Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Pennsylvania Installments Fixed Rate Promissory Note Secured By Personal Property?

Finding validated forms pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both individual and business requirements and various real-world situations.

All the files are correctly categorized by area of use and jurisdiction, making the search for the Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property as straightforward as 123.

Finalize your acquisition. Provide your credit card information or utilize your PayPal account to settle the payment. Download the Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property and save the form on your device to continue with its completion and gain access to it in the My documents section of your profile whenever necessary. Maintaining documents organized and in compliance with legal regulations is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any necessity!

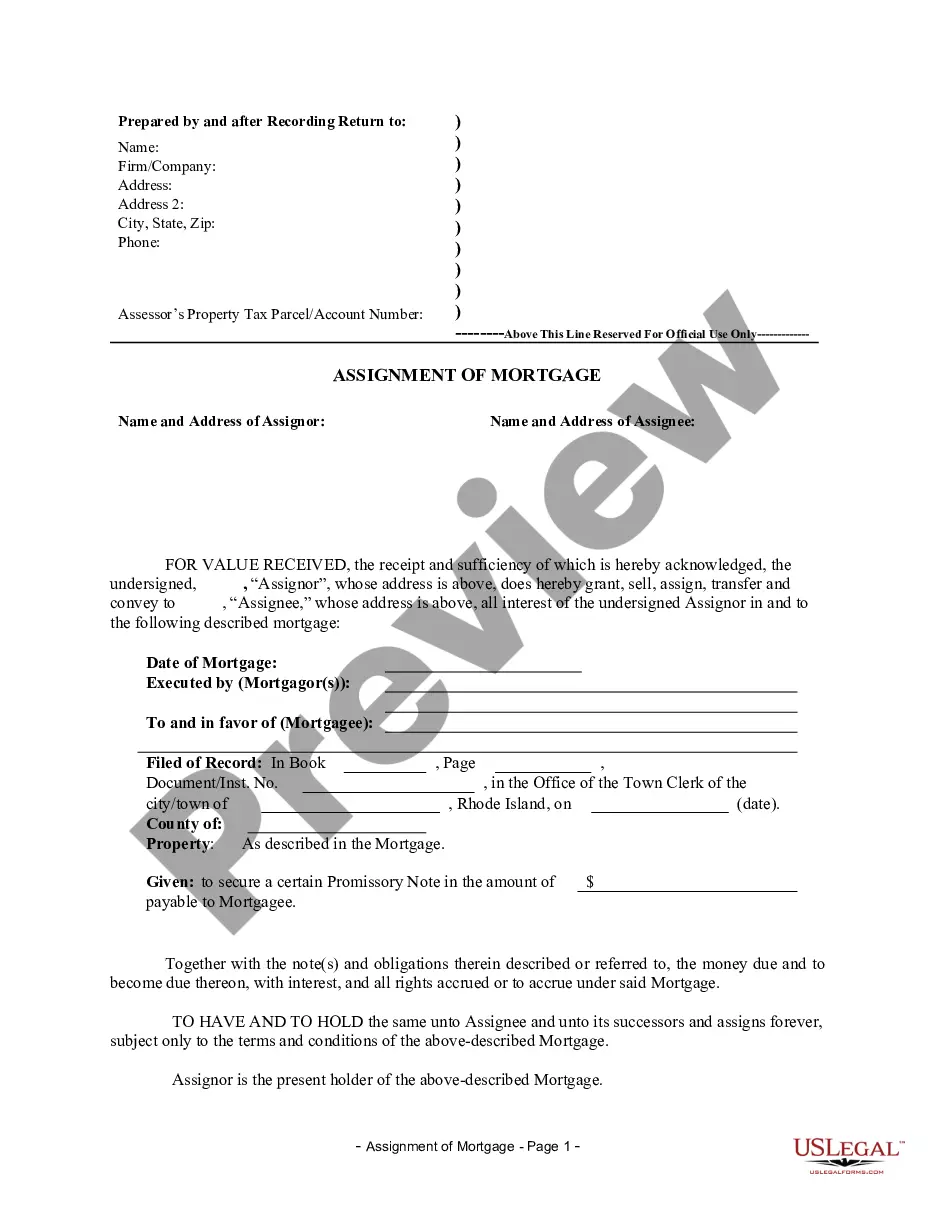

- Verify the Preview mode and document description.

- Ensure you’ve selected the right one that aligns with your needs and fully matches your local jurisdiction specifications.

- Search for another form, if necessary.

- If you notice any discrepancies, utilize the Search tab above to discover the correct one. If it meets your criteria, proceed to the next step.

- Purchase the form.

- Click the Buy Now button and select your preferred subscription plan. You will need to create an account to access the library’s materials.

Form popularity

FAQ

To write a simple promissory note, focus on the essential elements necessary for a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property. State the agreement date, the amount being borrowed, the interest rate, and the repayment schedule. Ensure that both the lender and borrower sign the document, which solidifies the terms. Remember, clarity is key in a simple note.

Writing a secured promissory note involves outlining key components for a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property. Begin with the basic details like the parties involved and the amount borrowed. Include a description of the personal property used as collateral, and specify the consequences of failure to repay. Precise and clear language helps protect both parties in the agreement.

In Pennsylvania, a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property generally does not need to be recorded with any government entity to be enforceable. However, recording can provide a public notice of the lien on the personal property securing the note, thus protecting your interests. Consider consulting uslegalforms for insights on the best practices regarding recording for your specific circumstances.

For a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, report the interest income on Schedule B of your Form 1040. This is the section where you clarify sources of interest income. If you later sell the promissory note, be sure to also report any capital gains on Schedule D. Using resources such as uslegalforms can help clarify the requirements specific to your situation.

When dealing with a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, you must report the interest income from the note on your tax return. Generally, you will declare the income in the year you receive it. Additionally, if you sell or transfer the promissory note, you may need to report any resulting gains or losses. For a clearer process, you may consider utilizing platforms like uslegalforms to ensure all reporting is done accurately.

Yes, promissory notes can indeed be backed by collateral, which adds an element of security to the transaction. In a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, the collateral often comes in the form of valuable personal items. This arrangement helps to mitigate the lender's risk while providing the borrower with access to necessary funds. Knowing that your note is backed by collateral can enhance your peace of mind.

A promissory note can be secured by various forms of collateral, such as personal property or real estate. In the context of a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, the note is specifically secured by personal property. This security offers a layer of protection for the lender, ensuring that they have a claim on the collateral in case of default. Understanding the type of security can help you navigate the borrowing process.

An unsecured promissory note generally does not fall under the definition of a security. In a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, the presence of collateral differentiates it from an unsecured note. This distinction is important as it affects both the risk and the legal considerations of the note. If you are exploring options, consider the benefits of securing your note.

A Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property is typically backed by collateral. This means that if the borrower defaults, the lender has the right to claim the specified personal property. This arrangement provides security for the lender, increasing the likelihood of repayment. Understanding the implications of collateral can help you make informed decisions.

Yes, a promissory note is considered personal property, as it signifies a financial obligation between parties. In a Philadelphia Pennsylvania Installments Fixed Rate Promissory Note Secured by Personal Property, this classification ensures effective legal protections. It can form a part of the borrower's ongoing financial transactions.