Texas Contract for Deed related forms. This is the Notice of Default form used when the Buyer has paid 40% of the principal of the contract or made a total of 48 or more payments. This form complies with the Texas law, and deal with matters related to Contract for Deed.

College Station Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

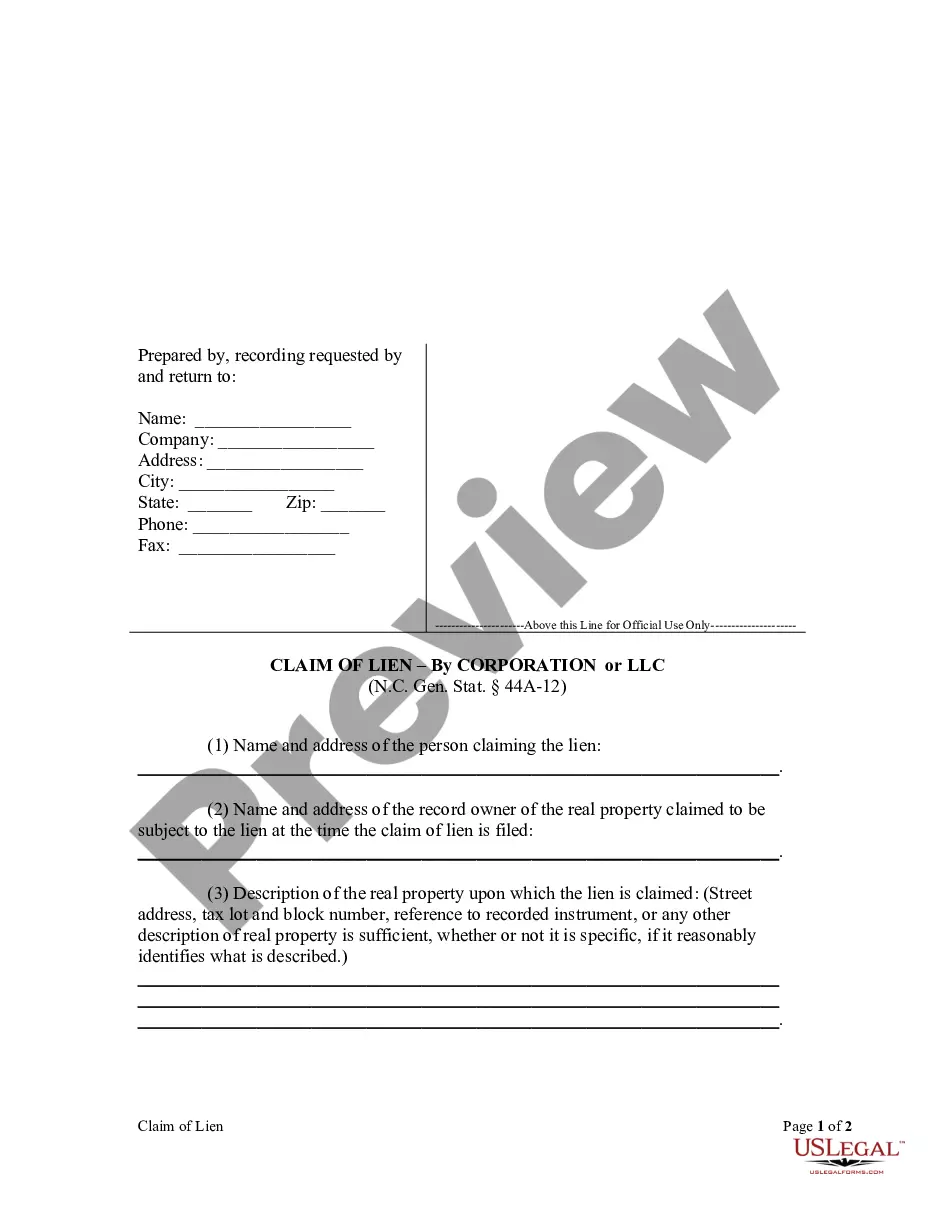

How to fill out Texas Contract For Deed Notice Of Default When 40% Of Loan Paid Or 48 Payments Made?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our helpful website with thousands of samples makes it easy to locate and acquire nearly any document template you may need.

You can download, complete, and sign the College Station Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made in just minutes instead of browsing the Internet for hours in search of a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions.

Locate the form you need. Make sure it is the form you are seeking: verify its title and description, and utilize the Preview option if available. Otherwise, use the Search field to find the correct one.

Commence the download procedure. Click Buy Now and select the pricing option you prefer. Then, create an account and finalize your order using a credit card or PayPal.

- Our experienced attorneys routinely review all the documents to ensure that the templates are current for a specific state and adhere to the latest statutes and regulations.

