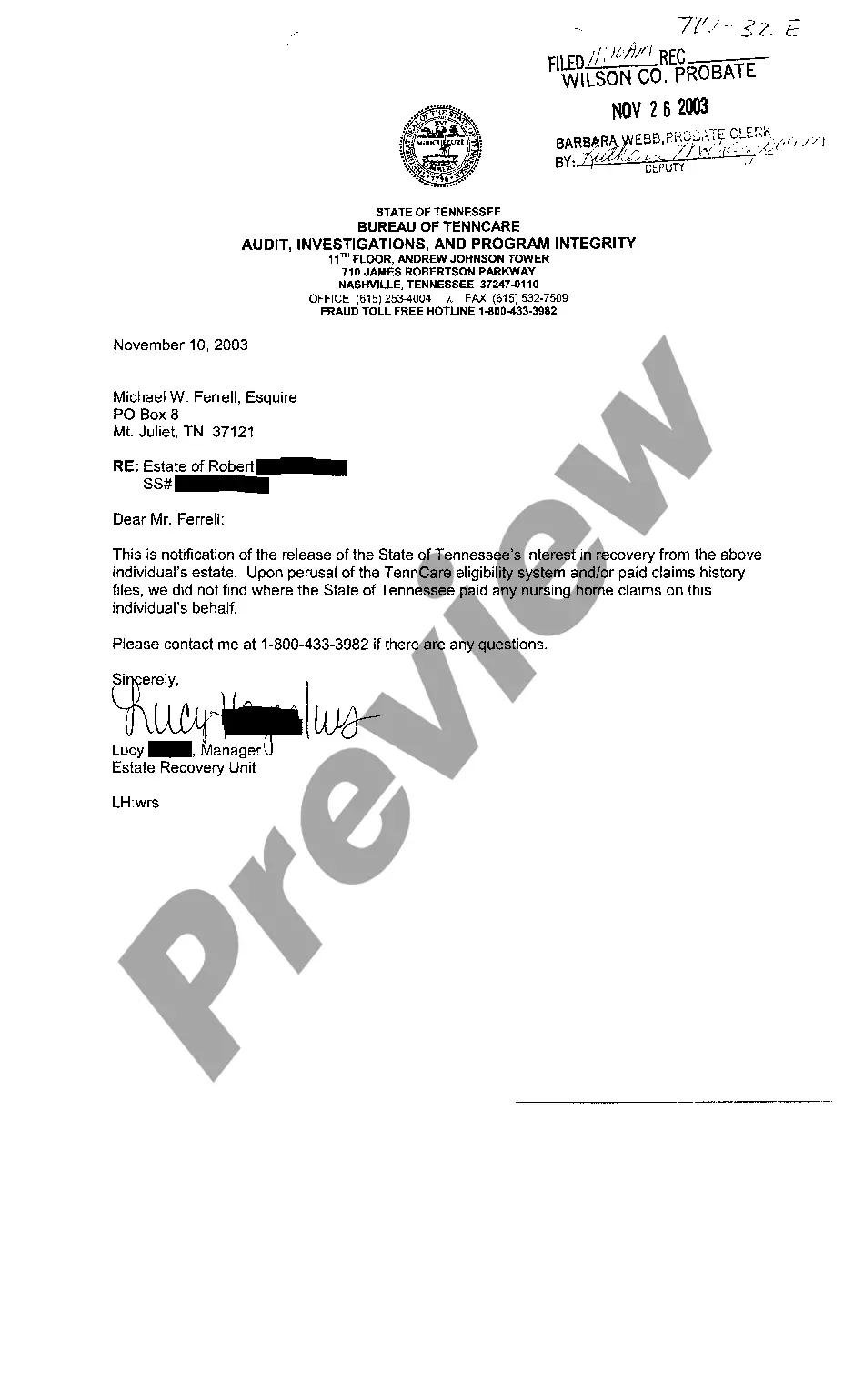

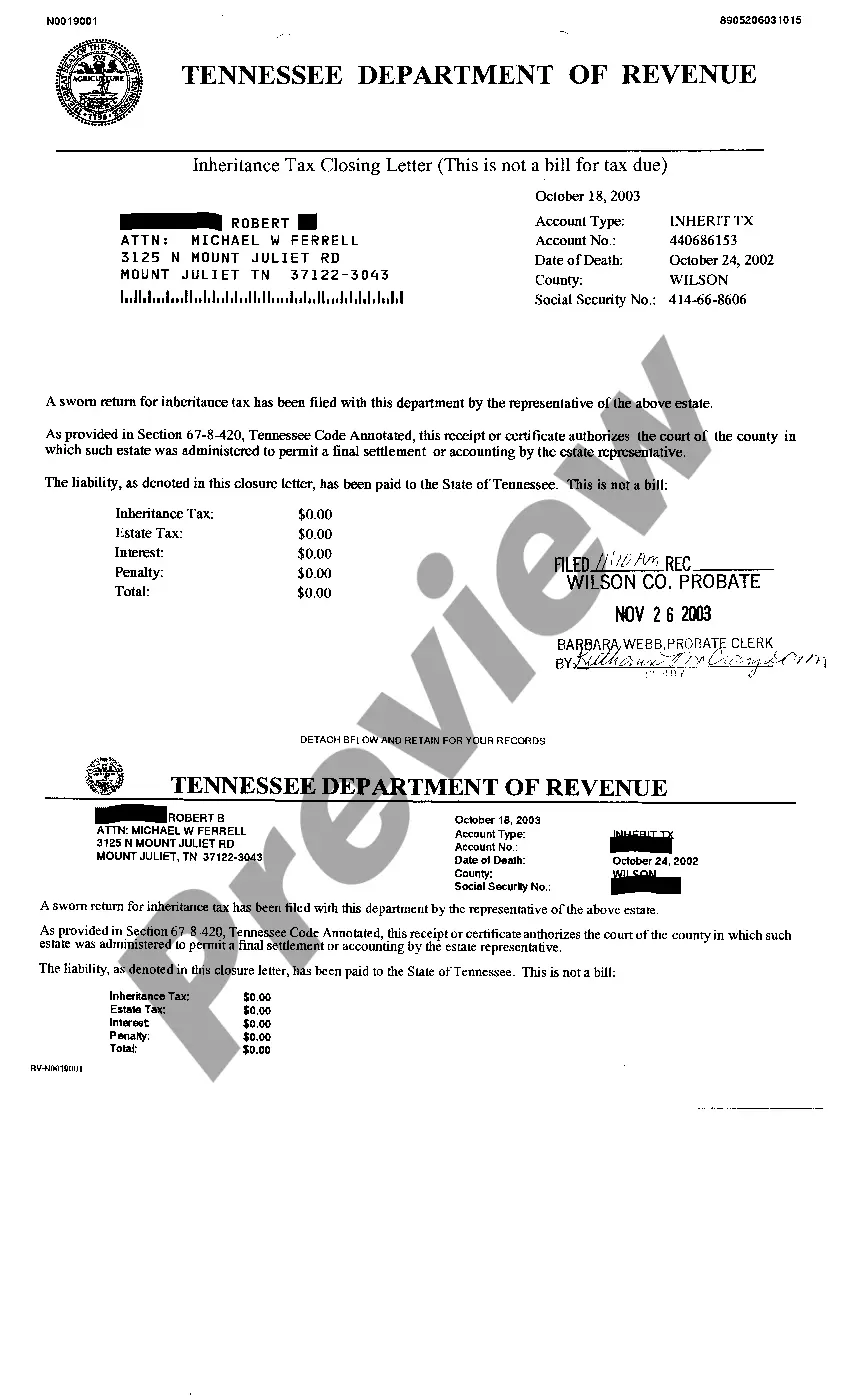

Memphis Tennessee Release by State of any interest in the Estate

Description

How to fill out Tennessee Release By State Of Any Interest In The Estate?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our user-friendly website with a vast collection of documents simplifies the process of locating and acquiring nearly any template you will require.

You can save, fill out, and validate the Memphis Tennessee Release by State of any interest in the Estate in just a few minutes, rather than spending hours online searching for a suitable template.

Using our library is a fantastic method to enhance the security of your form submissions.

Additionally, you can view all previously saved documents in the My documents section.

If you do not yet have an account, follow the steps below.

- Our expert legal consultants routinely review all documents to confirm that the forms are suitable for a specific state and compliant with updated laws and regulations.

- How can you obtain the Memphis Tennessee Release by State of any interest in the Estate.

- If you have a subscription already, simply Log In to your account.

- The Download button will become active on all the templates you access.

Form popularity

FAQ

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

An affidavit of heirship is the simplest way of transferring real property after a person has passed away. When a person dies in Tennessee without a will, real estate immediately vests in the heirs of the decedent.

Generally, in Tennessee, probate can take anywhere from six months to a year. However, the process can take longer if there is a dispute over the deceased person's will or any unusual assets or debts involved.

Probate in Tennessee commonly takes six months to a year. It may take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

Tennessee has no statutory time limit on submitting a will for probate. Generally, however, wills are considered void ten years after the decedent's death, with some exceptions.

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.

Settling an Estate in Tennessee File a petition with the court to open probate. The court appoints an Executor of Estate of Personal Representative. The Executor of the Estate notifies the heirs and publishes notice of probate for creditors.

As noted above, under Tennessee intestacy law, your heirs will be your spouse and/or your relatives. This may present an issue if you are legally divorced from, or otherwise not married to, your significant other/partner.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

The executor has 60 days to start the process by submitting an inventory of the estate's assets, notifying heirs and creditors and asking the state's tax authorities and the Medicaid agency, TennCare, for a release of any claims.