Texas Contract for Deed related form. This form explains the Buyer's Right to Cancel. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

Harris Texas Notice of Cancellation

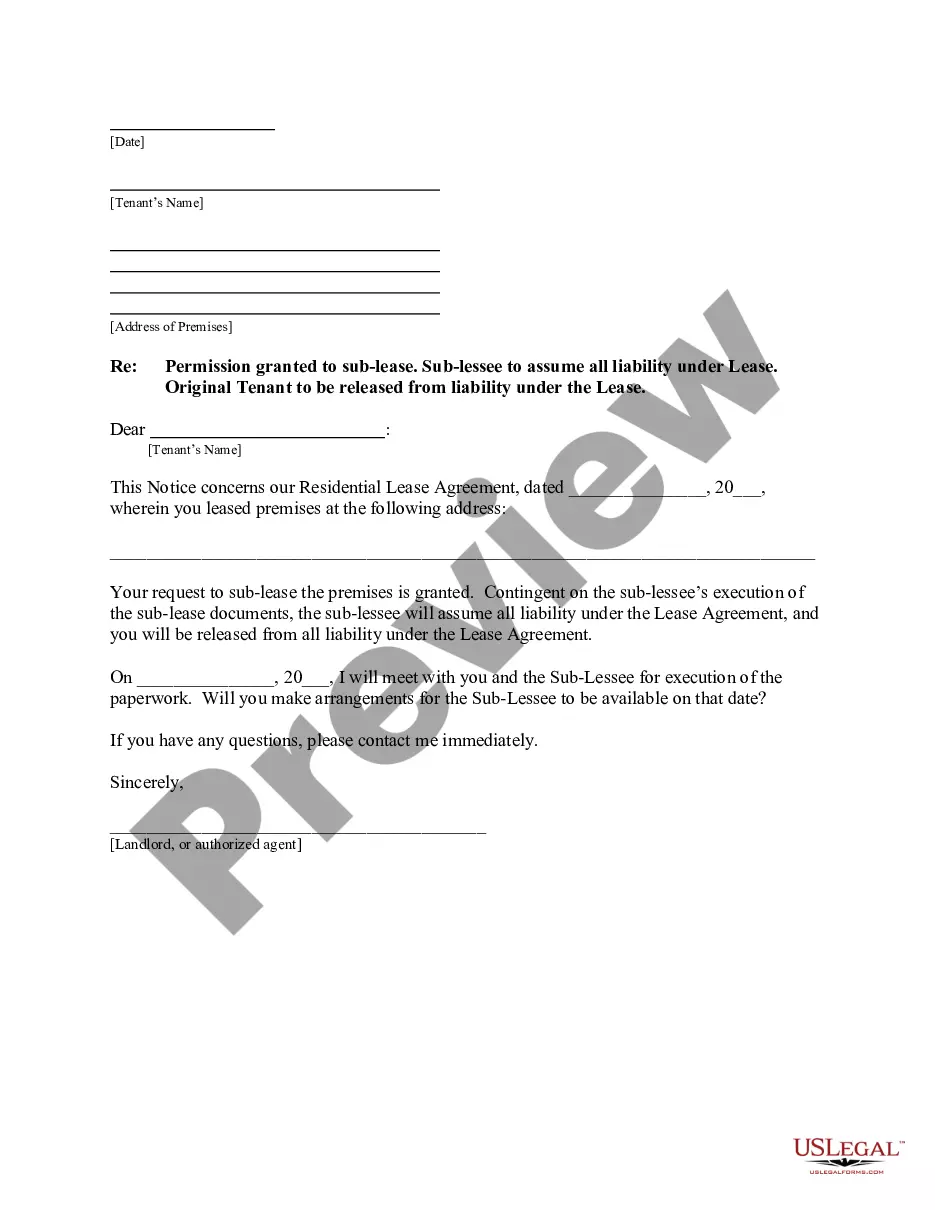

Description

How to fill out Texas Notice Of Cancellation?

Regardless of social or professional standing, filling out law-related documents is a regrettable requirement in the current professional landscape.

