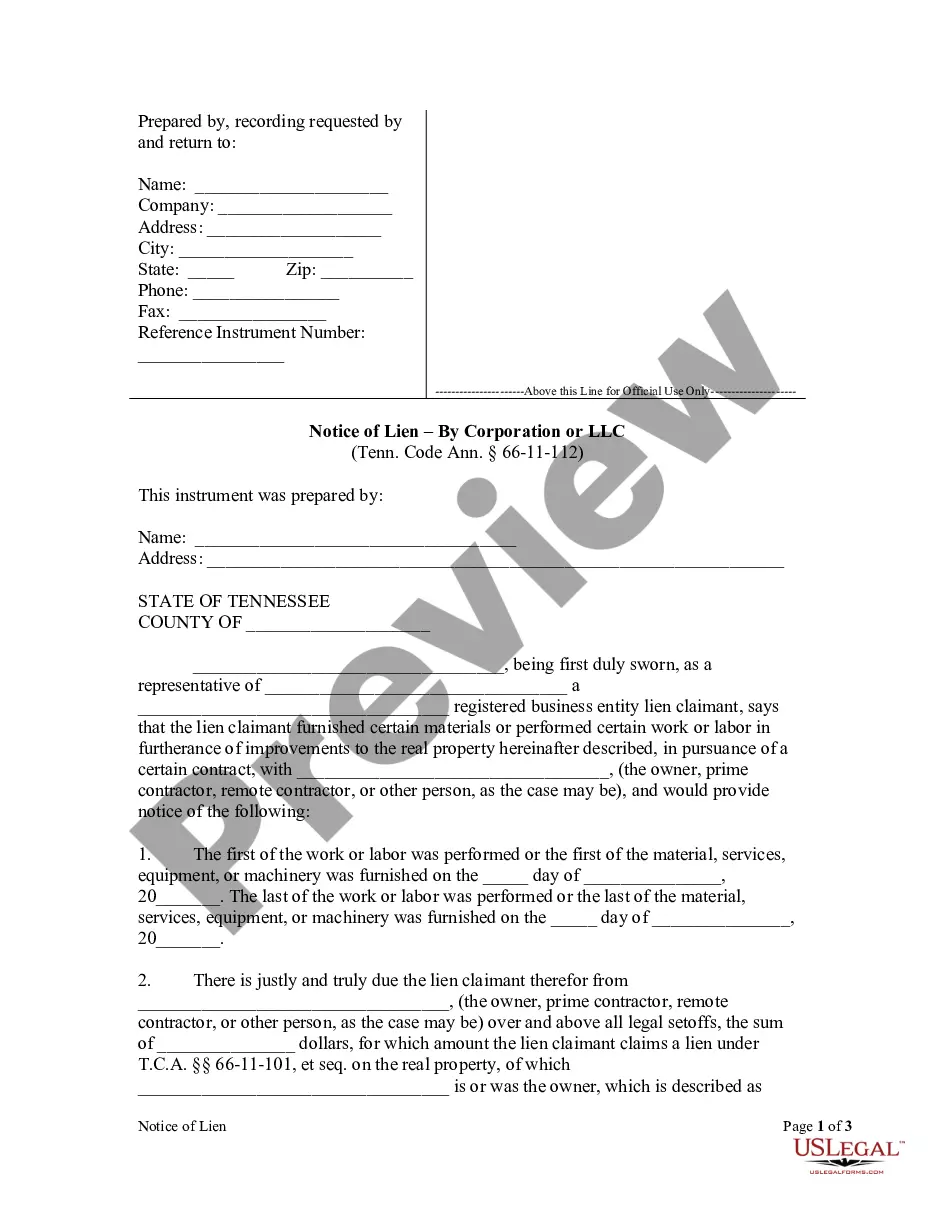

A mechanic's lien shall have precedence over all other subsequent liens or conveyances during such time; provided, that a sworn statement of the amount due and/or approximating that to accrue for such work, labor, or materials, and a reasonably certain description of the premises, shall be filed, within the ninety-day period referred to in § 66-11-115(b), or in the case of liens acquired by contract executed on or after April 17, 1972, by virtue of § 66-11-141, within ninety (90) days after completion of the structure which is or is intended to be furnished water by virtue of drilling a well, or abandonment of work on the structure, as the case may be, with the county register, who shall note the same for registration, and put it on record in the lien book in the office of the register, for which the register shall be entitled to the sums specified in § 8-21-1001, which sums shall be paid by the party filing the same; but such fees shall be receipted for on the statement of account, and shall be part of the indebtedness or charge secured by the lien, and this registration shall be notice to all persons of the existence of such lien.

