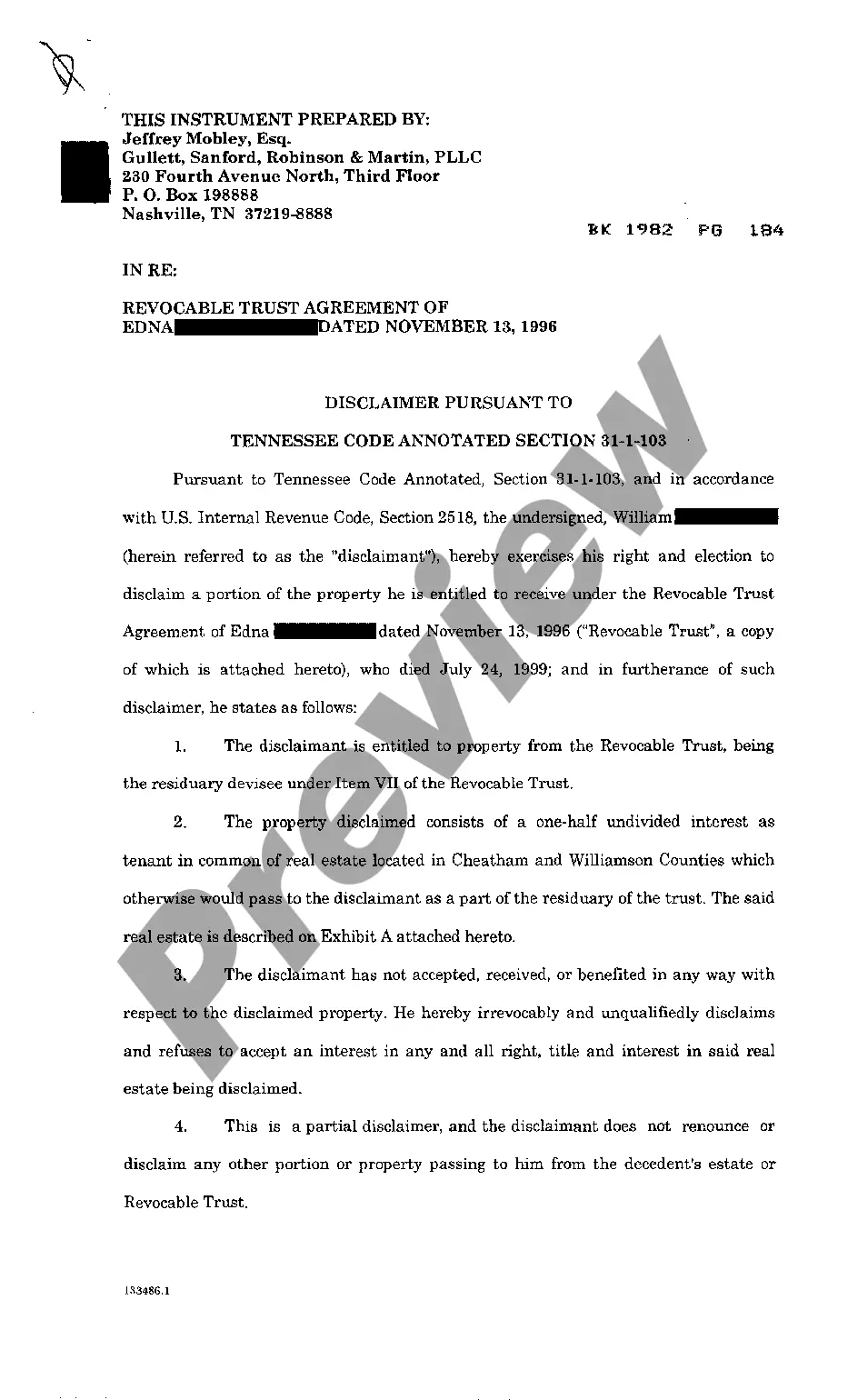

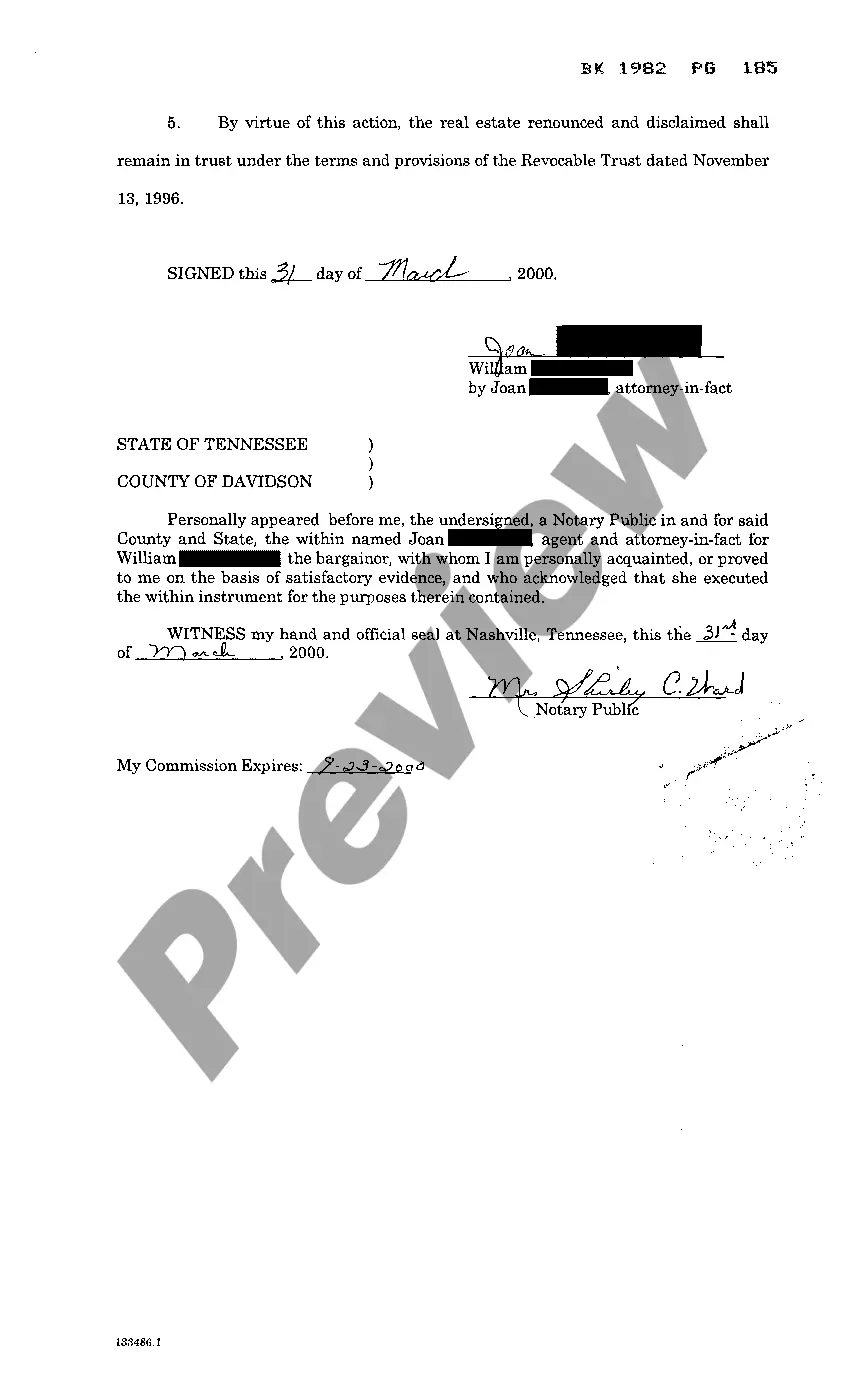

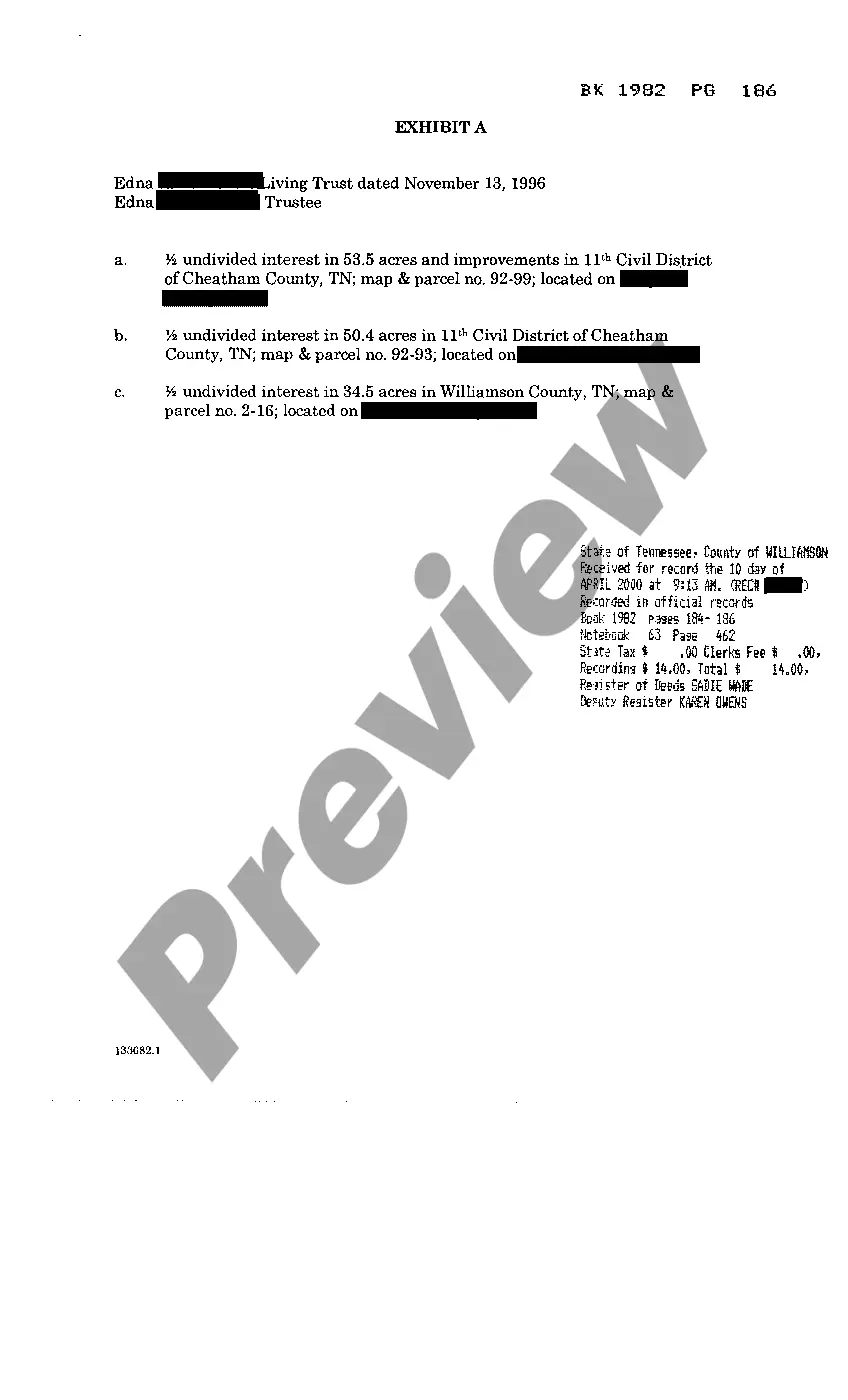

Title: Understanding Murfreesboro Tennessee Disclaimer of Interest in Real Property from Beneficiary of Trust Introduction: In Murfreesboro, Tennessee, beneficiaries of a trust may choose to release or disclaim their interests in real property, allowing them to avoid certain legal responsibilities and consequences associated with ownership. This article explores the intricacies of a Murfreesboro Tennessee Disclaimer of Interest in Real Property from a beneficiary, highlighting its purpose, process, and various types. 1. What is a Murfreesboro Tennessee Disclaimer of Interest in Real Property? A Murfreesboro Tennessee Disclaimer of Interest in Real Property refers to a legal instrument used by trust beneficiaries to legally renounce or relinquish their rights, title, or interest in a particular property held within a trust. This voluntary action allows beneficiaries to avoid any legal obligations or liabilities associated with the property's ownership. 