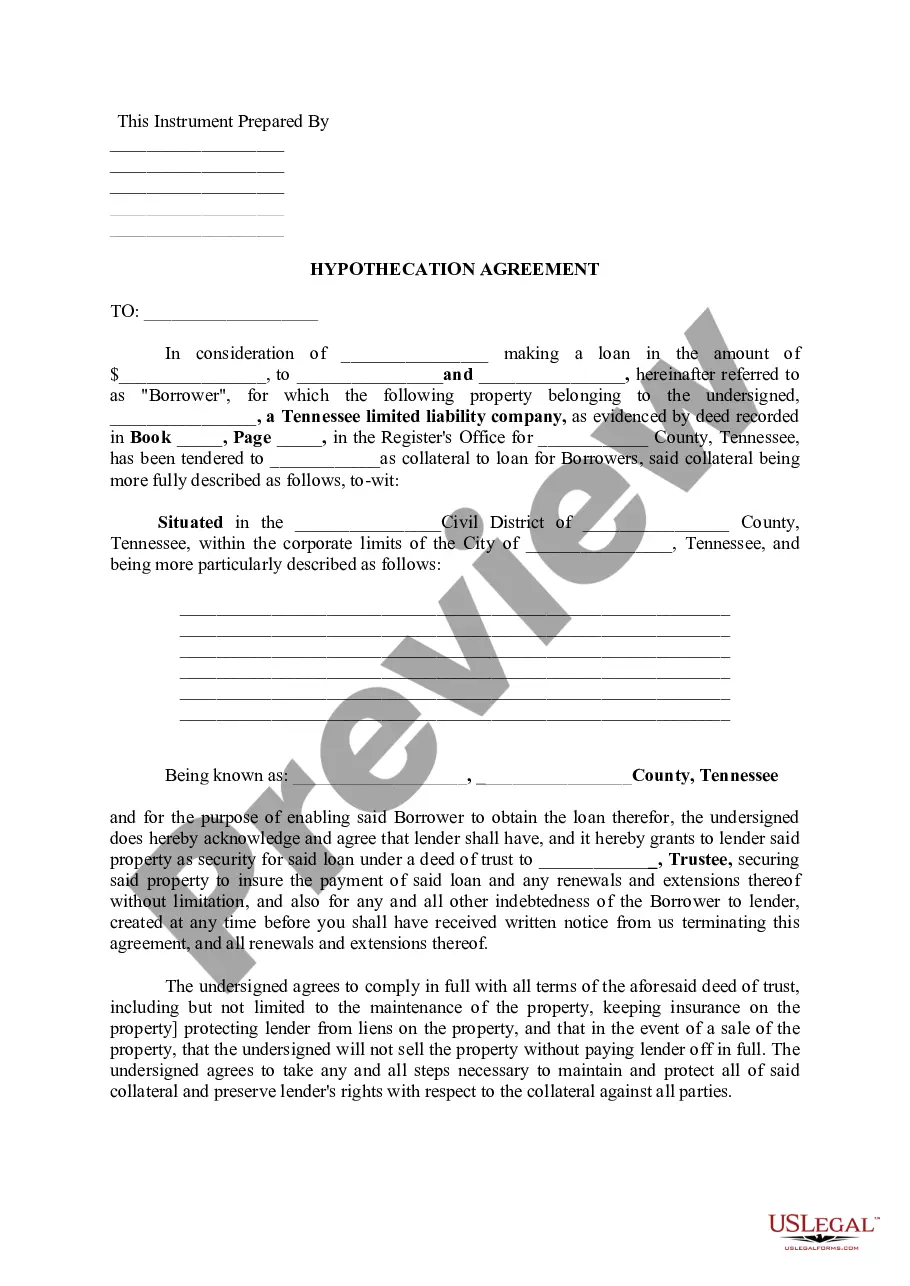

Clarksville Tennessee Intercreditor Agreement

Description

How to fill out Tennessee Intercreditor Agreement?

