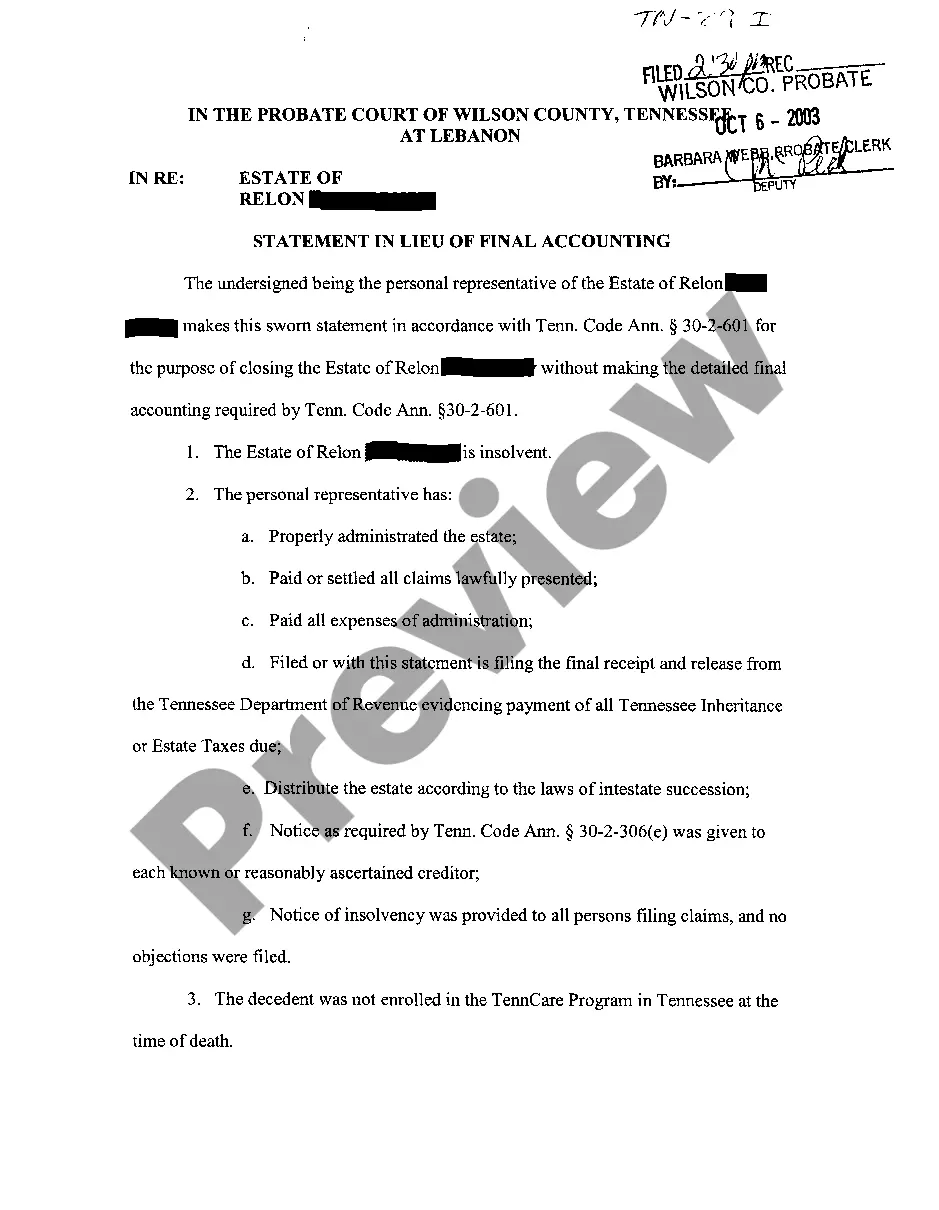

Murfreesboro Tennessee Statement In Lieu of Final Accounting

Description

How to fill out Tennessee Statement In Lieu Of Final Accounting?

