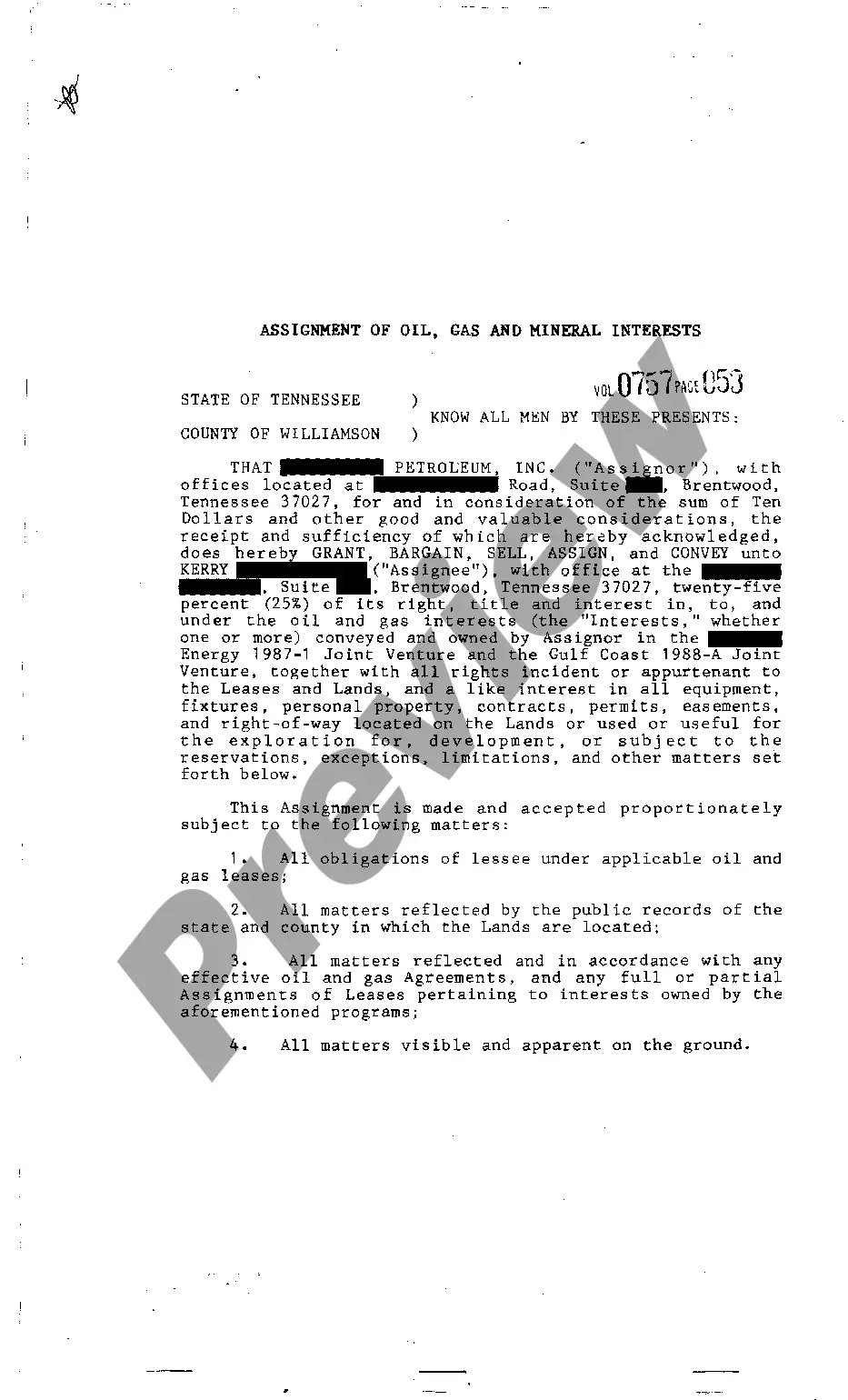

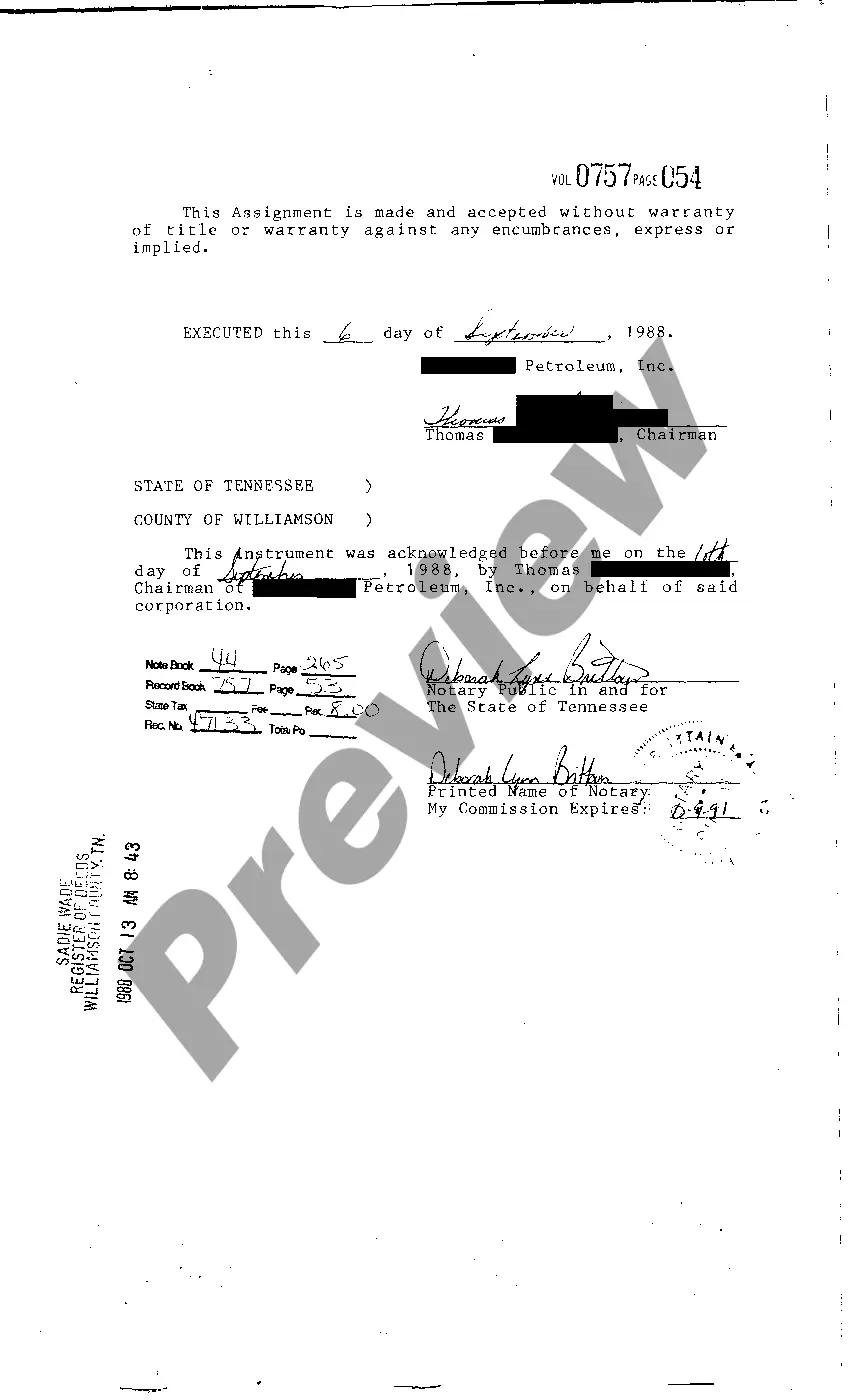

Memphis Tennessee Assignment of Oil, Gas And Mineral Interest

Description

How to fill out Tennessee Assignment Of Oil, Gas And Mineral Interest?

If you’ve previously utilized our service, sign in to your account and download the Memphis Tennessee Assignment of Oil, Gas And Mineral Interest onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it following your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have enduring access to every piece of documentation you have purchased: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to conveniently find and save any template for your personal or professional requirements!

- Confirm you’ve located the right document. Review the description and use the Preview feature, if available, to see if it fulfills your requirements. If it doesn’t suit you, utilize the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription option.

- Establish an account and process your payment. Employ your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Memphis Tennessee Assignment of Oil, Gas And Mineral Interest. Select the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The General Mineral Deed in Tennessee transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included. The transfer includes the oil, gas and other minerals of every kind and nature.

Mineral rights and air rights may be owned by someone other than the owner of the surface. It is common, for example, for a surface owner to sell to a third party the rights to any oil, gas, coal, and other minerals that may be located be- low the surface.

A ?mineral interest? is the real property interest created in oil and gas after a severance of those minerals from the surface estate. Typically, a mineral interest is severed from the fee estate by virtue of a conveyance or a reservation, and the interest created is in fee.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

(c) Any interest in coal, oil and gas, and other minerals shall, if unused for a period of twenty (20) years, be extinguished, unless a statement of claim is filed in accordance with subsection (d), and the ownership of the mineral interest shall revert to the owner of the surface.

The General Mineral Deed in Tennessee transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included. The transfer includes the oil, gas and other minerals of every kind and nature.

They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership. Mineral ownership records are often outdated.

Surface rights determine who owns the rights to the surface of the land, while mineral rights determine who has the right to mine the minerals below the surface of the property. Mineral rights can be completely separate from land rights.

Mineral rights and air rights may be owned by someone other than the owner of the surface. It is common, for example, for a surface owner to sell to a third party the rights to any oil, gas, coal, and other minerals that may be located be- low the surface.