Are you in search of a trustworthy and cost-effective provider of legal documents to obtain the Clarksville Tennessee Intercreditor Agreement? US Legal Forms is the perfect option for you.

Whether you require a simple agreement to establish rules for living with your spouse or a collection of papers to facilitate your separation or divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business applications. All templates we provide are not generic and are tailored according to the needs of specific states and regions.

To retrieve the form, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please keep in mind that you can re-download any of your previously acquired form templates at any moment in the My documents section.

Are you unfamiliar with our site? No need to worry. You can easily set up an account, but before doing so, ensure that you follow these steps.

Now you can establish your account. Then choose your subscription plan and complete the payment. Once the payment is finalized, you can download the Clarksville Tennessee Intercreditor Agreement in any available file format. You can revisit the website whenever necessary and redownload the form at no additional cost.

Obtaining current legal paperwork has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to find legal forms online.

- Verify if the Clarksville Tennessee Intercreditor Agreement aligns with the laws of your state and locality.

- Review the form’s description (if available) to understand its intended purpose and audience.

- Restart your search if the template does not match your particular situation.

Form popularity

FAQ

lender shares in the lending process, providing financial resources alongside other lenders, whereas an intercreditor primarily lays out the terms under which these lenders interact. In a Clarksville Tennessee Intercreditor Agreement, understanding this difference can clarify the collaborative dynamics of lending. This knowledge ensures that all parties are on the same page, enhancing the borrowing experience.

An intercreditor agent acts on behalf of all lenders in an intercreditor agreement, managing communications and enforcing the terms of the agreement. In the realm of a Clarksville Tennessee Intercreditor Agreement, this agent plays a crucial role in ensuring that all parties adhere to the set guidelines. Having a dedicated agent promotes efficiency and helps resolve issues quickly.

