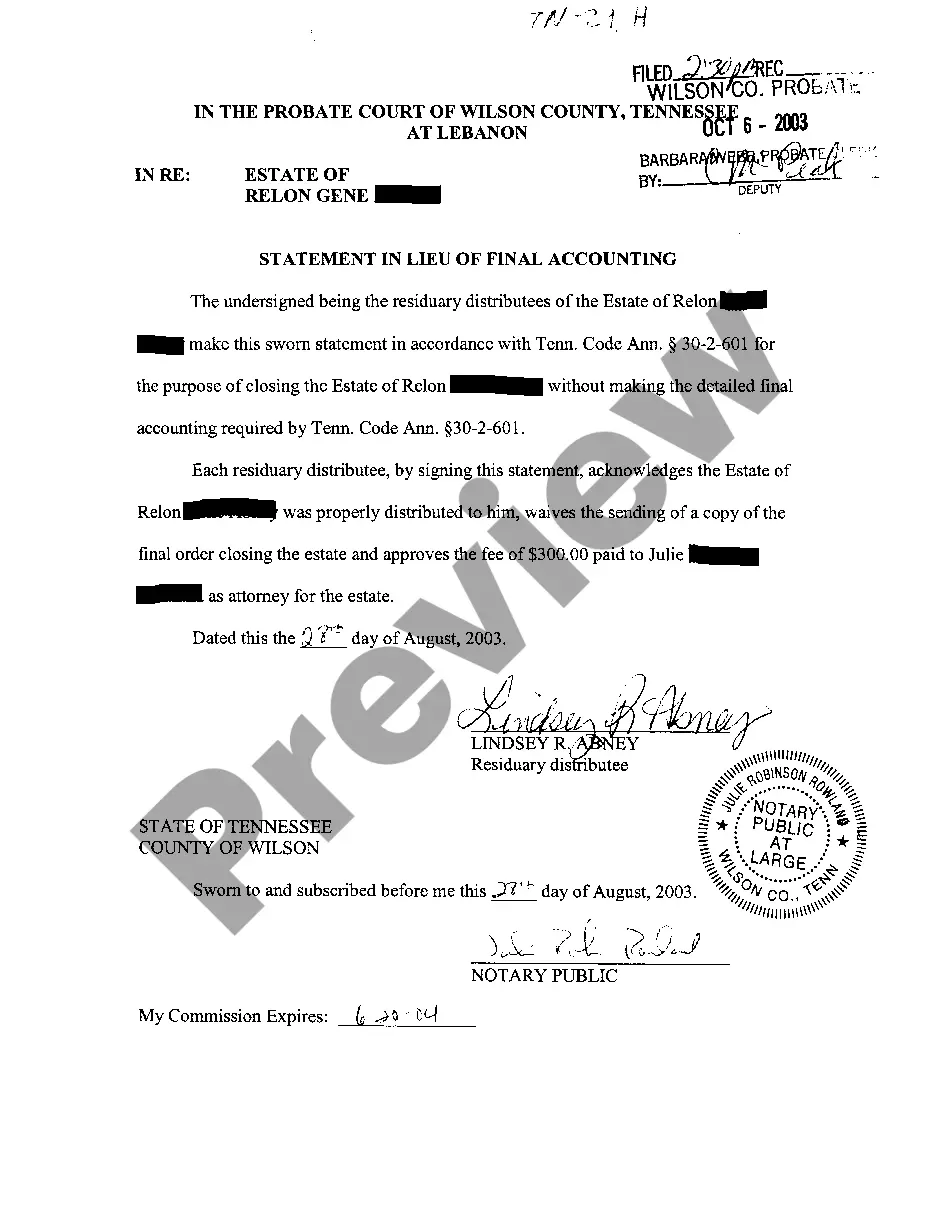

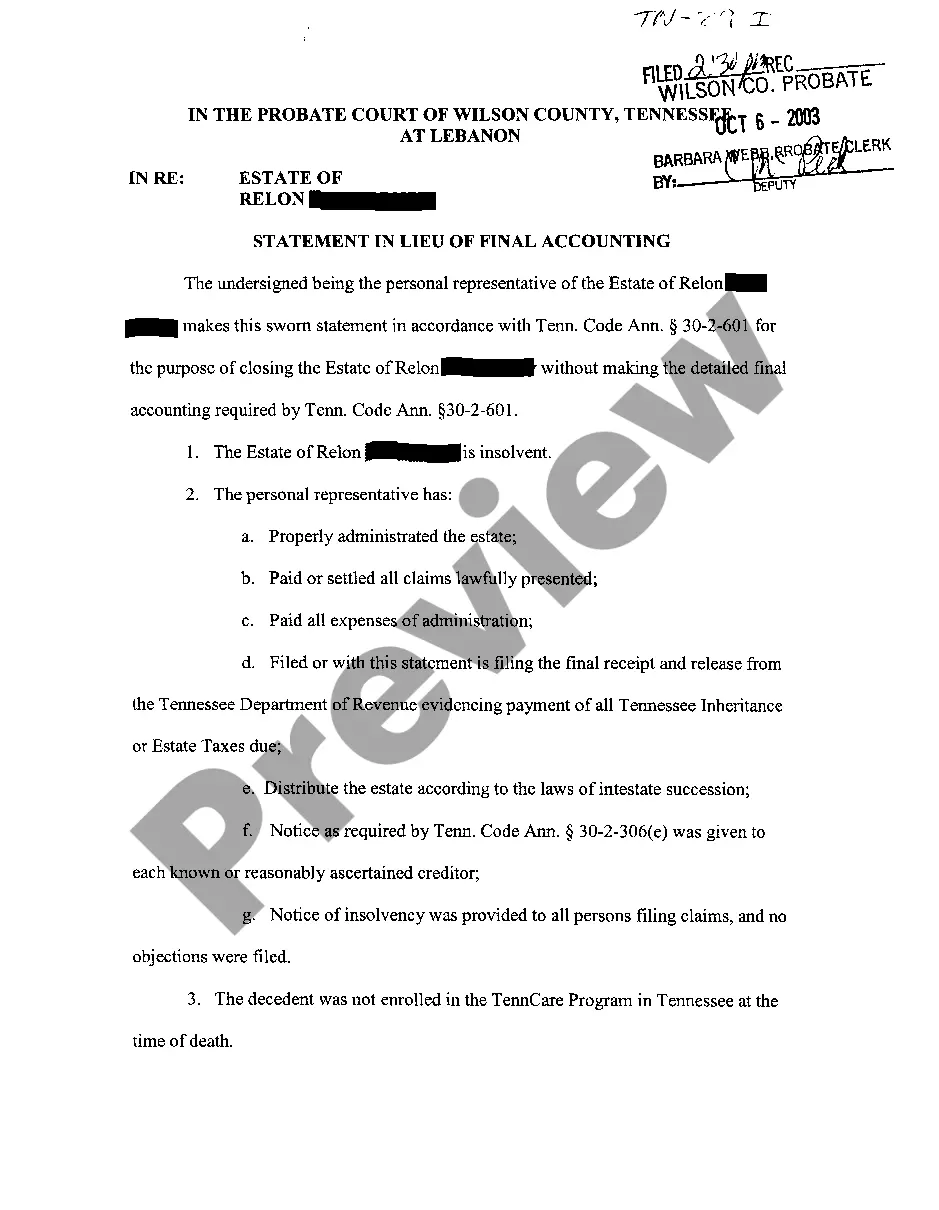

Knoxville Tennessee Statement In Lieu of Final Accounting

Description

How to fill out Tennessee Statement In Lieu Of Final Accounting?