2. Purpose of a Murfreesboro Tennessee Disclaimer of Interest in Real Property: — Avoiding tax consequences: By disclaiming their interest in the real property, beneficiaries may prevent potential tax burdens and estate taxes that could arise from ownership. — Preserving eligibility for government benefits: Disclaiming one's interest in property can ensure beneficiaries' eligibility for certain government assistance programs, such as Medicaid or Medicare. — Facilitating estate planning: Beneficiaries may utilize disclaimers to redirect assets to other family members or beneficiaries, according to the terms of the trust or estate plan. — Settling disputes or uncertainties: In cases where beneficiaries are uncertain about accepting ownership or there are disagreements among potential claimants, disclaiming can help resolve conflicts or uncertainties. 3. Process of a Murfreesboro Tennessee Disclaimer of Interest in Real Property: — Timeliness: Beneficiaries must act quickly and comply with specific timeframes for disclaiming their interest, typically within nine months after the property transfer or reaching the age of majority. — Written document: The disclaimer should be in writing, clearly expressing the beneficiary's intention to disclaim their interest in the property. — Delivery: The disclaimer document must be delivered to the person or entity responsible for administering the trust, such as the trustee, executor, or attorney, within the required timeline. — No acceptance of benefits: Beneficiaries should not accept any benefits or privileges associated with the property before disclaiming, as it could invalidate the disclaimer. Types of Murfreesboro Tennessee Disclaimer of Interest in Real Property: 1. General Disclaimer: This type of disclaimer involves a complete renunciation of the beneficiary's interest in real property, relinquishing all rights, titles, and responsibilities associated with it. 2. Partial Disclaimer: In certain cases, beneficiaries