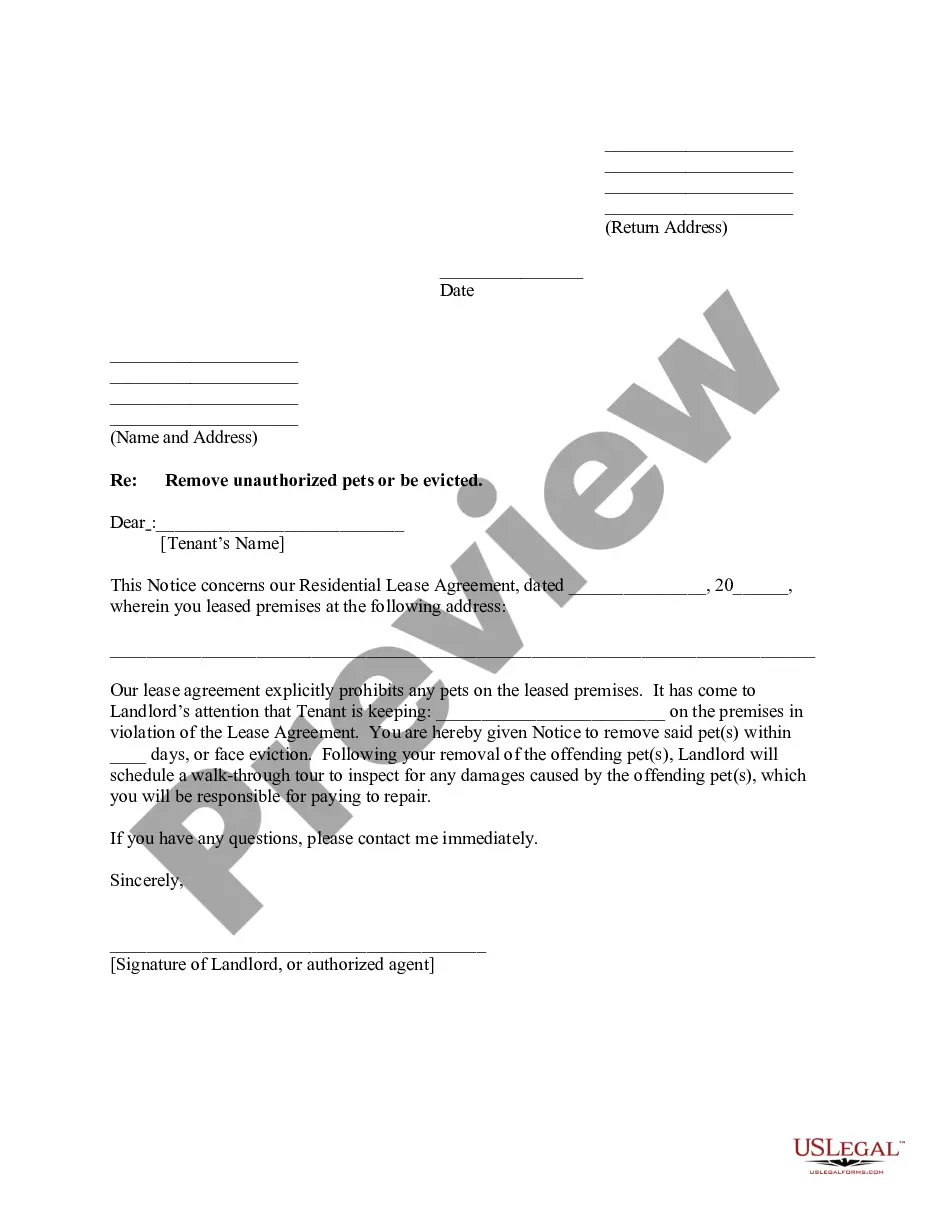

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you have previously used our service, Log In to your account and acquire the Abilene Texas Renunciation And Disclaimer of Property derived from Intestate Succession on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your payment plan.

If this is your first time using our service, follow these straightforward steps to access your document.

You have unlimited access to all documents you have purchased: you can find them in your profile under the My documents section anytime you wish to use them again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional needs!

- Confirm you’ve found an appropriate document. Browse through the description and utilize the Preview feature, if available, to verify if it aligns with your requirements. If it’s not a match, use the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Establish an account and process your payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Abilene Texas Renunciation And Disclaimer of Property derived from Intestate Succession. Choose the file format for your document and store it on your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In Abilene, Texas, you generally have nine months to file a renunciation and disclaimer of property received through intestate succession. This timeframe begins at the time you become aware of your inheritance. It is crucial to act promptly to ensure your interests are protected and to avoid any conflicts. For assistance, consider using the US Legal Forms platform, which provides the necessary resources and guidance for Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession.

An inheritance disclaimer example would state your full name, address, and your formal intention to renounce the property set to you by intestate succession. It should clarify the specific property you are disclaiming and include a statement of understanding about the implications of this decision. You may refer to US Legal Forms for templates that can guide you through this process in compliance with Texas law.

In Abilene, Texas, while a disclaimer of inheritance does not always require notarization, it is strongly recommended. Notarizing your document adds a layer of authenticity that can prevent disputes later. It's best to consult with a legal professional to confirm whether notarization is necessary for your specific situation.

An example of an inheritance letter for a beneficiary would include your full name and address, the name of the deceased, and a clear statement of your acceptance or disclaimer of the property. You can use templates from US Legal Forms to ensure the letter meets all legal requirements in Abilene, Texas.

Writing a beneficiary disclaimer letter is a straightforward process. Start by addressing the letter to the executor or trustee of the estate. Clearly express your decision to disclaim your benefits and provide relevant details, including your relationship to the deceased and your contact information for any follow-up.

An example of an estate Disclaimer is a formal letter where a beneficiary renounces their right to receive a portion of the decedent's estate. This letter typically states the beneficiary's name, the specific property they are disclaiming, and the intent to reject the inheritance, adhering to Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession standards. Such disclaimers are crucial for ensuring a smooth transfer of property to next beneficiaries in line.

To disclaim an inherited property, you must provide a written disclaimer that meets Texas legal requirements. This document should express your intention to refuse the property and must be filed with the court handling the estate. You must take action within nine months of the decedent's death, as pointed out in the guidelines for Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession. Seeking assistance from platforms like uslegalforms can simplify this process.

To write an inheritance Disclaimer letter in relation to Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession, start by addressing the letter to the appropriate estate administrator. Clearly state that you are formally renouncing your inheritance and provide your reasons if necessary. Include your full name, the description of the property, and your relationship to the decedent. It is essential to sign the document and date it to ensure legal clarity.

To disclaim inherited property in Texas, begin by drafting a written disclaimer and submitting it to the relevant court. Ensure your document states your intention clearly and meets the required legal format. For specific guidance on Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession, consider utilizing US Legal Forms to assist in this process.

A disclaimer works by allowing a beneficiary to refuse property before it legally passes to them. This refusal must be formalized to ensure the property goes to other heirs as dictated by intestate laws. When navigating Abilene Texas Renunciation And Disclaimer of Property received by Intestate Succession, understanding these dynamics is vital for managing estate processes smoothly.