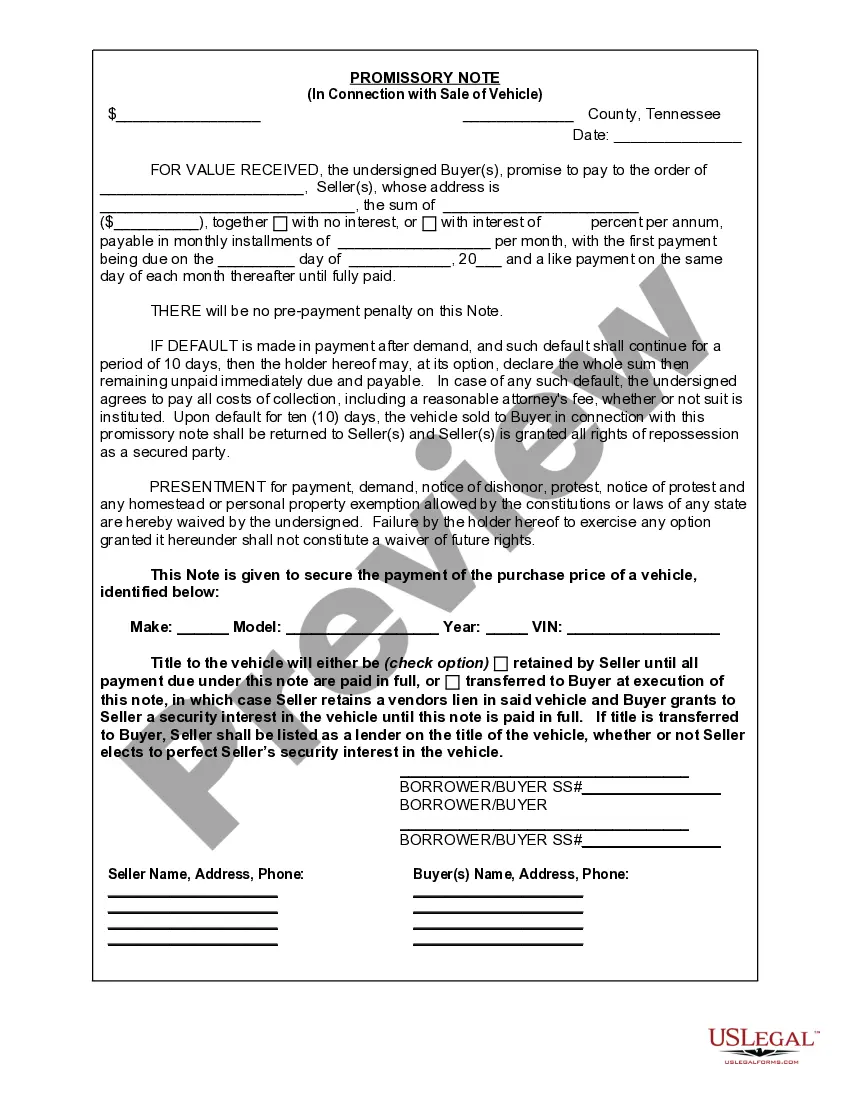

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Memphis Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Tennessee Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Are you in search of a trustworthy and cost-effective legal forms vendor to obtain the Memphis Tennessee Promissory Note related to the sale of a vehicle or automobile? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for cohabitation with your partner or a collection of documents to facilitate your divorce proceedings through the court, we have everything you need. Our site provides over 85,000 contemporary legal document templates for both personal and business use. All templates we offer are not generic and are tailored to meet the regulations of particular states and counties.

In order to download the form, you must Log In to your account, find the necessary template, and click the Download button beside it. Please note that you can download your previously acquired form templates at any time from the My documents section.

Are you a newcomer to our platform? No problem. You can create an account with great ease, but beforehand, ensure to do the following.

Now you can set up your account. Next, select a subscription plan and proceed to payment. Once the payment is completed, download the Memphis Tennessee Promissory Note related to the sale of a vehicle or automobile in any of the provided file formats. You can revisit the website at any point to redownload the form without incurring additional charges.

Obtaining current legal documents has never been simpler. Give US Legal Forms a chance now, and stop wasting your precious time looking for legal paperwork online once and for all.

- Verify if the Memphis Tennessee Promissory Note related to the sale of a vehicle or automobile complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is intended for.

- Restart the search if the template does not fit your legal needs.

Form popularity

FAQ

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

In Tennessee, there is no legal requirement to have a promissory note notarized. To make the document into a legal document, a Tennessee promissory note must be signed and dated by the borrower.

Promissory Notes: An Overview. Bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. Bills of exchange are more often used in international trade, whereas promissory notes are used most often in domestic trade.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

The promissory note should only be used if the buyer intends to make a down payment at the time of purchase and pay the remainder over time.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.