Pittsburgh Pennsylvania UCC1 Financing Statement

Description

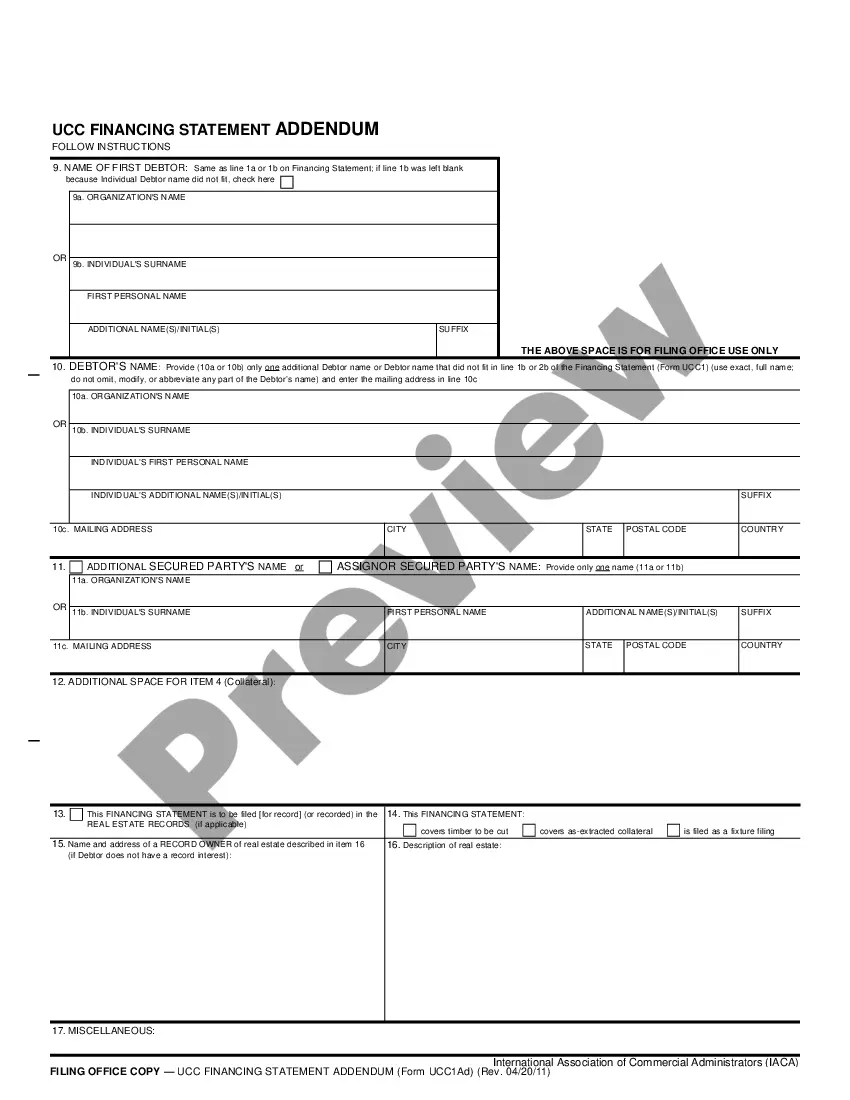

How to fill out Pennsylvania UCC1 Financing Statement?

We consistently endeavor to reduce or avert legal complications when managing intricate law-related or financial matters.

To achieve this, we enlist attorney services that are generally quite costly.

However, not all legal challenges are particularly complicated.

Many of them can be resolved independently.

Take advantage of US Legal Forms whenever you need to locate and download the Pittsburgh Pennsylvania UCC1 Financing Statement or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to incorporation articles and petitions for dissolution.

- Our platform empowers you to handle your affairs autonomously without relying on a lawyer's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are specific to your state and region, making the search process significantly easier.

Form popularity

FAQ

Pennsylvania adopted the Uniform Commercial Code in 1954, aligning with the national effort to standardize commercial laws across the states. This adoption allows for more uniformity in business transactions and legal interactions. Understanding the history of the Pittsburgh Pennsylvania UCC1 Financing Statement can provide valuable context when navigating current regulations and requirements.

A UCC filing in Pennsylvania is an official document that secures a lender’s interest in a borrower’s personal property. This filing is essential in commercial transactions, as it establishes priority in claims of assets. When dealing with a Pittsburgh Pennsylvania UCC1 Financing Statement, it’s vital to understand this process to protect your financial interests and obligations.

To look up a UCC filing, you can access the online database provided by your state’s Secretary of State office. Input the relevant details such as the name of the debtor or the document number. If you are specifically searching for information on a Pittsburgh Pennsylvania UCC1 Financing Statement, using the state resources can provide you with accurate and comprehensive results.

Yes, Pennsylvania is recognized as a pro union state, with a strong history of labor organizing. This status influences various aspects of business operations, including how UCC filings are handled. If you are navigating a Pittsburgh Pennsylvania UCC1 Financing Statement, being aware of labor laws can help you make informed decisions in your financial dealings.

Most states in the US utilize the Uniform Commercial Code, known as UCC, but a few do not. For instance, Louisiana does not adopt UCC in the same way as other states due to its unique legal system based on civil law. If you are dealing with a Pittsburgh Pennsylvania UCC1 Financing Statement, it is essential to understand how local laws impact your transactions and filings.

Several factors can render a Pittsburgh Pennsylvania UCC1 Financing Statement invalid, including missing information, incorrect debtor names, or failing to follow proper filing procedures. Additionally, if the financing statement is not filed within the required timeframe, it can lose its effectiveness. Always double-check your form to avoid these pitfalls.

To fill out a UCC-1 form correctly, you should start by gathering complete information about the debtor and the secured party. Next, accurately describe the collateral being secured and ensure that your filing conforms to Pittsburgh, Pennsylvania's requirements. If you're unsure, ulegalforms offers detailed guidance and templates to assist you.

UCC requirements in Pittsburgh, Pennsylvania, include providing accurate debtor information and a clear description of the collateral. It is also necessary to ensure that the filing is done with the correct state office and adheres to any formatting rules. Meeting these requirements is crucial for the enforceability of your security interest.

The priority of a Pittsburgh Pennsylvania UCC1 Financing Statement generally relies on the order of filing, meaning that the first party to file has the first claim against the collateral. Understanding this priority helps secured parties protect their investments and navigate potential disputes. Filing promptly ensures that your interests are safeguarded.

In Pittsburgh, Pennsylvania, UCC-1 statements must comply with certain rules outlined in the Uniform Commercial Code. These rules dictate how the statement should be formatted, the necessary information to include, and the filing process. Following these rules ensures that your financing statement is effective and protects your interests.