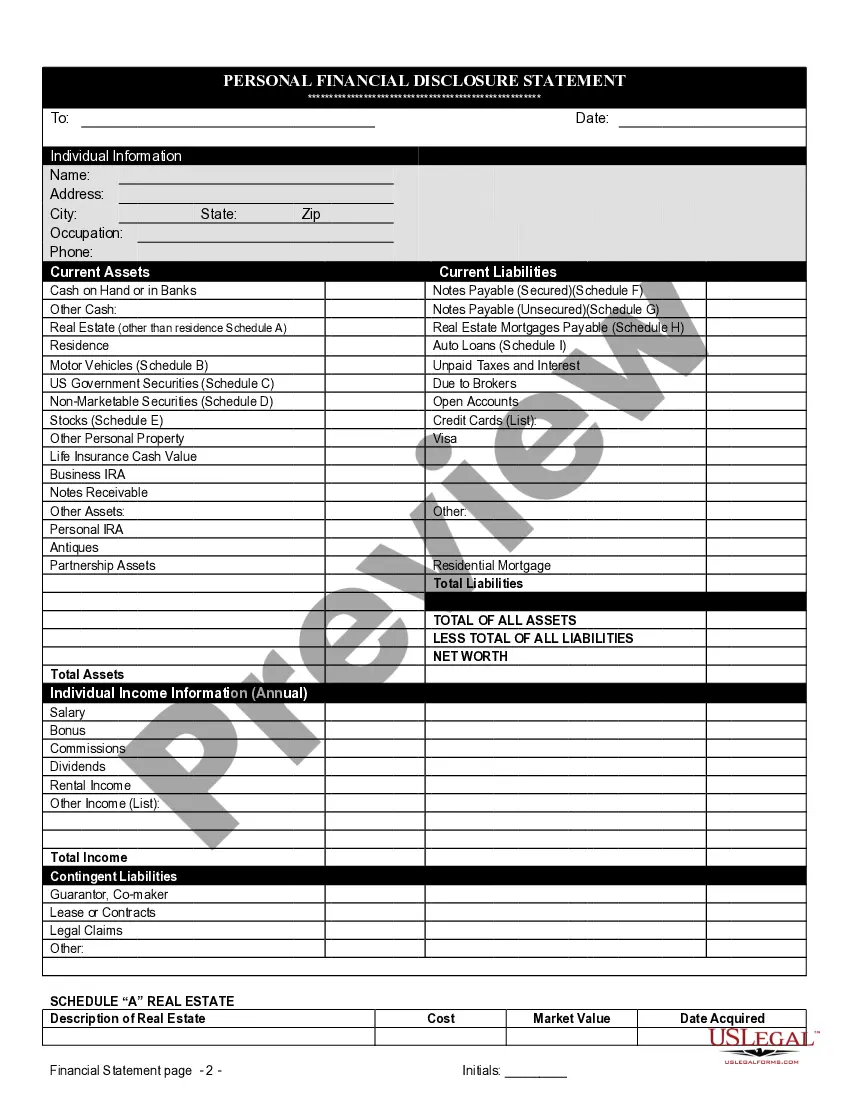

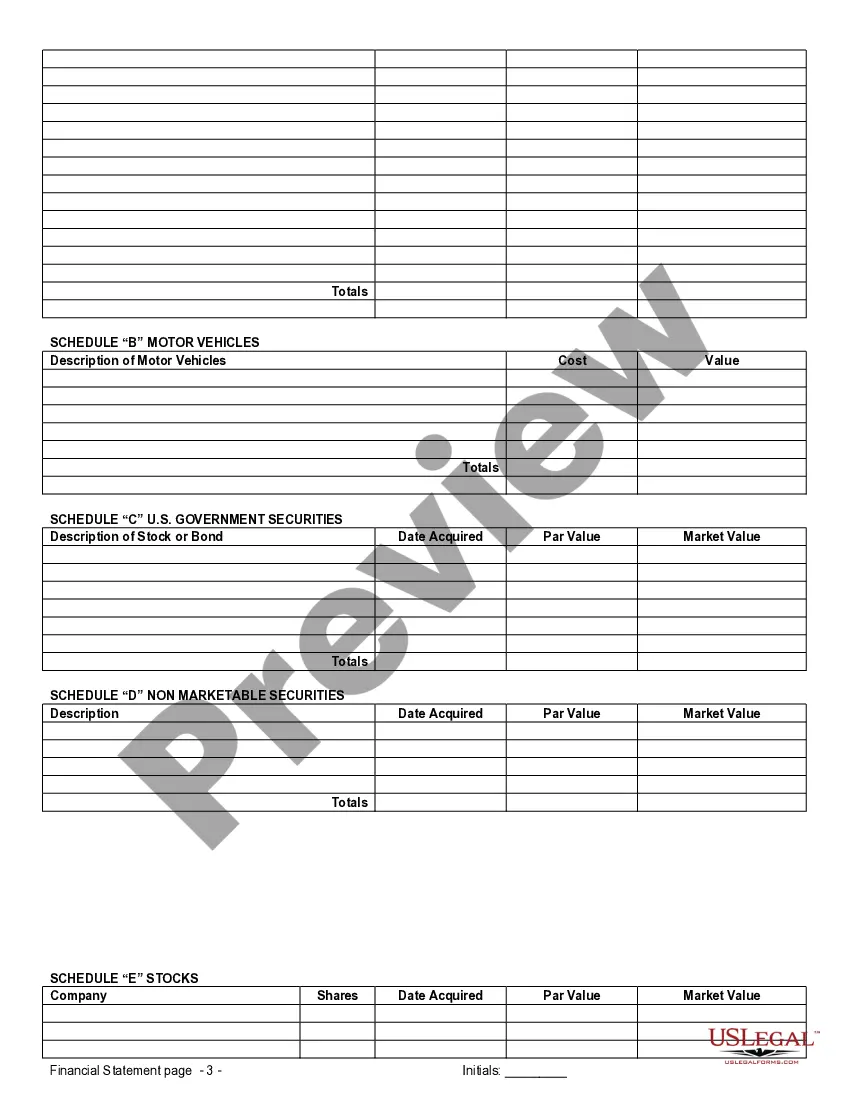

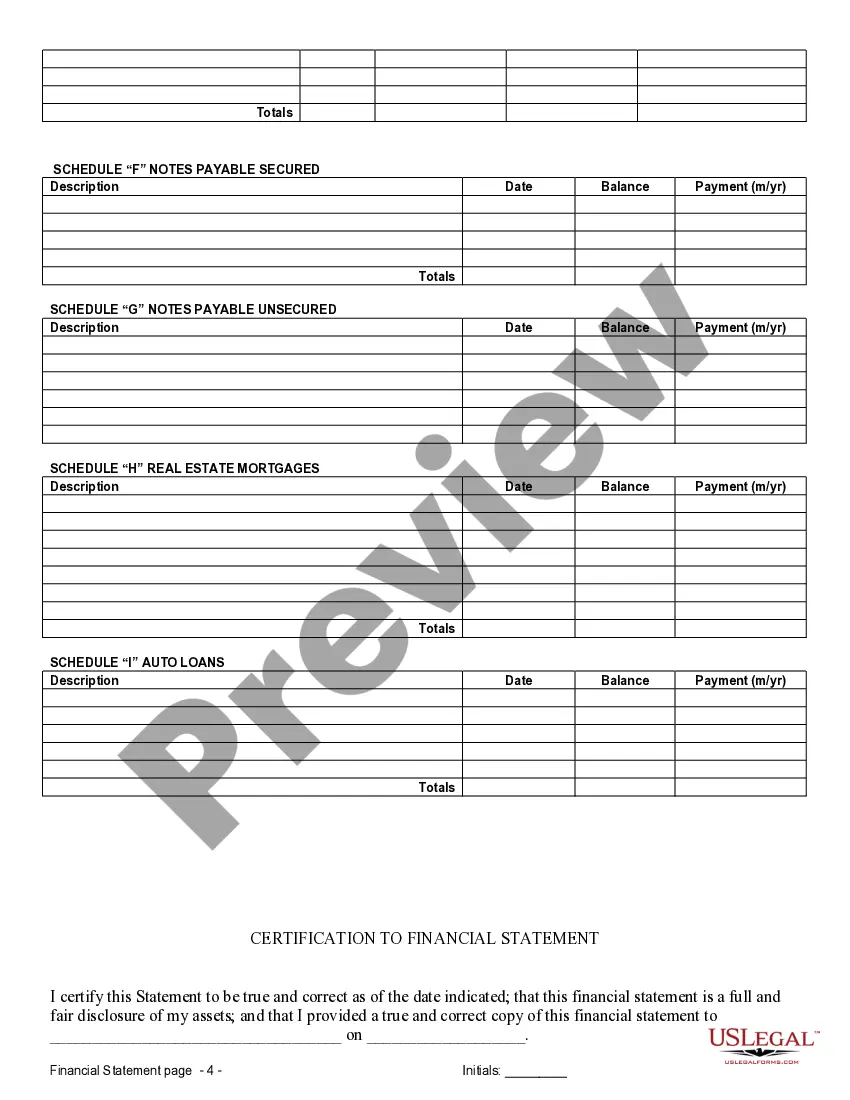

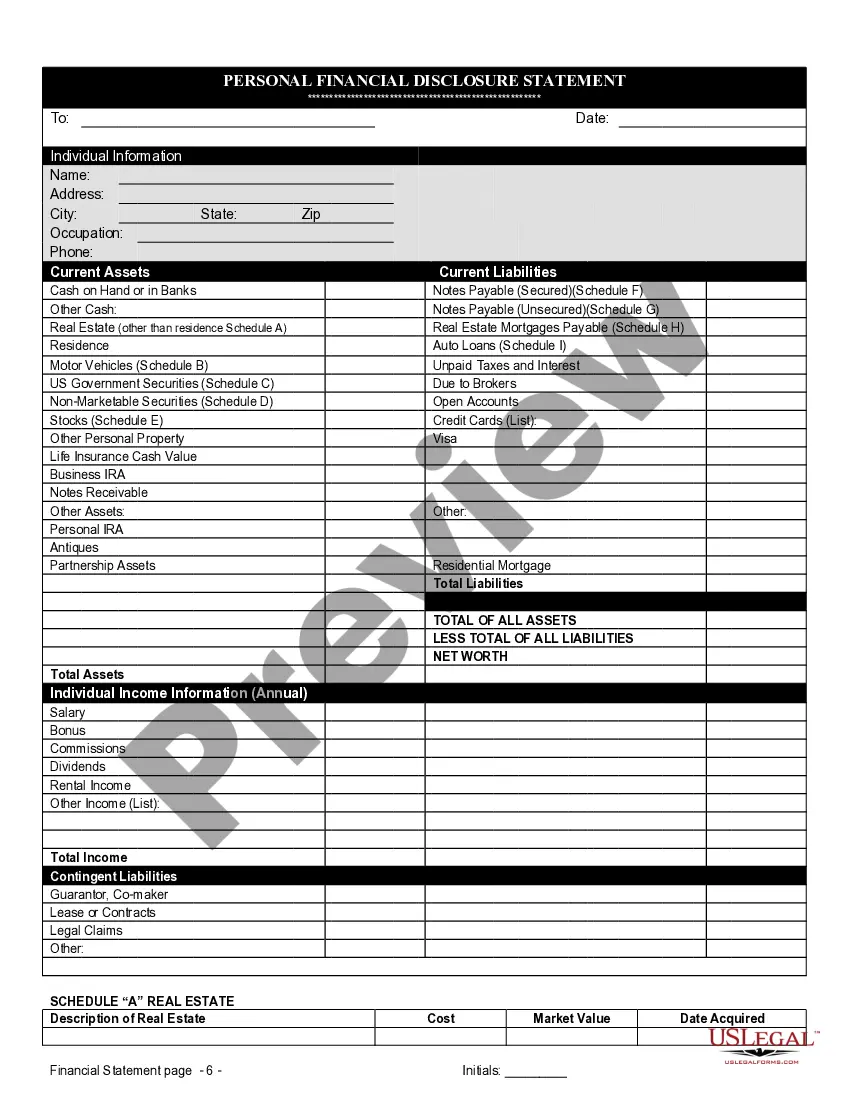

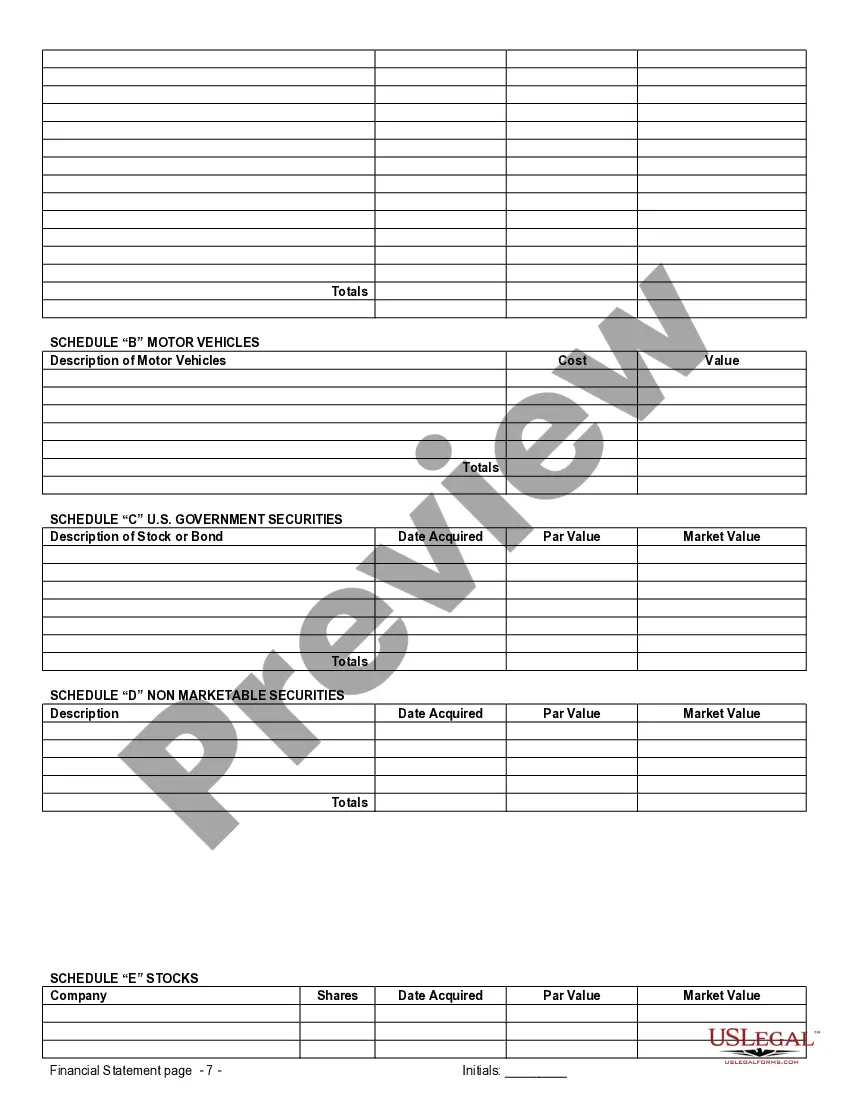

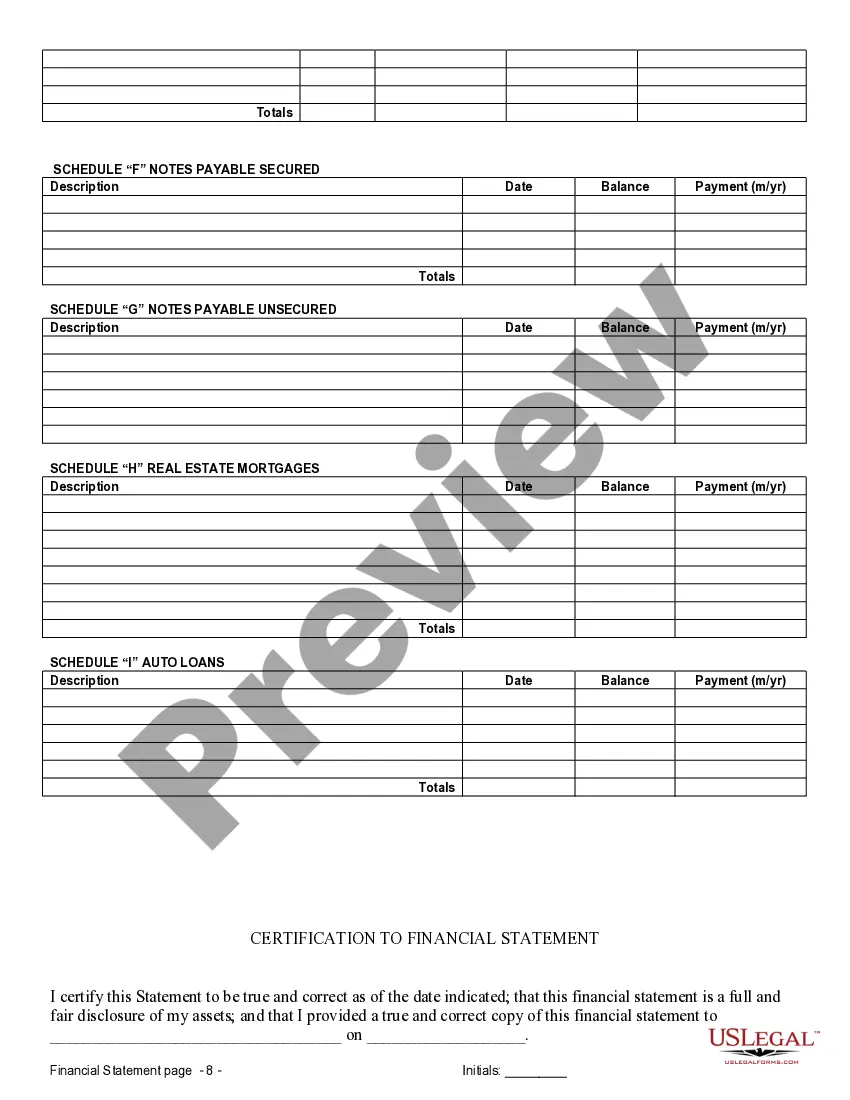

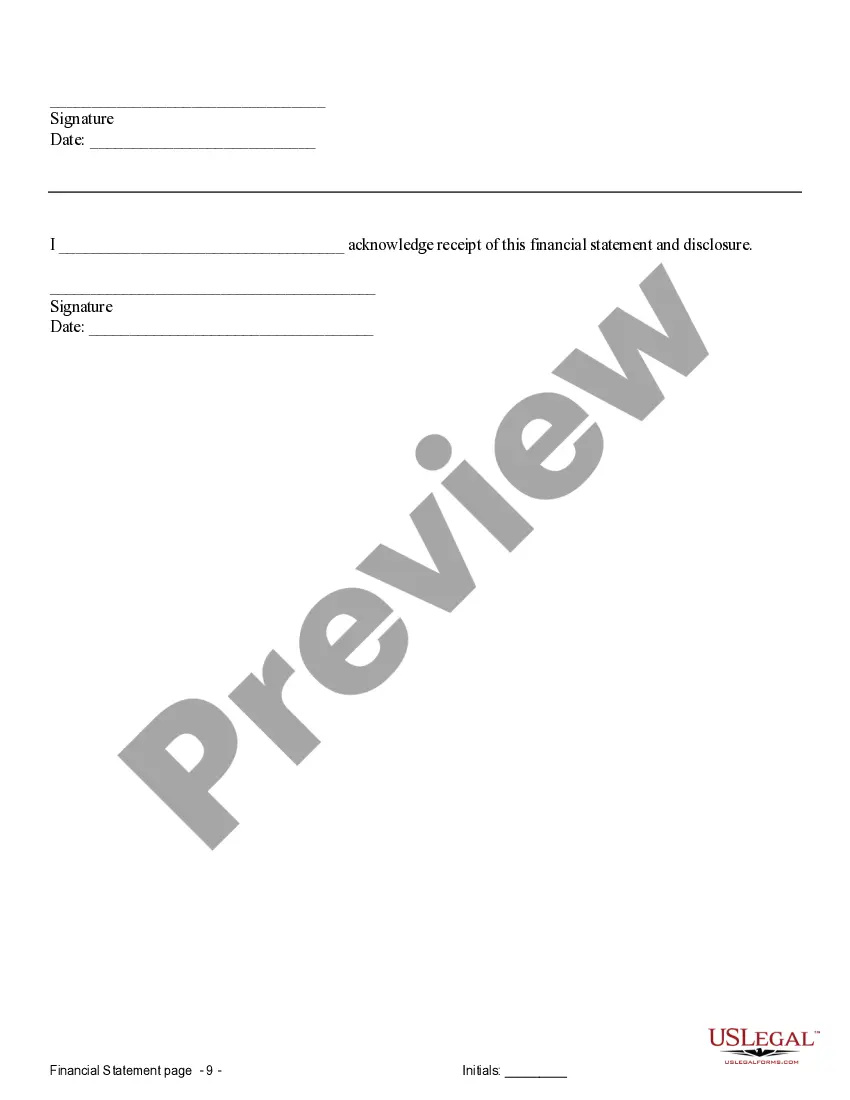

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

San Antonio Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Texas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Acquiring verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal documents for both personal and professional requirements as well as various real-life scenarios.