may choose to disclaim a portion or specific interest in the property while retaining ownership of the rest. 3. Conditional Disclaimer: A conditional disclaimer applies when beneficiaries disclaim their interest in the property only if certain conditions are met, such as the property's value exceeding a particular threshold. Conclusion: A Murfreesboro Tennessee Disclaimer of Interest in Real Property provides beneficiaries with the opportunity to release their rights and obligations concerning specific real estate held within a trust. By understanding the purpose, process, and types of disclaimers available, beneficiaries can make informed decisions while navigating the intricacies of estate planning and trust administration in Murfreesboro, Tennessee.

Murfreesboro Tennessee Disclaimer of interest in real property from beneficiary of trust

Description

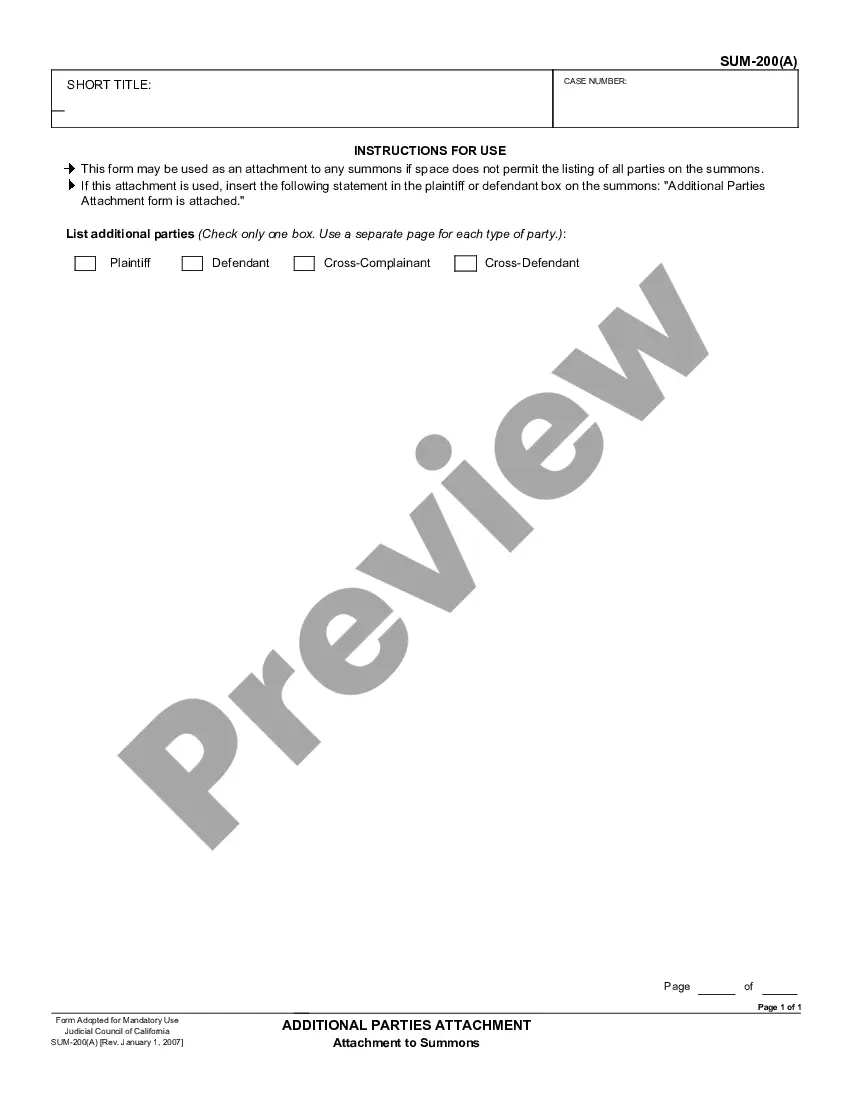

How to fill out Murfreesboro Tennessee Disclaimer Of Interest In Real Property From Beneficiary Of Trust?

