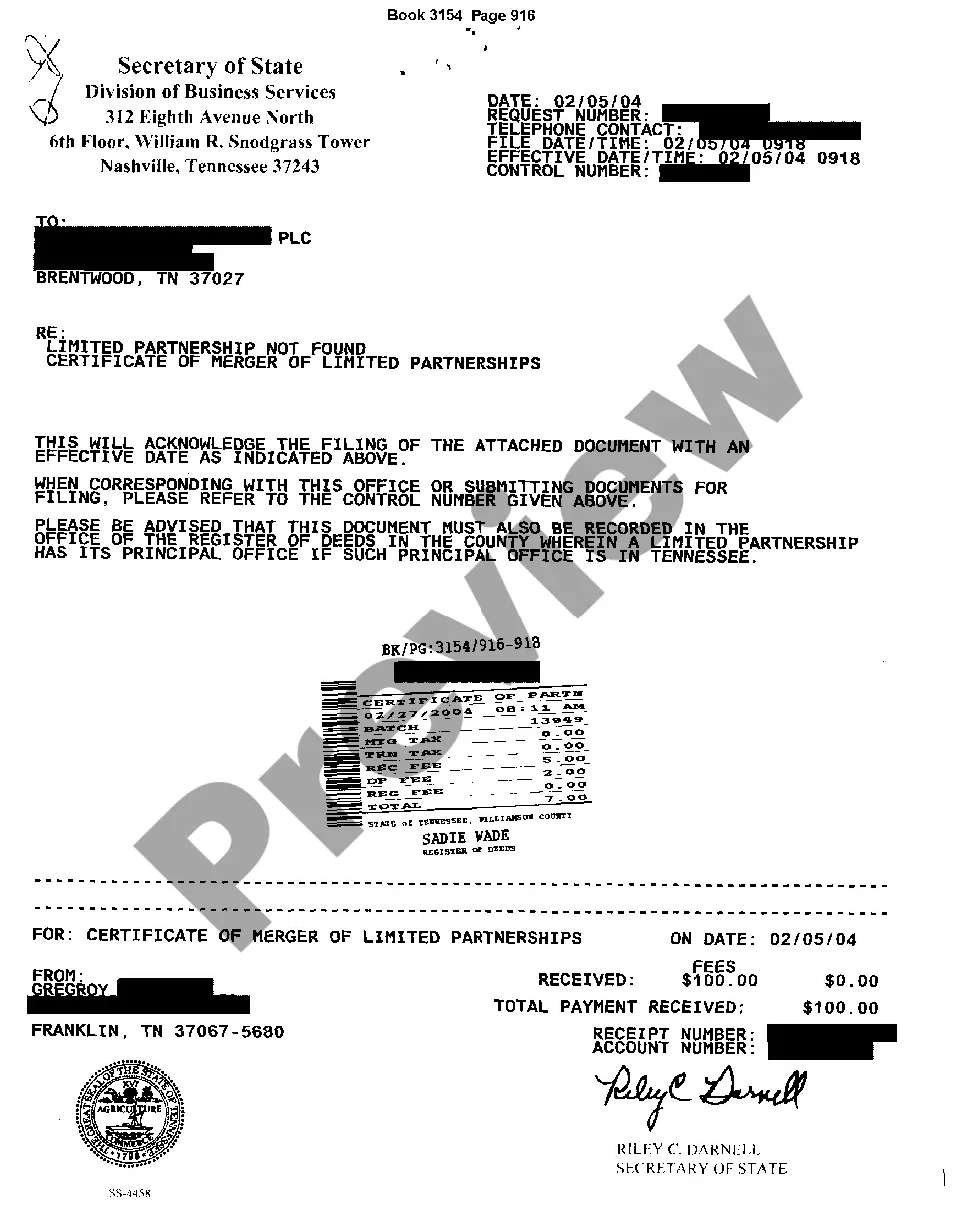

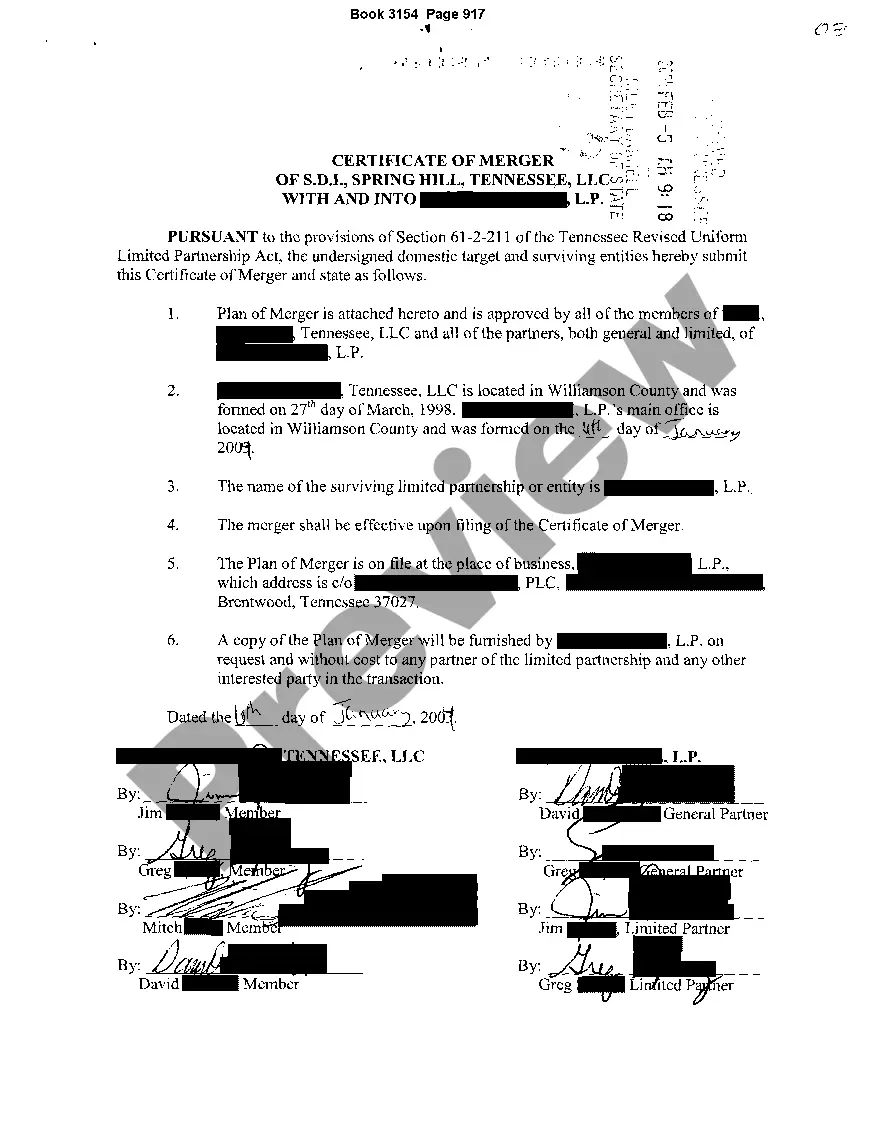

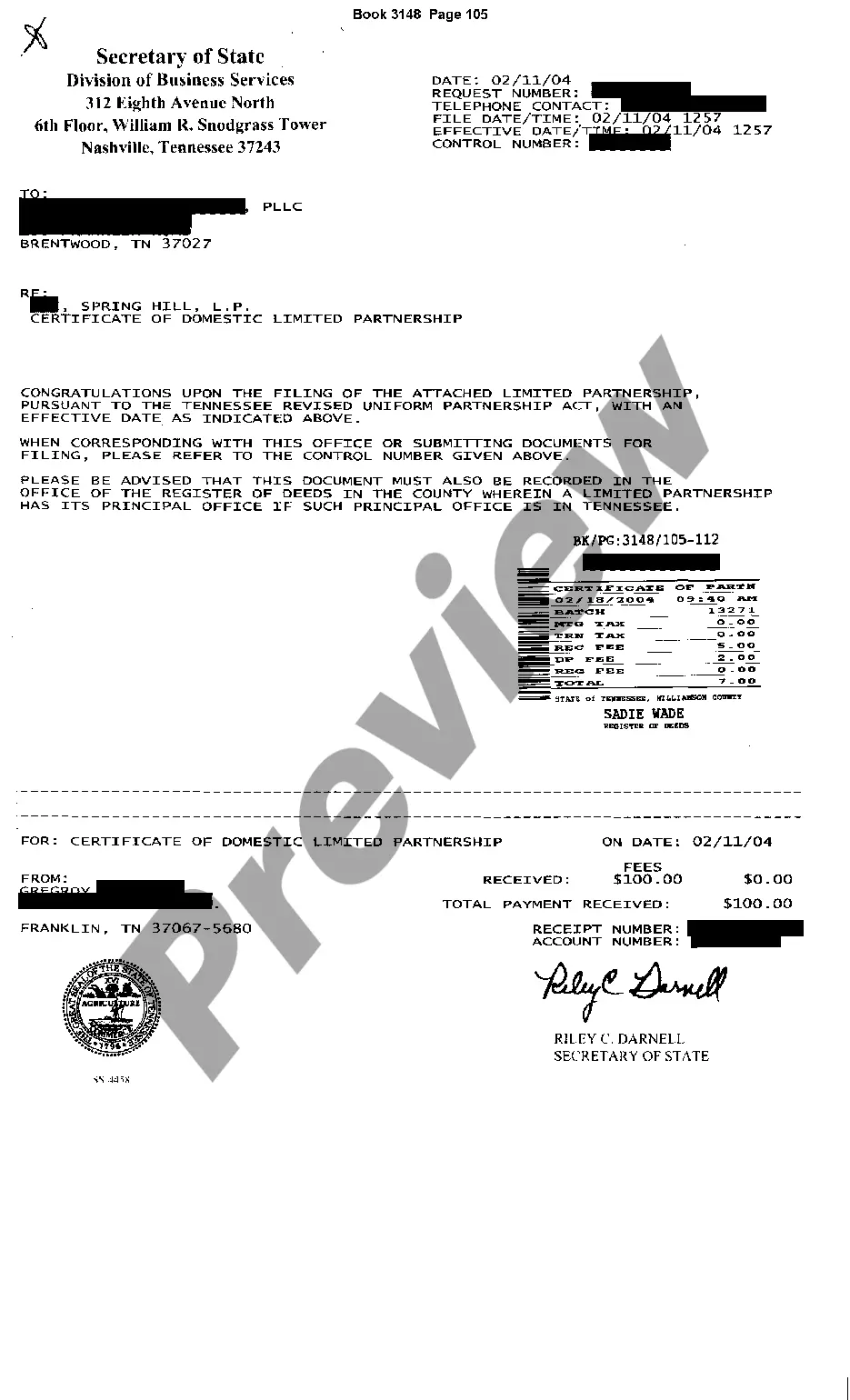

Memphis Tennessee Certificate of Merger of Limited Partnership

Description

How to fill out Tennessee Certificate Of Merger Of Limited Partnership?

If you have previously utilized our service, Log In to your account and download the Memphis Tennessee Certificate of Merger of Limited Partnership onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, adhere to these straightforward instructions to acquire your file.

You have ongoing access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and preserve any template for your personal or professional needs!

- Ensure you’ve located the correct document. Review the description and use the Preview feature, if available, to verify if it satisfies your needs. If it does not meet your expectations, utilize the Search tab above to find the accurate one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and complete the payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Acquire your Memphis Tennessee Certificate of Merger of Limited Partnership. Choose the file format for your document and store it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Any business registered in Tennessee is required to submit an annual report to the Secretary of State each year. Tennessee requires businesses to do this for two reasons. One, it allows the state to see which businesses are still actively operating in their state.

+Filings by general partnerships are not for the purpose of forming or maintaining a general partnership in Tennessee.

To dissolve an LLC in Tennessee you need to file the Articles of Termination with the Tennessee Secretary of State through mail or online by paying a filing fee of $20. If you are thinking about dissolving an LLC in Tennessee, you will need to file articles of termination or Articles of Dissolution.

Partnership: To create a general partnership in Tennessee, you don't need to file any organizational documents with the state. Although not legally required, all partnerships should have a written partnership agreement. The partnership agreement can be very helpful if there is ever a dispute among the partners.

Tennessee businesses are not legally required to obtain a certificate of existence. However, your business may choose to get one if you decide to do business outside of Tennessee or get a business bank account.