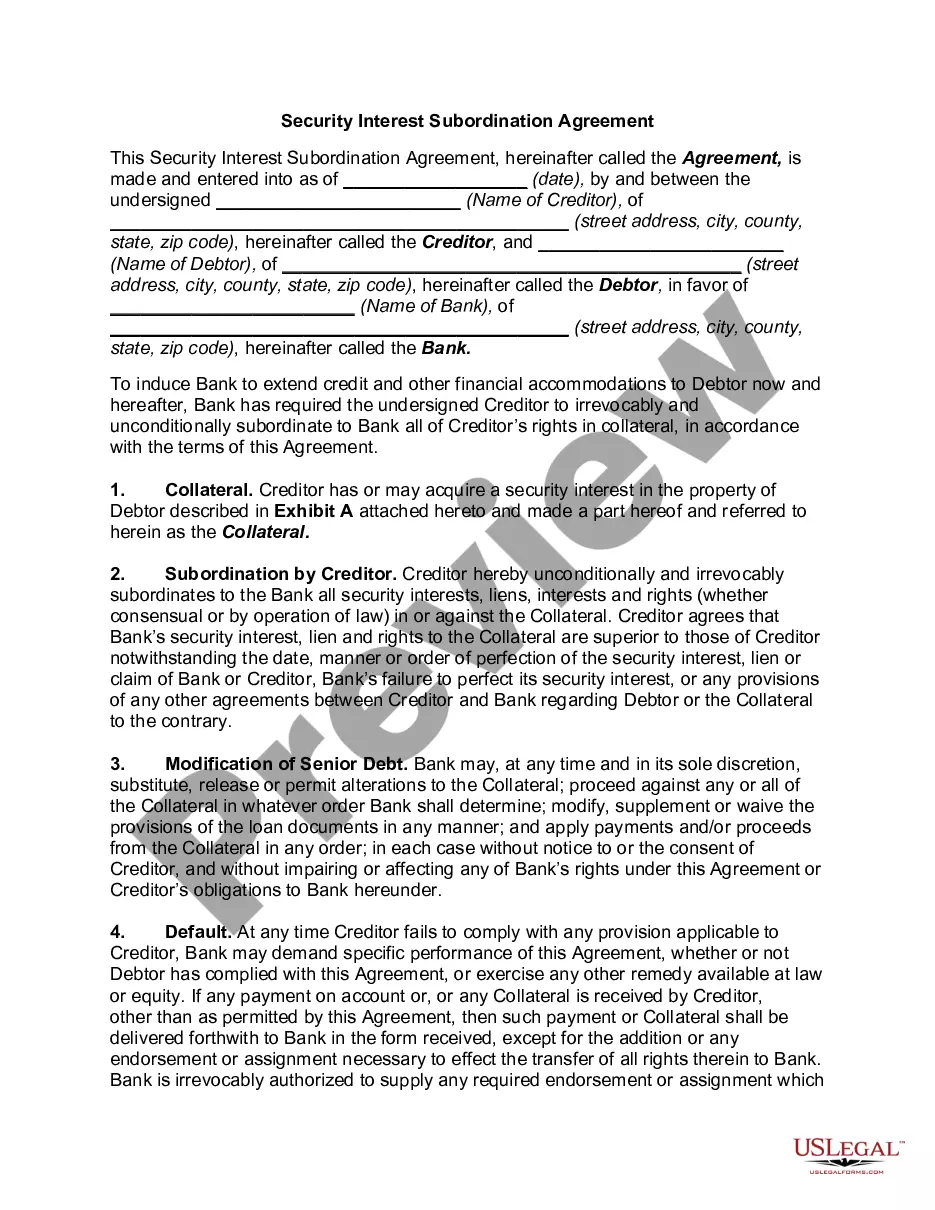

An intercreditor functions as an agreement between multiple lenders, detailing how they will share rights regarding a borrower's obligations. In the context of a Clarksville Tennessee Intercreditor Agreement, this is essential for coordinating interests among different creditors. Understanding the role of each lender promotes transparency and stability in financial relationships.

