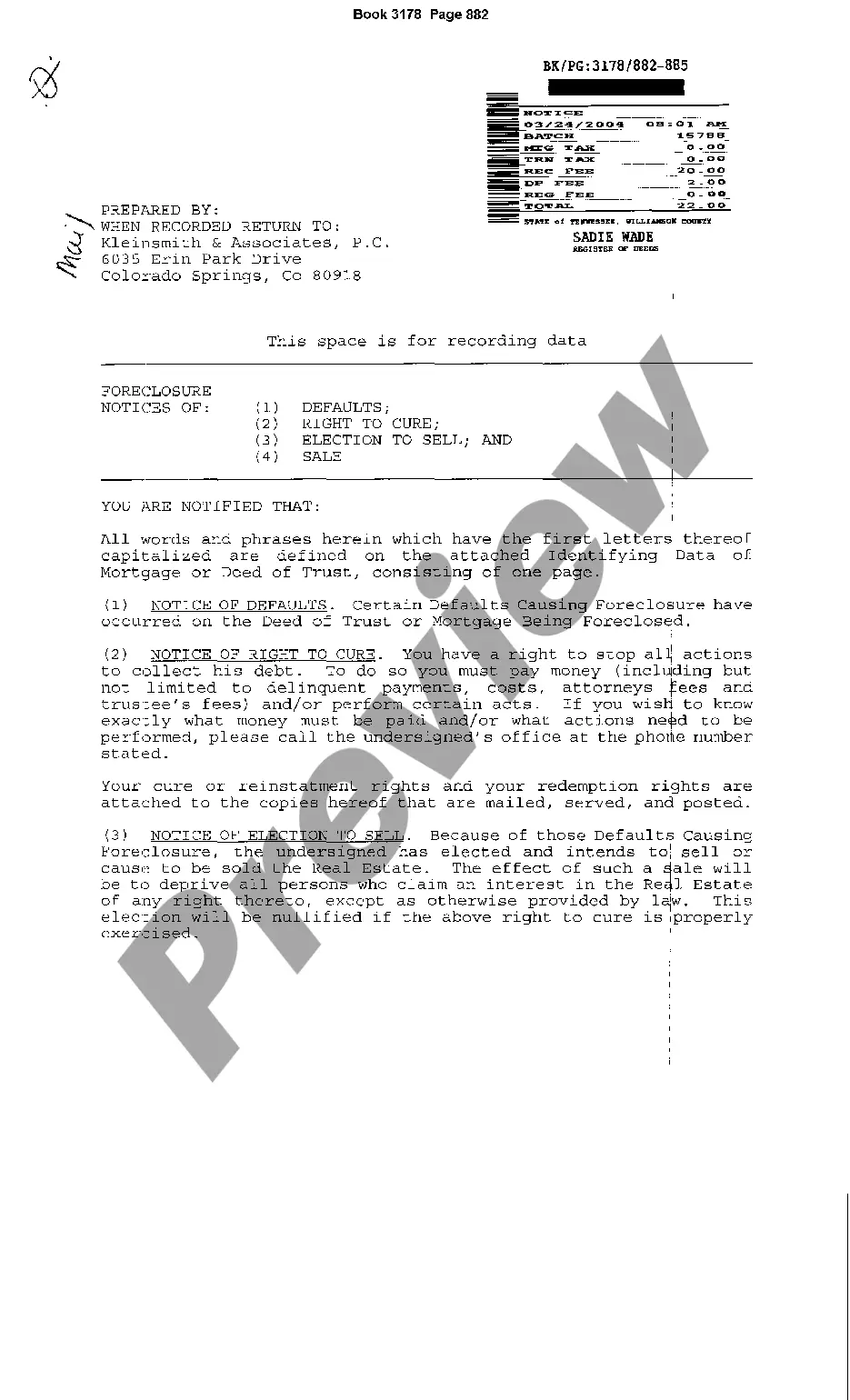

Chattanooga Tennessee Foreclosure Notice of Default

Description

How to fill out Tennessee Foreclosure Notice Of Default?

