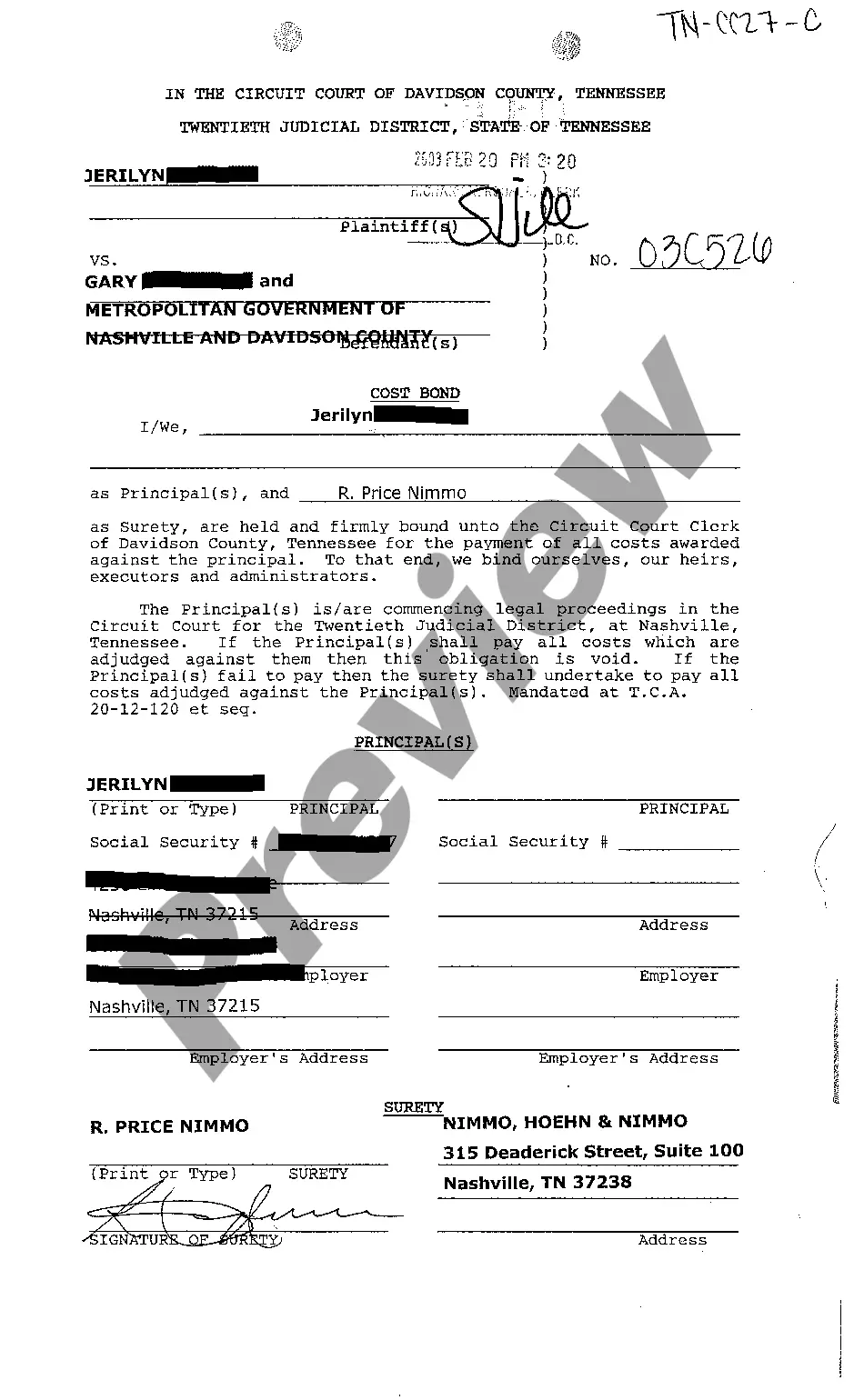

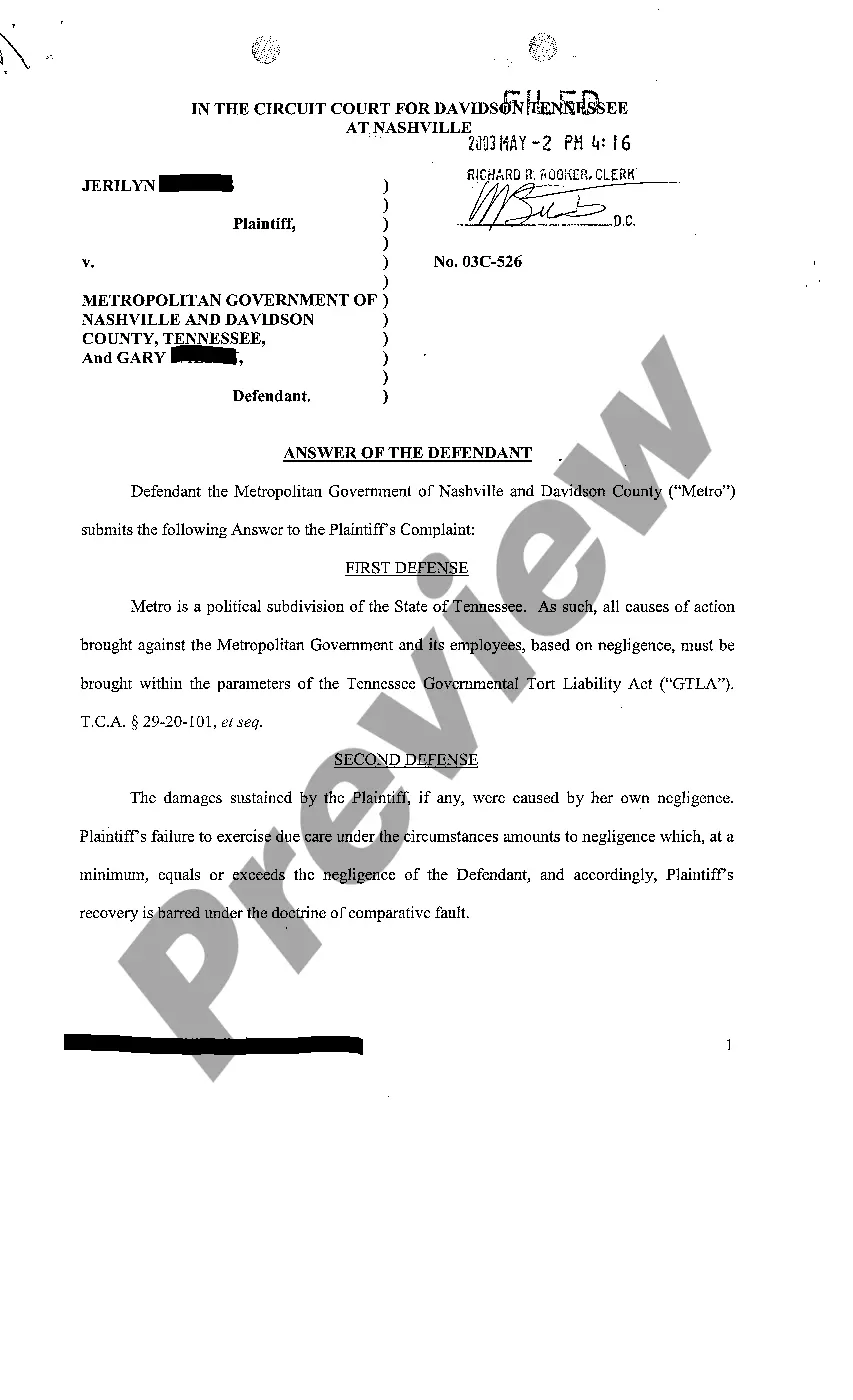

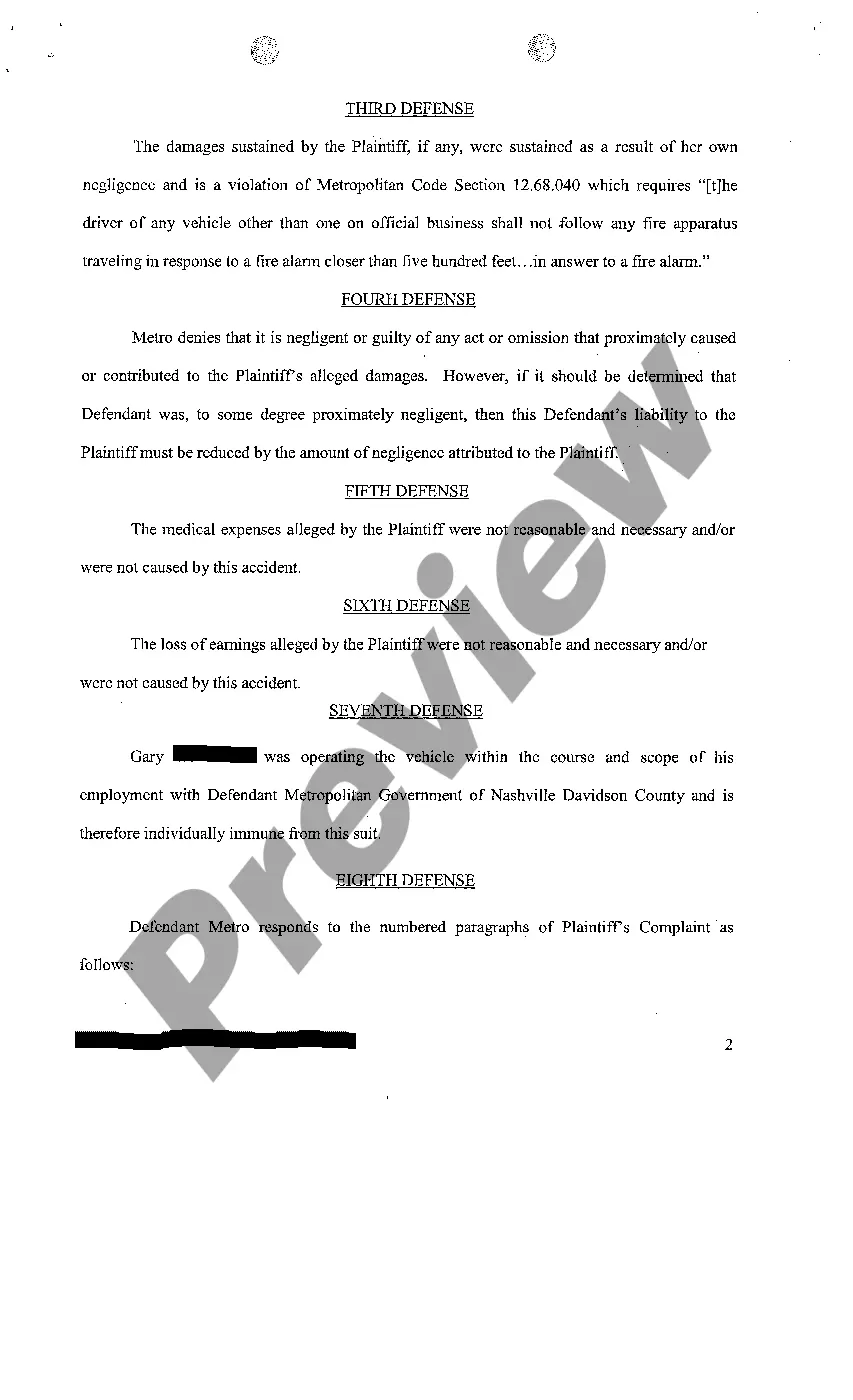

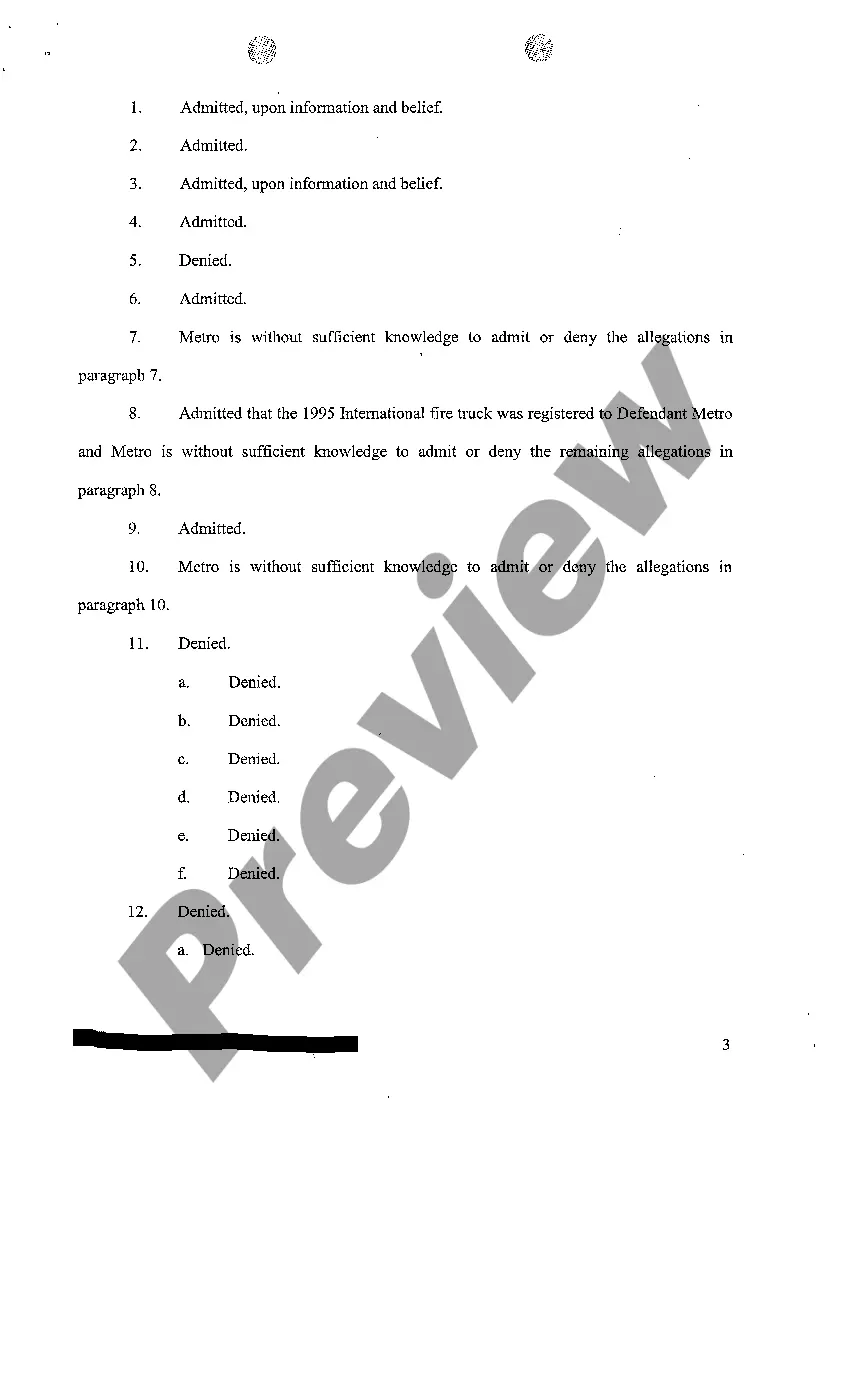

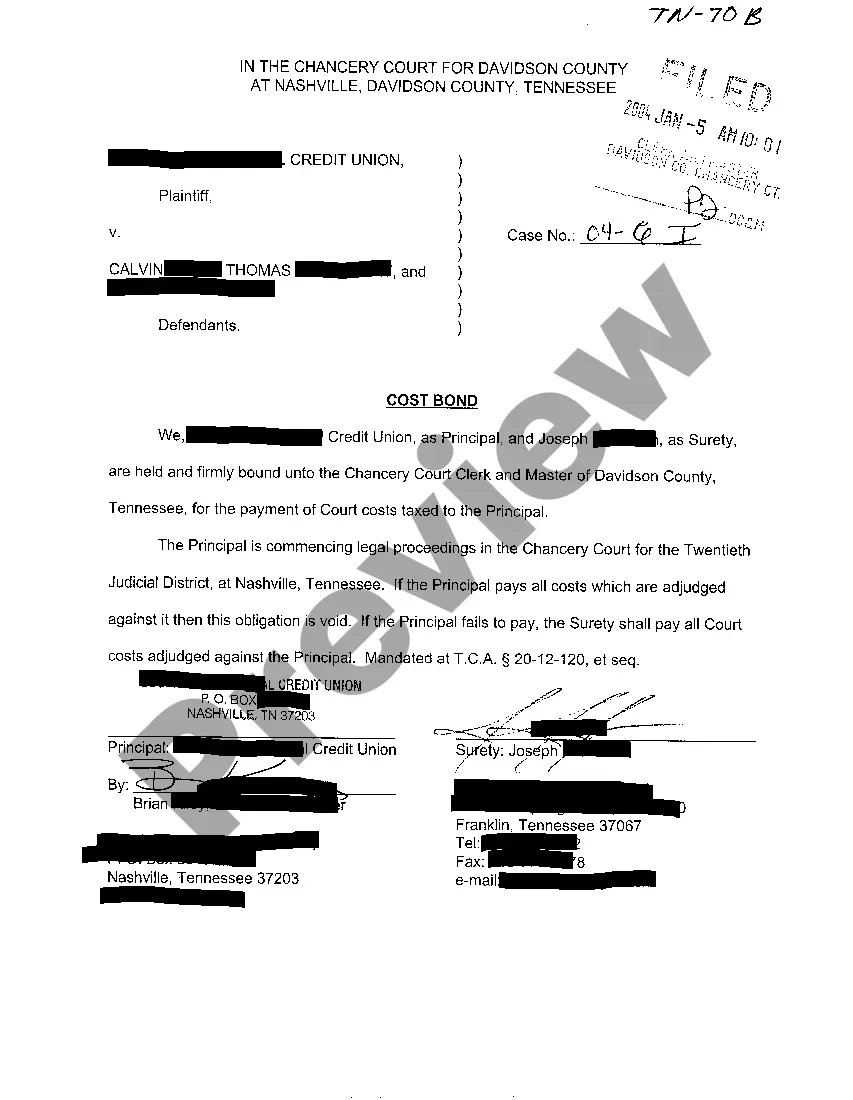

Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

State:

Tennessee

City:

Knoxville

Control #:

TN-CC27-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Free preview

How to fill out Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

If you have previously accessed our service, Log In to your account and retrieve the Knoxville Tennessee Cost Bond to Function as Surety for Payments of Costs Awarded Against the Principal on your device by selecting the Download button. Ensure your subscription is active. If it is not, renew it based on your payment arrangement.

If this is your initial use of our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have bought: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly find and store any template for your personal or professional purposes!

- Ensure you’ve identified a suitable document. Review the description and utilize the Preview option, if available, to determine if it meets your criteria. If it does not fit your needs, use the Search tab above to locate the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and make a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Knoxville Tennessee Cost Bond to Function as Surety for Payments of Costs Awarded Against the Principal. Select the file format for your document and download it to your device.

- Complete your form. Print it or utilize professional online editing tools to fill it out and sign it digitally.