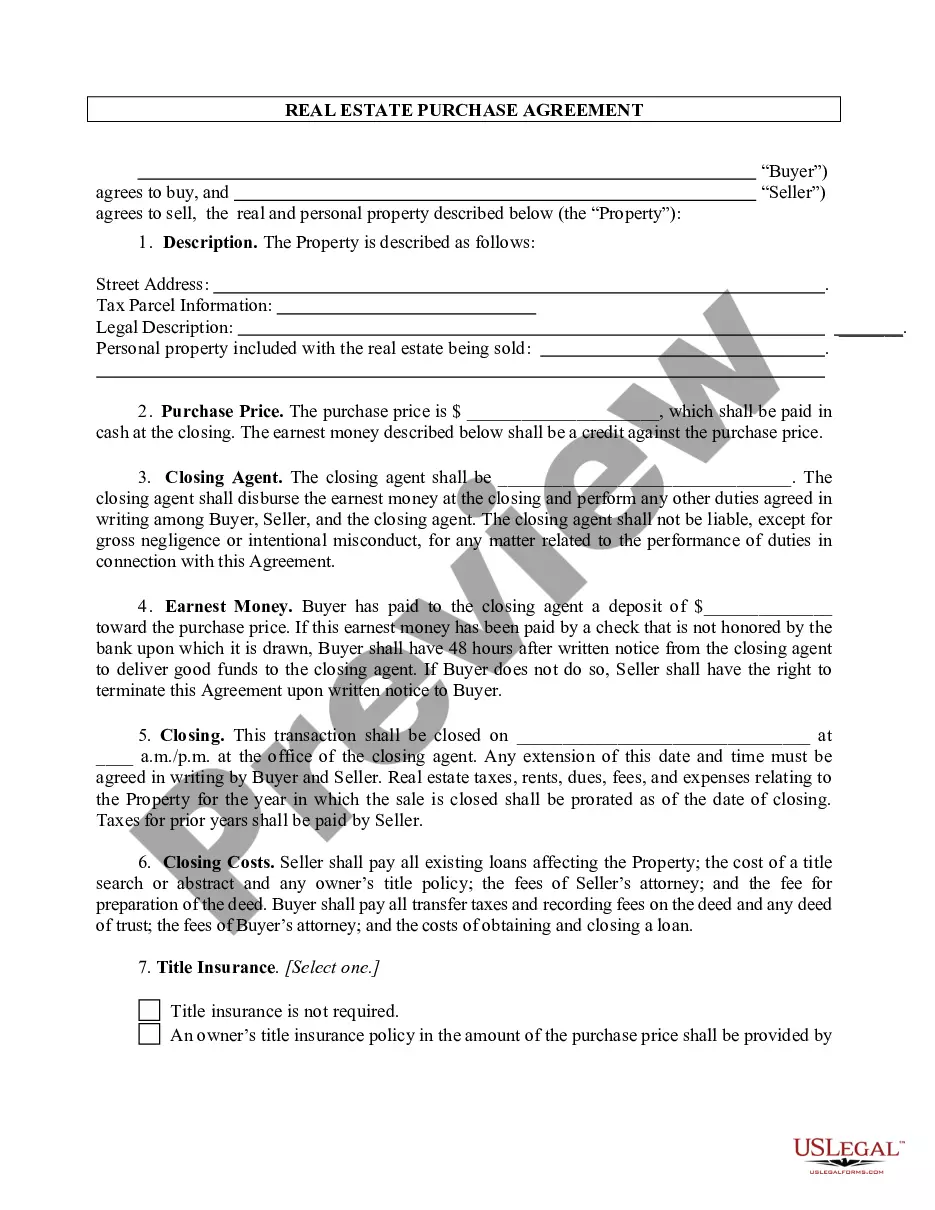

When exploring a Clarksville Tennessee Intercreditor Agreement, focus on terms that outline the rights and obligations of each lender. Ensure clarity on payment priorities, default scenarios, and how disputes will be resolved. A well-structured agreement should provide a clear understanding of each party's role, which helps prevent misunderstandings in the future.

In a Clarksville Tennessee Intercreditor Agreement, the primary parties typically include the senior lenders and the subordinated lenders. The senior lenders hold the priority claim on collateral and repayment, while the subordinated lenders accept a lower priority. This arrangement helps outline the rights and obligations of each party, ensuring clarity in financial structuring. A well-defined intercreditor agreement supports effective risk management and fosters healthier lending relationships.

An intercreditor agreement is a legal contract that establishes the relationship between multiple creditors dealing with a common borrower, particularly regarding payment priorities and rights. In Clarksville, Tennessee, such agreements are essential for ensuring fair treatment of all lenders involved, especially in complex financing situations. Developing a comprehensive Clarksville Tennessee Intercreditor Agreement helps avoid misunderstandings, allowing for smoother financial transactions.

The limitation period of a standstill agreement usually delineates the time frame within which lenders agree to suspend collection efforts. This period can vary based on the specifics of each agreement. For a Clarksville Tennessee Intercreditor Agreement, it is essential for all parties to clarify these terms to avoid future misunderstandings.

The standstill period for an Intercreditor Agreement, including those specific to Clarksville, Tennessee, can vary widely depending on the negotiations between creditors. Oftentimes, this duration allows participating lenders to defer collection efforts, providing the borrower with a breathing space. Understanding this period can be crucial for effective financial planning.

The standstill provision in a subordination agreement is a clause that restricts certain lenders from enforcing their rights during a specified timeframe. This provision gives the borrower a necessary break to regain financial stability. In a Clarksville Tennessee Intercreditor Agreement, a clear standstill provision can facilitate better collaboration among lenders.

The typical standstill period for a Clarksville Tennessee Intercreditor Agreement can vary, but it often ranges from six months to two years. This duration allows borrowers crucial time to recover or restructure their debts. A well-defined standstill period can ultimately benefit both creditors and the borrower by promoting stability and cooperation.