We consistently aim to reduce or prevent legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we seek legal assistance that is typically quite costly. Nevertheless, not all legal issues are as complicated.

The majority of them can be managed independently.

US Legal Forms is an online repository of contemporary do-it-yourself legal templates covering everything from wills and powers of attorney to incorporation documents and dissolution petitions.

Simply Log In to your account and hit the Get button next to it. If you happen to lose the document, you can always retrieve it again from the My documents section.

- Our library empowers you to manage your matters without relying on a lawyer's services.

- We offer access to legal form templates that are not always publicly available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Benefit from US Legal Forms anytime you need to easily and safely find and download the Chattanooga Tennessee Foreclosure Notice of Default or any other form.

Form popularity

FAQ

In Tennessee, homeowners typically have five days after a foreclosure sale to vacate the property. After this period, the new owner can take action to remove you. It's essential to understand your rights during this time, especially concerning the Chattanooga Tennessee Foreclosure Notice of Default. Consulting with a qualified attorney can help you navigate this complex process.

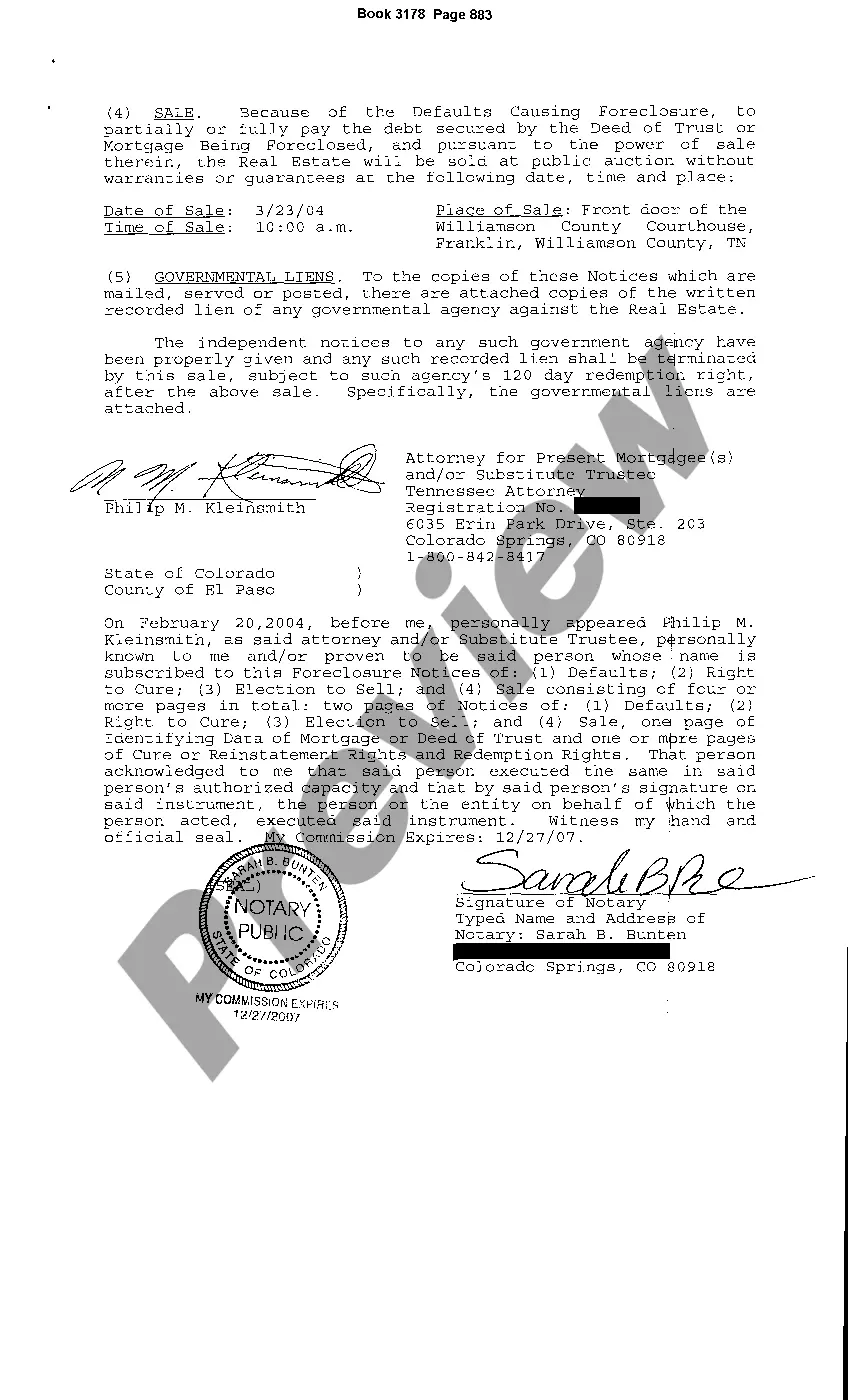

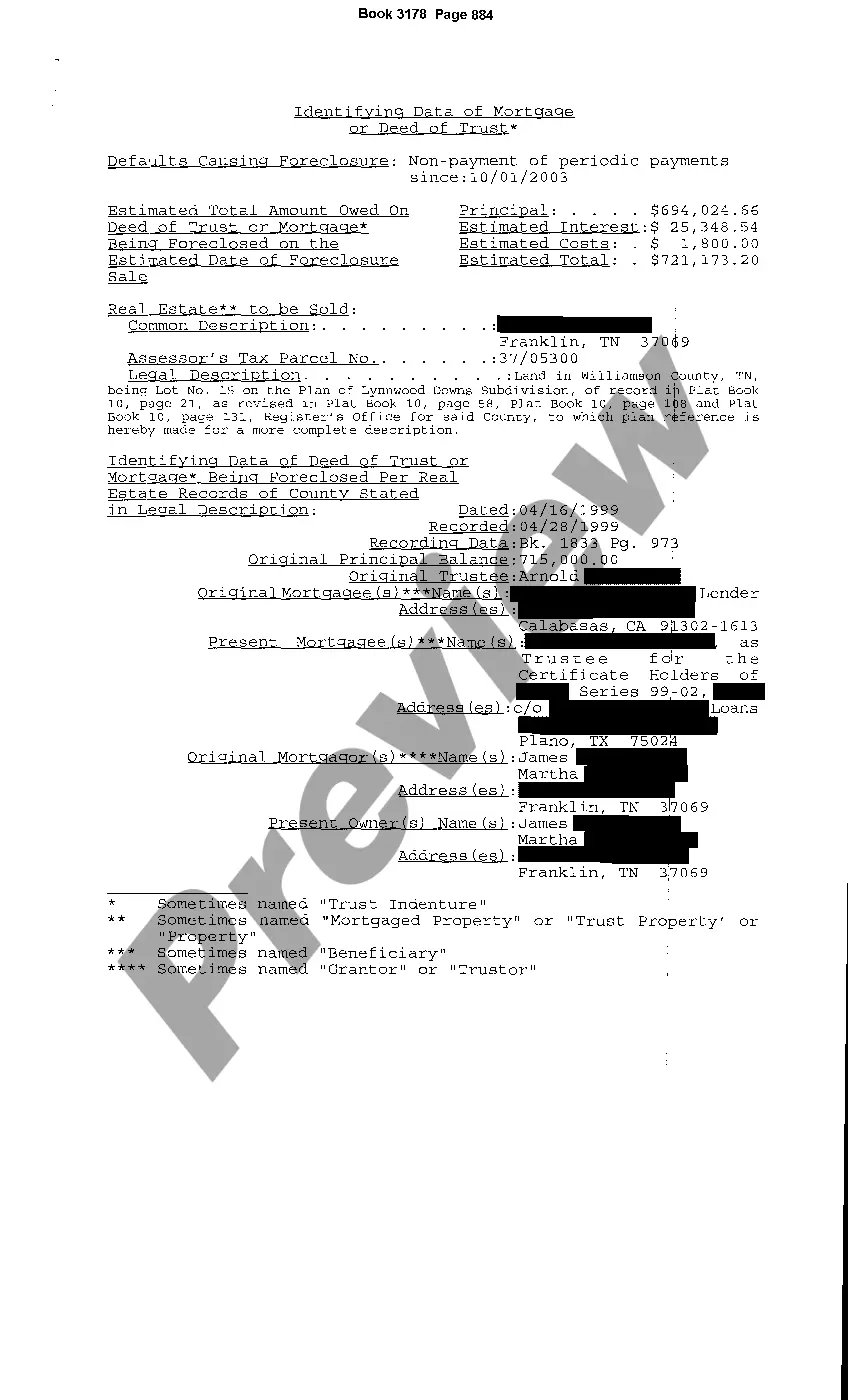

The foreclosure process in Tennessee begins when the lender files a Notice of Default, notifying the borrower of missed payments. After 20 days, the lender may initiate a foreclosure sale, commonly done through an auction. Understanding each step of this process can empower borrowers to take action, such as negotiating for alternatives, especially upon receiving a Chattanooga Tennessee Foreclosure Notice of Default.