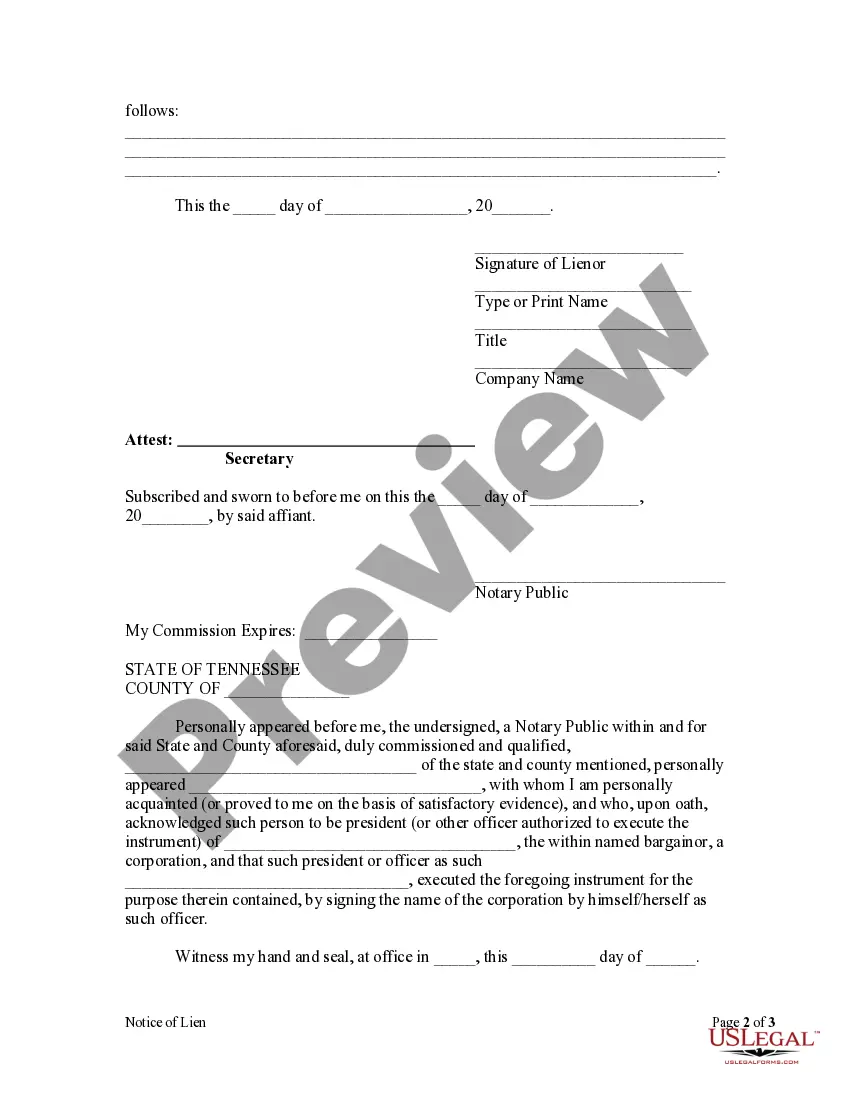

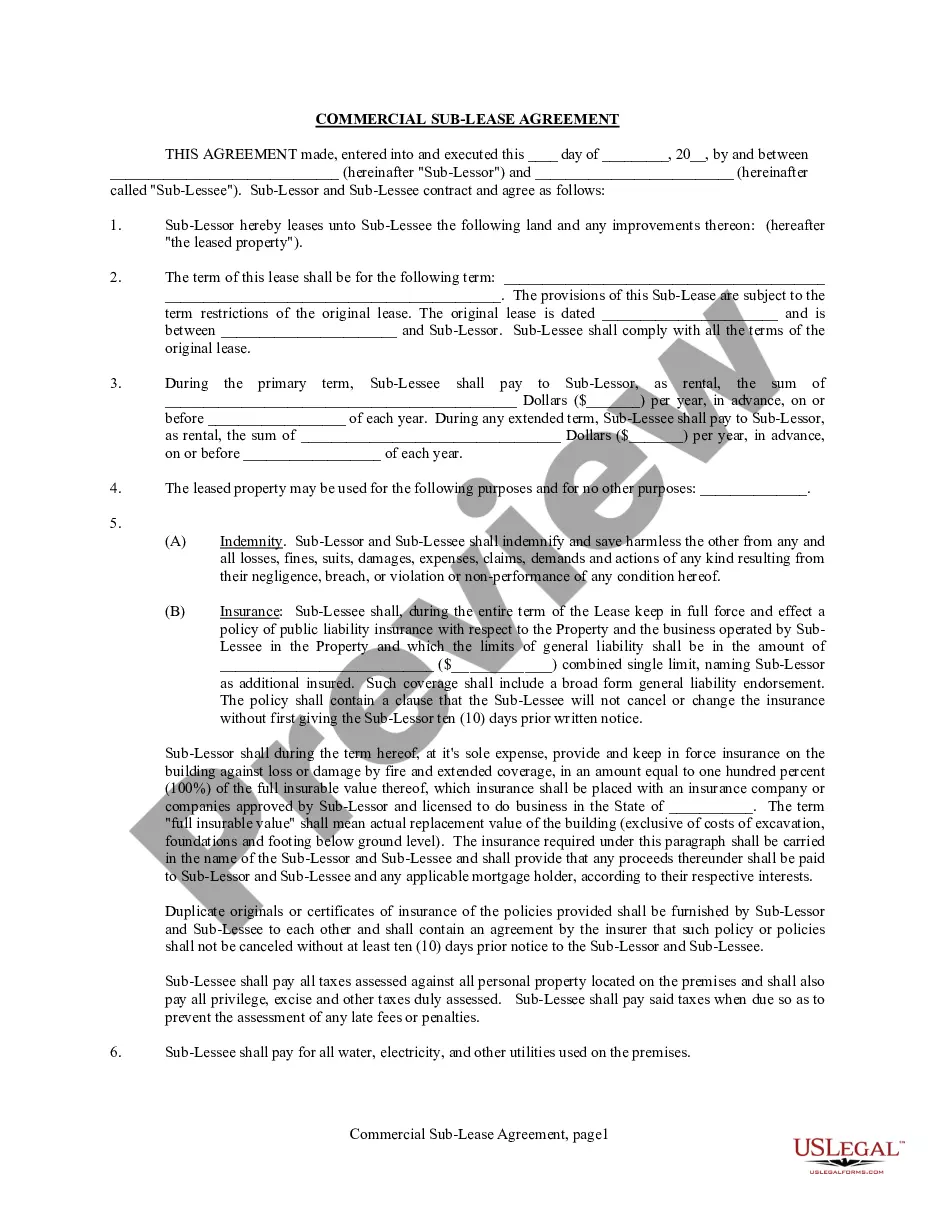

A Knoxville Tennessee Notice of Lien — Corporation or LLC is an important legal document that notifies individuals or entities about a company's outstanding debt or obligation. This notice serves as a public record, documenting that a certain corporation or limited liability company (LLC) is facing a lien against its assets as collateral for the unpaid debt. Keywords: Knoxville Tennessee, Notice of Lien, Corporation, LLC, legal document, outstanding debt, obligation, public record, lien against assets, unpaid debt. In Knoxville Tennessee, there are different types of Notice of Lien forms specific to corporations and LCS, including: 1. Knoxville Tennessee Notice of Lien — Corporation: This type of notice is issued for corporations, which are separate legal entities from their owners. Corporations may be subject to liens if they fail to fulfill financial obligations, such as tax payments, loans, or other debts. When a lien is placed against a corporation, it is crucial to file the appropriate legal documents to inform interested parties about the situation. The Notice of Lien — Corporation form is used for this purpose. 2. Knoxville Tennessee Notice of Lien — LLC: An LLC is a business structure that combines the benefits and flexibility of a partnership with limited liability protection for its owners. When an LLC fails to meet financial obligations, such as outstanding tax liabilities or defaulted loans, a lien may be placed against its assets. The Notice of Lien — LLC form is used to formally notify interested parties about the existence and nature of the lien. Regardless of the type, a Knoxville Tennessee Notice of Lien — Corporation or LLC should contain the following information: 1. Identification Details: This includes the legal name of the corporation or LLC against which the lien is filed, along with any alternate names under which the business operates. 