Take advantage of the US Legal Forms and gain immediate access to any form example you need.

Our valuable website filled with numerous document templates streamlines the process of locating and acquiring nearly any document example you require.

You can download, fill out, and authenticate the Murfreesboro Tennessee Statement In Lieu of Final Accounting in just a few minutes instead of spending hours online searching for a suitable template.

Utilizing our collection is a fantastic way to enhance the security of your record submissions. Our experienced attorneys regularly review all documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

Initiate the saving process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and complete your order using a credit card or PayPal.

Download the document. Select the format to receive the Murfreesboro Tennessee Statement In Lieu of Final Accounting and modify and complete it, or sign it as needed.

- How can you obtain the Murfreesboro Tennessee Statement In Lieu of Final Accounting.

- If you have a subscription, simply Log In to your account. The Download option will be activated on all the samples you view.

- Additionally, you can locate all previously saved documents in the My documents menu.

- If you do not yet have an account, follow the instructions below.

- Access the page with the form you need. Ensure it is the template you were looking for: check its title and description, and use the Preview option if available. If not, use the Search feature to find the right one.

Form popularity

FAQ

In Murfreesboro, Tennessee, executors typically need to provide bank statements to beneficiaries upon request. This practice fosters transparency by allowing beneficiaries to verify transactions made during the estate administration. Utilizing a Murfreesboro Tennessee Statement In Lieu of Final Accounting can simplify this process by summarizing key financial data, ensuring beneficiaries stay informed about the estate's standing without getting bogged down in excessive details.

Yes, beneficiaries can request to see accounts related to the estate in Murfreesboro, Tennessee. Having access to this information allows beneficiaries to understand how the estate is managed, including any expenditures or distributions made. This is where a Murfreesboro Tennessee Statement In Lieu of Final Accounting plays an important role, as it consolidates essential financial information for beneficiaries, promoting accountability and openness.

In Tennessee, an executor must disclose several key details to beneficiaries, including asset values, liabilities, and any distributions made. The Murfreesboro Tennessee Statement In Lieu of Final Accounting is a vital tool that can summarize these disclosures effectively. By offering a transparent view of the estate's financial health, executors build trust with beneficiaries, ensuring they feel informed and included in the process.