A letter of intent to foreclosure outlines the lender's intention to begin the foreclosure process due to missed payments. This letter serves as an official communication to the borrower, providing a chance to remedy the situation before it escalates. If you receive a Chattanooga Tennessee Foreclosure Notice of Default, responding to this letter with a proposal for any possible solutions can be crucial.

In Tennessee, the statute of limitations for a lender to initiate foreclosure is typically six years from the date of default. This means that after this period, the lender may no longer be able to enforce the mortgage debt through foreclosure. It is essential to stay informed about this timeline and act promptly if you receive a Chattanooga Tennessee Foreclosure Notice of Default.

Stopping a foreclosure in Tennessee involves taking swift action upon receiving the Chattanooga Tennessee Foreclosure Notice of Default. You have the option to negotiate directly with your lender to create a more manageable payment plan. Furthermore, contacting a foreclosure prevention counselor can guide you through your options and help you avoid legal complications.

The fastest way to stop a foreclosure in Chattanooga, Tennessee, is to address the Notice of Default promptly. You can explore options such as negotiating with your lender for a repayment plan or applying for a forbearance agreement. Additionally, contacting a local attorney who specializes in foreclosure can be beneficial, as they can provide legal insight and advocacy for your situation.

A notice of default in Tennessee, specifically a Chattanooga Tennessee Foreclosure Notice of Default, is a document issued when a borrower fails to meet mortgage payment obligations. This notice signifies that the borrower is in default and outlines the actions that may follow if the situation is not rectified. Understanding this document and its implications is essential for homeowners facing financial difficulties, as early intervention can often lead to more favorable outcomes.

Getting a default notice, particularly a Chattanooga Tennessee Foreclosure Notice of Default, signifies that you are at risk of losing your home. This notice is a critical alert about missed mortgage payments and the implications of not remedying the situation. It is wise to review your finances and explore options, such as reaching out to your lender for assistance or seeking help from professionals who can advise on foreclosure prevention strategies.

Receiving a Chattanooga Tennessee Foreclosure Notice of Default means that your lender has officially recorded your mortgage account as being in default. This notice serves as a warning, indicating that you have fallen behind on your payments. It also outlines the consequences if you do not take action, such as potential foreclosure. Understanding this notice is crucial for homeowners looking to resolve their financial situation.

In Tennessee, the process of foreclosure can take anywhere from a few months to over a year. Once a Chattanooga Tennessee Foreclosure Notice of Default is issued, the lender will typically provide a grace period to allow homeowners to catch up on missed payments. However, if the payments remain unpaid, the lender may proceed with foreclosure actions, which can elongate the timeline significantly depending on various factors.