If you’ve previously used our service, Log In to your account and retrieve the Knoxville Tennessee Statement In Lieu of Final Accounting on your gadget by clicking the Download button. Confirm that your subscription is current. If it’s not, renew it as per your payment arrangement.

If this is your initial interaction with our service, follow these uncomplicated steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents tab whenever you need to use it again. Utilize the US Legal Forms service to efficiently locate and save any template for your individual or business requirements!

- Verify you’ve found the correct document. Browse through the details and utilize the Preview option, if available, to ascertain if it fulfills your needs. If it doesn’t suit you, make use of the Search tab above to seek the correct one.

- Procure the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Knoxville Tennessee Statement In Lieu of Final Accounting. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Initiating probate in Tennessee begins with filing the will and necessary documentation in the appropriate probate court. You will also need to submit the Knoxville Tennessee Statement In Lieu of Final Accounting if applicable. After filing, the court will review your documents and set a hearing date. Staying informed about the probate process will help you navigate any challenges that may arise along the way.

To probate a will in Knox County, TN, you will need to visit the local probate court to file the will and the required forms. After submitting the documents, the court will schedule a hearing to validate the will. You should also prepare the Knoxville Tennessee Statement In Lieu of Final Accounting to address any financial matters. Being organized will help facilitate the process and ensure compliance with local regulations.

Yes, Tennessee law establishes a specific timeframe for probating a will. Typically, you should initiate the probate process within five years after the date of death. This timeline is crucial, as failing to probate within this period may prevent you from accessing the Knoxville Tennessee Statement In Lieu of Final Accounting. It's advisable to begin the process as soon as possible to ensure a smooth legal transition.

Yes, an executor must present an accounting to beneficiaries in Tennessee, ensuring that all actions taken during the estate settlement are transparent. This includes details about financial transactions, distributions, and any other relevant information. Open communication and proper documentation foster trust among all parties involved. To simplify your accounting responsibilities, consider utilizing the Knoxville Tennessee Statement In Lieu of Final Accounting.

In Tennessee, you typically have one year from the date of the deceased's passing to file a claim against their estate. It’s crucial to act within this timeframe to protect your rights. Filing a claim late may result in losing your opportunity to receive any debts owed. As you navigate this process, consider using resources like the Knoxville Tennessee Statement In Lieu of Final Accounting for better clarity.

To obtain letters of testamentary in Tennessee, you must file a petition for probate with the appropriate court. You should provide the original will and documentation that shows your relationship to the deceased. Once the court reviews your petition, they will issue the letters if everything is in order. These letters empower you to manage the estate, making the Knoxville Tennessee Statement In Lieu of Final Accounting a valuable tool for your responsibilities.

The final accounting to beneficiaries in Tennessee summarizes the estate's financial activities during the probate process. It lists all income, expenses, and distributions made by the executor. This document ensures transparency and helps beneficiaries understand how their inheritance has been managed. In some situations, you might prefer to use the Knoxville Tennessee Statement In Lieu of Final Accounting to streamline this process.

In Tennessee, there is no minimum value for an estate to enter probate; however, the process is generally more common for estates valued over $10,000. Assets like real estate, bank accounts, and investments typically push an estate into probate. If you are dealing with a smaller estate, you may consider a Knoxville Tennessee Statement In Lieu of Final Accounting to avoid formal probate proceedings.

In Tennessee, an executor typically has up to a year to settle an estate, although this period can vary based on the estate's complexity and any disputes that may arise. It is essential to stay organized and proactive during this time to meet the deadlines. When preparing your Knoxville Tennessee Statement In Lieu of Final Accounting, ensure you keep thorough records to streamline the process.

In Tennessee, it is not mandatory to have a lawyer to file for probate, but it can be beneficial. A lawyer can help navigate the legal complexities of the probate process, ensuring that you comply with all state laws. Using an online platform like uslegalforms can also guide you in preparing documents, including the Knoxville Tennessee Statement In Lieu of Final Accounting.