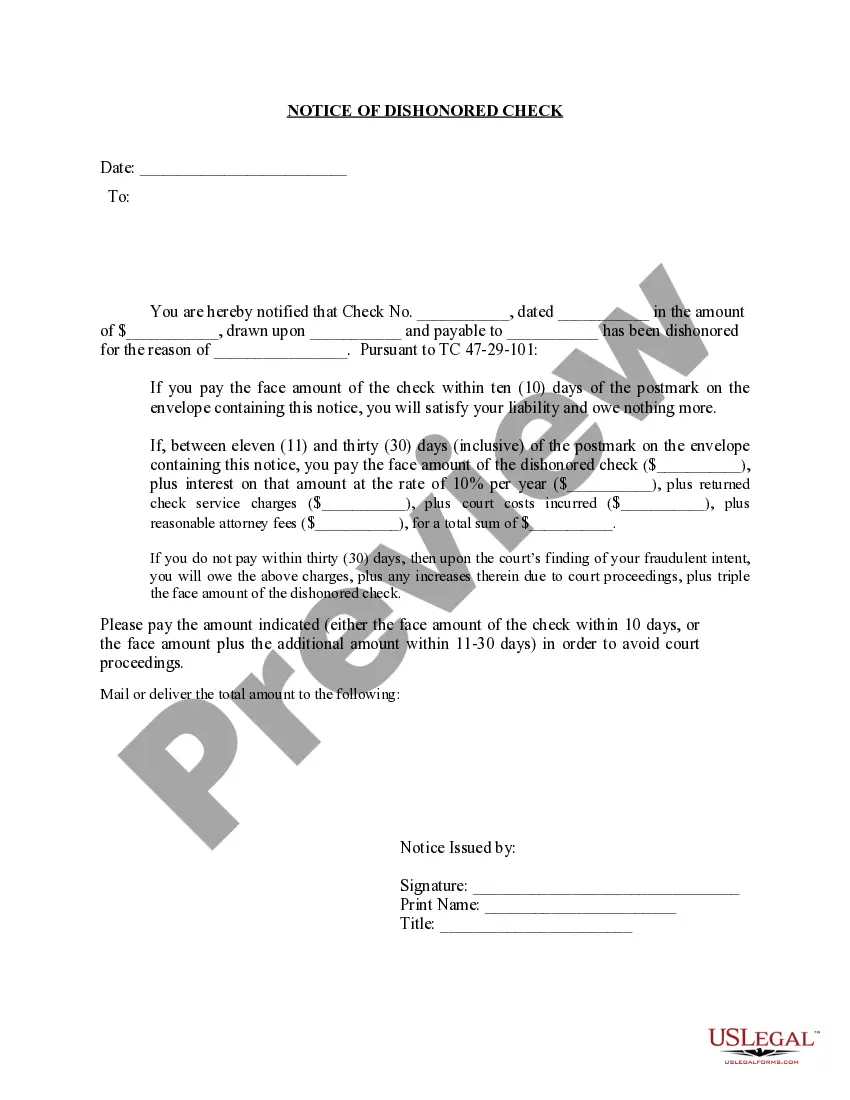

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Memphis Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Tennessee Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you are in search of a pertinent form template, it’s challenging to find a superior platform than the US Legal Forms website – likely the most comprehensive online repositories.

With this repository, you can discover a considerable number of templates for business and personal uses categorized by types and regions, or through keywords.

Employing our sophisticated search feature, locating the most recent Memphis Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is as straightforward as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the relevance of each document is substantiated by a team of proficient attorneys who routinely review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to access the Memphis Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is to Log In to your user profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions below.

- Ensure you have located the form you require. Review its description and utilize the Preview option (if accessible) to investigate its content. If it does not satisfy your needs, employ the Search feature located at the top of the screen to find the appropriate document.

- Verify your choice. Click the Buy now button. Then, select your desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

A dishonored cheque (or check or bank draft, according to local usage) has been presented for payment or deposited into a bank account but rejected or returned by the bank. Typical reasons include: Insufficient funds. Closed account.

If a cheque is dishonoured for any reason, the bank on which it is drawn must promptly return the cheque to the depositor's (payee's) bank, which will ultimately return it to the depositor.

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items. Depository banks attempt to deposit checks twice before being considered dishonored.

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items. Depository banks attempt to deposit checks twice before being considered dishonored.

Cheques are dishonoured by the bank if there are insufficient funds, a signature mismatch, overwriting or a stale date.

Writing a worthless check is considered a crime of theft in Tennessee. If the check is worth $500 or less, it is considered a Class A misdemeanor. It is a felony to write a worthless check for more than $500.

(a) A drawer negotiating a check who knows or should know that payment of such check will be refused by the drawee bank either because the drawer has no account with such bank or because the drawer has insufficient funds on deposit with such bank shall be liable to the payee for damages, in addition to the face amount

The crime of passing bad or worthless checks in Tennessee is treated and punished like theft. For instance, passing bad checks in value of $500 or less is a misdemeanor. Anything over $500 is a felony, with amounts over $1,000 and $10,000 bringing enhanced punishment.

Article 3, Section 503 of the UCC states that when a bank takes a negotiable instrument for collection, it must give a notice of dishonor ?before midnight of the next banking day following the banking day on which the bank receives notice of dishonor of the instrument.? If another person takes an instrument for

The Dishonored Check Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.