within nine months of the decedent's death to have it legally recognized. This timeframe is crucial, as it ensures clarity in estate distribution. If you're considering disclaiming property, understanding the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession can help navigate these complexities.

The intestate succession process in Texas occurs when someone passes away without a will. In such cases, Texas law determines how the deceased person's property will be distributed among their heirs. Typically, the surviving spouse and children receive the majority of the estate, while other relatives may be included if no immediate family exists. For specific guidance on the College Station Texas Renunciation And Disclaimer of Property received by Intestate Succession, legal assistance can be invaluable.