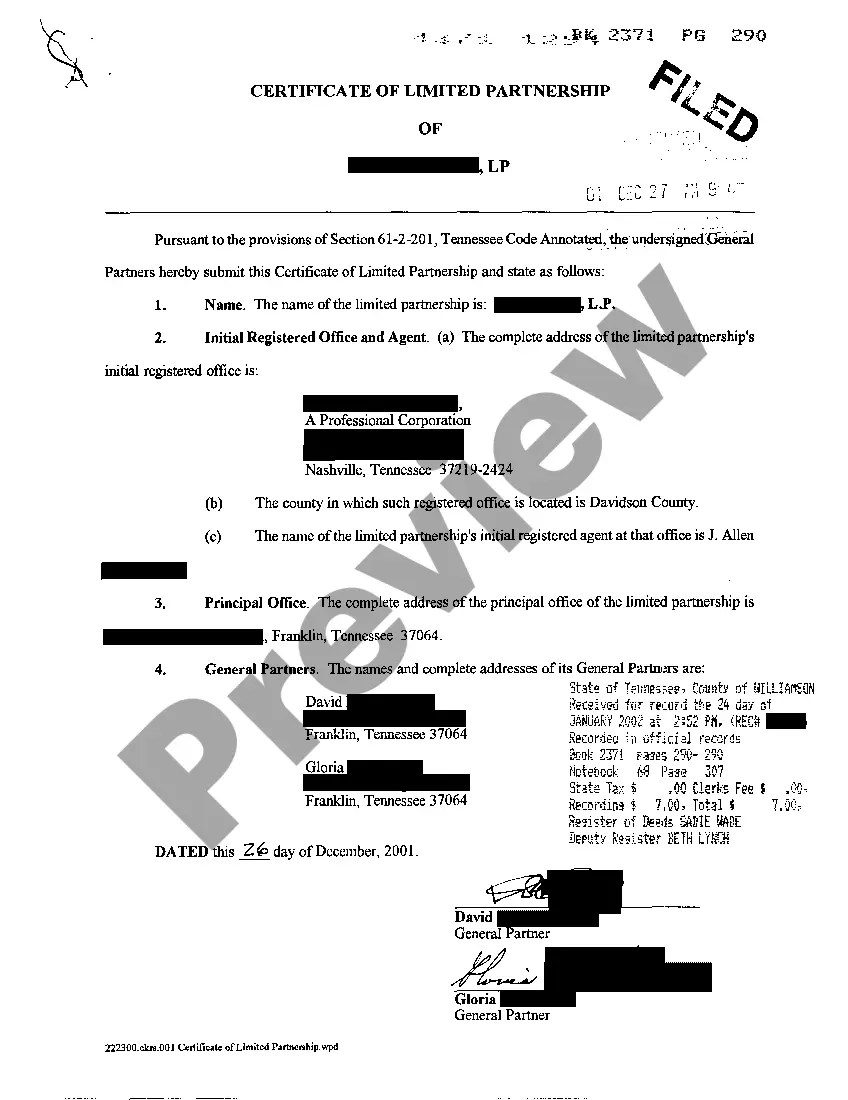

Limited Partnerships (LP) ? In Tennessee, a LP must file a Certificate of Limited Partnership with the Secretary of State. Limited Liability Partnerships (LLP) ? A Registration Statement with the Secretary of State is required in order to form an LLP in Tennessee.

Please note: A separate $15 business license registration fee must be paid to the county and/or municipal clerk for each new business. Once you register for business tax, please contact the individual county and/or municipal clerk to arrange for payment of this required fee and to obtain your business license.

Business Forms & Fees Domestic Limited PartnershipsCertificate of Limited Partnership (PDF, 354.4KB)SS-4470$100Amendment to the Certificate of Limited Partnership (PDF, 364.4KB)SS-4471$20Statement/Certificate of Correction (PDF, 340.1KB)SS-4480$20Change of Mailing Address (PDF, 307.8KB)SS-4800No Fee17 more rows

There is a $20 fee to file the notice. Your filing usually will be processed within 3-5 business days. You may also receive same-day processing if you deliver the notice in person. The SOS has a notice of dissolution form available for download.