We consistently strive to diminish or evade legal repercussions when navigating intricate legal or financial issues.

To accomplish this, we seek legal assistance that is typically very expensive.

However, not every legal concern is so intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and press the Get button beside it. If you lose the form, you can always retrieve it again in the My documents section.

- Our platform empowers you to take control of your affairs without engaging an attorney.

- We provide access to legal form templates that are not always publicly reachable.

- Our templates are tailored to specific states and regions, notably streamlining the search process.

- Utilize US Legal Forms whenever you require downloading the Murfreesboro Tennessee Disclaimer of interest in real property from beneficiary of a trust or any other form effortlessly and securely.

Form popularity

FAQ

Writing a disclaimer letter for inheritance in Murfreesboro, Tennessee, involves clearly stating your intent to refuse the property or funds you are entitled to. Ensure the letter includes your name, the deceased's name, a description of the property, and a statement that you are disclaiming the inheritance under Tennessee law. Using services from USLegalForms can provide templates and guidance for crafting a legally sound disclaimer letter.

Yes, there is a time limit on claiming your inheritance in Murfreesboro, Tennessee. Beneficiaries generally have nine months to file a disclaimer if they choose not to accept the inheritance. Failure to file within this period might result in the automatic acceptance of the inheritance, which may not align with your wishes.

You typically have nine months to disclaim an inheritance in Murfreesboro, Tennessee. This time frame starts from the moment the decedent passes away. It is important to remember that if you miss this window, you may lose your opportunity to decline the inheritance, so timely action is vital.

The nine-month disclaimer rule in Murfreesboro, Tennessee, allows you to refuse your inheritance within nine months of the decedent's death. This rule is essential for preserving your ability to disclaim an interest in real property from a beneficiary of trust. After this period, any attempts to disclaim may not be valid, so it's wise to stay informed and act promptly.

To disclaim interest from a trust in Murfreesboro, Tennessee, you typically need to prepare a written disclaimer that expresses your intention to reject the inheritance. This document must be signed and delivered to the trustee and possibly filed with the court. Using platforms like USLegalForms can streamline this process and ensure you meet all legal requirements.

In Murfreesboro, Tennessee, the general guideline states that you must file a disclaimer of interest in real property from a beneficiary of trust within nine months from the date of the decedent's death. It's crucial to act quickly to ensure that your rights are preserved. Legal advice can clarify the timeline for your specific situation, so consider consulting with a knowledgeable attorney.

To write a disclaimer of interest, start by clearly stating your intent to refuse the interest in the trust. Include relevant details such as the trust name, your identification, and the property descriptions involved. In Murfreesboro Tennessee, the disclaimer must adhere to legal requirements to be considered valid. UsLegalForms offers templates that can guide you through crafting this important document effectively.

A disclaimer clause in a trust outlines the rights and procedures for a beneficiary to refuse their interest in the trust. This clause ensures that should a beneficiary choose to disclaim, there are clear guidelines to follow. In Murfreesboro Tennessee, having this clause can be beneficial to prevent disputes and clarify intentions. Consulting with an attorney can help beneficiaries understand how this clause operates within the specific trust.

Yes, a beneficiary can disclaim an interest in a trust, which is a formal way to refuse any benefits. This act must follow specific legal protocols to be valid, especially in Murfreesboro Tennessee. A properly executed disclaimer enables the beneficiary to retain their legal rights while transferring potential benefits to alternate beneficiaries. Utilizing platforms like UsLegalForms can streamline the process and make it compliant with local laws.

Generally, a beneficiary of a trust can sell their interest, but this process varies based on the terms of the trust agreement. If the trust allows the sale, a beneficiary should follow the stipulated guidelines for transferring their interest. However, keep in mind that selling an interest may impact any disclaimers of interest in a trust in Murfreesboro Tennessee. Consulting with a legal professional can help clarify any complications involved.