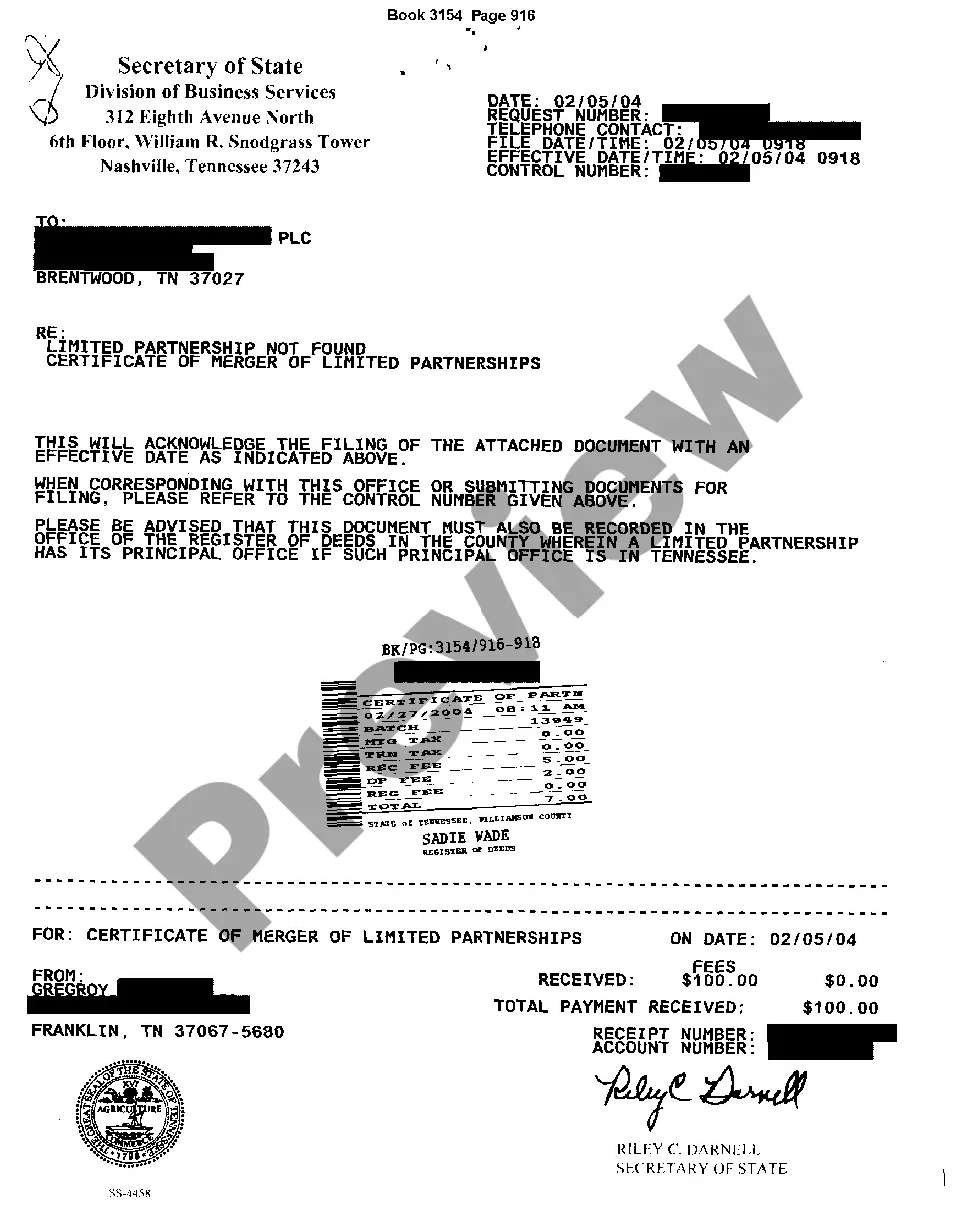

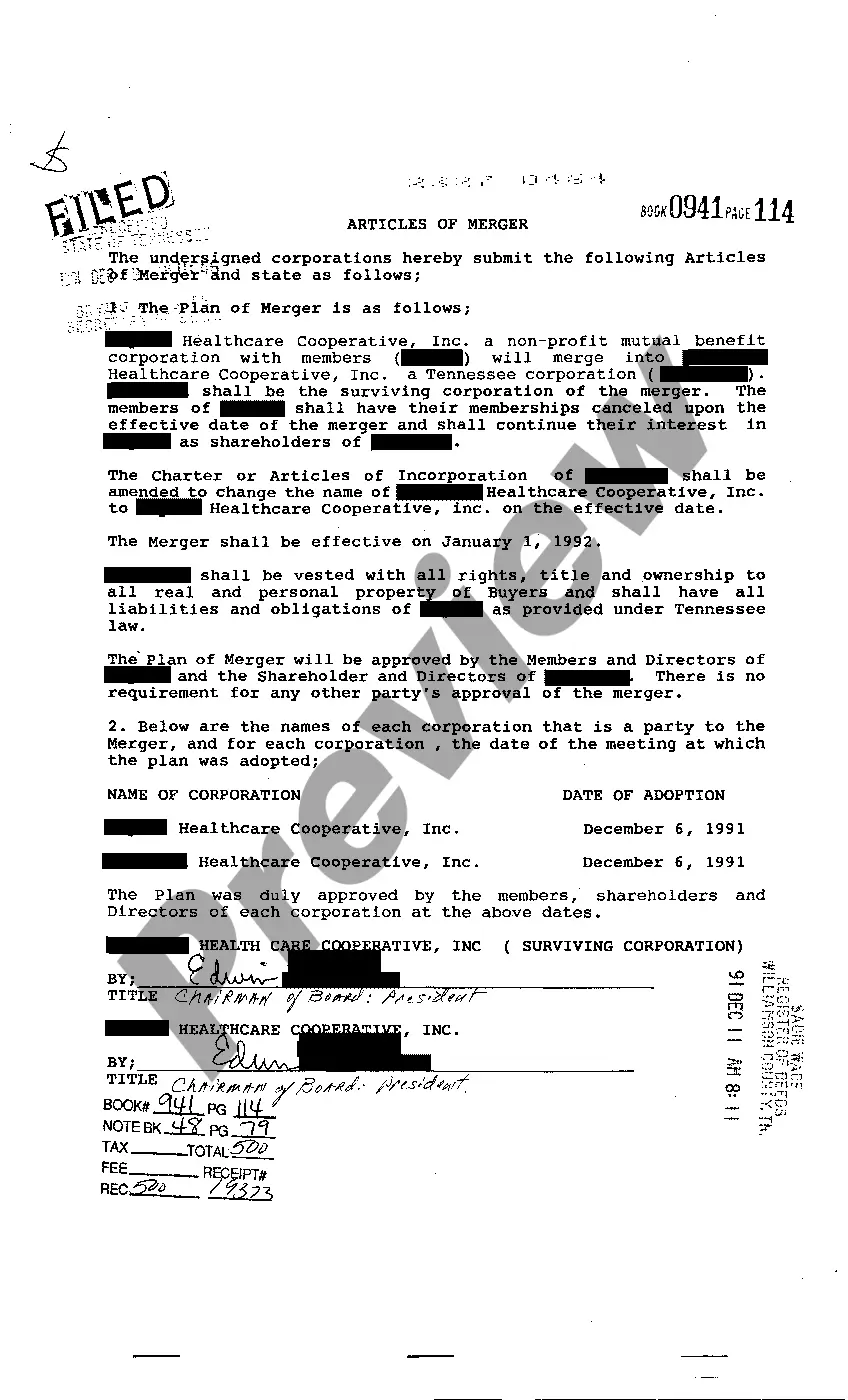

Memphis Tennessee Articles of Merger

Description

How to fill out Tennessee Articles Of Merger?

Utilize the US Legal Forms to gain instant access to any form template you need.

Our valuable platform featuring a vast array of templates streamlines the process of locating and acquiring almost any document sample you require.

You can download, fill out, and sign the Memphis Tennessee Articles of Merger in just a few minutes instead of spending hours online searching for a suitable template.

Using our catalog is an excellent method to enhance the security of your document submissions.

The Download button will be visible for all the samples you browse.

Additionally, you can find all your previously saved documents in the My documents menu.

- Our experienced attorneys consistently review all the documents to ensure that the templates are applicable for a specific region and adhere to new laws and regulations.

- How can you access the Memphis Tennessee Articles of Merger.

- If you already possess a profile, simply Log In to your account.

Form popularity

FAQ

The Request for Copy of Documents form may be submitted to the Secretary of State via mail or in person. The request must include the following: The Tennessee Secretary of State control number. Legal name of the business as listed on the Tennessee Secretary of State record.

If you do not know your Secretary of State Control number, you may search for it online or by contacting the Secretary of State, Business Services Division, at (615) 741-0526.

Tennessee articles of incorporation are included in the organizing document for a new corporation, which is referred to as a charter. The charter must be filed with Tennessee's Secretary of State before the corporation can commence operations. Charters are required for all corporations, whether profit or non-profit.

On March 8, 2011, Memphis city residents voted to dissolve their school charter and disband Memphis City Schools, effectively merging the city with the Shelby County School District.

How to Form a Corporation in Tennessee Choose a Corporate Name.File a Corporate Charter.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Initial Directors and Hold First Board Meeting.File Annual Report.Obtain an EIN.

You can find information on any corporation or business entity in Tennessee or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Nonprofit articles of incorporation is the document filed to create a Tennessee nonprofit corporation. Preparing and filing your articles of incorporation is the first step in starting your nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the nonprofit.

Other filings required at time of incorporation Tennessee requires the following: County filing. If the LLC's principal office is in Tennessee, a copy of the Articles of Organization must be filed with that county's government. If the principal office is not in Tennessee, no county filing is required.