Allegheny Pennsylvania UCC1 Financing Statement Addendum

Description

How to fill out Pennsylvania UCC1 Financing Statement Addendum?

Irrespective of social or occupational rank, completing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s virtually unfeasible for an individual without legal education to generate this kind of paperwork from the ground up, largely due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms becomes valuable.

Verify that the form you have located is appropriate for your area since the regulations of one state or county do not apply to another.

Inspect the document and read any brief summary (if accessible) of scenarios the form can be utilized for.

- Our service offers an extensive catalog with over 85,000 ready-to-use state-specific forms that cater to nearly any legal scenario.

- US Legal Forms is also an excellent resource for associates or legal advisors aiming to enhance their efficiency by utilizing our DIY forms.

- Whether you require the Allegheny Pennsylvania UCC1 Financing Statement Addendum or any other document suitable for your jurisdiction, with US Legal Forms, everything is at your disposal.

- Here’s how you can quickly obtain the Allegheny Pennsylvania UCC1 Financing Statement Addendum using our trustworthy service.

- If you are currently a subscriber, you can proceed to Log In to your account to download the relevant form.

- However, if you are new to our platform, be sure to follow these steps before acquiring the Allegheny Pennsylvania UCC1 Financing Statement Addendum.

Form popularity

FAQ

A UCC can be deemed invalid for several reasons, including incorrect information, inadequate signatures, or failure to file in the proper jurisdiction. In Allegheny Pennsylvania, addressing these issues promptly is key to maintaining an enforceable security interest. Ensuring proper completion and filing can safeguard against invalidation. Legal resources like US Legal Forms can assist you in avoiding common pitfalls.

You should file a UCC-1 financing statement with the appropriate state agency in Allegheny Pennsylvania, usually the Department of State. This filing provides public notice of the secured interest and protects your claim. The process can be complicated, but using services like US Legal Forms can streamline the filing process by providing guidance and necessary forms.

Yes, UCC financing statements typically require signatures from the debtor. This signature is essential to establish the debtor's acknowledgment of the claim. In Allegheny Pennsylvania, a properly signed statement ensures the effectiveness and enforceability of the security interest. Make sure to consult US Legal Forms for templates that help ensure all necessary details, including signatures, are correctly executed.

You must file a UCC-1 financial statement when you intend to secure a claim against the debtor's assets. In Allegheny Pennsylvania, timely filing is crucial, typically before engaging in any secured transactions to protect your interests. Failing to file on time can result in losing your priority. Using platforms like US Legal Forms can help ensure you meet all deadlines efficiently.

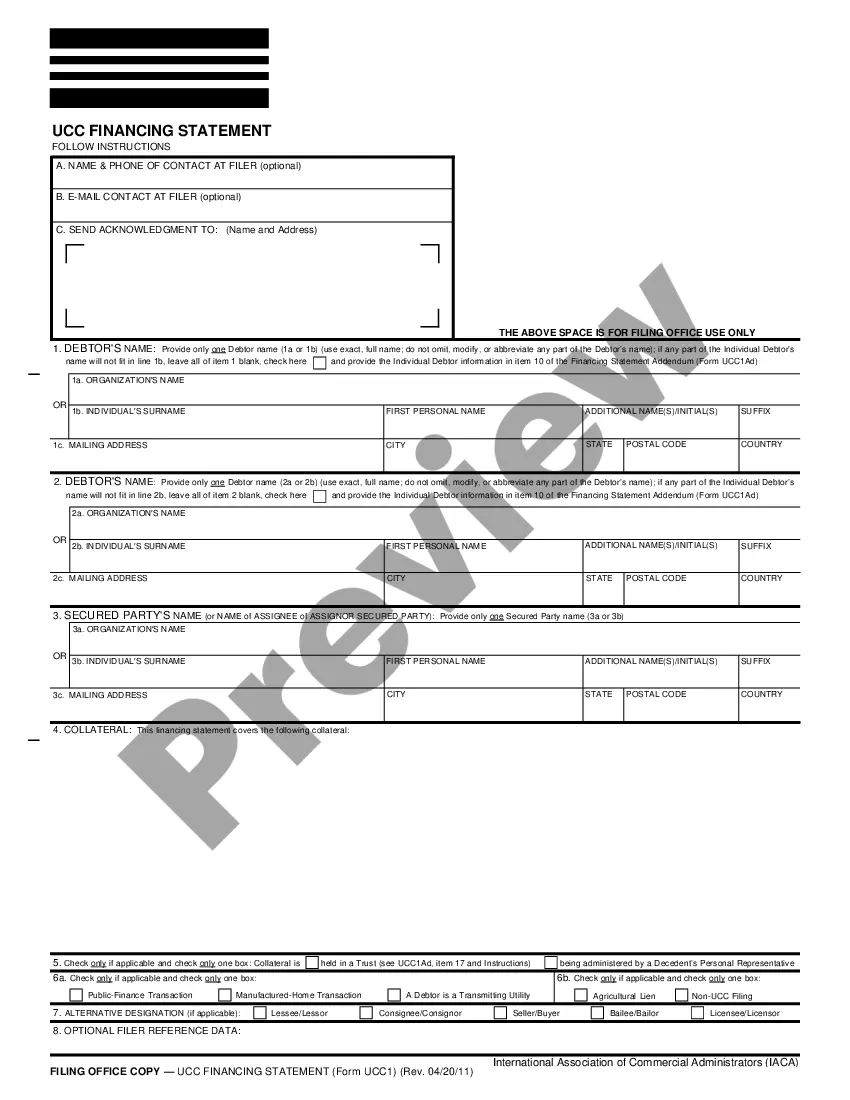

1 financing statement must include the name of the debtor, the name of the secured party, and a description of the collateral. In Allegheny Pennsylvania, you need to file this form to perfect a security interest in personal property. It's advisable to review the specific requirements found on legal platforms like US Legal Forms to ensure compliance and accuracy.

An UCC can indeed be assigned. This means that the rights associated with the UCC can shift from one creditor to another. Therefore, it is crucial to ensure that all relevant documents are updated accordingly to reflect this change in Allegheny Pennsylvania. Utilizing resources like US Legal Forms can simplify creating and filing these required updates.

Yes, you can assign a UCC financing statement. This process allows a creditor to transfer their rights to another party. In Allegheny Pennsylvania, it is essential to properly document this assignment to ensure the new party's rights are clear and enforceable. Consider using legal services, such as US Legal Forms, to assist in navigating the assignment process.

Filling out a UCC-1 Financing Statement requires a few key steps. First, gather necessary information about the debtor, secured party, and collateral description. In Allegheny, Pennsylvania, utilize the UCC1 Financing Statement Addendum by following the specific instructions for filling it out properly. Finally, file your completed statement with the correct state authority to ensure it becomes part of the public record.

To fill out a UCC-1 Financing Statement in Allegheny, Pennsylvania, start by identifying the debtor and the secured party. Next, clearly describe the collateral to ensure all parties understand what is secured. Include any necessary details as indicated in the UCC1 Financing Statement Addendum and then submit the document to the appropriate state filing office, ensuring compliance with local regulations.

A UCC filing, such as the Allegheny Pennsylvania UCC1 Financing Statement Addendum, can be either beneficial or detrimental, depending on your situation. It protects creditors by establishing a legal claim on the collateral provided by borrowers, ensuring they have priority if repayment issues arise. However, for borrowers, it can signal financial struggles, potentially affecting their creditworthiness. Ultimately, understanding your circumstances helps you assess the implications of a UCC filing.