2. Lien Details: The notice should outline the specific debt or obligation that has led to the creation of the lien. This may include the amount owed, the date the debt was incurred, and any additional details necessary to understand the nature of the lien. 3. Contact Information: It is essential to provide accurate contact information for the lien holder or their representative. This allows interested parties to reach out with any inquiries or disputes regarding the lien. 4. Filing Information: The notice should mention the date when the Notice of Lien was filed with the appropriate authorities. This ensures the information is officially recorded and readily accessible to the public. Knoxville Tennessee Notice of Lien — Corporation or LLC serves as a crucial document in protecting the rights of parties with an interest in the corporation or LLC's assets. It enables potential creditors, lenders, or other entities to make informed decisions about engaging with the business while being aware of the existing liabilities.A Knoxville Tennessee Notice of Lien — Corporation or LLC is an important legal document that notifies individuals or entities about a company's outstanding debt or obligation. This notice serves as a public record, documenting that a certain corporation or limited liability company (LLC) is facing a lien against its assets as collateral for the unpaid debt. Keywords: Knoxville Tennessee, Notice of Lien, Corporation, LLC, legal document, outstanding debt, obligation, public record, lien against assets, unpaid debt. In Knoxville Tennessee, there are different types of Notice of Lien forms specific to corporations and LCS, including: 1. Knoxville Tennessee Notice of Lien — Corporation: This type of notice is issued for corporations, which are separate legal entities from their owners. Corporations may be subject to liens if they fail to fulfill financial obligations, such as tax payments, loans, or other debts. When a lien is placed against a corporation, it is crucial to file the appropriate legal documents to inform interested parties about the situation. The Notice of Lien — Corporation form is used for this purpose. 