All the paperwork is accurately categorized by usage area and jurisdiction, making the search for the San Antonio Texas Financial Statements linked to the Prenuptial Premarital Agreement as simple as pie.

Maintaining organized paperwork that adheres to legal standards is crucial. Utilize the US Legal Forms library to always have necessary document templates readily available!

- Examine the Preview mode and form description.

- Ensure you’ve picked the correct one that satisfies your needs and aligns completely with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If any discrepancies arise, use the Search tab above to locate the accurate one.

- If it fits your needs, proceed to the next phase.

Form popularity

FAQ

A married couple can modify or invalidate the initial agreement by entering into a subsequent agreement, in writing, that disavows or alters the prenup. Both parties have to agree, and the new agreement must be in writing.

Your husband has agreed to pay back the creditor on any debt he's incurred. However, any debt he incurs belongs to you and your husband even if you have a prenup. This is because the prenup is an agreement between you and your husband ? it's not one that waives liability from the creditor.

You can keep your finances separate: Without a prenuptial agreement, even a separate bank account will be considered marital property in a divorce. You can keep your finances truly separate with a prenuptial agreement.

Under Texas' Uniform Premarital Agreement Act, a valid prenuptial contract can cover: The spouses' rights and obligations regarding any property they acquire. The spouses' rights to use and transfer property. The disposition of property in the event the spouses' marriage terminates due to divorce or death.

If either party is bringing property into the marriage or is wealthier than the other, a prenuptial agreement should be drafted. If an issue does occur, this protects the assets that each party brought into the union. In Texas, prenuptial agreements can include the rights to certain properties.

A court will invalidate your prenuptial agreement if it is not in writing. Texas law requires prenups to be in writing to be considered valid and legally binding.

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

California's Prenup Laws Prenuptial agreements can include income, real estate, earnings, financial interests, debts, and other present or future assets.

Texas courts do not want to enforce a prenuptial agreement?or any contract, really?that is unconscionable or that was entered into under duress. The court might void a prenuptial agreement if it sees proof of: Duress or coercion - Prenuptial agreements are only valid if they were entered into voluntarily.