- How can you obtain the College Station Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made.

- If you possess an account, simply Log In to your profile. The Download button will be activated on all the documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you are not yet registered, follow the instructions below.

Form popularity

FAQ

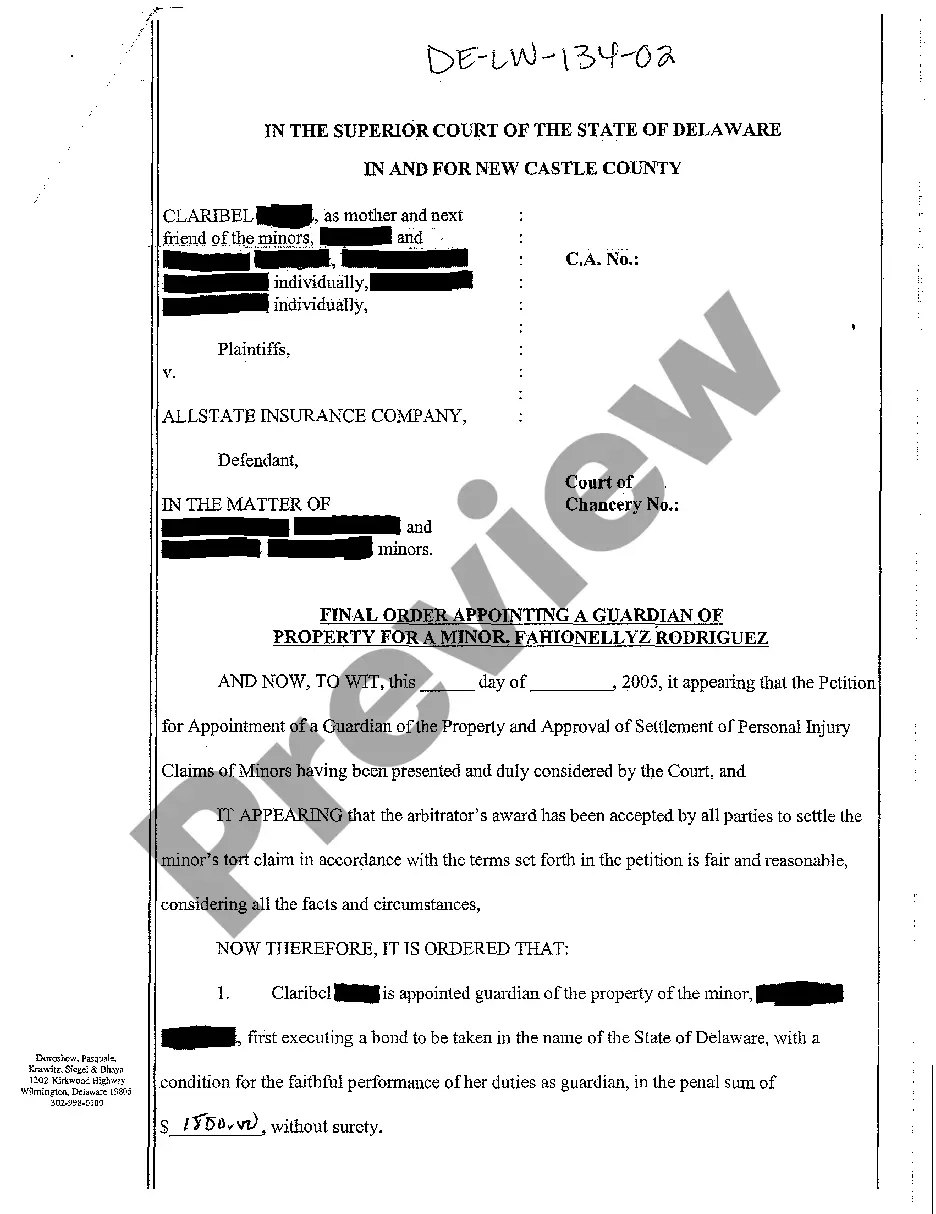

The deed was forged; The deed was induced by fraud, misrepresentation, coercion, duress, or undue influence; The deed was not delivered, or not delivered properly, and there was no acceptance by the grantee.