2. Knoxville Tennessee Notice of Lien — LLC: An LLC is a business structure that combines the benefits and flexibility of a partnership with limited liability protection for its owners. When an LLC fails to meet financial obligations, such as outstanding tax liabilities or defaulted loans, a lien may be placed against its assets. The Notice of Lien — LLC form is used to formally notify interested parties about the existence and nature of the lien. Regardless of the type, a Knoxville Tennessee Notice of Lien — Corporation or LLC should contain the following information: 1. Identification Details: This includes the legal name of the corporation or LLC against which the lien is filed, along with any alternate names under which the business operates. 2. Lien Details: The notice should outline the specific debt or obligation that has led to the creation of the lien. This may include the amount owed, the date the debt was incurred, and any additional details necessary to understand the nature of the lien. 3. Contact Information: It is essential to provide accurate contact information for the lien holder or their representative. This allows interested parties to reach out with any inquiries or disputes regarding the lien. 4. Filing Information: The notice should mention the date when the Notice of Lien was filed with the appropriate authorities. This ensures the information is officially recorded and readily accessible to the public. Knoxville Tennessee Notice of Lien — Corporation or LLC serves as a crucial document in protecting the rights of parties with an interest in the corporation or LLC's assets. It enables potential creditors, lenders, or other entities to make informed decisions about engaging with the business while being aware of the existing liabilities.