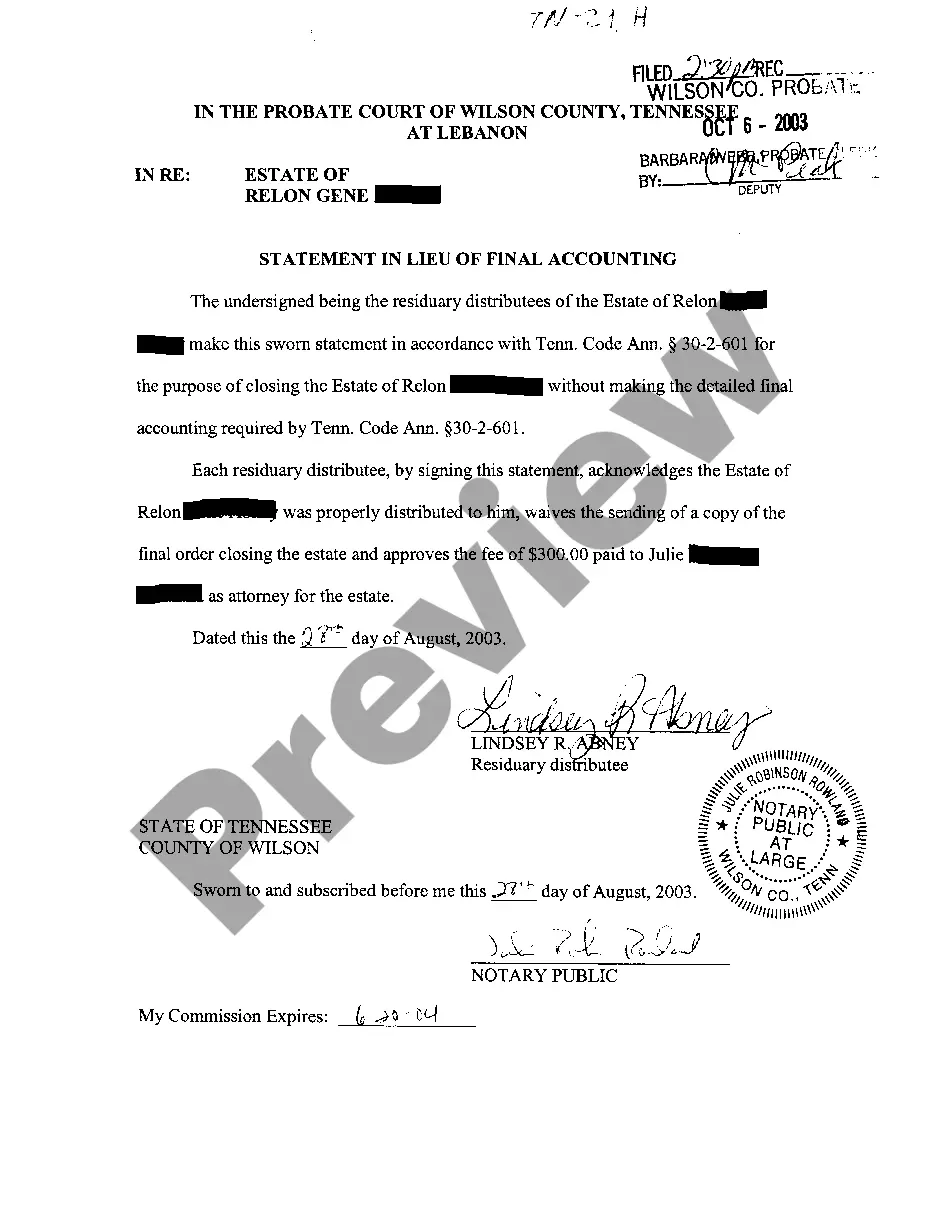

In Murfreesboro, Tennessee, beneficiaries have the right to request an accounting from the executor of the estate. This request ensures transparency and trust throughout the probate process. Executors should provide a clear breakdown of assets, expenses, and distributions, which can include a Murfreesboro Tennessee Statement In Lieu of Final Accounting. This document helps provide clarity, especially when beneficiaries have concerns regarding the handling of the estate.