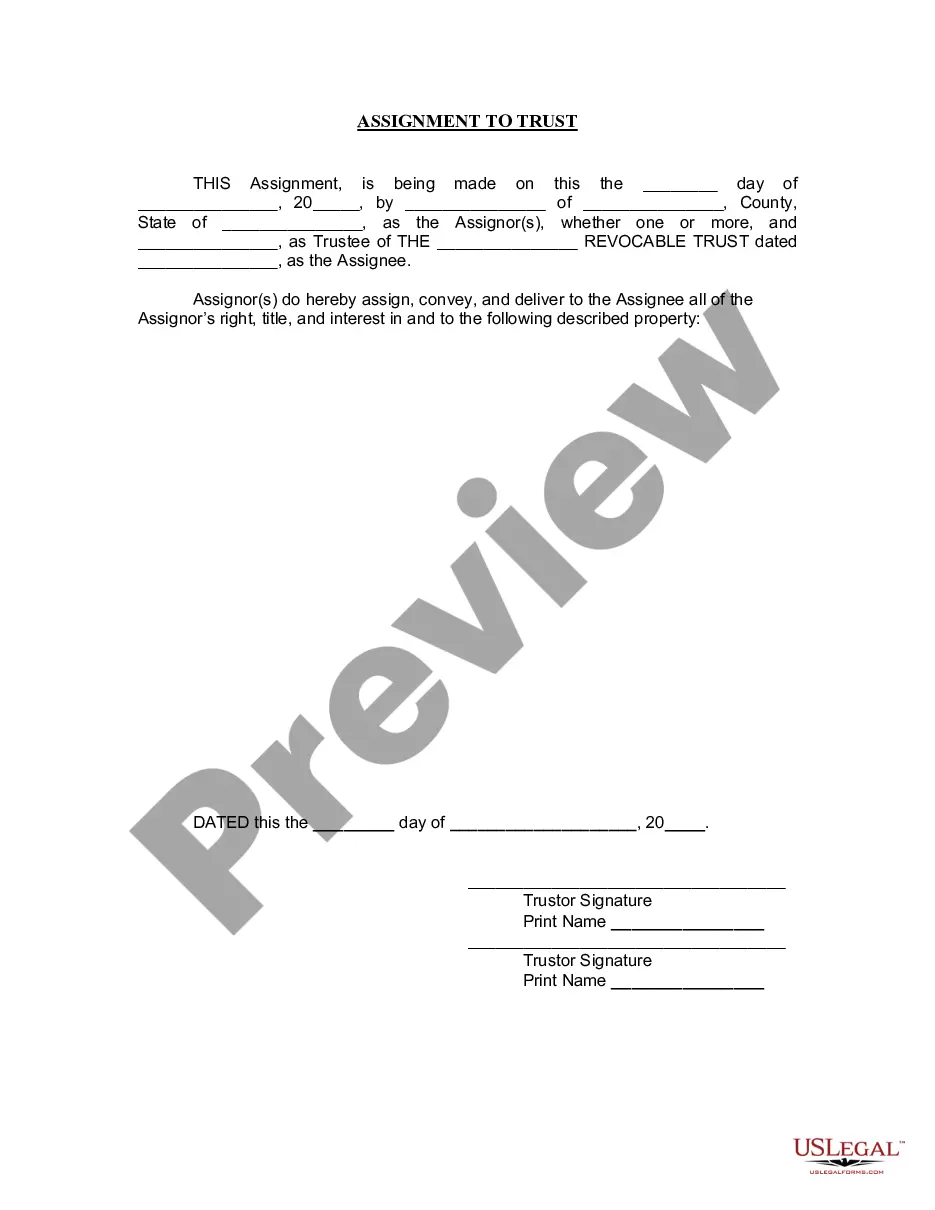

?Delivery? of a deed only requires that a grantor release its control over the deed to the grantee while simultaneously intending that the grantee receive the deed. This does not require that the grantor actually physically hand the deed over to the grantee.

A deed is typically considered a non-testamentary disposition. Property that has been deeded away, either directly or through a retained life estate, is not included in a grantor's estate at death.

When Can You Expect the Deed of Absolute Sale? The deed of absolute sale should be prepared as soon as the payment is made. The seller must first settle taxes due, such as the capital gains tax (if applicable), before executing the legal document.

The long-term purchase contract requires the buyer to make monthly or other periodic payments over a long period of time. The contract provides that the seller will deed the property to the buyer after the buyer completes all payments. History of Contract-for-Deed Law in Texas.

Under Texas law, a forged deed is void. However, a deed procured by fraud is voidable rather than void. The legal terms ?Void? and ?Voidable? sound alike, but they are vastly different. A void instrument passes no title, and is treated as a nullity.

A contract for deed is a contract in which the buyer pays for land by making monthly payments for a certain period of years. The buyer does not own or have title to the land until all the payments have been made under the contract.

Who prepares the Deed of Sale? The deed of sale is drafted by the seller and it includes the details of the transaction. The document should then be notarized by a lawyer, otherwise, it will have no power when presented to authorities or court.

Any time a deed is forged, that deed becomes void, considered null ab initio, from the beginning. It cannot be registered, and its intended function as a conveyance of property is completely inoperable and unenforceable.