Often, it’s nearly impossible for someone without legal education to draft such documents independently, primarily because of the intricate terminology and legal subtleties they involve.

This is where US Legal Forms steps in to assist.

Review the document and examine a brief summary (if available) of scenarios for which the document can be utilized.

If the selected form does not fulfill your requirements, you can start anew and search for the necessary document.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific templates applicable to virtually any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisers who wish to enhance their efficiency by utilizing our DIY forms.

- Whether you need the Harris Texas Notice of Cancellation or any other form suited to your state or region, with US Legal Forms, everything is readily available.

- To obtain the Harris Texas Notice of Cancellation promptly using our reliable platform, existing customers can simply Log In to their accounts to access the required template.

- If you are new to our library, make sure you follow these instructions before acquiring the Harris Texas Notice of Cancellation.

- Ensure the template you’ve discovered is appropriate for your region, as the regulations of one state or locality may not apply to another state or locality.

Form popularity

FAQ

Seniors in Houston, TX, do not necessarily stop paying property taxes altogether, but they can benefit from exemptions that lower their financial burden. Generally, homeowners aged 65 and older can receive exemptions that significantly decrease the amount owed. It is vital to apply for these tax benefits as soon as eligibility is reached, as clarified by the Harris Texas Notice of Cancellation. Staying proactive ensures you maximize your savings.

In Harris County, seniors aged 65 and older may qualify for property tax exemptions that significantly reduce their tax liabilities. While they might not completely stop paying property taxes, these exemptions can alleviate the financial pressure. Homeowners should apply promptly to ensure they receive the benefits available under the Harris Texas Notice of Cancellation. Understanding the local regulations will help seniors plan accordingly.

To achieve an exemption from property taxes in Texas, you must meet specific criteria set by the state and your local jurisdiction. Common exemptions include those for disabled individuals and seniors over 65, which help ease financial burdens. It’s essential to complete the necessary applications and provide evidence of eligibility, often guided by resources like the Harris Texas Notice of Cancellation. Consulting with a knowledgeable professional can also help clarify your options.

Houston Independent School District offers a property tax exemption for homeowners over the age of 65. This exemption reduces the amount of school taxes owed, making it easier for seniors to manage their finances. To receive this benefit, eligible homeowners need to file for the exemption with the Harris County Appraisal District. Always stay informed and check for any updates that may affect your eligibility.

In Harris County, seniors aged 65 and older can benefit from a significant property tax exemption. This exemption reduces the taxable value of the home, ultimately lowering the property tax bill. Specifically, the Harris Texas Notice of Cancellation can also be associated with appealing any unexpected tax increases. Make sure to apply for the exemption through your local tax office to take advantage of these savings.

To cancel a contract in Texas, you must follow the requirements outlined in the agreement. Typically, this involves providing a clear written notice of cancellation, often referred to as a Harris Texas Notice of Cancellation. It is important to send this notice to the other party, ensuring you keep a record of the communication. Utilizing platforms like uslegalforms can simplify this process by providing you with templates tailored to Texas laws.

Texas does not have a general three-day buyer's remorse law applicable to all purchases. However, there are specific laws concerning certain transactions, such as home solicitations. To understand how this may relate to your situation, consider referencing your Harris Texas Notice of Cancellation along with the related provisions on US Legal Forms.

In Texas, once you sign a contract, you can only cancel it under specific conditions. If the contract allows for a cancellation clause, you must follow those guidelines. For detailed assistance, you can use your Harris Texas Notice of Cancellation to structure your request and gain clarity on your options through resources like US Legal Forms.

Canceling a contract for deed in Texas involves several steps, including sending a formal notice to the seller. It's crucial to detail your reasons and use a certified method for sending your Harris Texas Notice of Cancellation. Remember, consulting with US Legal Forms can provide you with the necessary templates and guidance tailored to your situation.

To cancel your Texas Legal service, start by reviewing the terms outlined in your agreement. Typically, you should notify them in writing, specifying your intent to cancel. Take note of any deadlines to ensure your Harris Texas Notice of Cancellation is timely. Additionally, consider using US Legal Forms for guidance on cancellation processes.