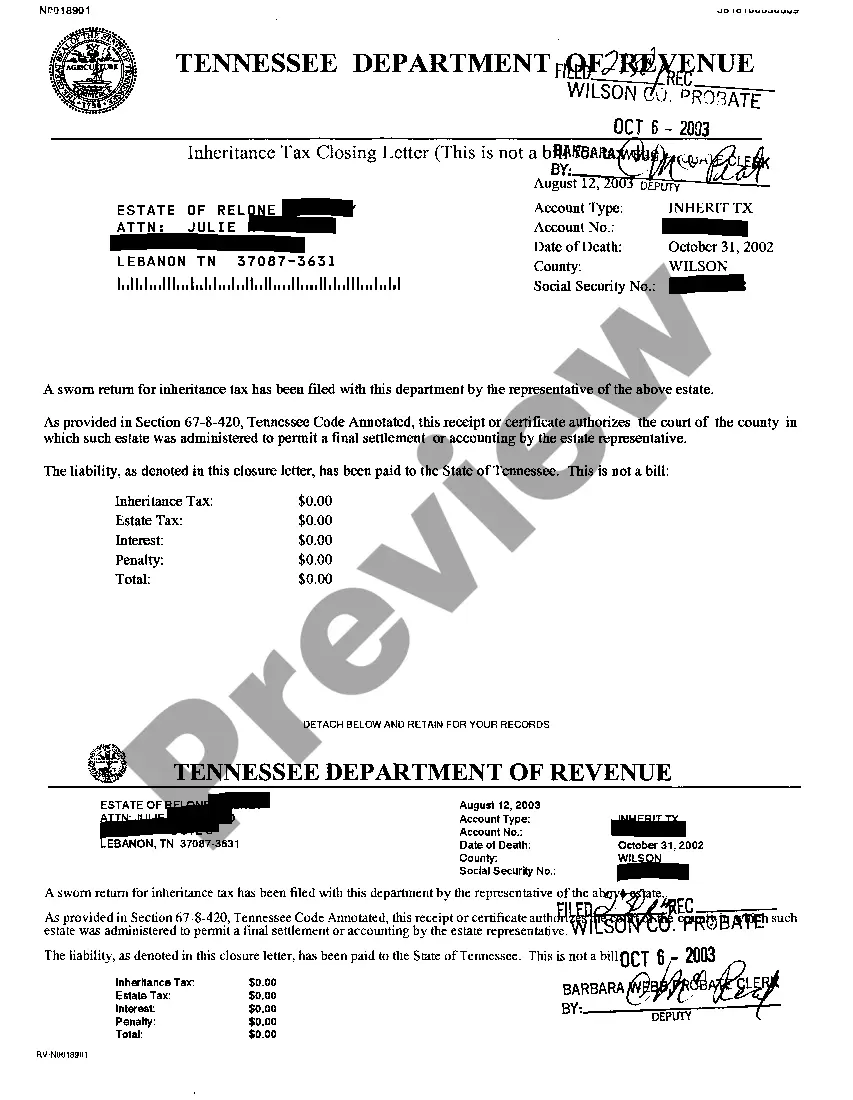

Tenn Code Ann 30-2-601(a)(1) outlines the legal requirements for the submission of final accounts in probate matters within Tennessee. It details the responsibilities of fiduciaries and the expectations for financial reporting to beneficiaries. Understanding this statute can enhance compliance during the estate settlement process. The Murfreesboro Tennessee Statement In Lieu of Final Accounting can help you adhere to these legal obligations while efficiently managing estate affairs.

Yes, beneficiaries are entitled to receive an accounting of the estate. This information helps them understand how assets were handled and ensures fair distribution. By keeping beneficiaries informed, you foster better communication. The Murfreesboro Tennessee Statement In Lieu of Final Accounting can be an excellent means to provide this necessary transparency.

The final accounting of probate is a comprehensive report submitted to the probate court that outlines all transactions made during the administration of an estate. This report must detail distributions to beneficiaries and address any outstanding expenses or debts. It serves to finalize the estate’s financial matters. By leveraging the Murfreesboro Tennessee Statement In Lieu of Final Accounting, executors can streamline this important process.

Yes, there is a general time limit to settle an estate in Tennessee. Typically, an estate should be settled within a year, though circumstances can cause this timeline to vary. Various factors, such as the complexity of the estate and court requirements, may impact this duration. Utilizing resources like the Murfreesboro Tennessee Statement In Lieu of Final Accounting can help ensure timely completion of the estate settlement.

Final accounting of an estate involves a detailed report showing all income, expenses, and distributions made during the administration of the estate. This document provides a clear picture of the financial status of the estate, ensuring beneficiaries are informed. In Murfreesboro, Tennessee, using the Statement In Lieu of Final Accounting can simplify this process, making it easier to communicate with beneficiaries.

The 3-year rule in Tennessee states that creditors have three years to make a claim against a deceased person's estate. After this period, the estate is freed from further claims by creditors, allowing for a smoother settlement process. Understanding this rule can prevent delays and complications in the probate process. Consider using the Murfreesboro Tennessee Statement In Lieu of Final Accounting to manage and finalize your estate matters effectively.